| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

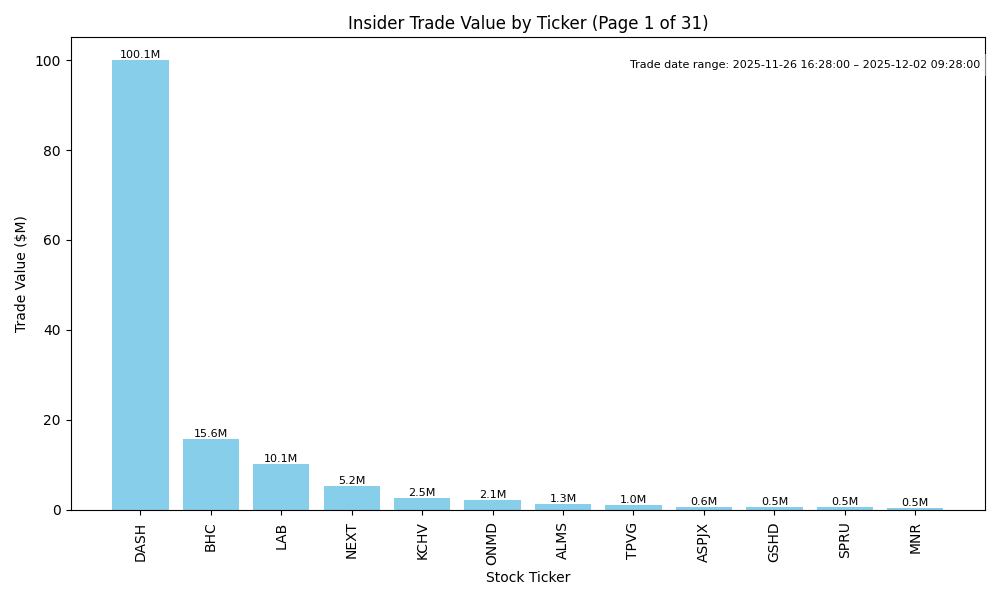

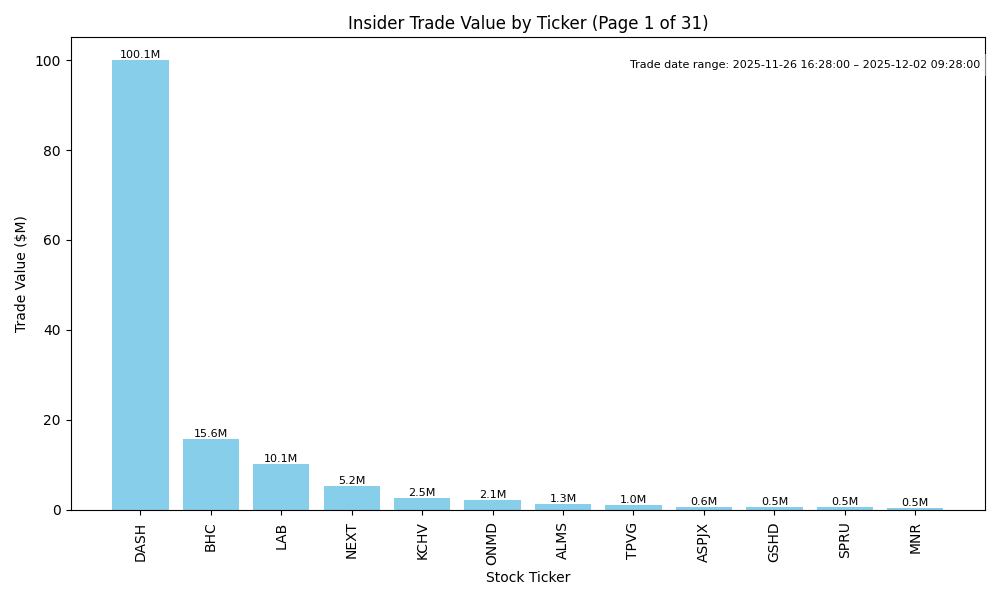

| DASH | DOWN | 0.65 | The recent insider trading activity for DASH shows a significant sale by multiple key insiders, including large quantities by the CFO and COO, which often indicates concerns about the company's short-term prospects. Although there was a notable purchase of over 500,000 shares by a director, the prevailing trend appears to be selling. Additionally, if company fundamentals are under review, particularly around earnings, margins, or growth potential, it could exacerbate negative sentiment. Market conditions, including high interest rates and inflation concerns, are likely to further suppress stock prices. The combination of heavy insider selling and general economic malaise leads to a cautious outlook for DASH. | Consumer Cyclical | Internet Retail |

