| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

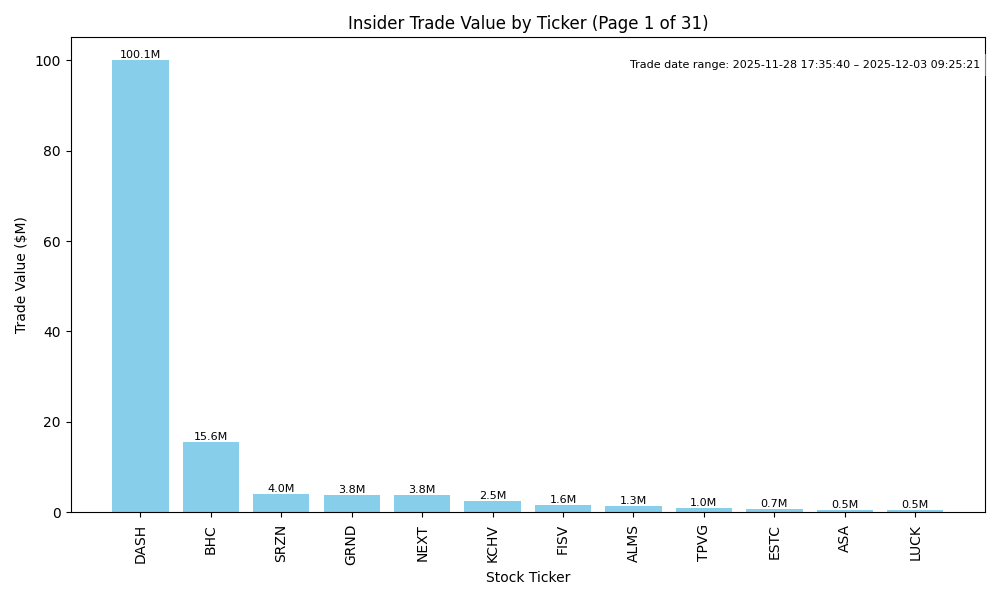

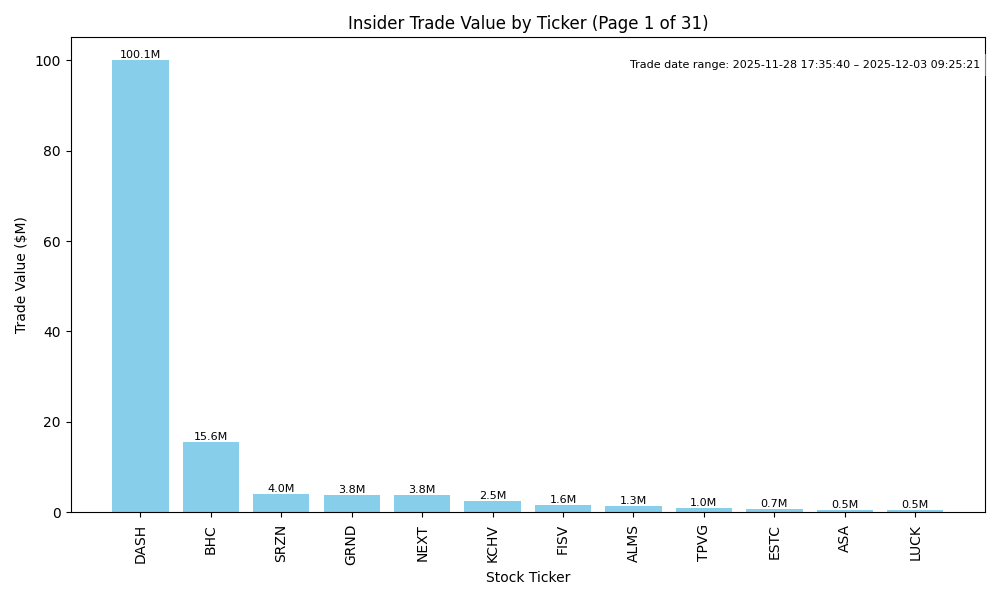

| DASH | DOWN | 0.70 | Recent insider trading reveals a significant pattern of sales among executive officers, including substantial transactions by the CEO and CFO, signaling potential lack of confidence in the stock's future performance. Despite one large insider purchase, the overwhelming volume of sales indicates a trend of profit-taking. Additionally, without specific insights into the company’s fundamentals, growth trajectory, or broader market influences, such as macroeconomic conditions and sector health, a downward price trajectory is more probable. The combination of heavy insider selling and uncertainty regarding fundamental conditions supports a bearish outlook. | Consumer Cyclical | Internet Retail |

