| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

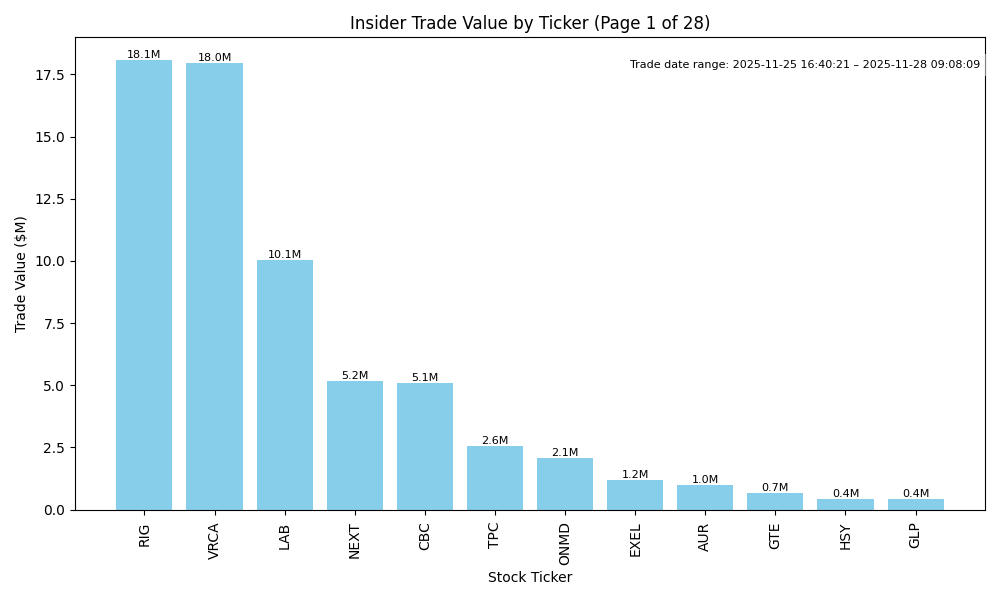

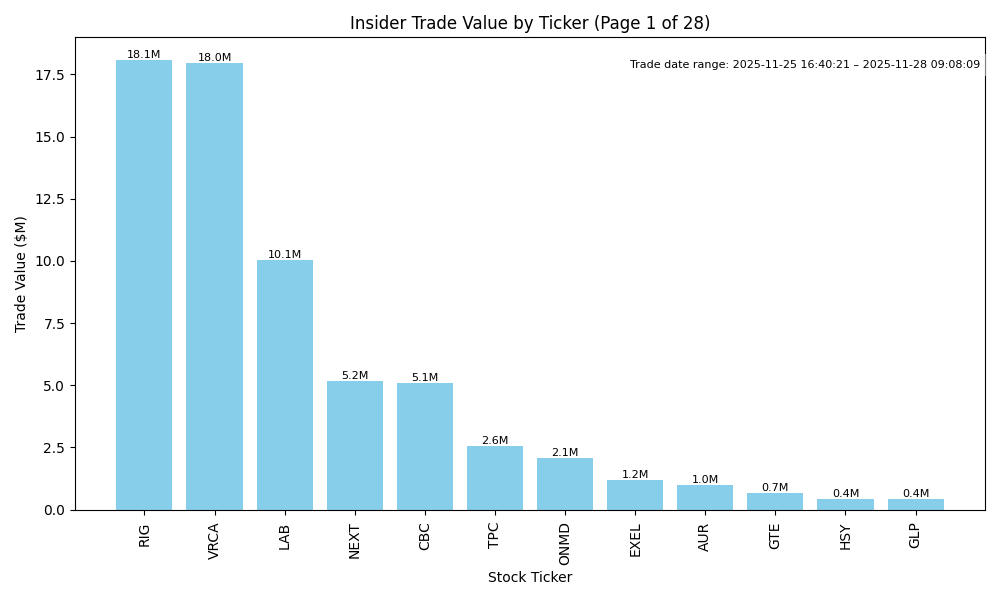

| RIG | UP | 0.80 | Recent insider purchases indicate strong confidence among executives, particularly from significant shareholders like Perestroika, who have recently bought large volumes at around $4.02. This is a bullish signal, suggesting belief in the company's potential rebound. However, it's essential to consider recent sales by other insiders, which could imply caution or liquidity needs. The broader industry remains volatile with uncertain macroeconomic conditions, potentially limiting growth; these factors create some tension in the outlook. Overall, the insider buying trend trumps the sales, leading to a positive near-term outlook with high confidence but some caution due to potential macroeconomic headwinds. | Energy | Oil & Gas Drilling |

