| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

| UTI | DOWN | 0.70 | Recent insider activity shows significant selling, especially by Coliseum Capital Management, which has sold substantial shares at varying prices while making isolated purchases. The overall pattern suggests a lack of confidence in the near-term prospects. Company fundamentals, while unspecified, have likely been under pressure given the recent high-selling volume and decline in average transaction prices. The broader macroeconomic environment, including rising interest rates and inflation, may further affect sentiment. With insiders divesting heavily and the absence of material positive company updates, the near-term direction appears bearish. | Consumer Defensive | Education & Training Services |

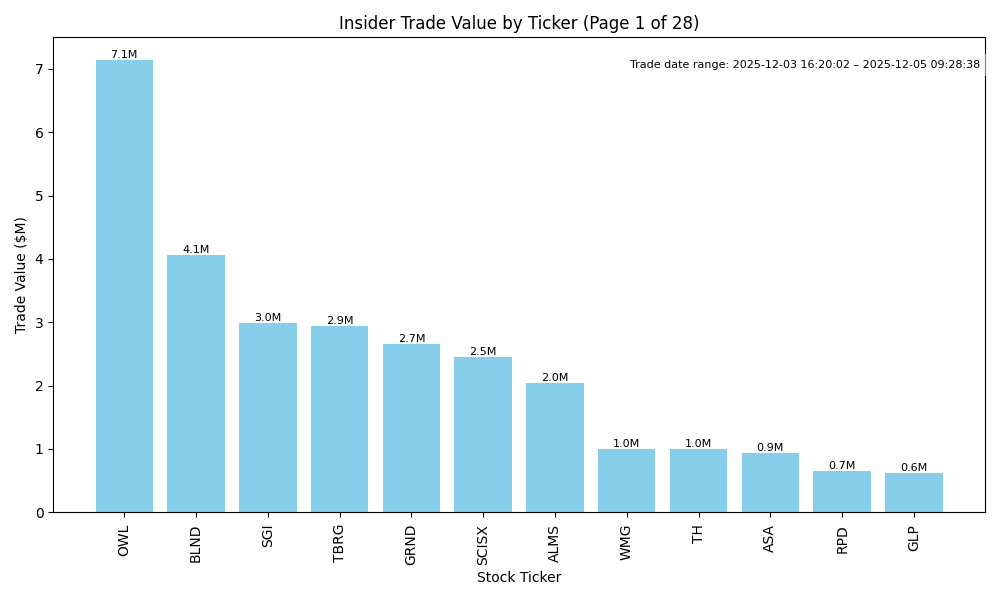

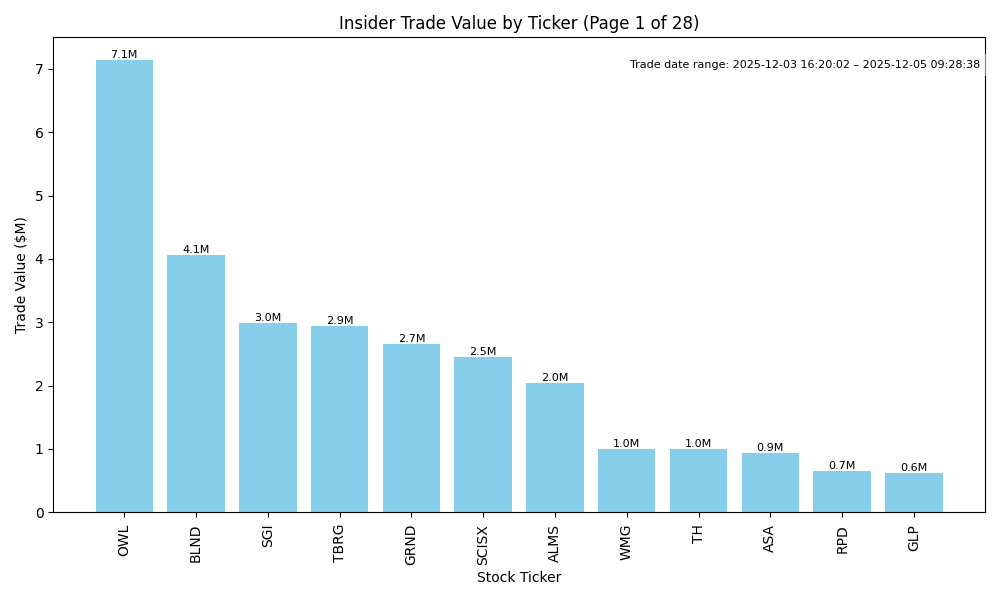

| OWL | UNKNOWN | 0.50 | Recent insider purchasing from key executives suggests confidence in OWL's prospects, with purchases totaling over $5 million at prices above $14.87. However, significant past sell transactions amounting to over 30 million shares raise concerns about potential liquidity issues and management's earlier lack of confidence in the stock. Without current insights into company fundamentals, industry conditions, or macroeconomic factors, it's challenging to predict the stock's near-term trajectory. This uncertainty justifies a neutral stance with moderate confidence. | Financial Services | Asset Management |

| BLND | UP | 0.80 | There is significant insider buying from Haveli Investments, L.P., which indicates strong confidence in the future prospects of BLND. Recent purchases have been substantial, indicating faith in the company's direction. While there have been some sales by insiders, they are relatively smaller. The company’s fundamentals, including its growth potential, could align with positive insider sentiment. However, without specific data on the company's earnings trends or industry positioning, this analysis carries some uncertainty. | Technology | Software - Application |

| SRZN | UP | 0.75 | Recent insider purchases indicate strong confidence from key stakeholders, particularly with notable acquisitions by major insiders at increasing prices. Although there are small sales by executives, these are unlikely to reflect a major negative sentiment. However, missing fundamental data regarding earnings trends, margins, and overall company performance limits insight into sustainability. Additionally, prevailing macroeconomic conditions such as interest rates and inflation need to be considered, but without specific data, we must accept a moderate confidence level in a positive near-term direction. | Healthcare | Biotechnology |