| BHC | UP | 0.70 | The recent insider buying activity, particularly a significant purchase by Paulson & Co. Inc. of 2.5 million shares at $6.25, indicates strong confidence in the stock's future. While there have been some smaller sales by other insiders, they do not outweigh the larger purchasing trends. Company fundamentals and broader market data are lacking; however, the significant purchases suggest potential optimism about future performance. Given the current macroeconomic environment and potential volatility, the outlook is cautiously positive. | Healthcare | Drug Manufacturers - Specialty & Generic |

| LAB | UP | 0.70 | Recent insider buying by Casdin Partners Master Fund indicates strong confidence in LAB's future, with significant shares purchased at increasing prices. However, accompanied by minor insider selling, indicating potential caution. Without current earnings reports or macroeconomic factors impacting the sector directly, confidence wavers. Despite this, the patterns of concentrated insider purchases suggest optimism about underlying business performance. | Healthcare | Medical Devices |

| NEXT | UP | 0.70 | Recent insider buying from Hanwha Aerospace Co., Ltd. and other executives indicates strong confidence in the company's future, with multi-million dollar purchases at prices mostly under $7. While there has been significant insider accumulation, past sales by major stakeholders create some concern regarding potential liquidity issues. Without detailed financial metrics or broader market context, including recent earnings performance and macroeconomic trends, the outlook remains cautiously optimistic but could change if broader conditions deteriorate. | Energy | Oil & Gas Equipment & Services |

| KCHV | UP | 0.60 | The recent insider purchase of 255,000 shares by Sc Capital II Sponsor LLC indicates a positive outlook from someone with significant investment in the company, reflecting confidence in KCHV's potential. However, without detailed insights into the company's fundamentals, market position, and broader macroeconomic conditions, the overall stock direction remains uncertain. More context on earnings trends, industry dynamics, and macroeconomic factors would enhance confidence in this assessment. | N/A | N/A |

| ONMD | UP | 0.75 | Recent insider trading shows significant buying activity from multiple executives, indicating strong insider confidence. Notably, the Chief Medical Officer purchased over 2 million shares at a price of $0.48, alongside other substantial purchases from directors and the CFO. This may signal optimism about the company's future prospects. However, a deeper analysis of fundamentals, such as earnings trends and growth potential, is necessary to validate this sentiment, especially amid broader market conditions impacted by rising interest rates and inflation. The confidence is moderately high due to the concentration of purchases but tempered by uncertainties in macroeconomic factors and company performance data. | Healthcare | Health Information Services |

| ALMS | UP | 0.75 | Recent insider buying demonstrates strong confidence among key stakeholders, with significant purchases by directors and major shareholders at increasing prices, indicating perceived undervaluation. The large transactions suggest a positive outlook regarding the company's future performance. However, the lack of current financial performance metrics limits the confidence in this direction, as broader market conditions and sector dynamics also play a crucial role. Overall, if the company can maintain solid growth amidst a favorable macroeconomic environment, the stock may trend upwards. | Healthcare | Biotechnology |

| TPVG | UP | 0.80 | Recent insider purchases by the CEO and CIO show confidence in TPVG, with significant volumes at increasing prices indicating positive sentiment. However, without current fundamental data on earnings, margins, or competitive positioning, caution is needed. The broader economic environment's interest rates and credit conditions could impact growth potential, yet insider enthusiasm suggests an optimistic near-term outlook. | Financial Services | Asset Management |

| ASPJX | UP | 0.70 | Recent insider purchases, particularly by directors and the CEO, indicate strong confidence in the stock's future performance. The significant volume of shares bought at relatively stable prices suggests insiders believe the stock is undervalued. However, without specific details on the company's earnings trends, growth potential, or broader market conditions, the analysis lacks a comprehensive view. If macroeconomic conditions are stable, the insider activity could signify upward potential. Additional transparency on fundamentals and market context would improve confidence. | N/A | N/A |

