| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

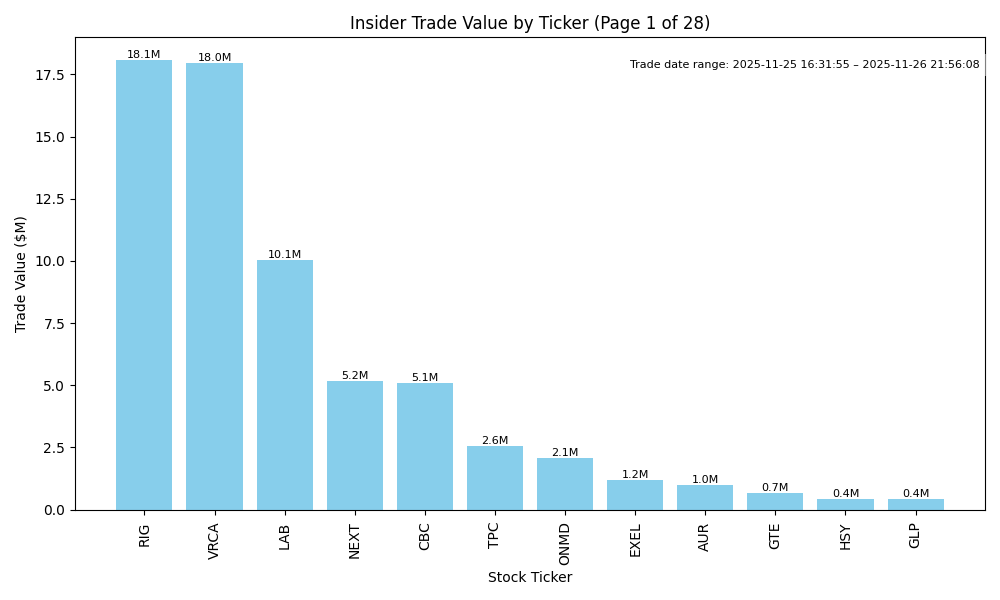

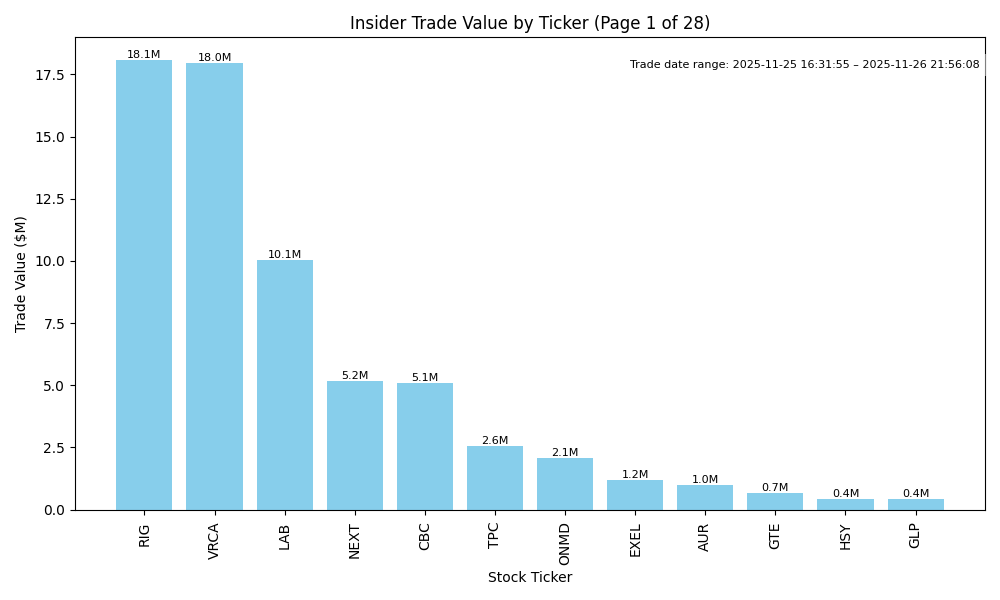

| RIG | UP | 0.70 | Recent insider purchases from multiple directors, particularly significant transactions from Perestroika (Cyprus) Ltd and Mohn Frederik Wilhelm, suggest strong confidence in the company's prospects. This wave of buying at an average price of $4.02, especially following previous purchases at lower prices, indicates a bullish outlook. However, notable insider sales, particularly from the Chief Commercial Officer, could imply concerns about short-term performance. Without current earnings trends and industry health data, confidence in a sustained upward movement is moderate. | Energy | Oil & Gas Drilling |