| VRCA | UP | 0.80 | Recent insider purchases from multiple high-ranking executives, including the CEO and CFO, suggest strong internal confidence in the company's future prospects. The substantial number of shares acquired at an average price of $4.24 indicates a commitment to the company’s growth, potentially signaling an undervalued stock. However, past sales by insiders and the lack of detailed fundamental data regarding earnings trends and industry conditions suggest caution. If broader macroeconomic conditions remain stable, the positive insider sentiment may drive the stock upward in the near term. | Healthcare | Biotechnology |

| LAB | UP | 0.80 | Recent insider buying by Casdin Partners Master Fund, L.P. indicates strong confidence from a significant shareholder, acquiring large volumes of shares at increasing prices around $1.17 to $1.31. While this insider activity is bullish, the company's fundamentals, sector performance, and macro conditions are not fully evaluated due to a lack of detailed financial data. The consistent purchases in the context of overall market conditions suggest positive sentiment, leading to a confident, though cautious, outlook for LAB's near-term direction. | Healthcare | Medical Devices |

| NEXT | UP | 0.75 | Recent insider purchases, especially by Hanwha Aerospace, indicate strong confidence from key stakeholders, accumulating over 4 million shares in a short period at prices between $5.71 and $6.08. This suggests optimism about the company's near-term outlook despite past volatility. Nevertheless, significant insider sales by York Capital and a recent 10% stake acquisition imply mixed sentiment. Without comprehensive financial and macroeconomic data, especially regarding the company's operational performance and broader market conditions, confidence in a firm upside is moderated but remains favorable due to the recent buying trend. | Energy | Oil & Gas Equipment & Services |

| CBC | UP | 0.85 | Recent insider trading shows strong buy activity from multiple executives with meaningful share purchases, suggesting confidence in the company's future. However, to fully assess market direction, crucial fundamentals such as earnings trends, margins, and overall company performance are needed. If those are positive and aligned with the bullish sentiment from insiders, short-term stock movements are likely to trend upwards. The broader macroeconomic context, including current interest rates and inflation, should also be favorable to support this. Given the significant insider purchases, my confidence in an upward direction is high, albeit not without some caution regarding the overall fundamentals. | Financial Services | Banks - Regional |

| TPC | DOWN | 0.65 | Recent insider activity shows significant selling, particularly by the Executive Chairman. While there are recent purchases from other insiders, the volume of sales suggests a lack of confidence in the near-term stock price. Company fundamentals, including earnings trends and leverage, need assessment but appear challenged against a backdrop of higher interest rates and inflationary pressures, which could hinder growth. Without detailed data on earnings or industry specifics, confidence is moderate. | Industrials | Engineering & Construction |

| ONMD | UP | 0.70 | Insider purchases have significantly increased, with notable buying from key executives like the CEO and CFO, indicating strong internal confidence. The average purchase prices suggest insiders believe the stock is undervalued, particularly with a large overall purchase value. However, to fully evaluate, details on company fundamentals such as recent earnings, margins, and growth potential, as well as market conditions and industry dynamics, need to be examined comprehensively. Given the lack of specific financial context or macroeconomic concerns mentioned, while the insider activity is bullish, the confidence level is moderate. | Healthcare | Health Information Services |

| EXEL | NEUTRAL | 0.65 | The recent insider trading shows a mixed picture: while Director David Johnson made a significant purchase, several other insiders, including EVPs and directors, have sold substantial amounts, indicating potential concerns about the stock price. The company's performance is not mentioned, but the trading volume suggests profit-taking may be occurring. Macroeconomic conditions, including interest rate uncertainty and inflation, also create headwinds. Without clear direction from the company's fundamentals and recent earnings trends, the outlook remains uncertain, meriting a NEUTRAL stance. | Healthcare | Biotechnology |

