| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

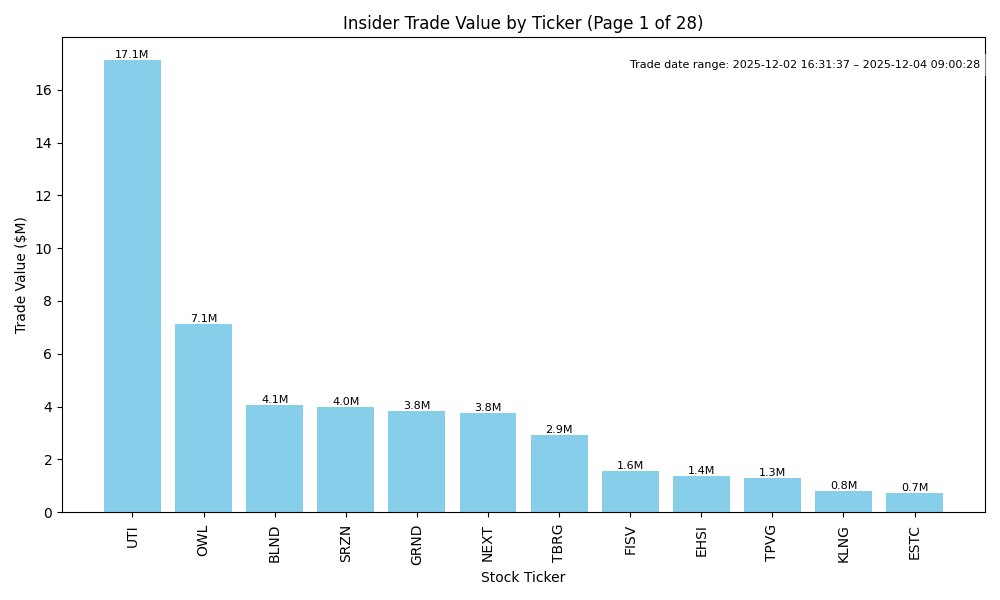

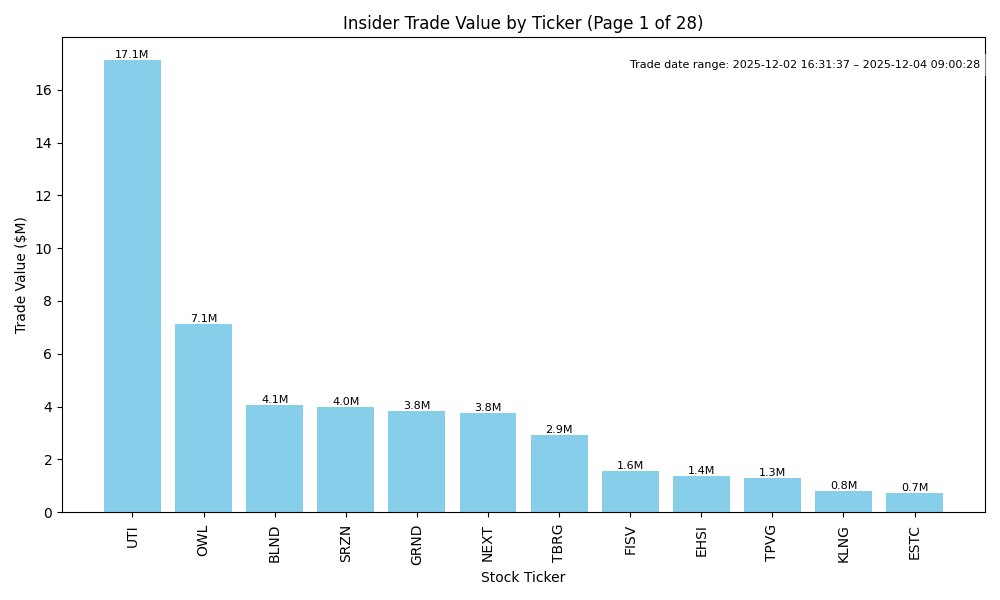

| SRZN | UP | 0.75 | Recent insider buying by key figures indicates strong confidence in the company's future, especially with substantial purchases at lower prices. Although there were minor insider sales earlier in the year, the overall trend seems positive. Without current data on company fundamentals, industry outlook, or macroeconomic conditions, there's some uncertainty. However, if the company shows resilience in its fundamentals and the macro environment remains stable, the stock is likely to trend upward due to insider sentiment. | Healthcare | Biotechnology |