| VRCA | UP | 0.80 | Recent insider purchases indicate strong confidence in the firm's future, with key executives acquiring significant shares at prices around $4.24. The concentration of purchases, especially from high-ranking officials like the CEO and interim CFO, adds credibility. Absence of recent negative news or fundamental weakness strengthens this outlook. However, the stock has seen past sales by insiders at higher prices, which raises caution. Without clear data on earnings trends or macroeconomic challenges facing the industry, I remain moderately confident in a positive trend given the recent activity. | Healthcare | Biotechnology |

| CBC | UP | 0.75 | The significant volume of insider buying, with multiple executives purchasing shares at $21, indicates strong internal belief in the company's future. Notably, the CEO and CFO also participated in these purchases, suggesting confidence in upcoming performance. However, without additional context regarding company fundamentals, earnings trends, or macroeconomic conditions, caution is warranted. If the company's performance aligns with insider sentiment, the stock could trend upward, but potential external economic vulnerabilities remain a concern. | Financial Services | Banks - Regional |

| NEXT | UP | 0.70 | Recent insider buying from Hanwha Aerospace Co., Ltd. includes significant purchases at prices ranging from $5.86 to $6.08, indicating strong confidence in the stock's potential. The active buying pattern by insiders shows a positive sign. However, the sale of shares by York Capital Management and the lack of recent earnings data or macroeconomic context limits confidence. Overall, while insider sentiment is bullish, missing data makes the outlook cautiously optimistic. | Energy | Oil & Gas Equipment & Services |

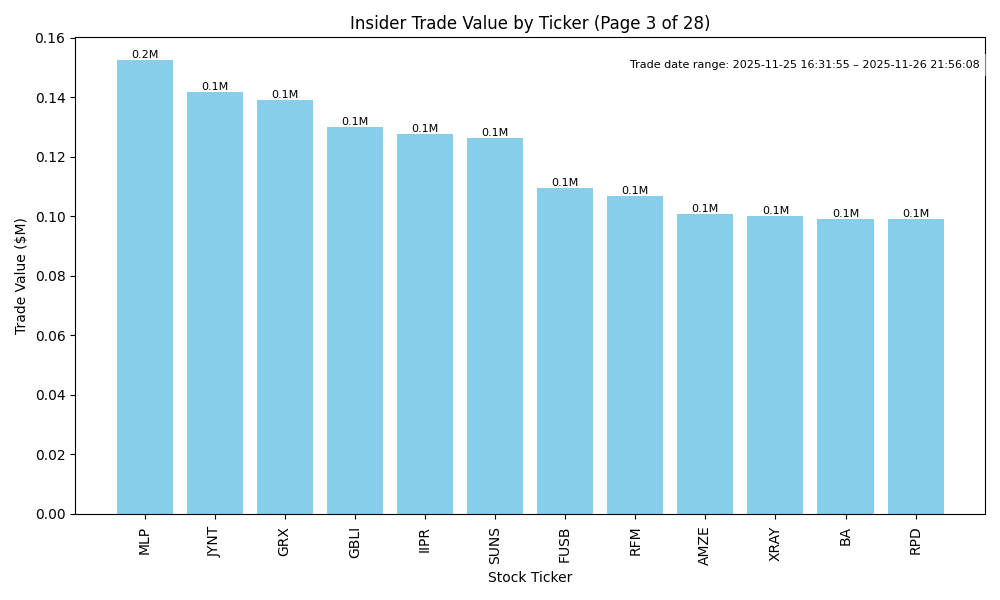

| RPD | NEUTRAL | 0.60 | Recent insider buying from key figures like the CEO and a significant market participant (Jana Partners) indicates potential confidence in future prospects. However, this is tempered by notable insider selling, especially from the Chief Accounting Officer and the lack of clarity on fundamental metrics such as revenue growth, margins, and industry comparisons. Additionally, macroeconomic factors like interest rates and inflation remain uncertain, likely affecting investor sentiment. Until clearer fundamentals or positive developments emerge, the stock's direction remains cautiously neutral. | Technology | Software - Infrastructure |