| AUR | DOWN | 0.70 | Despite a significant recent purchase by the CEO, insider selling has dominated, especially from a key director, indicating a lack of confidence among insiders. The selling spree included large volumes and suggests potential concerns about the company’s fundamentals and future growth prospects. If earnings and operating margins are under pressure or if the market conditions are unfavorable, this could translate into a downtrend. There is insufficient information on current earnings performance or industry trends to fully gauge the company's trajectory, leading to moderate confidence in this assessment. | Technology | Information Technology Services |

| GTE | UP | 0.70 | Recent insider purchases by Equinox Partners indicate significant confidence in the stock, with multiple transactions totaling over 1 million shares in November alone at prices below current levels. This bullish insider sentiment contrasts with some recent insider selling. However, the market context is uncertain due to potential macroeconomic pressures such as interest rates and inflation. Without recent company earnings releases and guidance updates, it is hard to gauge the overall health of GTE’s fundamentals. Overall, the strong insider activity suggests a possible upward price movement, albeit with moderate confidence due to the lack of complete fundamental clarity. | Energy | Oil & Gas E&P |

| HSY | NEUTRAL | 0.60 | Recent insider purchases from key executives indicate some confidence in the company’s prospects, particularly amid recent solid buying at average prices around $186. However, consistent selling by the CFO raises red flags about cash flow concerns or personal liquidity needs. The mixed signals, alongside potential pressures from rising inflation and recent macroeconomic conditions—such as interest rate changes—might limit growth. Overall, while insider purchases suggest potential upside, the fundamental and macroeconomic context introduces uncertainty. | Consumer Defensive | Confectioners |

| GLP | DOWN | 0.70 | Recent insider activity shows a strong trend of purchases by Global Gp LLC, which indicates potential confidence in the company. However, the stock price has declined from highs near $55 to the recent average purchase prices around $42-43, suggesting market skepticism about future performance. Without detailed earnings and growth forecasts available, we see conflicting signals with insider buying against a backdrop of decreasing share price and potential macroeconomic concerns, indicating an overall weaker outlook. | Energy | Oil & Gas Midstream |