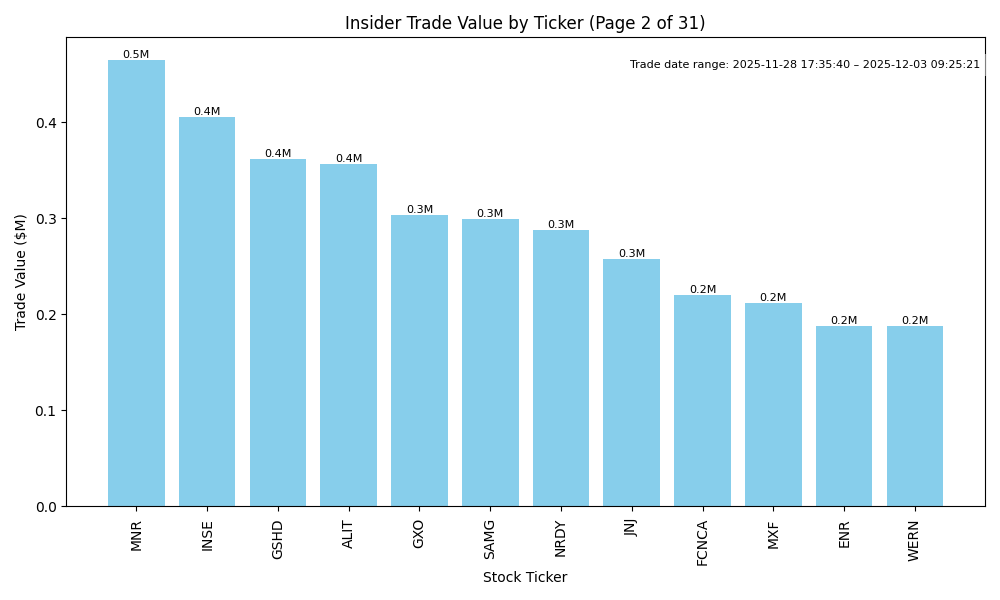

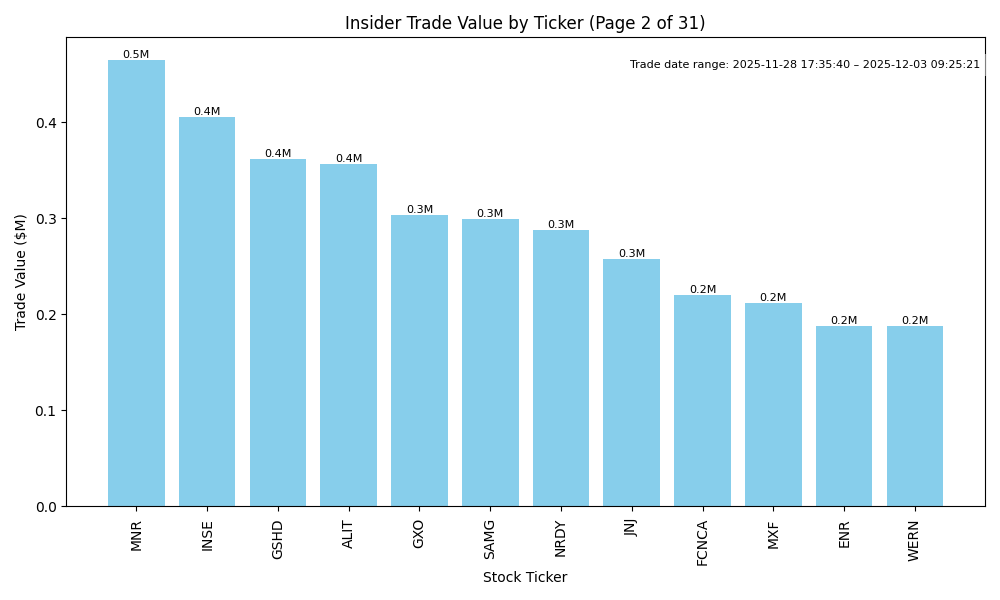

| GSHD | UNKNOWN | 0.50 | Recent insider purchases by the CEO and General Counsel suggest confidence at higher price levels, while significant selling by major stakeholders raises concerns about liquidity and market sentiment. The mix of rising investments by top executives in December coupled with prior months' heavier sell-offs indicates conflicting signals. Additionally, lack of recent financial performance data and macroeconomic context reduces confidence in this analysis. Trend persistence and market conditions are not well captured from the data presented. | Financial Services | Insurance Brokers |

| ASA | UP | 0.75 | Insider purchases from Saba Capital Management, accumulating over 1 million shares within a short timeframe, suggest strong confidence in the company's prospects. Despite the recent drop in average purchase price from around $53 to about $15, indicating significant value perceived by insiders, more contextual data on company fundamentals—like earnings performance and growth outlook—is needed for a comprehensive assessment. However, the consistent buying trend points to potential upward price movement in the near term, especially if broader macroeconomic conditions stabilize. | Financial Services | Asset Management |