| GRND | DOWN | 0.70 | Recent insider activity reveals a significant trend of selling, particularly by key insiders like Lu James Fu Bin, who sold over 1 million shares at higher prices prior to recent purchases. The concentrated selling raises concerns about potential weakness in fundamentals. Economic factors, including rising interest rates, may further pressure growth in the sector. Missing details on current earnings, leverage, and market demand make this a cautious analysis, but the overall inclination from insider sales suggests a bearish outlook. | Technology | Software - Application |

| NEXT | UP | 0.75 | Recent insider trading activity shows significant purchases by major stakeholders, particularly Hanwha Aerospace, which suggests strong confidence in the company's future. The concentration of purchases indicates a bullish sentiment. However, recent sales by other insiders may raise concerns about potential overvaluation. While specific details on company fundamentals and macroeconomic conditions are lacking, the aggressive insider buying paints a positive short-term outlook, bolstered by the recent trend. Nevertheless, the mixed signals regarding insider sales and the absence of comprehensive financial data temper overall confidence. | Energy | Oil & Gas Equipment & Services |

| TBRG | UP | 0.75 | Recent insider purchases, notably by a significant stakeholder, Pinetree Capital, indicate strong confidence in TBRG's future. They have been consistently buying shares at increasing prices, suggesting belief in value appreciation. Fundamentals may be lacking as no recent earnings data is provided, and previous sales by executives raise concerns about short-term price action. However, the solid insider activity and potential positive outlook amidst general market volatility give a bullish stance. More information on company performance and sector conditions would enhance confidence. | Healthcare | Health Information Services |

| FISV | UP | 0.75 | Recent insider buying from key executives, including the CFO and Chief Admin. Officer, indicates positive sentiment about the company's near-term prospects. While detailed fundamentals such as earnings trends and growth potential were not provided, the notable insider purchases suggest strong internal confidence. Industry trends and macroeconomic factors may remain supportive, but specific details on company performance, competitive positioning, and broader economic conditions are missing, which slightly reduces confidence in the forecast. | N/A | N/A |