| BHC | UP | 0.70 | Insider buying, particularly from Paulson & Co. Inc., indicates strong confidence in BHC's prospects, with notable purchases at varying price points averaging lower than recent trading levels. This could indicate underlying value or potential recovery. However, the limited insider selling could signify caution among other executives, and mixed indicators about fundamentals are not analyzed here. Additional context on recent earnings, margins, and macroeconomic conditions would strengthen this analysis, but the insider activity leans towards a bullish outlook in the near term. | Healthcare | Drug Manufacturers - Specialty & Generic |

| LAB | UP | 0.75 | Recent insider purchases, especially by a significant shareholder (Casdin Partners Master Fund, L.P.), indicate strong confidence in the stock's potential, with multiple large transactions occurring at increasing volumes. While insider purchasing is positive, there is a lack of recent company fundamental data (earnings, margins, growth) which lowers confidence. Additionally, the broader macroeconomic environment is uncertain, but if industry trends favor LAB's sector and if insiders believe the stock is undervalued, there is a compelling case for a near-term upward direction. | Healthcare | Medical Devices |

| NEXT | UP | 0.75 | Recent insider buying activity by Hanwha Aerospace and other directors indicates strong confidence in the company's prospects. The volume of purchases is substantial, especially from a significant stakeholder. However, there are mixed signals due to a large sale by York Capital Management, which might suggest differing views on future performance. Without clear earnings or guidance information, and given the current economic landscape's rising interest rates and inflation pressures, caution is warranted. Overall, while the insider activity suggests potential upside, the market context tempers that optimism. | Energy | Oil & Gas Equipment & Services |

| CBC | UP | 0.80 | The insider trading summary shows a strong pattern of insider purchases across multiple executives and directors, indicating a high level of confidence in the company's future prospects. Insider purchases amounting to over $2 million in total, especially from high-ranking officials like the CEO and CFO, suggest a positive outlook. While specific company fundamentals (earnings, margins) are missing, the collective purchasing behavior indicates optimism which may outweigh broader macroeconomic pressures, such as rising interest rates. However, without more detailed financial data, the assessment carries moderate confidence. | Financial Services | Banks - Regional |

| TPC | DOWN | 0.65 | Recent insider transactions reveal a predominance of selling over buying, with significant sales from high-level executives like Tutor Ronald N, suggesting negative sentiment among insiders. Although there are recent purchases, including a substantial buy by Director Arkley Peter, the overall pattern shows insiders are liquidating shares. External market conditions and company performance indicators are not provided but could contribute further insight. Without clear positive momentum in underlying fundamentals or specific recent developments, confidence in a near-term upward direction weakens. | Industrials | Engineering & Construction |

| ONMD | UP | 0.80 | Recent insider purchases indicate strong confidence from key executives, particularly large transactions from the Chief Medical Officer and CFO. The aggregated purchases, particularly from top insiders, suggest they believe the stock is undervalued. However, a full evaluation of the company's fundamentals is needed, including earnings, margins, and industry dynamics, as missing recent data on performance metrics and industry outlook lowers overall confidence. Despite this, the insider sentiment supports a bullish near-term outlook. | Healthcare | Health Information Services |

| EXEL | UNKNOWN | 0.40 | Recent insider trading presents a mixed picture. Notably, there’s a significant purchase from David Johnson (27,532 shares at $43.12) which might indicate confidence in the company. However, this is overshadowed by substantial sales by multiple insiders, particularly from key executives like Patrick Haley and Stelios Papadopoulos, suggesting potential concerns about the company's near-term prospects. Without current earnings trends or macroeconomic context provided, it's difficult to substantiate a clear direction, hence the low confidence. | Healthcare | Biotechnology |