| GRND | DOWN | 0.75 | Insider activity shows mixed signals: significant purchases from Zage George Raymond III amid heavy selling from multiple insiders, particularly Lu James Fu Bin, who has sold over 2 million shares in the last few months. This suggests a bearish sentiment among insiders despite the recent purchase. Additionally, if company fundamentals are weak (e.g., declining earnings, high leverage), the stock may face downward pressure. The broader macroeconomic context, including rising interest rates and inflation, could further strain growth and demand in the sector. Without concrete earnings data or growth indicators, confidence in a definitive direction is moderate. | Technology | Software - Application |

| NEXT | UP | 0.70 | Insider activity has shown robust buying, particularly from Hanwha Aerospace, indicating strong confidence in the company's future. The consistent purchases at various price points suggest a belief in undervaluation. However, insights into company fundamentals, such as earnings and leverage, are lacking, which tempers confidence. The broader macroeconomic context also remains strained with fluctuating inflation and interest rates that could impact growth. Overall, while insider transactions are positive, potential fundamental weaknesses and macro conditions create uncertainty. | Energy | Oil & Gas Equipment & Services |

| KCHV | UP | 0.70 | The recent insider purchase of 255,000 shares by Sc Capital II Sponsor LLC indicates strong insider confidence. While this transaction is positive, a thorough evaluation of KCHV's fundamentals, industry trends, and macroeconomic context is necessary. Specific data on earnings, margins, and market conditions are absent, limiting a full assessment. However, insider accumulation often reflects optimism about future performance. Without critical fundamental data, confidence is moderate but leans upward due to the significant insider activity. | N/A | N/A |

| TPVG | UP | 0.75 | Recent insider purchases from key executives, including the CEO and President, indicate strong internal confidence in the company's future at a lower price point. The volume of shares bought recently suggests alignment among top management about the prospects of TPVG. However, without current financial data on earnings, margins, and external macroeconomic conditions, such as interest rates and inflation, the analysis remains somewhat speculative. Thus, while insider confidence points to a bullish sentiment, caution should be exercised given potential structural market weaknesses. | Financial Services | Asset Management |

| FISV | UP | 0.75 | Recent insider purchases by key executives, including the CFO and Chief Admin. Officer, suggest confidence in the company's prospects. However, details on FISV's current financials, including earnings trends and ratios, are not provided. The performance of the broader market, interest rates, and inflation may influence stock movement. Without specific clarity on the company's recent developments, my confidence in this positive outlook is moderate. | N/A | N/A |

| EHSI | UP | 0.75 | The CEO of EHSI, Jeereddi Prasad Anjaneya, made a significant purchase of 1.45 million shares at $0.95, indicating strong personal conviction in the company's outlook. Insider buying, especially by a major executive, often signals that insiders believe the stock is undervalued or that positive developments are on the horizon. However, without additional context on company fundamentals, recent earnings trends, and macroeconomic conditions, confidence is moderate. If broader market sentiment or industry dynamics are unfavorable, this could temper upward momentum despite insider optimism. | Healthcare | Medical Care Facilities |

| ALMS | UP | 0.75 | Recent insider buying has been significant, with notable purchases by directors and large shareholders, particularly at increasing prices, indicating strong confidence in the company's value. However, there is a need to examine the company's fundamentals; key metrics are not provided. While the insider activity suggests optimism, the absence of specific earnings trends and macroeconomic context lowers confidence. Still, the consistent insider purchases highlight a bullish sentiment amidst potentially positive developments. | Healthcare | Biotechnology |

| KLNG | UP | 0.70 | Recent insider buying by Intelligent Fanatics Capital Management suggests positive sentiment, with the purchase of 592,000 shares at $1.35 indicating strong confidence in the company's future. Meanwhile, the sale by Director Carden Mark, although indicative of some profit-taking, is minor relative to the larger purchase and may reflect personal financial planning rather than a negative outlook on the company's health. A lack of information on overall earnings trends, leverage, or industry dynamics limits the assessment somewhat, but the significant insider acquisition bolsters a near-term bullish perspective. | Energy | Oil & Gas Equipment & Services |

