| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

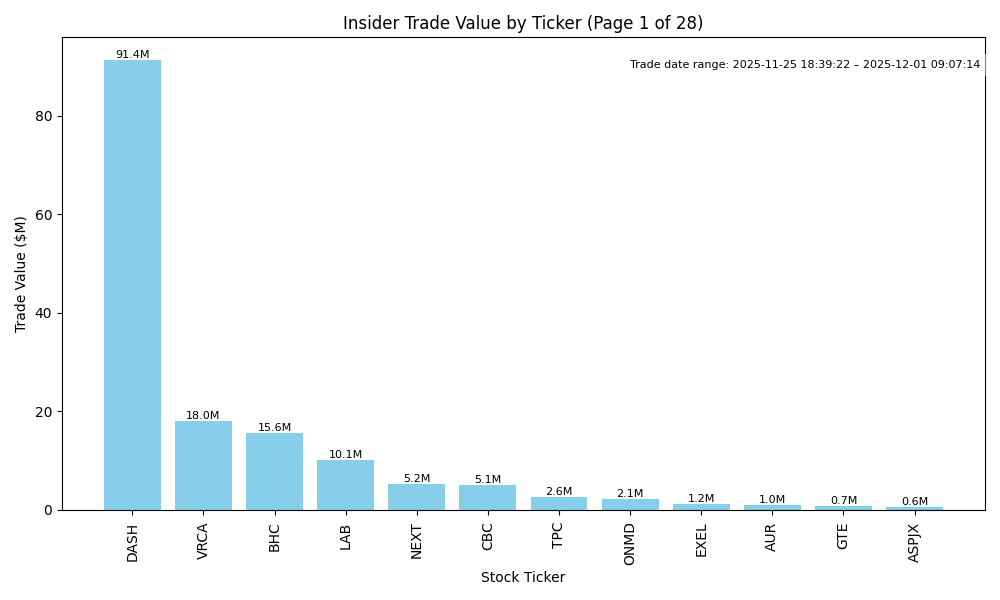

| RIG | UP | 0.75 | Recent insider purchases, particularly by major Directors, indicate strong confidence in the stock's potential upside. The latest purchases show significant additional investment, totaling 6 million shares at an average price of $4.02. While there have been some insider sales, these appear to be smaller and could be for personal reasons rather than indicative of negative sentiment. However, a thorough evaluation of company fundamentals, including earnings trends and leverage, is needed, and these details are currently missing, which lowers certainty. Additionally, macroeconomic factors such as potential interest rate movements and inflation should be monitored as they can affect overall market sentiment toward equities. | Energy | Oil & Gas Drilling |