| TPC | DOWN | 0.70 | Recent insider activity shows significant selling, especially from key insiders including the Executive Chairman who sold over 1 million shares in the last few months, suggesting a negative outlook or profit-taking. Although there were some purchases by the CEO and a director recently, the scale of selling indicates a lack of confidence among insiders. Additionally, without information on current company fundamentals, macroeconomic conditions, or industry health, the overall confidence is moderate due to the conflicting signals from insider transactions. | Industrials | Engineering & Construction |

| ALMS | UP | 0.75 | Recent insider trading shows a strong positive trend with multiple high-value purchases by key insiders at prices significantly lower than previous highs (up to $16). This indicates insider confidence in the company's prospects. However, without detailed insights into the company's fundamentals, such as recent earnings performance and leverage status, the outlook is tempered. Additionally, the broader market context is uncertain due to fluctuating macroeconomic factors like interest rates and inflation, suggesting caution. Overall, there is a bullish sentiment from insiders, leading to an upward stock direction, albeit with moderate confidence due to the lack of deeper fundamental insights. | Healthcare | Biotechnology |

| TPVG | UP | 0.75 | Recent insider trading is heavily concentrated among top executives (CEO and CIO), who have consistently purchased substantial shares at increasing prices, indicating confidence in the company's future. The repeated purchases, especially on the same dates, suggest a strong belief in value at current levels. However, to fully assess the outlook, a review of the company's earnings trends and broader macroeconomic conditions is critical. Without explicit data on these fundamentals and market conditions, confidence is moderate. | Financial Services | Asset Management |

| CARR | DOWN | 0.70 | Insider trading activity shows a significant trend of sales, with multiple insiders selling substantial shares at higher prices throughout 2024, indicating a lack of confidence in short-term prospects. The recent purchase by the CEO is a positive sign, but it is dwarfed by the scale of recent sales. Company fundamentals may also reflect pressure from rising interest rates and inflation, potentially straining margins. Overall, despite the CEO's purchase signaling potential optimism, the prevailing trend of insider selling and broader economic pressures suggest a likely downward direction for the stock in the near term. | Industrials | Building Products & Equipment |

| NOV | NEUTRAL | 0.60 | Insider activity shows a significant purchase by director Kendall Christian S, indicating potential confidence in the company's future despite a recent trend of sales by other insiders. The larger sales on November 8 suggest some insiders may be capitalizing on previous gains, which could imply concerns about stock performance or company fundamentals. Without recent earnings data or macroeconomic context regarding industry health, the analysis remains tentative. The mixed signals from insider transactions along with the lack of current fundamental performance data leads to a neutral outlook with moderate confidence. | Energy | Oil & Gas Equipment & Services |

| BBWI | UP | 0.70 | Recent insider buying is significant, with multiple directors purchasing shares at prices around $14.40 to $15.58, indicating confidence in the company. This contrasts with earlier sales by certain insiders at much higher prices, suggesting a potential undervaluation now. However, the decline in share price from the previous year's highs raises concern over earnings trends and company fundamentals, which should be evaluated further. Overall sentiment indicates a buying opportunity, but market conditions and company performance remain critical factors that could impact near-term direction. | Consumer Cyclical | Specialty Retail |

| AUR | UNKNOWN | 0.40 | Insider activity shows a mixed picture: significant purchases from the CEO and a director, but also large sales from the same director (Hoffman Reid). While CEO purchases may indicate confidence, the volume and frequency of insider sales raise concerns. There's a lack of recent fundamental data regarding earnings, margins, or growth potential, which is critical for a more comprehensive assessment. Additionally, the broader market conditions, including interest rates and inflation, remain uncertain, contributing to the low confidence in a definitive direction. | Technology | Information Technology Services |