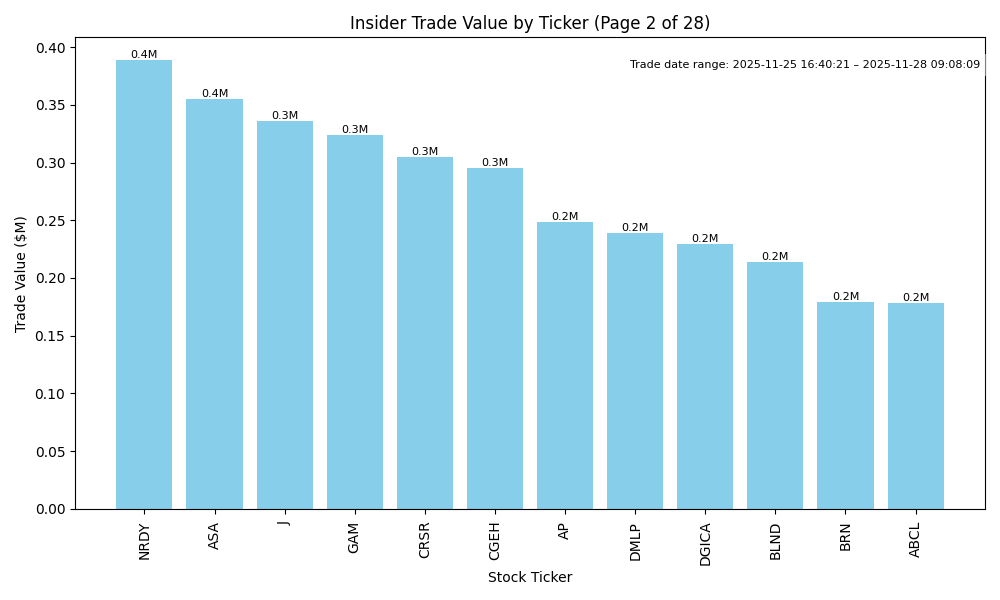

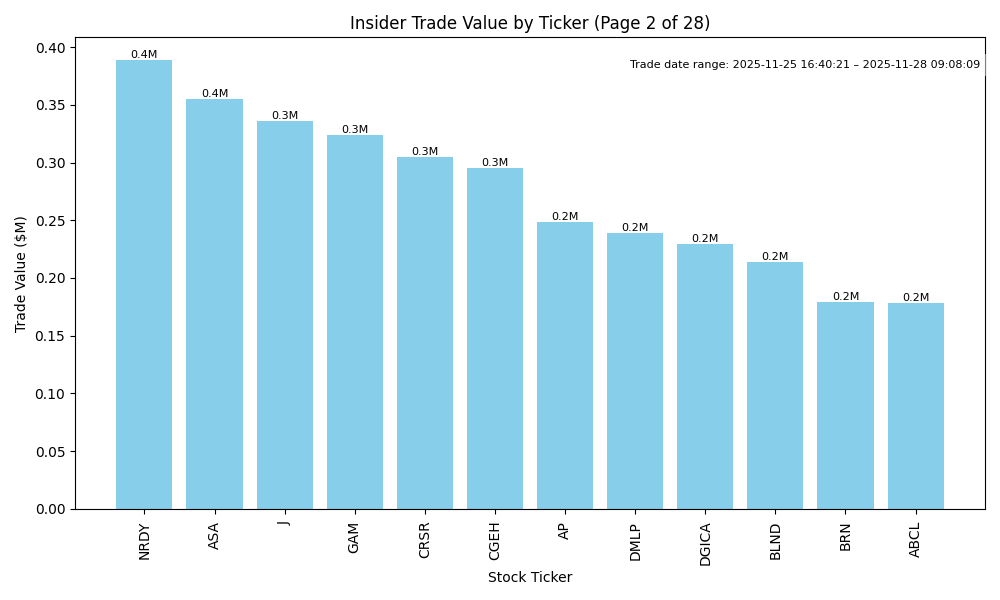

| ASA | UP | 0.75 | Insider buying by Saba Capital Management (10% holder) has been consistent and substantial, indicating strong confidence in the company's prospects. The recent purchases occurred at varying prices, showing a strategic approach to accumulating shares. However, critical company financials such as earnings trends, margins, and growth potential are not provided, limiting a comprehensive analysis. The sector's health and broader macroeconomic conditions must also be evaluated, as these factors could influence stock performance. While the insider activity points to a bullish outlook, underlying economic pressures could temper this. Overall, I assess a likely upward move but with some uncertainty. | Financial Services | Asset Management |

| J | DOWN | 0.65 | Recent insider trading shows significant selling activity, especially from high-ranking executives. In contrast, there has been a recent uptick in purchases by directors and CFO, but they appear minor relative to the previous sales. The company fundamentals, particularly regarding margins and earnings consistency, are currently unclear, which raises questions about future growth. Additionally, broader macroeconomic conditions remain uncertain, particularly with interest rates and inflation potentially impacting consumer demand. This mix of heavy selling and uncertain fundamentals suggests a likely downward trajectory for the stock. | Industrials | Engineering & Construction |

| GAM | UP | 0.75 | Recent insider trading in GAM shows significant purchases, particularly by the Chairman and CEO, indicating confidence in the company's future. The concentration of purchases and their large size suggests a strong belief that the stock is undervalued. While information on company fundamentals such as earnings trends and margins is lacking, the repeated purchases at prices around $24.95-$25.00 imply a bullish outlook. The broader macroeconomic context, particularly regarding inflation and interest rates, may also support equities in this sector. However, without further data on financial performance and industry dynamics, some uncertainty remains. | Financial Services | Asset Management |

| CRSR | UP | 0.70 | Recent insider purchases by the CEO and a director indicate positive sentiment about the company's future prospects, despite past sales by other directors suggesting some caution. Strong insider purchases (150,000 shares at prices around $6) may signal undervaluation. However, the overall trend from prior insider sales at higher prices raises concerns about the stock's performance. Additional data on current earnings, margins, and macroeconomic impacts (such as inflation and interest rates) is necessary for a complete assessment. Given the mixed signals, there is moderate confidence in a near-term price increase. | Technology | Computer Hardware |