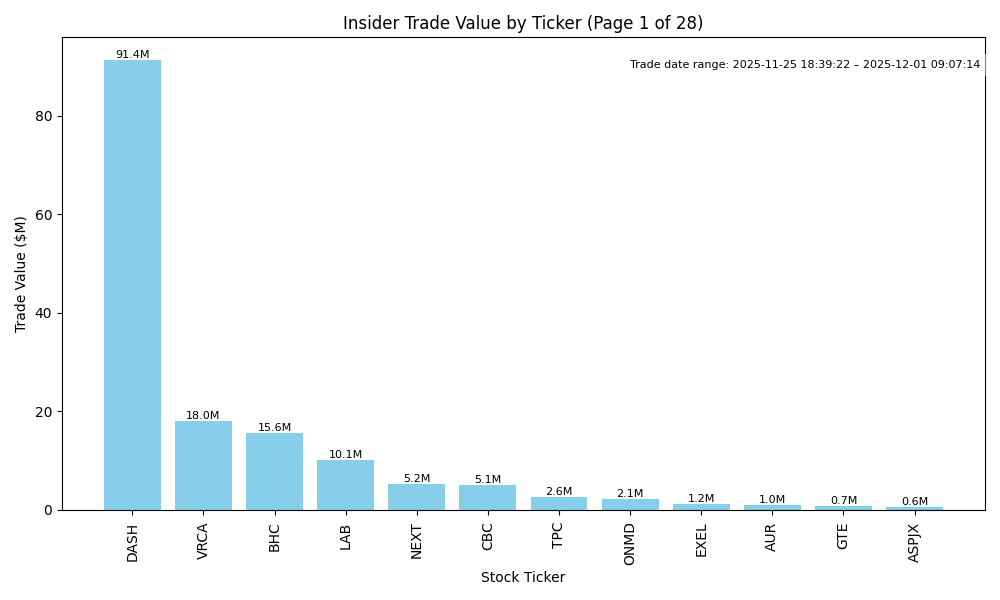

| VRCA | UP | 0.85 | Recent insider purchases reflect strong confidence from key executives, especially with the CEO and CFO making significant investments. The average purchase price of $4.24 indicates they believe the stock is undervalued compared to its recent trading history around $7.06 in July 2024. However, a previous pattern of insider selling may raise some caution about volatility. Beyond insider activity, additional context on company fundamentals, market conditions, and sector performance is needed to thoroughly assess longer-term trends, though near-term sentiment appears positive based on buying activity. | Healthcare | Biotechnology |

| LAB | UP | 0.75 | Recent insider activity indicates a strong bullish sentiment, especially by a major director, Casdin Partners Master Fund, which has purchased over 8 million shares within a short time frame at increasing average prices. This purchasing pattern suggests confidence in the company's prospects. However, without current earnings trends or broader market analysis, we hold some uncertainty. Overall, positive insider activity combined with potential growth implies a likely upward trajectory, but it is tempered by a lack of context on the company’s financial stability and market conditions. | Healthcare | Medical Devices |

| NEXT | UP | 0.75 | Recent significant insider buying, particularly from Hanwha Aerospace, indicates strong internal confidence in the company's performance as they accumulated over 2.5 million shares in a short period. Despite past high-volatility sales clustered around larger share disposals, the trend toward purchasing suggests a bullish sentiment. However, without current company financials or macroeconomic context, particularly regarding earnings trends or sector competitiveness, confidence is moderate. Overall, the insider activity suggests a likely upward trajectory for NEXT stock in the near term. | Energy | Oil & Gas Equipment & Services |

| CBC | UP | 0.80 | Insider buying activity is concentrated and significant, with multiple purchases from high-ranking executives, totaling over $2 million at a consistent price of $21, indicating strong insider confidence in the stock. While the current market and macroeconomic conditions remain relatively challenging, the lack of specific negative catalysts and the positive sentiment from insider transactions suggest a potential near-term upward price movement. However, missing data on recent earnings performance or guidance limits this confidence somewhat. | Financial Services | Banks - Regional |

| TPC | UNKNOWN | 0.40 | Recent insider buying by significant figures (like the Director and CEO) could indicate confidence in the company's future. However, the pattern of previous insider sales, especially by the Executive Chairman, suggests there was recent discontent or profit-taking at higher price levels. Without insights into broader market conditions, company fundamentals, and recent financial performance, the direction remains uncertain. The significant sales outnumber the recent buys, indicating potential concerns that could overshadow the recent purchases. | Industrials | Engineering & Construction |

| ONMD | UP | 0.75 | Insider buying activity is substantial and concentrated among key executives, indicating strong internal confidence. The Chief Medical Officer and CFO have made significant purchases, which often reflects belief in the company's future potential. However, the overall market context, including potential macroeconomic challenges, could limit immediate price movement. Without detailed financial performance metrics or recent earnings updates, full confidence is tempered. Nonetheless, the insider purchases suggest a more favorable near-term sentiment. | Healthcare | Health Information Services |

| EXEL | DOWN | 0.70 | Recent insider activity shows a significant volume of sell transactions from multiple executives, particularly by key insiders like Haley Patrick J. and Papadopoulos Stelios, indicating a bearish sentiment despite a recent purchase by a director. Additionally, the trend of insider selling suggests potential concerns regarding future performance or valuation. Without detailed fundamental or macroeconomic data to offset these indicators, including earnings performance, debt levels, or sector outlook, there is a prevailing bearish sentiment. Thus, the likely near-term direction for EXEL is downward. | Healthcare | Biotechnology |