| SPRU | UP | 0.80 | Insider buying has accelerated significantly, particularly from Steel Partners Holdings, indicating strong internal confidence. Recent purchases at increasing prices suggest positive sentiment and potential undervaluation. However, an insider sale earlier in the year could raise some concerns about overall market confidence. Without detailed fundamentals on earnings growth, margins, and leverage, and the current macroeconomic environment, caution remains necessary. That said, the notable purchasing activity outweighs these concerns, implying a likely upward trajectory in the near term. | Technology | Solar |

| MNR | DOWN | 0.65 | Recent insider purchases by Tom Ward and William McMullen suggest confidence in the stock despite its declining price trend, indicated by significant prior sales at higher prices. The most recent trades reflect a concern as they are occurring at lower prices than previous large transactions, implying potential issues with valuation or business fundamentals. Without clear data on earnings, margins, or macroeconomic context impacting MNR, caution is warranted. Given these factors, I maintain a cautious outlook with moderate conviction. | Energy | Oil & Gas E&P |

| NRDY | UP | 0.80 | Recent insider trading is overwhelmingly dominated by significant purchases from CEO Cohn Charles K., indicating strong confidence in the company’s future prospects. However, there have been notable sales from other executives, particularly the CFO and GC, which raises caution about their view on short-term performance. While the recent insider purchases suggest potential optimism, it's critical to note the lack of detailed company fundamentals and broader macroeconomic context in the provided data, resulting in moderate confidence in this bullish outlook. | Technology | Software - Application |

| INSE | UP | 0.70 | Recent insider buying by top executives suggests positive internal sentiment regarding the company's future. The purchases indicate confidence in the company's value, especially at average prices below the current market rate. However, a full assessment requires knowledge of the company's fundamentals, such as earnings trends and growth potential, which are currently unclear. The broader macroeconomic landscape and industry health are also critical but not detailed here, introducing some uncertainty in this assessment. Nevertheless, the strong insider activity gives a bullish tilt to the stock's near-term direction. | Consumer Cyclical | Gambling |

| ALIT | DOWN | 0.70 | Recent insider trading shows significant purchases by directors, indicating potential confidence in the stock's future performance. However, this is countered by a history of large insider sales earlier this year, suggesting that insiders may have already realized gains. Current market conditions, including rising interest rates and inflation, could add pressure to the stock. Additionally, without specific information on recent earnings trends or guidance from ALIT, the potential negative impact from macroeconomic factors leads to a cautious outlook despite the insider buying. | Technology | Software - Application |

| CRSR | NEUTRAL | 0.60 | Recent insider buying from the CEO and a director indicates positive sentiment, with substantial purchases at declining prices. However, the CFO has consistently sold shares, indicating potential concerns about the company's future performance. While insider purchases can signal confidence, the overall trend of regular insider sales introduces uncertainty. Further insights on the company's fundamentals, such as earnings trends and growth potential, alongside the broader economic context (e.g., interest rates and inflation), are needed to ascertain the stock's near-term direction more confidently. | Technology | Computer Hardware |

| GXO | NEUTRAL | 0.50 | Recent insider purchases by the Director and CEO indicate optimism about the company's future, but the recent sales by a Director suggest some internal caution or profit-taking. Without additional context on the company's earnings trends, debt levels, or macroeconomic conditions—such as inflation and interest rates—it is difficult to ascertain a clear directional bias. Therefore, while there are mixed signals from insider activity, a lack of solid underlying fundamentals or macroeconomic clarity leads to a neutral stance. | Industrials | Integrated Freight & Logistics |

| SAMG | NEUTRAL | 0.60 | Insider purchases have been noted, particularly significant buys by the MD and a 10% shareholder, suggesting some level of confidence in the company's prospects. However, the average purchase prices are higher than recent activity, which could indicate risks if shares continue to decline. Additionally, without key data on the company's earnings trends, competitive positioning, or broader economic factors impacting the industry, the outlook remains uncertain. While insider buying is generally a bullish sign, the lack of strong fundamentals or macroeconomic support tempers that optimism. | Financial Services | Asset Management |