| AUR | DOWN | 0.75 | Insider activity shows significant recent selling by multiple directors, notably Hoffman Reid, who sold millions in shares at higher prices. Meanwhile, the CEO's purchase may indicate optimism, but is overshadowed by the broader trend of insider selling and the concentration of such sales. The company’s fundamentals, such as growth potential and margins, are unclear from the provided data, raising uncertainty. Additionally, if overall market conditions are affected by rising interest rates and macroeconomic inflation, AUR may face downward pressure. Thus, while there is mixed insider sentiment, the strong selling trend suggests a likely downward direction in the near term. | Technology | Information Technology Services |

| ASPJX | UP | 0.70 | Recent insider purchases indicate confidence from key executives in the company's future. Notably, the concentration of purchases from directors and the CEO suggests a strong belief in positive prospects. However, the analysis lacks insight into current company fundamentals, industry conditions, and macros which could impact performance significantly. If fundamentals are weak or macro headwinds persist, even large insider buy transactions might not translate into price gains. The overall sentiment is cautiously optimistic based on insider behavior but tempered by existing unknowns. | N/A | N/A |

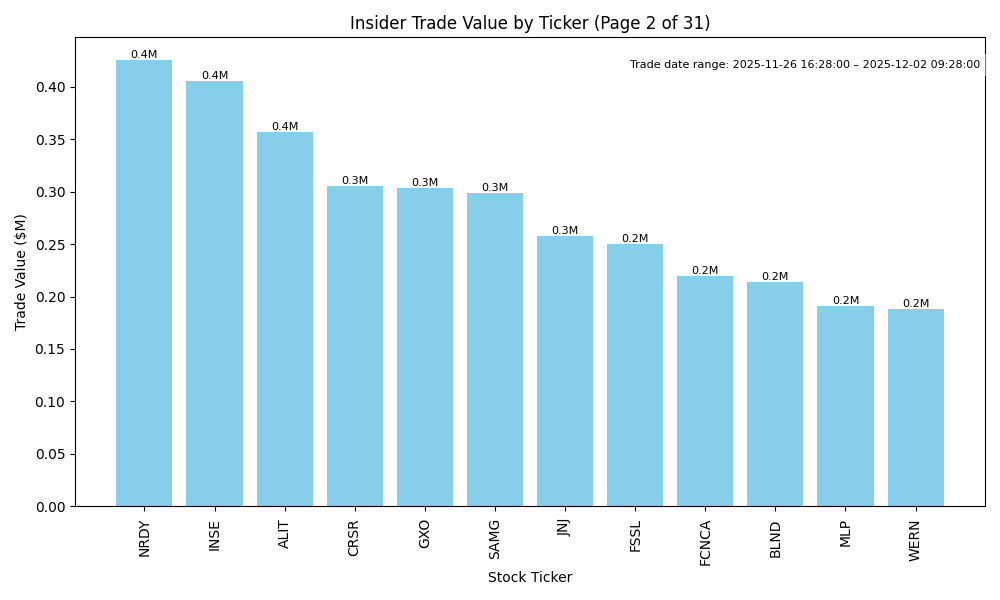

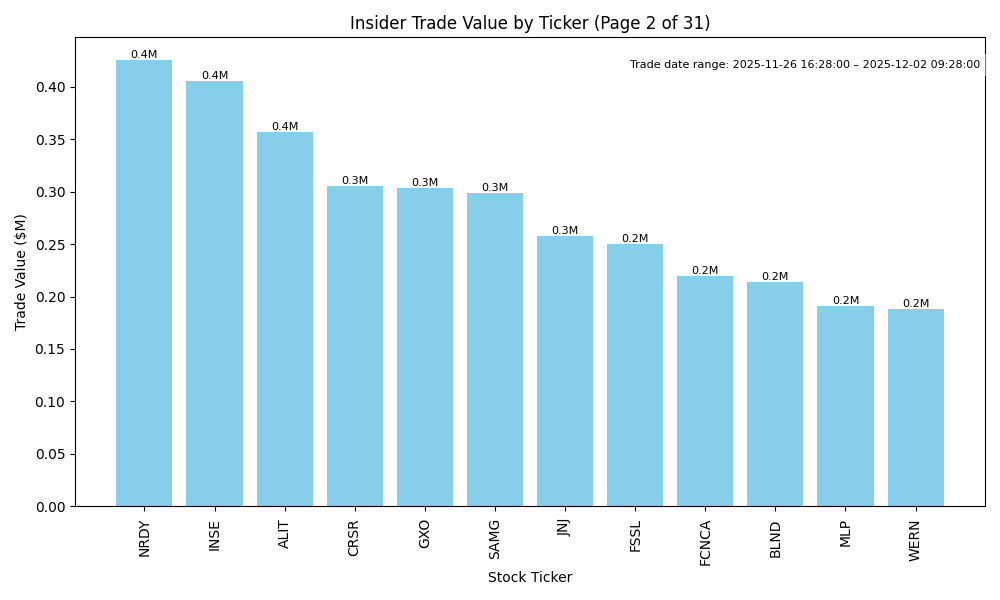

| NRDY | UP | 0.80 | Recent insider purchases, predominantly by the CEO, indicate strong internal confidence in the company's future prospects, with a marked focus on buying at varying price points below recent highs. This suggests a belief that the shares are undervalued. However, the CFO's consistent selling raises some caution regarding liquidity or personal liquidity needs. On the fundamental side, specific metrics such as earnings trends and overall industry health are missing from the data, leading to a medium level of confidence in this upward directional outlook. | Technology | Software - Application |