| AUR | DOWN | 0.70 | Insider trading shows a concerning pattern, particularly significant sales by Director Reid Hoffman, indicating a lack of confidence in the stock's near-term performance. While CEO Christopher Urmson recently purchased a substantial amount of shares, suggesting a bullish outlook, this is overshadowed by the heavy selling. Additionally, without detailed insights into the company's recent earnings, margins, or broader macroeconomic factors, it is difficult to be fully confident. Overall, the negative sentiment from insider sales indicates potential downward pressure on the stock. | Technology | Information Technology Services |

| GTE | UP | 0.75 | Recent insider purchases, particularly from Equinox Partners Investment Management LLC, indicate strong confidence from major stakeholders, accumulating substantial shares at increasing prices. Despite recent sales by other insiders, the buying activity outweighs these sales. However, lacking comprehensive data on company fundamentals such as earnings trends, margins, and leverage, limits confidence. Additionally, broader macroeconomic conditions may impact sentiment, but the current insider sentiment signals a bullish outlook toward GTE’s near-term performance. | Energy | Oil & Gas E&P |

| GLP | DOWN | 0.70 | Recent insider buying is a positive indicator, particularly by a major partner, but the stock has seen significant insider selling earlier, notably by the COO. The trend of purchases is at lower prices compared to prior months, reflecting declining investor sentiment. Without access to current fundamentals, earnings performance, or broader market conditions, the combined patterns suggest potential short-term weakness despite some insider confidence. | Energy | Oil & Gas Midstream |