| SPRU | UP | 0.75 | Recent insider purchases, especially by Steel Partners Holdings L.P., indicate strong confidence in SPRU's future. The substantial amount of shares bought at increasing prices suggests optimism about the company's outlook. However, the overall market environment and industry specifics are unclear, and potential macroeconomic challenges could affect performance. While insider activity is strong, without solid fundamentals or recent material developments, my confidence is tempered. | Technology | Solar |

| BH | UP | 0.75 | Insider purchases by CEO Sardar Biglari indicate strong confidence, especially with significant investments at varying price points, reflecting a bullish outlook. The high concentration of ownership by an insider suggests alignment in interests. However, without current fundamentals like earnings trends, growth forecasts, and sector dynamics, it’s hard to fully gauge the stock's trajectory. The overall market context could also impact performance. Therefore, while insider sentiment points upwards, the missing fundamental data necessitates moderate confidence. | Consumer Cyclical | Restaurants |

| NN | DOWN | 0.65 | Recent insider trading presents a mixed picture. While Joseph D. Samberg, a significant insider, purchased 58,457 shares at $11.86, this is overshadowed by the substantial sale of 600,000 shares by the same insider just a week prior. Multiple insiders, including the COO, CFO, and CEO, have frequently sold shares, indicating potential concerns about the company's future. Fundamentals are unclear as there is no recent financial data provided, which could help assess performance trends. If earnings and growth are healthy, the recent purchases might suggest undervaluation; however, the lingering sell-off and lack of solid recent developments in financial performance raise caution. Thus, the overall sentiment leans towards a declining outlook. | Technology | Software - Infrastructure |

| GTE | UP | 0.75 | Insider purchases by Equinox Partners are concentrated and significant, indicating bullish sentiment from a major shareholder. Recent buying accumulates over 1.5 million shares at average prices around $4.29, suggesting confidence at this level. However, a notable insider sale (by the CEO) occurred last December. Company fundamentals and macro conditions must be assessed, but with such strong insider buying, the stock's near-term direction appears positive despite potential risks from recent sales and broader market dynamics. | Energy | Oil & Gas E&P |