| SPRU | UP | 0.80 | Recent insider purchases by Steel Partners Holdings L.P., totaling over 1.1 million shares, indicate strong insider confidence in the stock's future. This intensified buying activity contrasts with an earlier sale by a director, suggesting emerging bullish sentiment. However, without recent earnings data and insights into company performance, it's challenging to gauge overall fundamentals. The industry and macroeconomic outlook could also affect performance, yet the size and frequency of insider transactions increase the likelihood of a near-term stock price increase. | Technology | Solar |

| ALIT | DOWN | 0.70 | Recent insider trading shows significant purchases from multiple directors, which may indicate confidence in the company. However, this was preceded by substantial insider sales, including drastic sell-offs from key executives at much higher prices, suggesting a lack of conviction in the company's future at high valuations. The recent insider purchases are at a much lower average price than previous sales, reflecting a potential shift in sentiment. Without updated company fundamentals or market context, including earnings performance or macroeconomic conditions, my confidence in a positive outlook remains moderate. | Technology | Software - Application |

| ASA | UP | 0.85 | The ongoing and significant insider buying activity by Saba Capital Management (10% holder) suggests strong confidence in the company's future. The recent trades indicate a pattern of accumulating shares at various price points, indicating a long-term bullish sentiment. However, without detailed insights into ASA's financial performance, growth potential, and industry positioning, our assessment of near-term movements is cautious. If the broader macroeconomic conditions are supportive, such as stable interest rates and controlled inflation, this could further enhance the stock's upside potential. Overall, the insider buying is a positive signal, supporting an upward stock trajectory. | Financial Services | Asset Management |