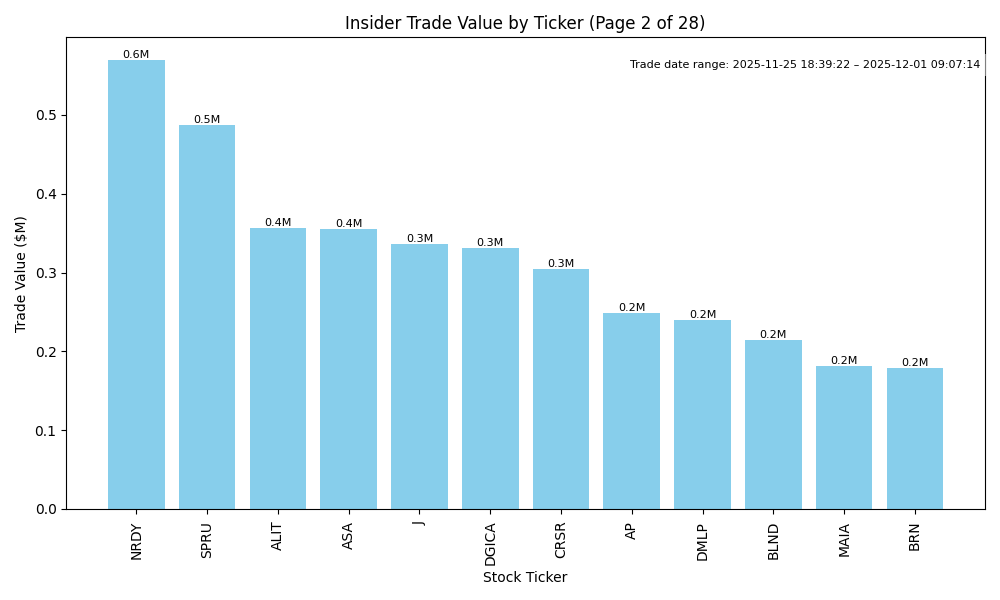

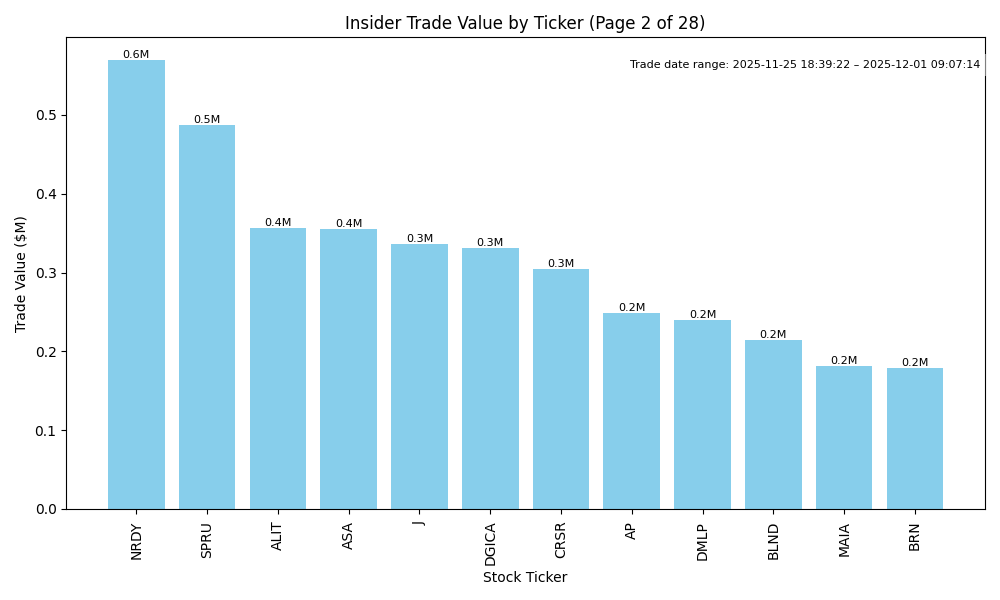

| NRDY | UP | 0.70 | Recent insider purchases by CEO Charles K. Cohn indicate strong confidence in NRDY's future, marked by substantial buying activity over a short period. However, there are simultaneous sales by other executives, which could suggest varied sentiment within the management. Overall performance metrics are unclear as specific details on fundamentals and earnings were not provided in the data. Additionally, broader macroeconomic factors, including interest rates and inflation, may introduce uncertainties that could temper growth expectations. Despite these concerns, the dominant insider buying trend points toward a bullish sentiment for NRDY in the near term. | Technology | Software - Application |

| ASA | UP | 0.75 | There has been significant and consistent insider buying by Saba Capital Management, which owns 10% of the company, indicating strong confidence in ASA's potential. The recent purchases at varying prices highlight a strategic accumulation and belief in the stock's future value. However, without specific details on earnings, margins, and broader economic conditions, the analysis remains incomplete. The overall bullish sentiment from insiders combined with the lack of any immediate red flags in fundamentals suggests a likely upward trajectory in the near term. | Financial Services | Asset Management |

| J | DOWN | 0.65 | Recent insider transactions show significant selling activity, particularly by high-ranking executives, indicating a lack of confidence or liquidity needs. While recent insider purchases from directors and the CFO suggest some positive sentiment, the prevailing trend is dominated by selling at higher prices, which may reflect overvaluation concerns. Without recent positive news on fundamentals or macroeconomic improvements, and considering broader market volatility, I anticipate downward pressure on the stock in the near term. | Industrials | Engineering & Construction |

| GAM | UP | 0.80 | There has been significant insider buying, particularly from key executives like the CEO and Chairman, which suggests internal confidence in GAM's prospects. Notably, recent purchases occurred at prices around $24.95 to $25.00, indicating a perceived undervaluation. However, this optimism must be tempered by the broader economic context; if macroeconomic conditions remain challenging, affecting revenue growth or margins, stock performance could still falter. Without recent earnings updates or guidance, confidence is moderate but pointed towards a potential upward trend. | Financial Services | Asset Management |

| CRSR | NEUTRAL | 0.60 | Recent insider buying by the CEO and a director suggests positive sentiment, with purchases at lower price points than earlier sales. However, there are significant historical sales by other directors and the CFO, indicating potential lack of confidence in the stock's future. The recent context also lacks critical fundamental details like earnings trends and industry health, limiting certainty. Overall, this presents a mixed signal, hence a neutral outlook with moderate confidence. | Technology | Computer Hardware |