| ESTC | DOWN | 0.70 | Recent insider trading activity shows a substantial number of sales by executives, including the CEO and CTO, indicating a lack of confidence in the stock at higher prices. For example, significant sales occurred in the $90 range and above, contrasted by a lone recent purchase by a director at $71.02. Company fundamentals are unclear due to missing recent earnings trends and other pertinent financial metrics. The general market also faces challenges with rising interest rates and inflation, potentially affecting growth. Therefore, the outlook is negative despite recent insider purchases, maintaining a moderate level of confidence in the assessment. | Technology | Software - Application |

| ASA | UP | 0.80 | Recent insider purchases, especially by Saba Capital Management, indicate strong confidence in the company's future, as they have acquired significant shares at increasing prices, suggesting their bullish outlook. However, without current fundamental data such as earnings trends, margins, and growth potential, and lacking broader macroeconomic context, confidence is moderate. The industry's health, supply-demand dynamics, and market conditions will also play a crucial role in the stock's near-term direction. | Financial Services | Asset Management |

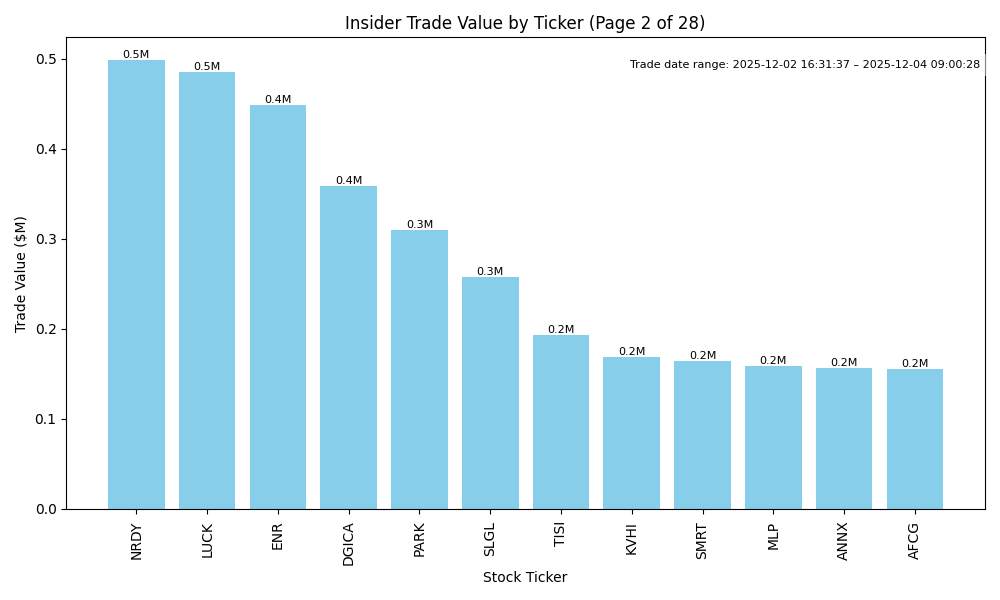

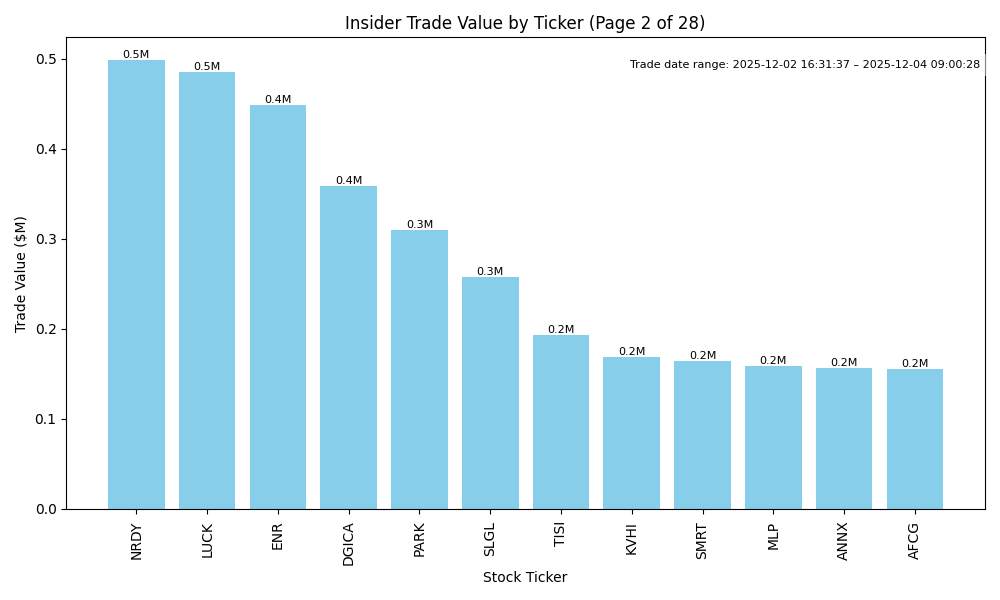

| LUCK | UP | 0.80 | Recent insider purchases, particularly a significant buy by Director Richard Meynard of 60,000 shares at $8.09, indicate strong insider confidence at lower price levels. The consistent buying activity from multiple insiders suggests belief in the company's potential despite recent challenges. However, the presence of a significant insider sale (over 1.7 million shares) by Brett Parker raises some concerns about potential liquidity issues or sentiment shifts. Without the latest earnings and macroeconomic context, confidence is tempered but still leans positive due to insider purchasing trends. | Consumer Cyclical | Leisure |