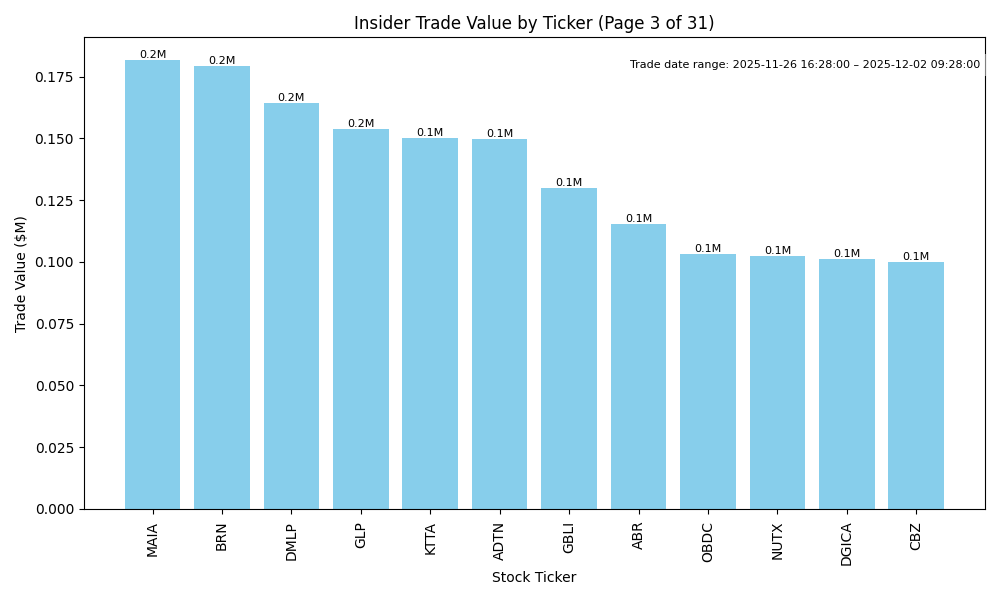

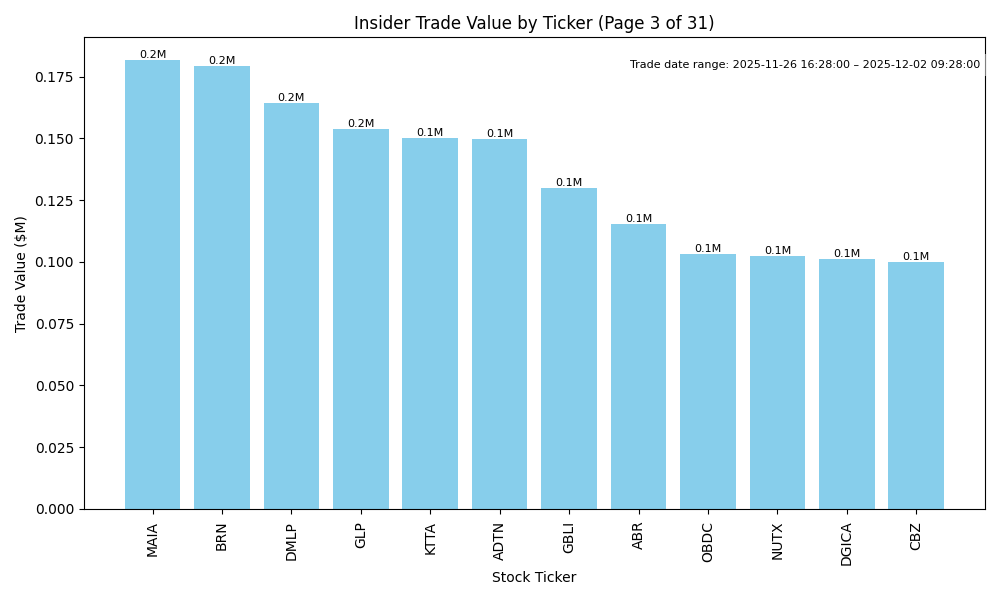

| DGICA | UP | 0.75 | Recent insider trades indicate significant bullish sentiment, especially by Donegal Mutual Insurance Co, which consistently purchased large volumes of shares at incrementally higher prices. While there were some insider sales, the concentration of buying activity suggests confidence in the company's prospects. However, comprehensive fundamental data like recent earnings trends or industry performance indicators is missing, moderating confidence. If the broader macroeconomic environment remains stable, the strong insider buying could signal an impending price appreciation. | Financial Services | Insurance - Property & Casualty |

| CRSR | NEUTRAL | 0.60 | Recent insider purchases by the CEO and a director indicate some confidence in the company's future, as evidenced by their significant stake increases at lower price points. However, the sales by directors and the CFO raise concerns about potential liquidity issues or lack of confidence in short-term performance. Furthermore, without insights into current earnings trends, competitive position, and macroeconomic indicators, the outlook remains uncertain. Therefore, while there are positive signals, the mixed nature of insider activity and lack of robust fundamentals leads to a cautious stance. | Technology | Computer Hardware |