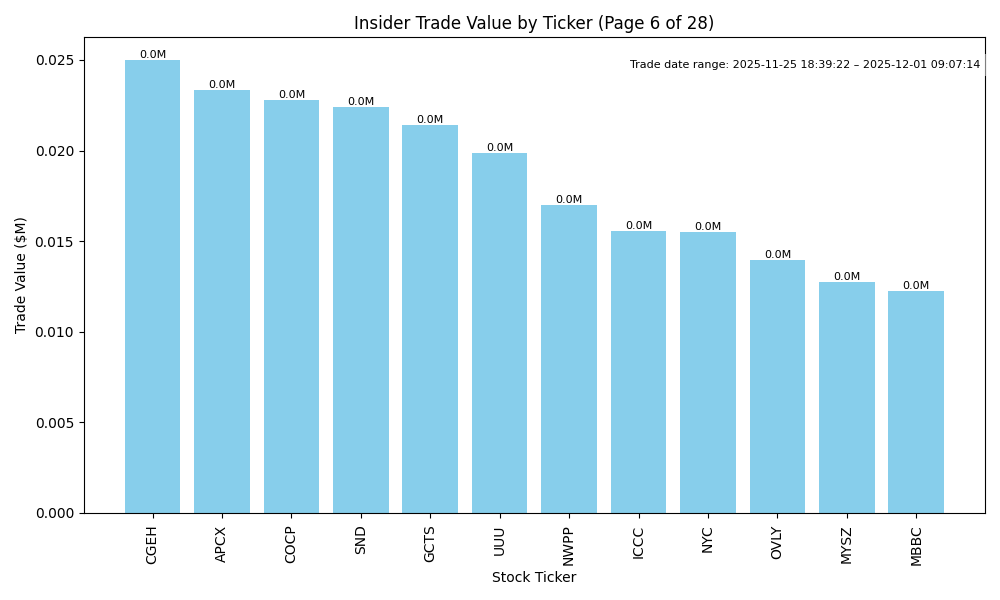

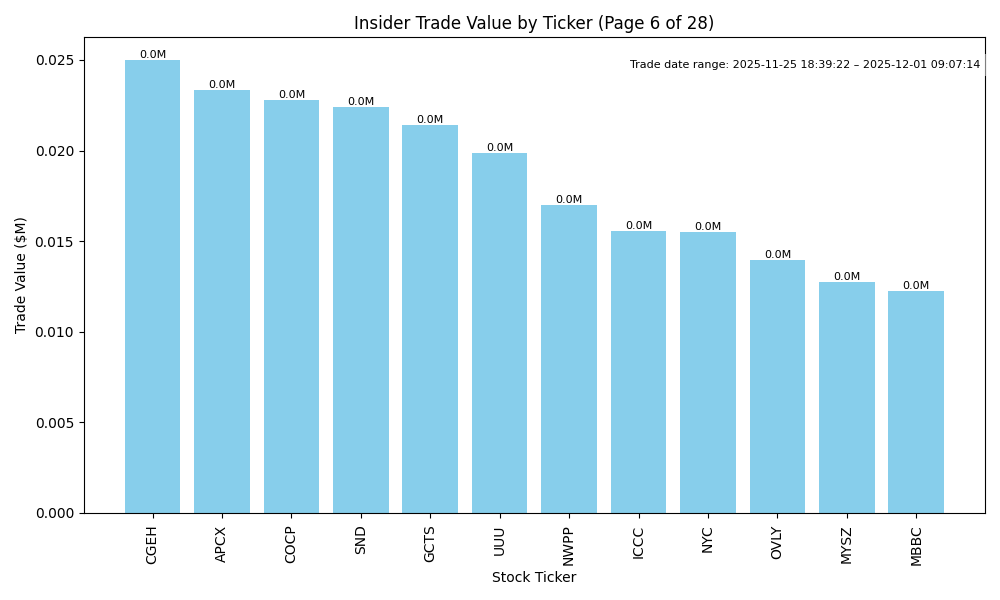

| CGEH | UP | 0.75 | Insider purchases from key executives and directors totaling 250,000 shares at $2.00 suggest strong confidence in the company's future. However, without additional information on company fundamentals, industry conditions, or macroeconomic factors, the analysis remains somewhat limited. The positive insider sentiment can indicate expected growth or valuation upside, but the lack of context for earnings, competitive positioning, and market conditions reduces overall confidence in a definitive upward direction. | Industrials | Specialty Industrial Machinery |