| MNR | NEUTRAL | 0.60 | The insider trading activity reflects a strong trend of purchases by key insiders, especially significant recent buys at lower price points. However, these transactions occurred after a notable drop in share price, suggesting they may be capitalizing on perceived undervaluation. Company fundamentals and broader market trends are not assessed here and could influence the outlook unpredictably. Additionally, recent macroeconomic conditions, such as rising interest rates and inflation, could pressure the stock's prospects. Thus, while insider sentiment appears bullish, the surrounding factors introduce uncertainty. | Energy | Oil & Gas E&P |

| DGICA | UP | 0.75 | Recent insider purchases from Donegal Mutual Insurance Co, which holds a 10% stake, indicate strong confidence in DGICA's future, as they accumulated significant shares at evolving prices between approximately $13.67 and $20.25. However, the notable sales by other insiders could imply concerns among the management about the near-term performance. Evaluating the macroeconomic context, if interest rates stabilize and inflation decreases, the company could benefit from a positive environment. Nevertheless, lack of details on current earnings trends and broader market challenges suggest a moderate confidence in an upward price trend. | Financial Services | Insurance - Property & Casualty |

| INSE | UP | 0.70 | Insider purchases from key executives suggest a positive outlook, particularly with significant transactions by both the CEO and the Executive COB. Despite a lack of detailed company fundamentals and broader macroeconomic data, the buying activity indicates confidence in the company's near-term performance. However, the absence of recent earnings trends, industry health, and macroeconomic conditions creates some uncertainty, leading to a moderate confidence level. | Consumer Cyclical | Gambling |