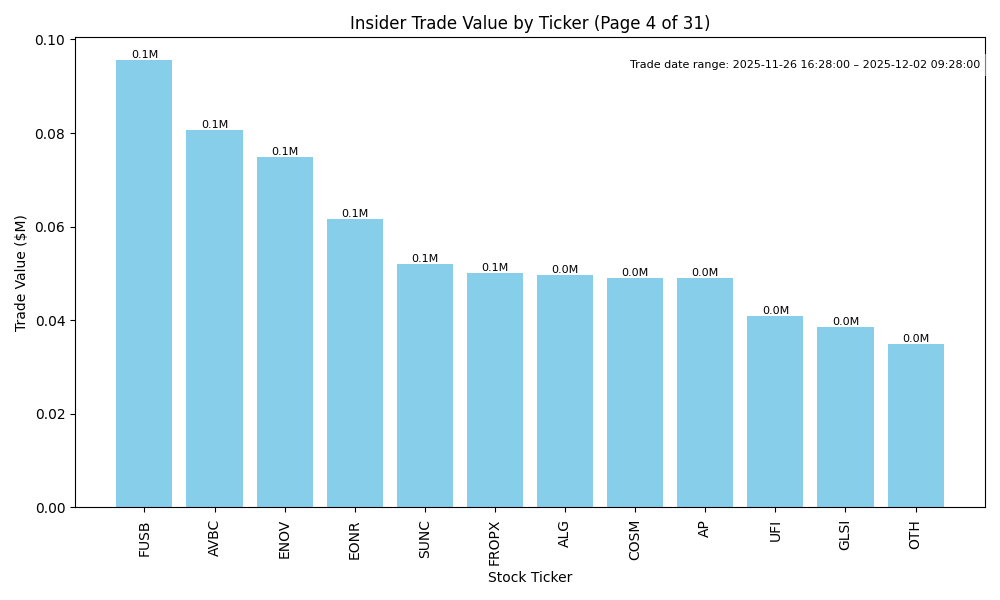

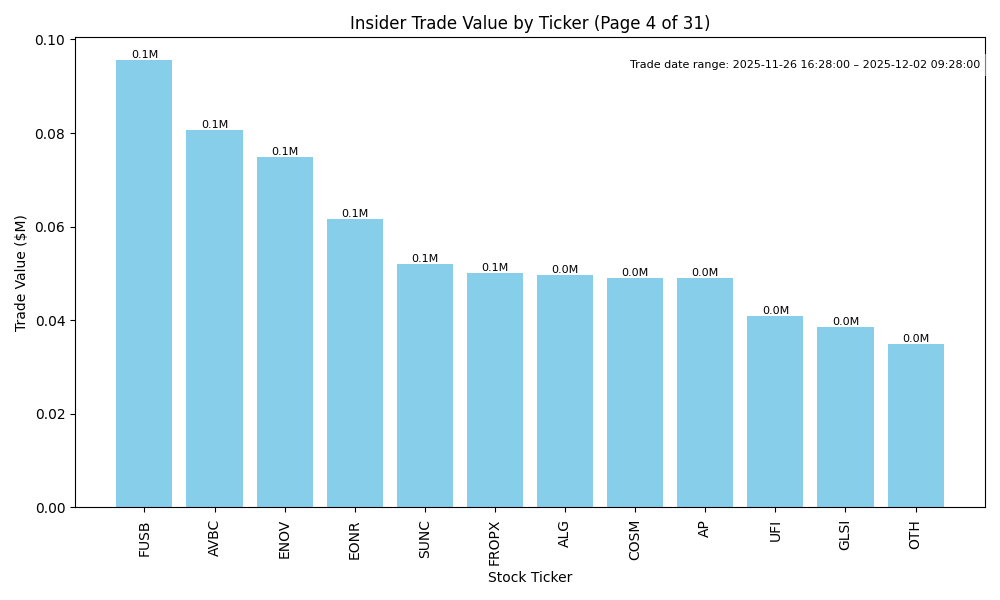

| AP | UP | 0.75 | Recent insider purchases by significant stakeholders, including a 10% owner acquiring 93,000 shares, suggest positive sentiment about the company's outlook. The average purchase prices indicate that insiders are willing to buy at levels higher than previous transactions, reflecting confidence in the company's future. However, without specific company fundamentals or broader market context available, potential weaknesses in earnings trends or macroeconomic factors could temper this optimism. Overall, the strong insider buying activity leans towards a positive direction for the stock. | Industrials | Metal Fabrication |