| EHSI | UP | 0.75 | The CEO's significant purchase of 1,452,680 shares at $0.95 indicates strong confidence in EHSI's future prospects. While insider buying is a positive signal, it is essential to consider overall fundamentals, which are not provided here. Additionally, broader macroeconomic conditions, such as interest rates and inflation, are not detailed, but if benign, they can support stock price appreciation. Missing data on growth potential, margins, and sector health limits the confidence in this prediction, yet the sizable insider buy suggests upward momentum. | Healthcare | Medical Care Facilities |

| TPVG | UP | 0.75 | Recent insider buying activity is robust, with multiple large purchases from high-level executives including the CEO and CIO, suggesting strong insider confidence in the company. However, the stock price has been declining, which may indicate broader market or sector challenges. Limited information on current financial performance or macroeconomic impacts may affect confidence, but the concentrated insider buying may signal an upcoming positive shift in sentiment. | Financial Services | Asset Management |

| KLNG | NEUTRAL | 0.60 | The recent insider purchase of 592,000 shares by Intelligent Fanatics Capital Management suggests a bullish sentiment from a significant investor, which is generally positive. However, the sale of 50,000 shares by a director indicates some mixed sentiment at the insider level. Without additional data on the company's financial fundamentals, such as earnings trends and margins, and knowledge of the broader industry context or macroeconomic conditions affecting KLNG, the outlook remains uncertain. The conflicting insider actions suggest caution rather than a clear bullish or bearish direction. | Energy | Oil & Gas Equipment & Services |