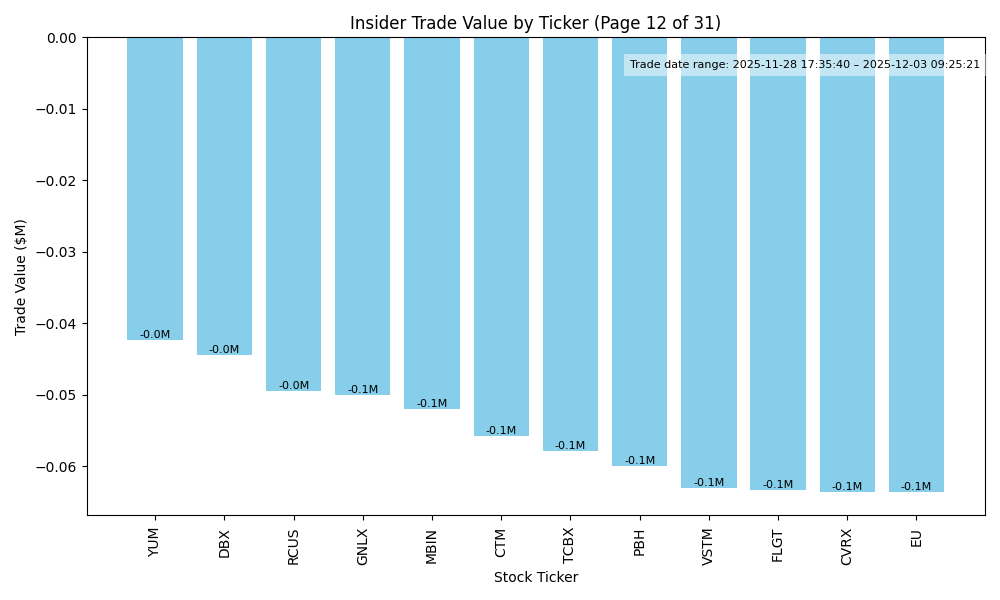

| JNJ | DOWN | 0.70 | Recent insider activity suggests a negative sentiment, with several high-level executives selling significant share quantities, including the CEO and EVP's, which raises concerns about their outlook on the company's stock. The lone purchase by a director, although positive, is notably outweighed by the volume of sales. Company fundamentals are crucial; if earnings are under pressure from competitive dynamics, industry trends, or macroeconomic factors (e.g., rising interest rates and inflation), the stock may face downside risk. A review of recent earnings reports or guidance could help clarify these fundamentals, but as of now, the overall outlook leans negative. | Healthcare | Drug Manufacturers - General |

