| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

| STAA | UP | 0.75 | The recent insider buying from Broadwood Partners, L.P., especially a large purchase of 1.5 million shares at $27.37, indicates strong confidence in the company's prospects. Additionally, cumulative purchases at various price points suggest an optimistic outlook despite recent higher average purchase prices. However, I lack specific information on the company's current earnings trends and margins, along with macroeconomic conditions that could influence performance. Given the significant insider activity alongside potentially positive fundamentals, my overall outlook is moderately bullish. | Healthcare | Medical Instruments & Supplies |

| BFLY | DOWN | 0.70 | Insider trading shows a mixed sentiment with significant recent purchases by Larry Robbins and smaller shares being sold by other directors. However, the pattern leans towards selling, suggesting potential concerns among insiders. The lack of concrete fundamental data, like earnings trends or growth potential, alongside broader macroeconomic factors such as high inflation and rising interest rates, raises uncertainty. Without visibility into company performance or industry dynamics, the current context points to downward pressure on the stock's price. | Healthcare | Medical Devices |

| RUM | DOWN | 0.70 | Recent insider trading indicates significant selling from key executives, particularly at higher price points (approximately $7.50), suggesting a lack of confidence in the stock's current valuation. Although a large purchase by Tether Holdings (1,063,670 shares at $5.43) may signal potential value, it contrasts sharply with the selling pressure from insiders. Without clear positive trends in company fundamentals, industry conditions, or broader economic context, this mixed signal supports a bearish outlook in the near term. | Communication Services | Internet Content & Information |

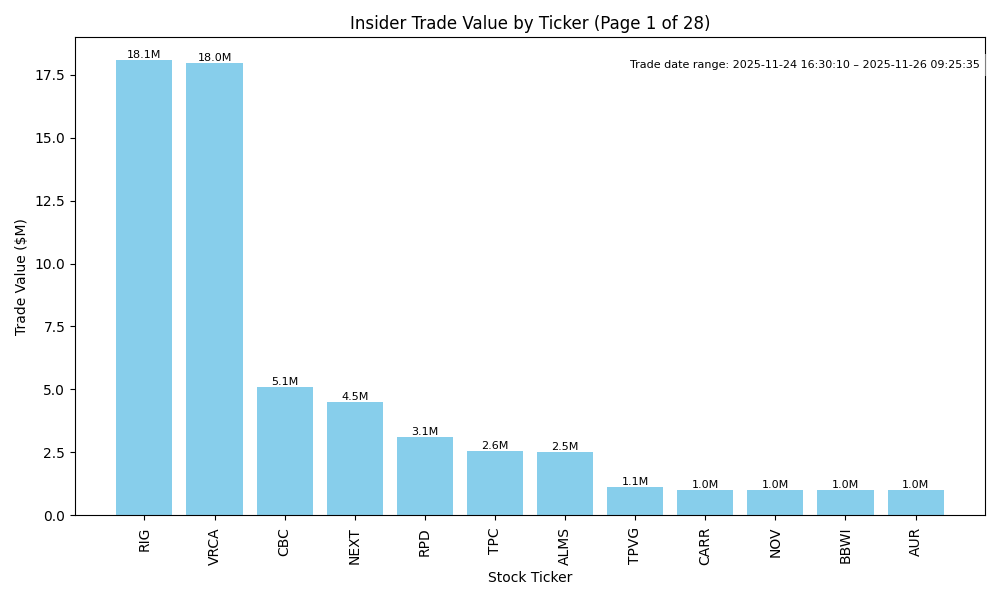

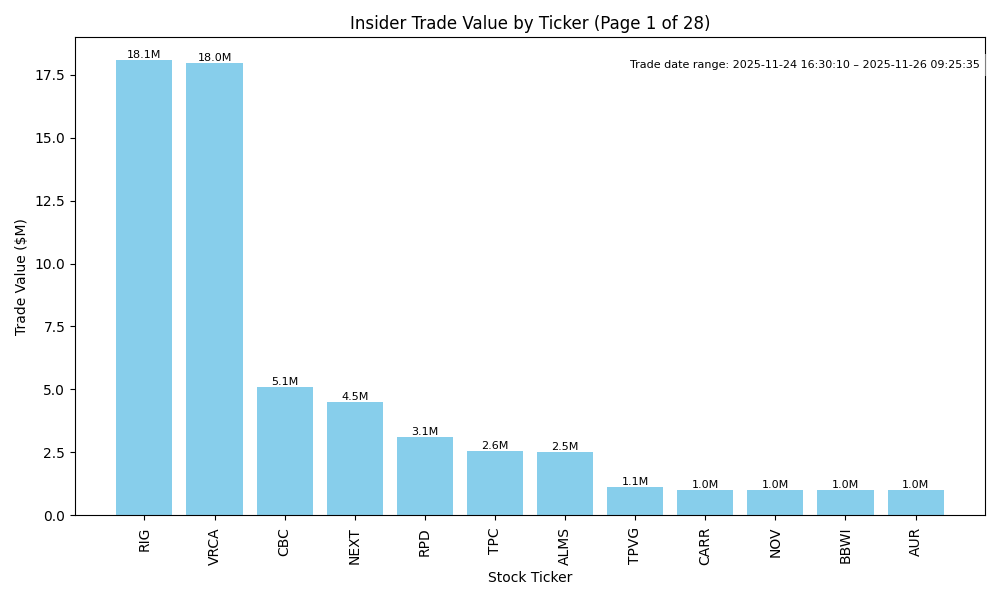

| NEXT | UP | 0.75 | Recent insider purchases from Hanwha Aerospace suggest strong confidence from substantial stakeholders, with purchases totaling over 4.4 million shares at prices averaging between $5.86 and $6.08, showing a commitment despite price declines. However, there's a lack of recent data on company fundamentals, notably earnings trends and leverage, which limits a full assessment. The sector might face challenges due to broader macro concerns like interest rates and inflation, but current insider activity indicates potential near-term upward momentum. | Energy | Oil & Gas Equipment & Services |