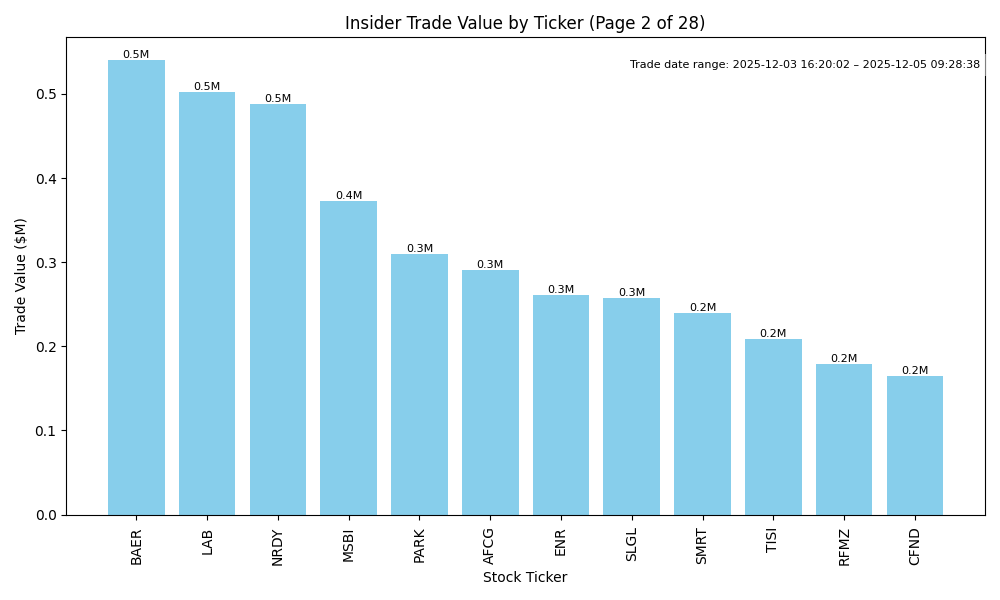

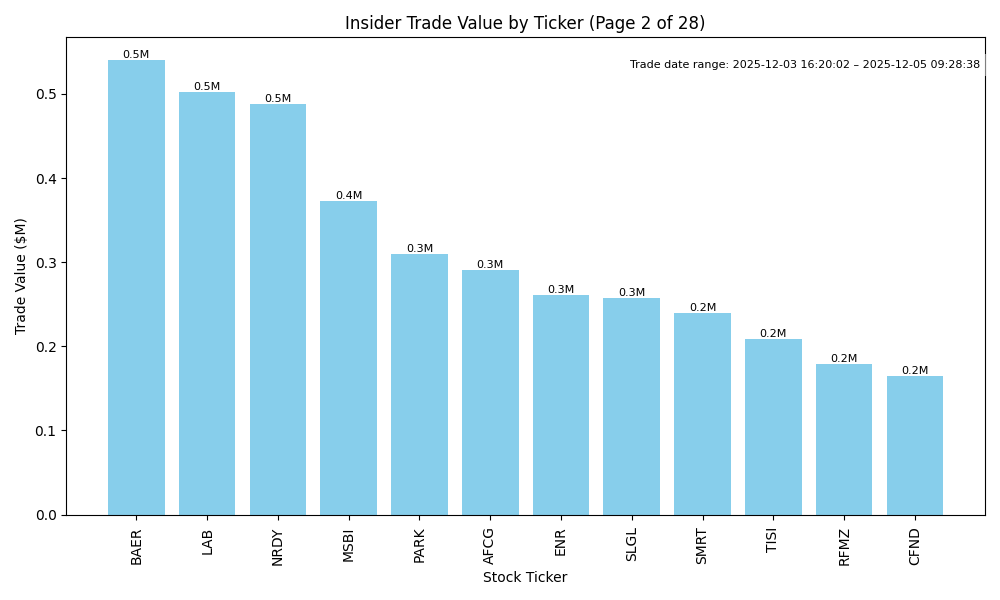

| NRDY | UP | 0.75 | Insider trading shows strong purchasing activity, particularly by the CEO, with multiple large acquisitions in a short period, signaling confidence in the company's prospects. However, there are also significant sales from executives, which raise some caution. The company's recent purchases at lower price levels suggest a belief in undervaluation. Without concrete fundamentals available (like earnings trends or debt levels), the analysis leans on positive insider sentiment outweighing potential risks from sales, market conditions, and macroeconomic factors. | Technology | Software - Application |

| LUCK | UP | 0.70 | Recent insider purchases, especially by the CEO and CFO, suggest a positive outlook from key executives despite a recent large insider sale. The trend of consistent buying at prices lower than recent highs indicates a bullish sentiment. However, without current data on company fundamentals, earnings trends, and broader macroeconomic conditions, confidence in this upward direction is moderate. There may also be tensions due to the significant insider sale a few months prior, reflecting potential liquidity issues or concerns about company valuation. | Consumer Cyclical | Leisure |

| ENR | NEUTRAL | 0.65 | Recent insider purchases from high-level executives like the CEO and directors indicate confidence in the company's future, particularly as they bought shares at much lower prices than their previous purchases. However, the significant insider selling activity within the same timeframe raises concerns about potential volatility. Without recent earnings data or macroeconomic context such as inflation impacts or sector trends, it's challenging to predict strong upward momentum. Thus, while insider actions suggest stability, conflicting signs prevent a strong bullish outlook. | Industrials | Electrical Equipment & Parts |

| MSBI | NEUTRAL | 0.60 | Recent insider buying, particularly by key executives, suggests internal confidence in MSBI's prospects. However, substantial previous sales by senior insiders, especially at higher prices, may indicate ongoing concerns. The company fundamentals and broader macroeconomic context reveal pressure from rising interest rates and inflation, which could hinder growth potential. Given the mixed signals and lack of clear positive or negative trends in key indicators, the stock's near-term direction appears uncertain, justifying a neutral stance. | Financial Services | Banks - Regional |

| DGICA | UP | 0.80 | Insider buying has significantly increased recently, especially from Donegal Mutual Insurance Co, indicating strong internal confidence in the company's future. However, recent sales by other insiders could suggest some caution. Company fundamentals should be examined further to confirm growth trends and financial health. Given the overall bullish insider activity, I expect the stock to trend upwards, albeit with concerns about broader market conditions and potential volatility. | Financial Services | Insurance - Property & Casualty |

| PARK | UP | 0.75 | Recent insider buying from multiple directors and the CEO, who collectively purchased a substantial number of shares at $13, indicates strong internal confidence in the company's prospects. However, the analysis lacks crucial data about the company's financial performance, industry conditions, and macroeconomic factors, which limits certainty. Without this context, while the insider activity suggests optimism, uncertainty surrounding fundamentals and market trends tempers overall conviction. | Healthcare | Medical Care Facilities |