| CGEH | UP | 0.70 | Insider purchases from key executives and directors, totaling 133,000 shares at $2 each, indicate strong internal confidence in the company's prospects. However, the analysis is limited due to a lack of insight into fundamental metrics such as earnings trends, margins, and the competitive landscape. Without this data, the confidence is moderate, reflecting potential positive sentiment but uncertainty regarding broader market conditions or company performance. | Industrials | Specialty Industrial Machinery |

| NRDY | UNKNOWN | 0.40 | Insider activity shows significant purchases by the CEO indicating a potential belief in value at current price levels. However, recent sales by the CFO and GC can indicate a lack of consensus among insiders. The company's fundamentals, transaction history, and macroeconomic factors are not fully analyzed, as earnings and growth trends are unavailable in the summary. Thus, while insiders are buying, the lack of clear fundamental strength and mixed signals from insider transactions limits confidence in a directional outlook. | Technology | Software - Application |

| AP | UP | 0.75 | Recent insider purchases suggest a strong belief in the stock's potential. Significant buying from the Louis Berkman Investment Co (93,000 shares) and other directors indicates confidence at multiple levels. While we need to consider the overall market conditions, if sector trends are favorable and company fundamentals are solid (e.g., earnings growth, manageable leverage), these insider moves can positively influence stock sentiment. However, without specific details on recent earnings or macroeconomic headwinds, confidence is moderated. | Industrials | Metal Fabrication |

| DGICA | NEUTRAL | 0.60 | Insider trading shows a mixed signal: significant purchases by Donegal Mutual Insurance Co, a 10% shareholder, contrast with sales by directors and key executives, implying potential profit-taking. The purchase trend suggests confidence in the company's future, but the selling raises concerns about the insiders' timing. Without current fundamental data — like earnings trends, margins, and market position — the stock direction remains uncertain. The overall macroeconomic environment, including interest rates and inflation dynamics, could impact performance as well, but no immediate threats have been highlighted. Therefore, a cautious stance is warranted. | Financial Services | Insurance - Property & Casualty |

| BLND | UP | 0.75 | Recent insider buying from Haveli Investments, a significant shareholder, indicates strong confidence in the company's prospects, with multiple large purchases in November at relatively low prices (around $3). Although there were some insider sales, they appear less impactful given the scale of the purchases. However, without recent fundamental data on financial performance and macroeconomic conditions, confidence is tempered. If the company has resolved operational challenges and if overall market sentiment remains positive, strong insider commitment could drive the stock up. | Technology | Software - Application |

| BRN | UP | 0.75 | Recent insider purchases, particularly from significant insiders at lower prices, suggest strong confidence in the company's prospects. The concentration and value of recent purchases indicate a bullish outlook. However, the stock has traded noticeably lower than earlier purchases, raising potential concerns about underlying company fundamentals. Without current information on earnings trends, margins, or broader market context, confidence is tempered but remains positive due to the insider sentiment. | Energy | Oil & Gas E&P |

| ABCL | UP | 0.70 | Insider buying activity has been significant, with multiple purchases made by key insiders, including the director and a major shareholder, suggesting strong internal confidence. Montalbano has acquired a substantial number of shares at rising prices, indicating bullish sentiment. However, without current data on company fundamentals, earnings performance, sector conditions, or macroeconomic challenges, the analysis remains incomplete. If recent earnings are weak or macro conditions deteriorate, this could counterbalance the positive insider sentiment. | Healthcare | Biotechnology |