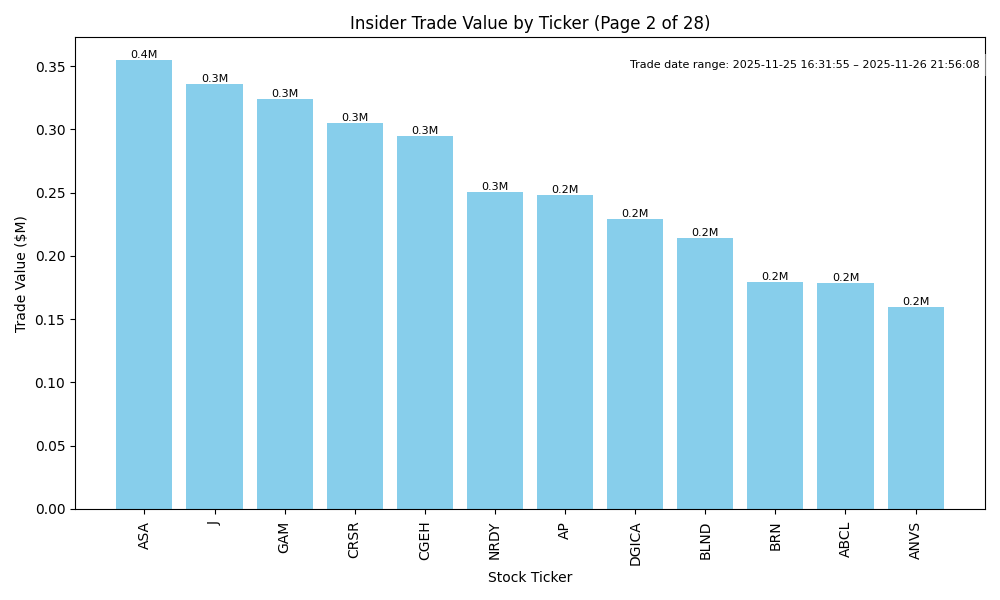

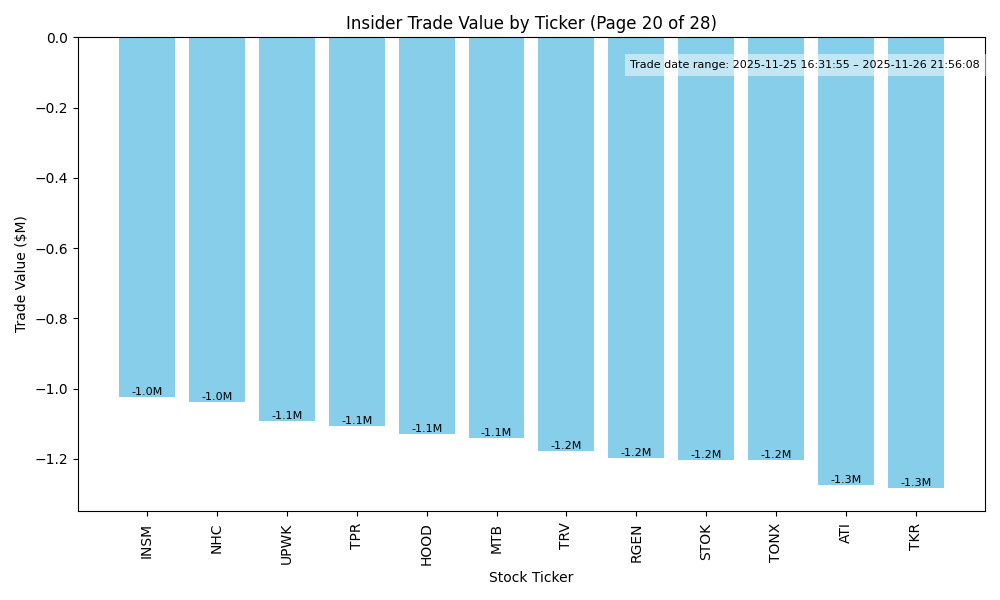

| NRDY | UP | 0.80 | Insider trading indicates strong buying sentiment, predominantly from the CEO, Charles Cohn, who has made multiple significant purchases recently. This confidence from leadership suggests belief in the company's upside potential. However, there are concurrent insider sales from other executives, which could signal caution or liquidity needs. Without current earnings data or broader macroeconomic context, the analysis holds some uncertainties. Overall, the buying pattern and volume from insiders outweigh the selling, pointing to a likely upward price movement. | Technology | Software - Application |

| MNR | DOWN | 0.65 | Insider purchases recently indicate strong confidence, particularly by significant figures; however, historical data shows that shares were bought at higher prices, and previous significant sales occurred. The market sentiment may be influenced by broader economic conditions such as rising interest rates and inflation, which can impact demand in real estate, a critical area for MNR. Without concrete updates on earnings or growth potential post these trades, I maintain a cautious stance despite recent buy signals, leading to a net negative outlook. | Energy | Oil & Gas E&P |

| ONEW | DOWN | 0.70 | Recent insider activity shows a mixed sentiment; while CEO Philip Singleton purchased a significant number of shares recently, key directors have been selling larger quantities, indicating potential lack of confidence in future growth. The stock price also seems to be on a downward trend based on average purchase prices from previous months, declining from above $22 to around $11.47. Without current data on the company's earnings, margins, or broader market conditions affecting its sector, the current situation suggests caution, making a downward direction more likely in the near term. | Consumer Cyclical | Specialty Retail |

| GLP | DOWN | 0.70 | Recent insider purchasing activity indicates confidence in the stock's future; however, the significant recent purchases are at a lower price point compared to earlier trades and coincide with a controlled decline in stock prices. The recent trend of insider sales, particularly by the COO, raises a concern about potential issues with company fundamentals. Without current earnings trends, growth potential, or macroeconomic conditions, this analysis carries moderate conviction due to mixed signals in insider behavior versus possible fundamental weaknesses. | Energy | Oil & Gas Midstream |

| HSY | UNKNOWN | 0.40 | Recent insider purchases by key executives, including the CEO and Chief Growth Officer, suggest confidence in the company's near-term prospects. However, these purchases are countered by significant sales from the CFO and former CEO, indicating potential concerns about the company's future performance or liquidity needs. The mix of buying and selling activities creates uncertainty. Additionally, a lack of information on current earnings trends and broader macroeconomic conditions further lowers confidence in a definitive direction for the stock. | Consumer Defensive | Confectioners |