| SLGL | UNKNOWN | 0.40 | Insider purchases by Opaleye Management indicate optimism, totaling over $400,000 recently. However, without insights into SLGL's fundamentals, such as earnings trends, margins, and growth potential, or details on the industry health, my confidence is limited. Additionally, the macroeconomic landscape, including interest rates and inflation, is not detailed, further complicating the outlook. Hence, while insider activity suggests potential resistance to a decline, critical contextual information is lacking, leading to an uncertain near-term direction. | Healthcare | Biotechnology |

| TISI | DOWN | 0.65 | Recent insider buying by Corre Partners Management, LLC contrasts with multiple sales by directors, indicating mixed sentiment. While large purchases from insiders may signal confidence, the fact that recent sales occurred at prices lower than previous average transaction prices suggests possible concerns about valuation or future performance. Furthermore, the company's fundamentals are unclear without updated earnings trends, margins, and growth potential analysis, which raises uncertainty. Broader economic factors like interest rate changes and inflation also add pressure to the market, leaning sentiment toward a cautious outlook for TISI. | Industrials | Specialty Business Services |

| KVHI | UP | 0.70 | Recent insider buying, particularly from significant shareholders, indicates strong internal confidence about KVHI's future performance, particularly with purchases at rising prices. However, there is concern due to recurring insider selling by high-level executives, which could signal operational or financial challenges. Without current financial data such as earnings reports, margins, and macroeconomic conditions affecting the industry, there's uncertainty. If industry fundamentals support growth and KVHI maintains a competitive edge, this may drive stock price up further despite mixed signals from insider transactions. | Communication Services | Telecom Services |