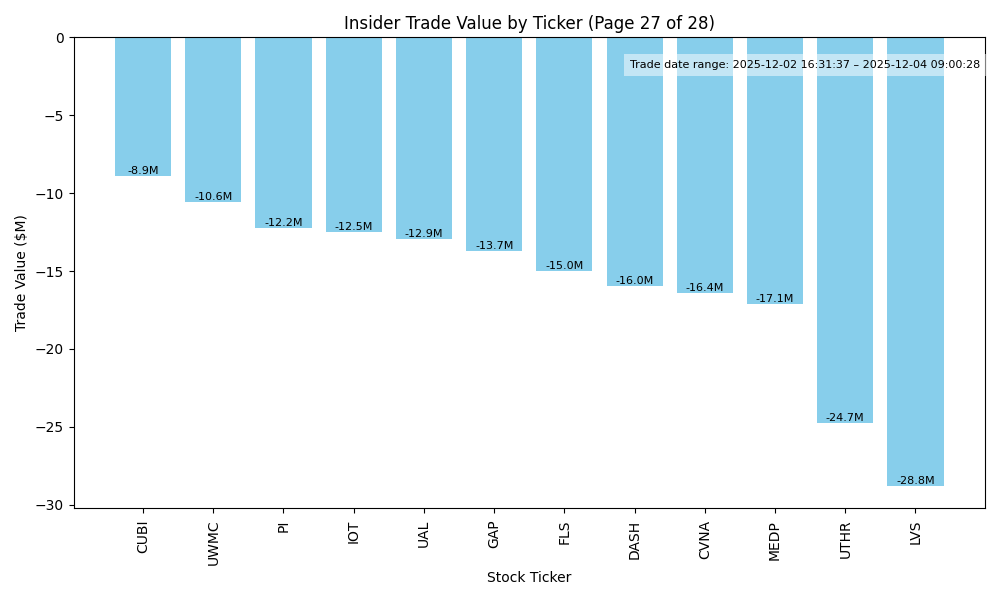

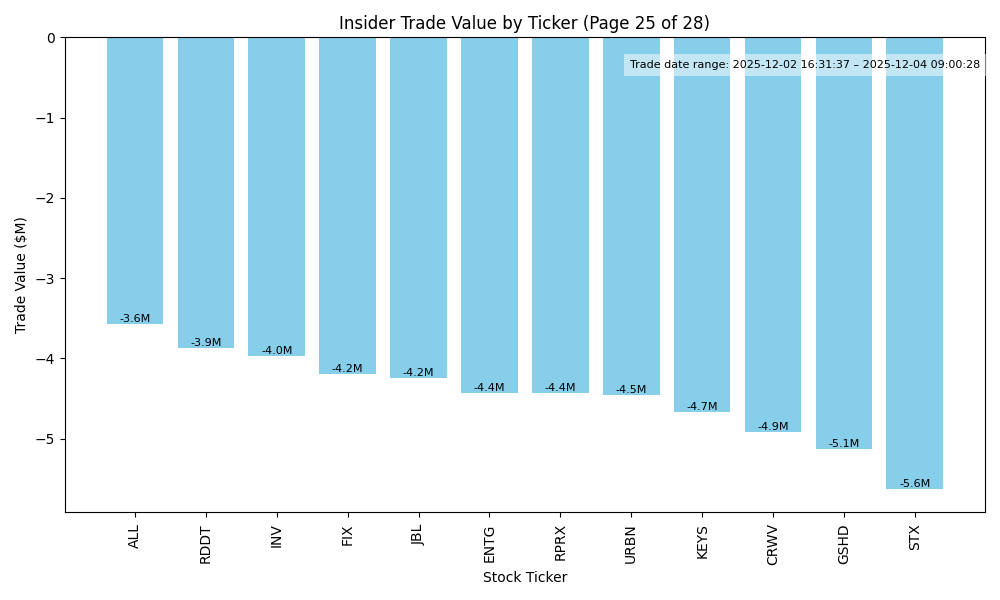

| GSHD | DOWN | 0.70 | Recent insider activity shows significant selling by major shareholders, particularly the Mark & Robyn Jones Descendants Trust, which raised concerns about future stock performance. While there have been recent insider purchases by the CEO and other executives indicating some confidence, the scale of selling compared to buying suggests a bearish sentiment. Furthermore, the stock has seen a notable decrease in price from earlier highs around $120, indicating potential weakness in fundamentals. Without robust financial data on earnings trends, growth potential, or macroeconomic conditions affecting the sector, the outlook remains cautiously negative. | Financial Services | Insurance Brokers |

| NRDY | UP | 0.70 | Recent insider buying by the CEO represents a strong bullish sign, with significant purchases at increasing volume and average prices, indicating confidence in the company's future. While there are also sell transactions by other insiders, the recent buying trend is indicative of potential positive developments. However, without detailed information on company fundamentals and market conditions, my confidence is moderate. Analyzing the general positive trend in insider sentiment, I expect the stock will likely trend upwards in the near term. | Technology | Software - Application |