| AP | UP | 0.70 | Insider purchases are concentrated and substantial, indicating confidence in future performance. Notably, Louis Berkman Investment Co, which holds a significant position, purchased 93,000 shares, enhancing the bullish signal. However, without data on company fundamentals, notably earnings trends or industry conditions, it's difficult to predict sustained growth. Despite the positive insider sentiment, broader macroeconomic factors such as interest rates and inflation could exert pressure. Overall, the strong insider buying suggests potential near-term price increases, but underlying unknowns in fundamentals and macro conditions lower confidence in predictions. | Industrials | Metal Fabrication |

| DMLP | DOWN | 0.60 | While recent insider buying from executives at DMLP suggests confidence in the company's prospects, the overall trend shows purchases at significantly higher price levels (averaging above $30) compared to recent transactions near $21-22. This indicates potential strain on market sentiment. Company fundamentals, such as higher leverage and potential margin pressure, along with broader macroeconomic challenges like elevated interest rates and inflation, further suggest headwinds. Despite insider activity, the conflict with deteriorating price levels leads to a cautiously bearish outlook. | Energy | Oil & Gas E&P |

| DGICA | UP | 0.70 | The recent insider trading activity shows a significant concentration of purchases by Donegal Mutual Insurance Co, indicating strong confidence in the company's prospects. This is bolstered by recent purchases at prices above the current market levels, suggesting a bullish outlook. However, there are also notable sales by directors and executives, which indicates some uncertainty or profit-taking. While the overall market conditions are uncertain, the solid insider buying suggests a likely upward trend when combined with any positive corporate developments. Additional fundamental data about the company's performance and future guidance would strengthen the analysis, but currently, the mix supports an upward trajectory. | Financial Services | Insurance - Property & Casualty |

| BLND | UP | 0.75 | Recent insider purchases, primarily by Haveli Investments (holding 10%), indicate strong confidence in the company's future. The large volume of shares acquired at prices around $3.02 to $3.06 suggests a bullish sentiment from insiders. However, insider selling by other executives, particularly the Head of Revenue, raises some concern about near-term performance. Without specific information on company fundamentals, earnings trends, or broader macroeconomic conditions, confidence is moderate. The prevailing environment of inflationary pressures and rising interest rates could affect overall market performance, influencing BLND's stock performance as well. | Technology | Software - Application |

| BRN | DOWN | 0.60 | Recent insider buying shows confidence at lower price points, but the majority of the transactions are at an average price well above the current purchase price of $1.10, indicating potential concern about valuation. Additionally, the near-term macroeconomic environment is challenging, with rising interest rates and inflation pressures affecting market confidence. Without recent positive developments in company fundamentals or substantial industry advancements, the overall outlook appears cautious despite the insider activity. | Energy | Oil & Gas E&P |