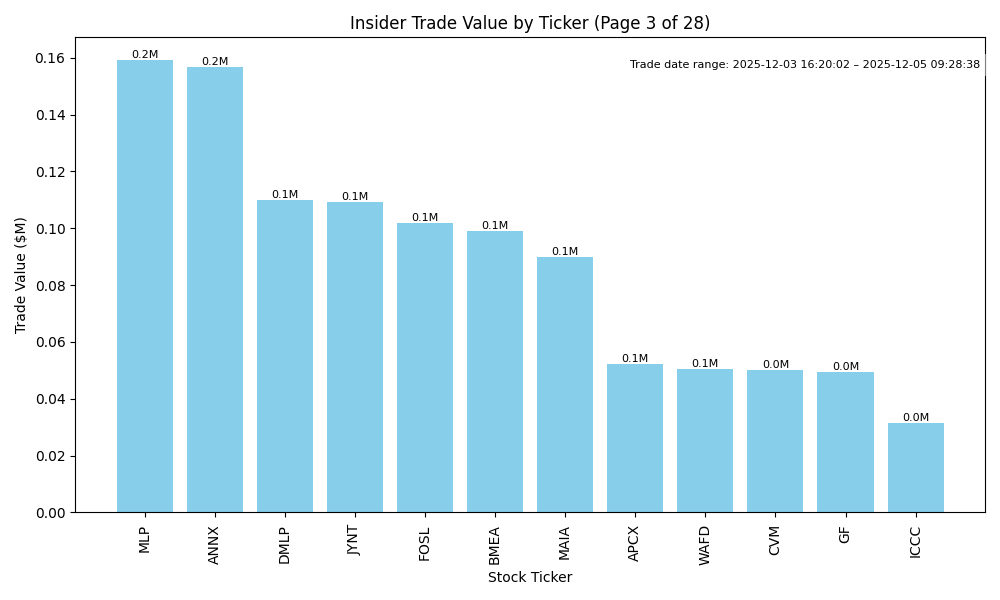

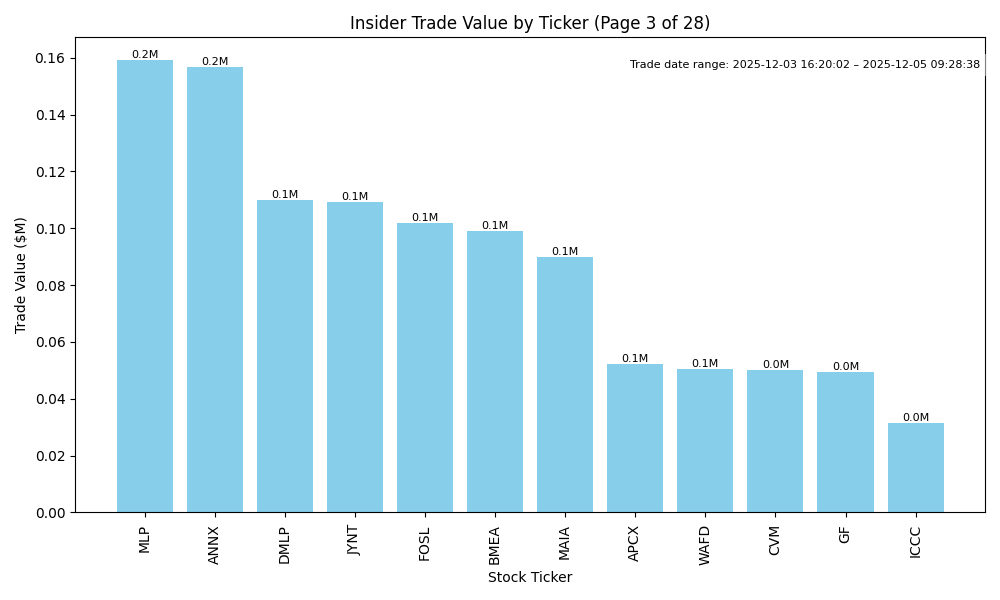

| MLP | UP | 0.75 | Insider purchases by key individuals, particularly the director and CEO, indicate strong internal confidence in the company's prospects. Recent trading activity shows a consistent pattern of buying at increasing volumes and prices, particularly at lower averages below recent highs. However, the effectiveness of these purchases relies on the company’s current fundamentals, which are not detailed here. Overall market conditions, such as interest rates and inflation dynamics, also pose risks. Yet, the insider activity strongly suggests a positive near-term sentiment, leading to an upward direction forecast. | Real Estate | Real Estate Services |

| ANNX | UP | 0.75 | Recent insider buying has accelerated, particularly with significant purchases by Directors and key executives, signaling confidence in the company's prospects despite previous sales. The consistent increase in purchase amounts, particularly from Satter Muneer A, is noteworthy. However, there is a history of selling by executives, which creates some ambiguity. Company fundamentals and sector specifics are not provided, limiting overall assessment strength. Macroeconomic conditions affecting the sector remain uncertain, affecting confidence. Thus, while the outlook leans positive based on insider trades, fundamental and macroeconomic data gaps temper overall confidence. | Healthcare | Biotechnology |

| AFCG | DOWN | 0.70 | Recent insider purchases from key executives like the CEO and a 10% owner indicate confidence in the company's future, particularly with large transactions at lower average prices. However, the trend shows a marked decline in purchase prices from around $12 in mid-2024 to approximately $2.87 in December 2025, suggesting diminishing market confidence. Without information on company fundamentals, such as earnings trends or industry health, it is difficult to ascertain the overall picture, which lowers confidence in the outlook. | Real Estate | REIT - Mortgage |

| DMLP | DOWN | 0.70 | Despite recent insider purchases indicating confidence from directors and executives, the stock has been trending downwards based on averaged transaction prices, currently around $21-22 against prior highs of $31+. The substantial insider buying in the past was at higher prices, suggesting insiders might be trying to support the stock amid potential weakness. Company fundamentals are unclear, and the market may be influenced by broader macroeconomic conditions such as rising interest rates and inflation concerns, potentially limiting growth. Overall, lacking robust fundamentals and facing macro challenges tempers the optimism from insider transactions. | Energy | Oil & Gas E&P |

| JYNT | UP | 0.70 | Recent insider purchases by significant figures, particularly large volume acquisitions at relatively low prices, suggest positive sentiment regarding the company's near-term prospects. However, a holistic evaluation requires more insight into the company's financial health, competitive landscape, and macro conditions. Without current earnings data or broader industry trends, confidence is somewhat tempered. Positive insider activity indicates belief in value growth, but uncertainty exists without additional supporting fundamentals. | Healthcare | Medical Care Facilities |