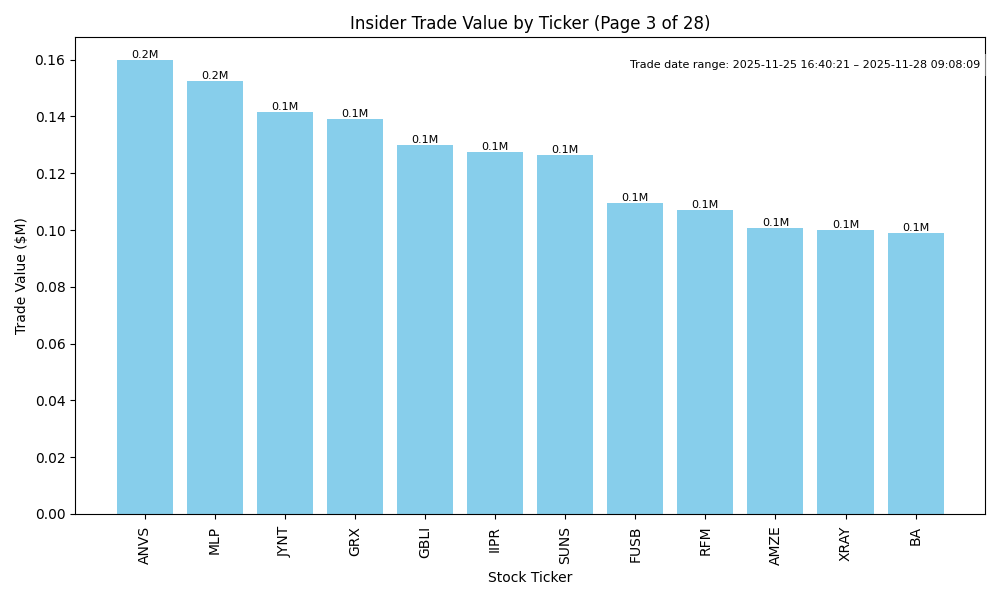

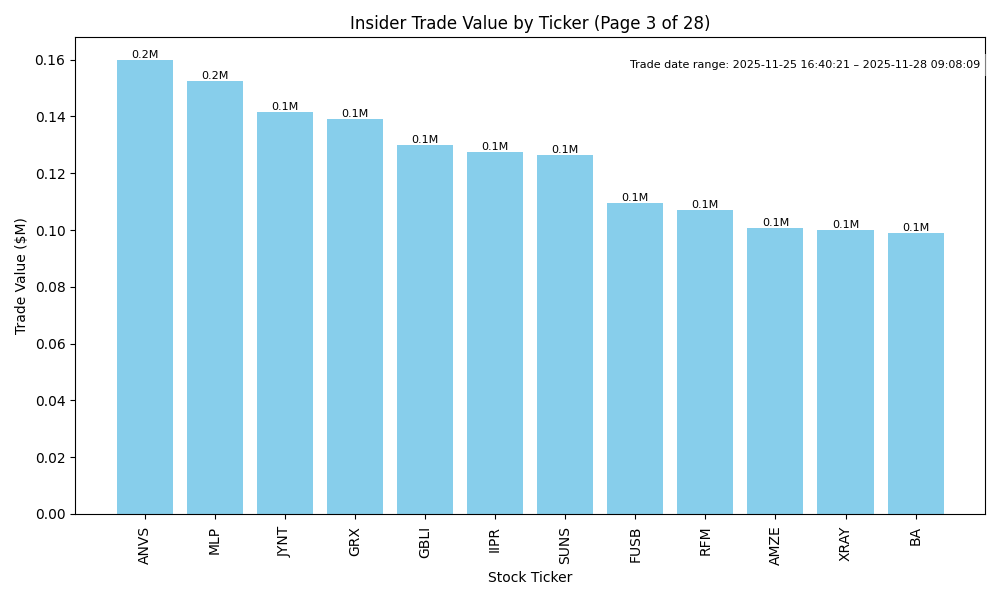

| ANVS | UP | 0.70 | Recent insider purchases by key executives, including the CEO, demonstrate confidence in ANVS's potential growth. The transactions show increasing share purchases at gradually higher prices, indicating optimism about future performance. However, the lack of context on company fundamentals, such as earnings trends or industry-specific challenges, limits overall confidence. Should macroeconomic conditions remain stable, particularly if interest rates do not rise significantly, the stock may trend upward due to this insider buying activity. | Healthcare | Biotechnology |

| MLP | UP | 0.75 | Recent insider trading is heavily weighted towards purchases, indicating strong insider confidence in the stock's potential. Notably, both the CEO and a significant director have made substantial purchases in the last week, suggesting positive sentiment regarding the company's near-term performance. However, without specific data on company fundamentals such as earnings trends, margins, or growth projections, the analysis lacks full depth. Depending on the broader macroeconomic conditions, including rates and inflation, this could impact the stock's trajectory. Overall, the predominant insider buying activity leans positively, but there are notable gaps in fundamental data to assess future growth adequately. | Real Estate | Real Estate Services |