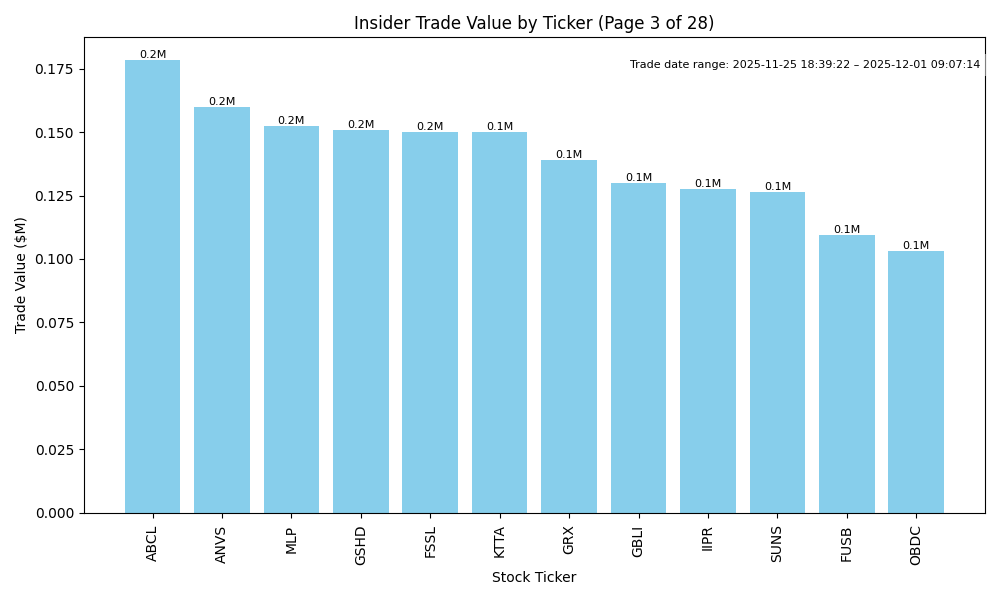

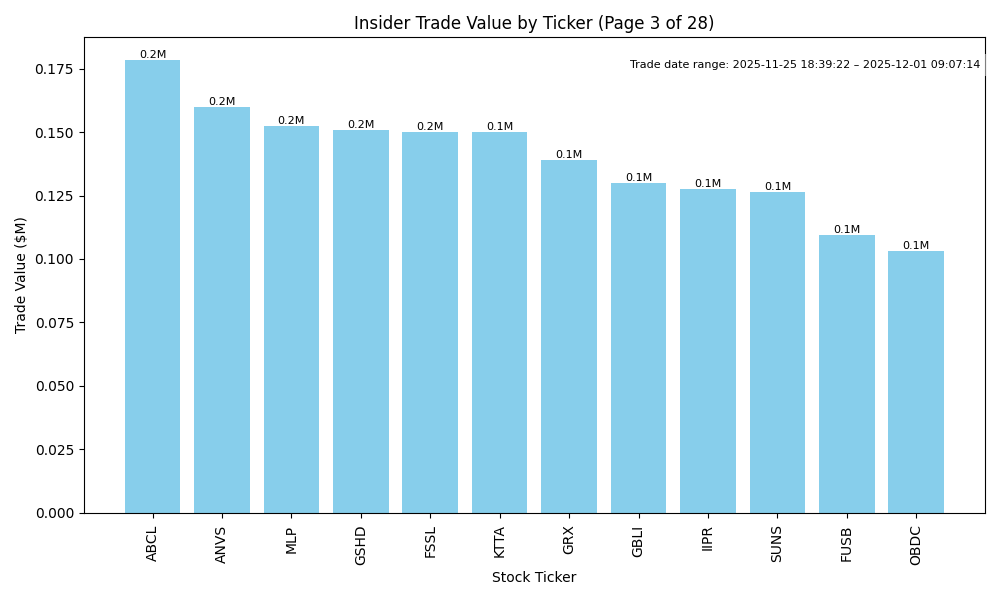

| ABCL | UP | 0.70 | Recent insider buying signals optimism, particularly from a director and a significant stakeholder, suggesting confidence in ABCL's prospects. The cumulative insider purchases from multiple parties, including recent large transactions, imply a strong belief in the company’s potential. However, without details on company fundamentals, competitive positioning, or macroeconomic context, confidence in a sustained upward direction is moderate. Market sentiment should remain cautious, particularly given the uncertain broader environment. | Healthcare | Biotechnology |

| ANVS | UP | 0.70 | Insider buying, particularly significant purchases by the CEO and a director, suggests confidence in the company's future. The consistent activity at increasing prices indicates strong belief in value appreciation. However, without insight into broader company fundamentals, such as earnings growth, margins, or current market conditions, confidence is tempered. Potential macroeconomic headwinds or sector performance issues could impact the stock's trajectory. Overall, the buying trend leans positive, but risks remain due to missing fundamental data. | Healthcare | Biotechnology |

| MLP | UP | 0.80 | Recent insider buying, particularly by the CEO and a major shareholder, indicates strong confidence in the company's future prospects. Notably, the purchases were made at a range of prices, suggesting a belief in value even as the stock has trended down recently. While industry and macroeconomic conditions were not detailed, the consistent insider buying during this period suggests a belief that the company’s fundamentals are solid and could potentially benefit from positive developments or recovery. However, the lack of data on earnings trends or industry dynamics introduces some uncertainty, warranting a confidence of 0.8. | Real Estate | Real Estate Services |