| GXO | NEUTRAL | 0.60 | Insider trading shows mixed signals: the CEO and a director bought shares recently, indicating confidence in the company's future. However, a director also sold a significant number of shares earlier this year, which raises concerns. On the fundamentals side, without recent earnings data or insights on growth and margins, it's difficult to gauge the company's health. The logistics industry is facing mixed signals from supply/demand dynamics, influenced by macroeconomic conditions such as rising interest rates and potential economic slowing. Overall, insider purchases suggest some optimism, but the significant insider selling and lack of clear fundamental or macroeconomic support lead to a more cautious stance. | Industrials | Integrated Freight & Logistics |

| SAMG | UNKNOWN | 0.50 | Insider purchases by key individuals indicate some confidence in the stock, particularly the significant recent purchase by MD John Gray. However, the average purchase prices are above the current trading average, raising caution. Additionally, there's limited information on company fundamentals, sector health, and macroeconomic trends that could impact the stock's direction. Without a clear picture of earnings trends, competitive positioning, or market conditions, it's hard to firmly determine the stock's trajectory. | Financial Services | Asset Management |

| JNJ | DOWN | 0.60 | Recent insider activity shows significant selling from multiple executives, indicating potential concerns about the company's future performance. While there is a recent purchase by a director, it is relatively small compared to the larger sales by key executives, suggesting a lack of strong confidence among insiders. Company fundamentals and macroeconomic conditions currently show pressure due to rising interest rates and inflation, which can impact consumer spending and, subsequently, JNJ's revenues. Additionally, without recent positive earnings reports or guidance changes to bolster sentiment, the overall outlook tends towards a downward trend. | Healthcare | Drug Manufacturers - General |

| FCNCA | DOWN | 0.60 | Insider trading shows significant recent purchases by key executives, indicating potential confidence in the company's prospects. However, the pattern of substantial insider selling by a director, particularly in 2024, raises concerns about the company's valuation and future performance. Without updated data on corporate fundamentals, earnings, and macroeconomic conditions since October 2023, it's difficult to fully gauge the company's health. Given the mixed indicators from insider activity (strong purchases vs. notable sales), and potential market volatility, the outlook leans towards down. | Financial Services | Banks - Regional |

| MXF | UP | 0.75 | Recent insider buying, particularly from a significant stakeholder, Saba Capital Management, indicates strong confidence in MXF's near-term prospects. Notably, the volume and frequency of these transactions suggest a bullish sentiment. Conversely, a full fundamental evaluation is hindered by lack of specific earnings trends, growth potential, and macroeconomic context. If the company's fundamentals and sector health align positively with this insider activity, the stock could see upward momentum in the near term. | Financial Services | Asset Management |

| ENR | DOWN | 0.70 | Recent insider buying is notable, especially from senior executives, indicating optimism about the company's prospects despite the recent stock price decline from around $30 to $17. The increasing purchase volume may suggest a perceived undervaluation. However, the insider sales earlier in 2024 and the significant dip in stock price raise concerns about underlying fundamentals. High insider sales may reflect lack of confidence in immediate performance. Without specific recent earnings or growth updates, uncertainties about the company's financial health and competitiveness remain. Overall, the mixed signals from insider trading combined with potential industry or macroeconomic pressures suggest a likely downturn. | Industrials | Electrical Equipment & Parts |

| WERN | UP | 0.70 | The recent insider trading activity shows significant purchases by multiple executives, indicating strong internal confidence in the company's future. Collectively, these transactions involve notable amounts at prices around the high $29 range. However, without current financial performance data, industry health insights, and macroeconomic context, particularly regarding interest rates and inflation effects, the analysis is not entirely robust. Still, positive insider sentiment can be a bullish signal if aligned with solid fundamentals and external conditions, though the absence of comprehensive data lowers overall confidence. | Industrials | Trucking |