| DMLP | DOWN | 0.70 | Recent insider purchases suggest confidence among key executives, but the significant decline in purchase prices over the past months indicates potential weakness, with averages falling from the high $30s to the low $22s. The current macroeconomic environment characterized by rising interest rates and inflation may negatively impact demand for equities. Additionally, the lack of detailed company fundamentals and specific recent performance metrics limits confidence in a strong bullish outlook. While insider buying conveys some optimism, the price drop and external economic pressures signal caution. | Energy | Oil & Gas E&P |

| BLND | UP | 0.70 | Recent insider buying by Haveli Investments (10% director) has been significant, with multiple large purchases at prices around $3.00-$3.06, indicating positive sentiment about the stock's value. However, recent sales by other insiders could balance this sentiment. Company fundamentals remain unclear from the data provided, as details on earnings, margins, and growth potential are missing. The industry and macroeconomic context also seem robust, although specific market conditions were not evaluated. Therefore, while insider activity leans positive, a lack of critical fundamental data lowers confidence in a definite upward trend. | Technology | Software - Application |

| MAIA | UP | 0.75 | Recent insider trading activity reveals a strong purchasing trend, particularly from key executives like the CEO, indicating confidence in the company's future. The average purchase price has dropped, suggesting insiders perceive value at current levels. However, detailed information regarding financial performance, market conditions, and sector health is lacking, which could influence stock direction. As insider buying is significant and consists of multiple large transactions, this bolsters a bullish outlook. Nevertheless, the absence of concrete company fundamentals and broader macroeconomic context reduces confidence to 0.75. | Healthcare | Biotechnology |

| BRN | DOWN | 0.65 | Recent insider purchases suggest confidence in the company's future, but saturation at higher price levels indicates a divergence. The latest transactions occurred at $1.10, significantly lower than previous purchases averaging around $2.00-$2.88. The concentration of recent insider buying, particularly by key executives, is promising. However, if the market sentiment or fundamentals remain weak (e.g., declining margins, elevated leverage), we could see pricing struggles. Without detailed insights into earnings trends or macroeconomic pressures (like interest rates and inflation), I'm cautious. The stock faces potential downward pressure amidst uncertain broader market conditions. | Energy | Oil & Gas E&P |

| ABCL | UP | 0.75 | Recent insider purchases indicate strong confidence in the stock, particularly from board members and significant shareholders. The concentration of trades by insiders like John Montalbano at increasing prices suggests they see value despite current market conditions. However, the overall company fundamentals, such as earnings trends and market dynamics, remain unclear. If the company is positioned well in its industry and can capitalize on growth potential, these insider transactions could reflect a positive near-term outlook. Still, given the lack of details on broader economic context (e.g., interest rates or inflation effects), confidence is moderate. | Healthcare | Biotechnology |

| MLP | UP | 0.75 | Recent insider buying by key executives, notably the CEO and a significant director, signals positive sentiment towards the company's future prospects. The purchases were made at prices lower than previous levels, indicating potential belief in recovery or growth. However, the analysis lacks current company fundamentals, including revenue trends and profit margins, and external macroeconomic factors affecting the industry or sector. Despite this, strong insider activity provides a bullish indicator, though confidence is moderated by the absence of detailed financial performance data. | Real Estate | Real Estate Services |

| GSHD | DOWN | 0.70 | Insider trading activity shows recent purchases by key insiders at lower prices compared to previous sales, indicating potential optimism. However, significant recent selling by major insiders, particularly the Mark & Robyn Jones Trust, at much higher average prices reflects a substantial value transition. The overall trend of insider selling suggests that insiders may have reservations about the stock's near-term price stability. Without current fundamental performance data or broader contextual insights on company earnings, margins, and sector performance, there's a degree of uncertainty. The balance of insider selling over buying indicates a likely downward pressure on stock prices in the short term. | Financial Services | Insurance Brokers |

| FSSL | UP | 0.70 | Recent insider purchases from multiple executives indicate a strong belief in the company's prospects, as they collectively bought a significant number of shares at prices around $13.27 to $13.55. This trend suggests optimism about future performance. However, without specific information on the company's fundamentals, the precise valuation, and broader market conditions, the overall confidence is moderated to 0.7. The direction indicates potential upward movement based on insider confidence, although broader factors such as industry conditions and macroeconomic trends must also be considered. | | |