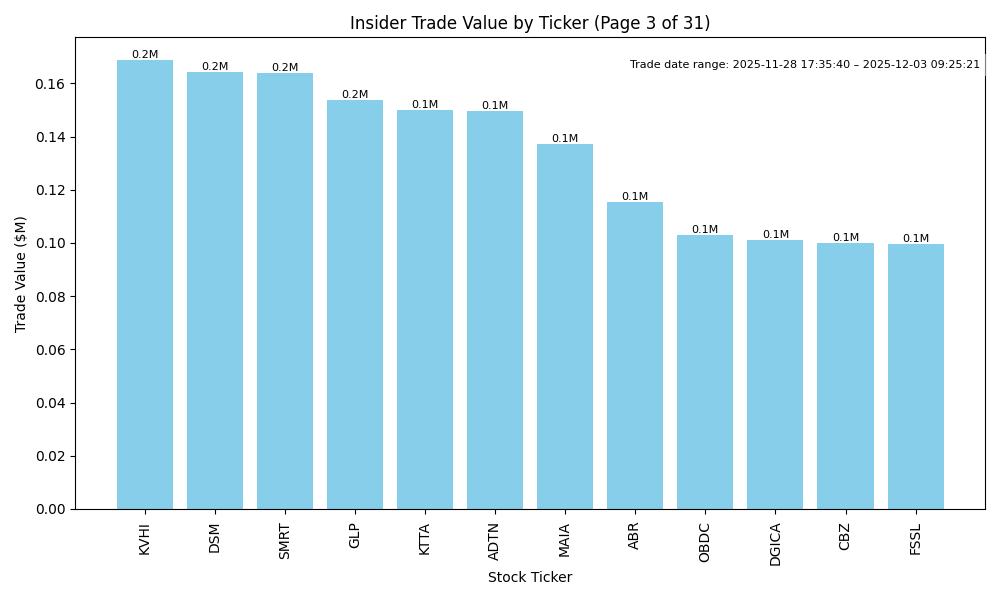

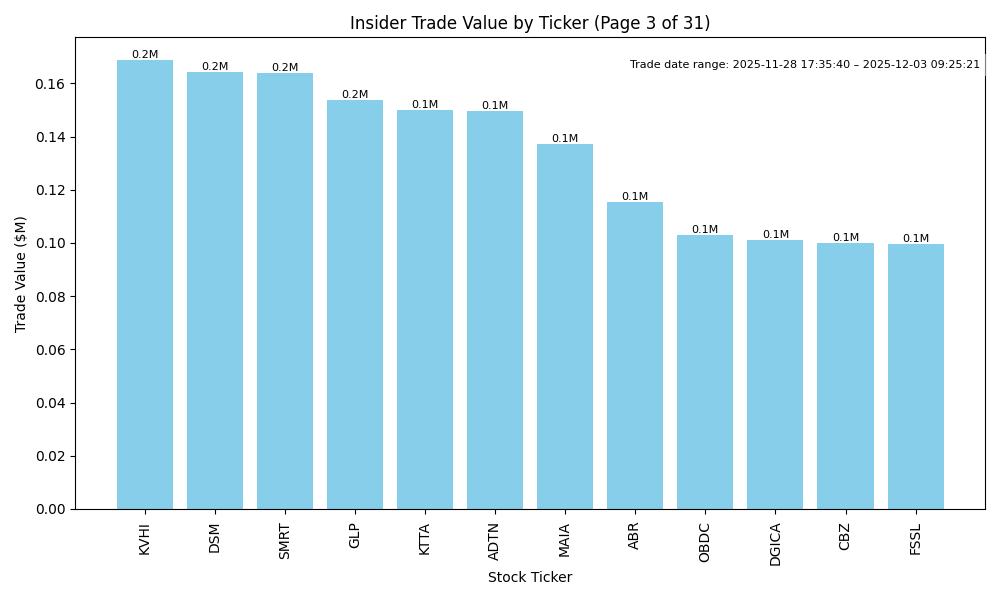

| FSSL | UP | 0.75 | Recent insider buying suggests a positive outlook for FSSL, with multiple directors purchasing shares at prices between $13.27 and $13.55, indicating their confidence in the company's prospects. However, without data on company fundamentals, industry positioning, or macroeconomic context, there's uncertainty. The concentration of purchases, particularly by Forman Michael C., may imply strategic positioning. Yet, overall confidence remains moderate due to lack of additional context such as earnings performance, debt levels, and broader market conditions. | | |

| FCNCA | UP | 0.70 | Recent insider purchases from key executives, including the CEO and other directors, indicate strong internal confidence in FCNCA's future at varied price points. While past insider selling by Alemany raises some concerns, the recent buying trend and substantial purchases at lower ranges suggest that insiders see value. However, a comprehensive view of company fundamentals and macroeconomic conditions is lacking, which diminishes the overall confidence, particularly if broader market uncertainties arise. | Financial Services | Banks - Regional |

| BLND | UP | 0.70 | Recent insider activity shows significant purchases by Haveli Investments, indicating strong confidence from management, particularly with a total of over 3.4 million shares bought recently at prices around $3.00-$3.06. Despite some selling by other insiders, the buying trend suggests bullish sentiment. However, the lack of details regarding current financial performance, growth metrics, or industry conditions poses a potential risk. The broader market dynamics remain challenging due to macro conditions, including interest rates and inflation pressures, which could impact all sectors. Still, the concentrated buying by a large insider is a positive signal. | Technology | Software - Application |

| MXF | UP | 0.75 | Recent insider purchases, particularly by a significant shareholder, indicate strong confidence in the stock. Saba Capital Management has been active in buying large quantities, suggesting they believe the stock is undervalued. While the fundamentals remain unclear without recent performance data, the pattern of consistent buying could indicate positive sentiment. However, further analysis on earnings, margins, and macroeconomic conditions is necessary for a comprehensive assessment. Current economic factors such as interest rates and inflation could pose risks, but the insider activity points to a bullish outlook in the near term. | Financial Services | Asset Management |

| WERN | UP | 0.75 | Recent insider purchases by key executives, including the CEO and other top officers, indicate strong confidence in the company's future, with significant cumulative investment at prices around $29-$30. While these transactions suggest optimism, it is essential to also consider broader factors like market conditions, sector trends, and company fundamentals. Current macroeconomic challenges, such as inflation and rising interest rates, may pose risks. However, if the company's financials are healthy and growth prospects are solid, these insider purchases could indicate a favorable near-term outlook despite potential headwinds. Detailed company fundamentals are missing to fully validate the strength of this outlook. | Industrials | Trucking |