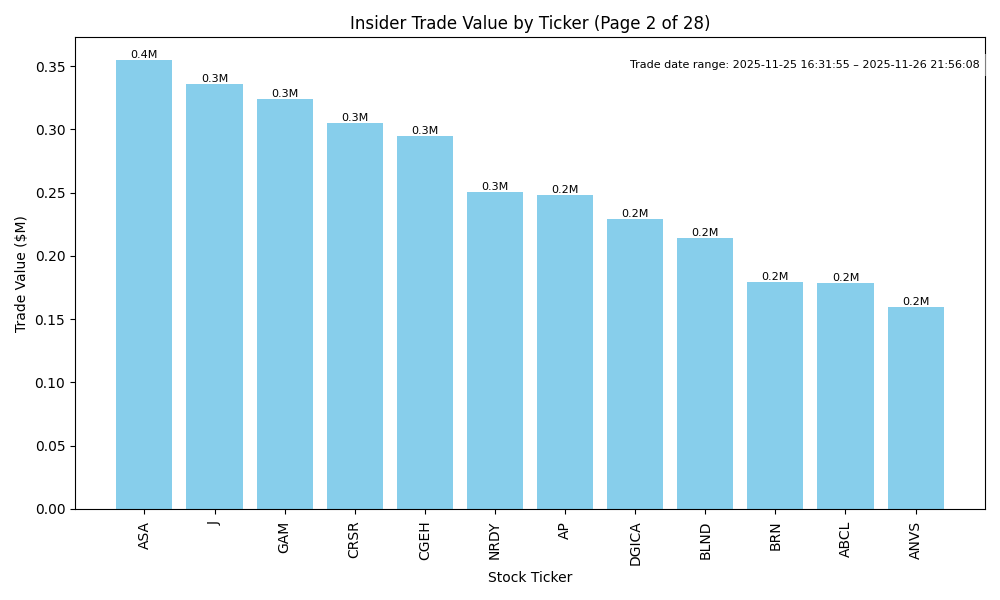

| ASA | UP | 0.75 | Significant insider buying by Saba Capital Management, indicating strong confidence from a major stakeholder. Recent purchases show strategic accumulation at varying price points, suggesting a bullish outlook. However, detailed company fundamentals like earnings trends or leverage are not available for assessment, which lowers confidence. The macroeconomic context appears mixed with inflation concerns but manageable interest rates. Overall, the persistent insider buying could indicate positive near-term price movement. | Financial Services | Asset Management |

| J | UNKNOWN | 0.40 | Recent insider purchases indicate emerging confidence among directors and CFOs, with purchases occurring at relatively high prices (around $134-$135). However, the history of significant insider selling, notably by the executive chair, raises concerns about potential overvaluation or internal pessimism. Company fundamentals and specific financial metrics are absent, leaving gaps in the analysis. Current economic conditions, such as interest rates and inflation, also remain undefined in this context, further complicating the outlook. Thus, the overall direction is uncertain, reflecting both insider optimism and significant selling pressure in the past. | Industrials | Engineering & Construction |

| GAM | UP | 0.73 | Recent insider buying indicates strong confidence from executive leadership, particularly from the CEO and Chairman, with significant purchases despite past sales. This suggests a belief in future growth or recovery. The stock price is currently around $25, which aligns with insider purchases. However, missing data on company fundamentals like earnings trends, margins, and macroeconomic factors may affect confidence levels. The macro environment's interest rates and inflation trends may influence purchasing decisions, introducing some risk. Overall, the insider activity and prevailing price suggest an uptrend is likely, albeit with caution due to unknowns. | Financial Services | Asset Management |

| ANVS | UP | 0.70 | Recent insider purchases, particularly by key executives, signal confidence in the stock's potential. The transactions are substantial, indicating belief in a positive outlook. However, a comprehensive analysis of company fundamentals is necessary, but is limited here. Without additional data on earnings trends, margins, or macroeconomic conditions, there is uncertainty about sustained momentum. The current insider activity suggests optimism, but external factors could impact performance. | Healthcare | Biotechnology |