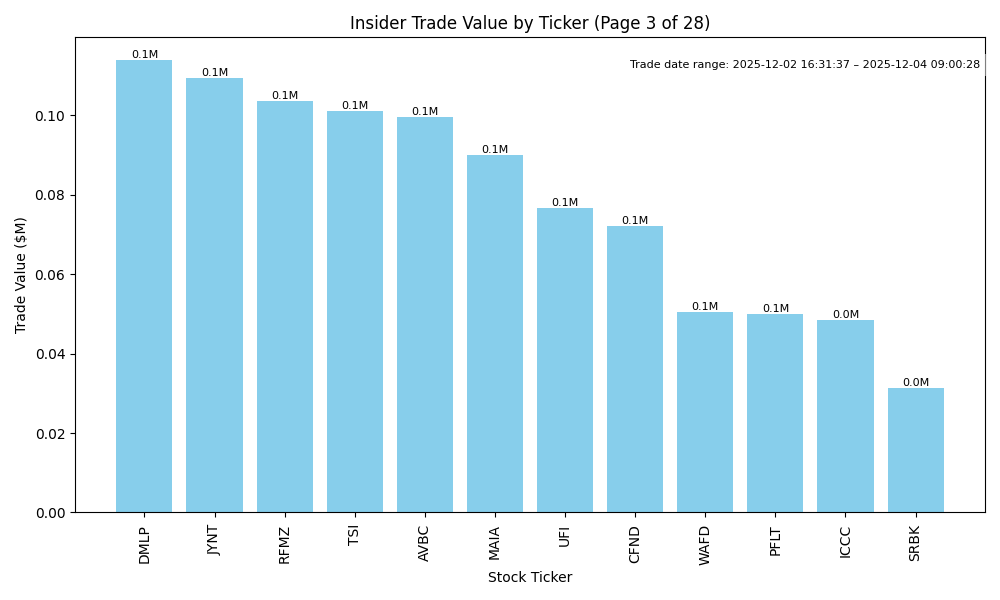

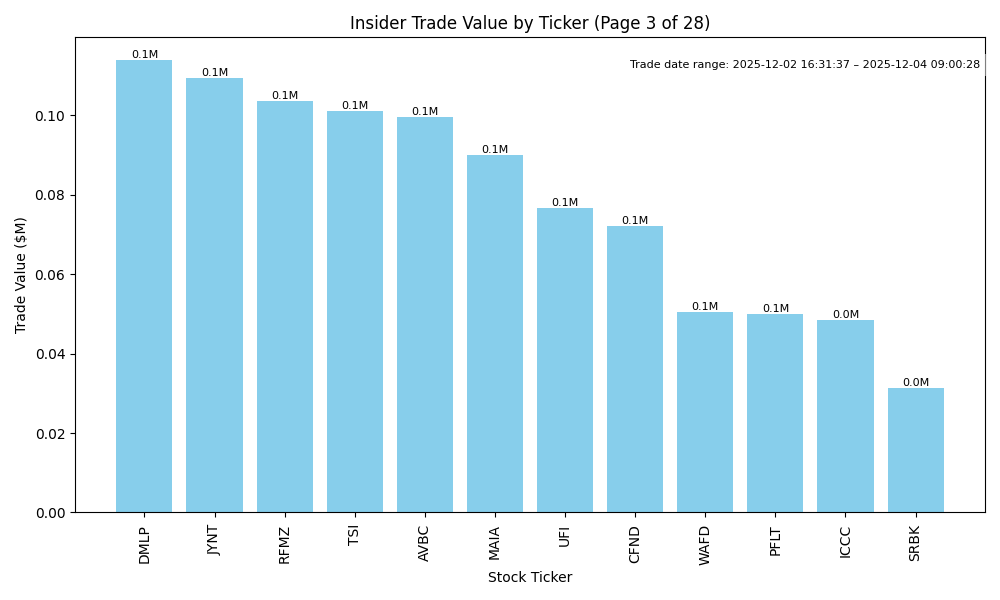

| AVBC | UP | 0.80 | AVBC has witnessed substantial insider buying in recent months, including significant purchases by the Chairman, CEO, and CFO, suggesting strong internal confidence in the company's prospects. The purchase activity concentrated among key executives indicates a bullish sentiment. However, a thorough analysis of company fundamentals, including earnings trends and margins, is necessary to contextualize this insider behavior. If the broader sector remains healthy and if macroeconomic conditions stabilize or improve, the insider purchasing could positively influence stock performance. Overall, while insider activity is encouraging, potential gaps in detailed financial metrics may temper overall confidence. | Financial Services | Banks - Regional |