| ANNX | UP | 0.70 | Recent insider buying is significant, particularly from key directors, with substantial purchases at rising prices. This insider confidence suggests positive developments in the company. However, the broader economic environment—with inflation and interest rate uncertainties—and any lack of recent solid earnings or business model clarity creates some headwinds. Still, the strong insider buying could indicate prospective improvements or strategic initiatives that may support stock price appreciation in the near term. | Healthcare | Biotechnology |

| IKT | UP | 0.70 | Recent insider buying activity, particularly by a significant fund (Sands Capital), indicates strong confidence in the company's prospects. This is supported by multiple transactions at rising prices, suggesting a belief in undervaluation. However, without specific details on IKT's core fundamentals (earnings, margins, and leverage), the assessment remains incomplete. Market conditions also play a role; if the macro environment is stable, the upward pressure from insider buys could prevail. Nonetheless, the lack of detailed fundamental and macro data leads to a moderate confidence level. | Healthcare | Biotechnology |

| PROP | DOWN | 0.60 | Insider buying has occurred significantly in recent months, particularly by key executives and directors, suggesting confidence in the company's future. However, the stock's price has dropped notably from previous highs (above 10), with recent purchases made at lower prices (around 1.72). This indicates a potential downward trend, reflecting broader market concerns. Additionally, without clear information on the company's financials, earnings trends, and macroeconomic context (e.g., interest rate pressures or inflation), my confidence is moderate due to uncertainty in fundamentals. Overall, despite insider buying, the stock may continue to experience downward pressure due to broader challenges. | Energy | Oil & Gas E&P |

| ASA | UP | 0.75 | Insider buying has been significant, particularly from Saba Capital Management, indicating strong belief in the company's future. The volumes and average prices suggest increasing confidence, particularly at lower price levels. However, critical fundamentals, such as earnings trends, margins, and leverage, are not provided, which limits the analysis. The stock has potential growth, but it's vital to remain cautious due to macroeconomic uncertainties like inflation and interest rates that could affect performance. Overall, given the strong insider activity, there is a positive tilt toward the stock's near-term direction. | Financial Services | Asset Management |

| TPVG | UP | 0.75 | Recent insider buying by both the CEO and the President in significant volumes indicates strong confidence in the company's prospects. However, the stock has seen a decline in average purchase price, suggesting potential underlying weakness. There's a need to evaluate company fundamentals, including earnings trends and market conditions, but the consistent insider purchases provide a bullish signal. Without further context on macroeconomic conditions and recent company developments, the analysis could shift. Overall, the sentiment leans positive but with moderate caution. | Financial Services | Asset Management |

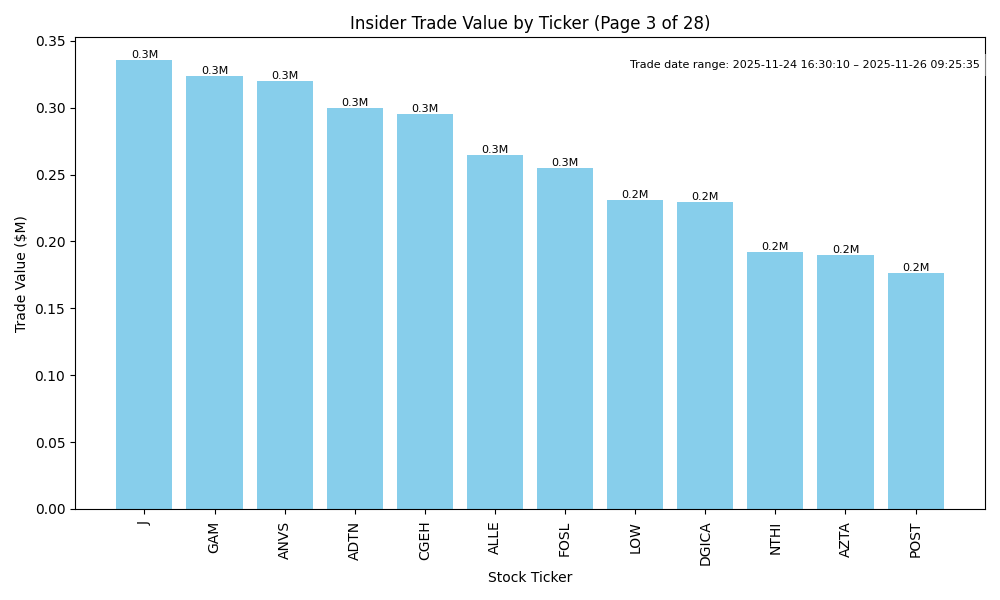

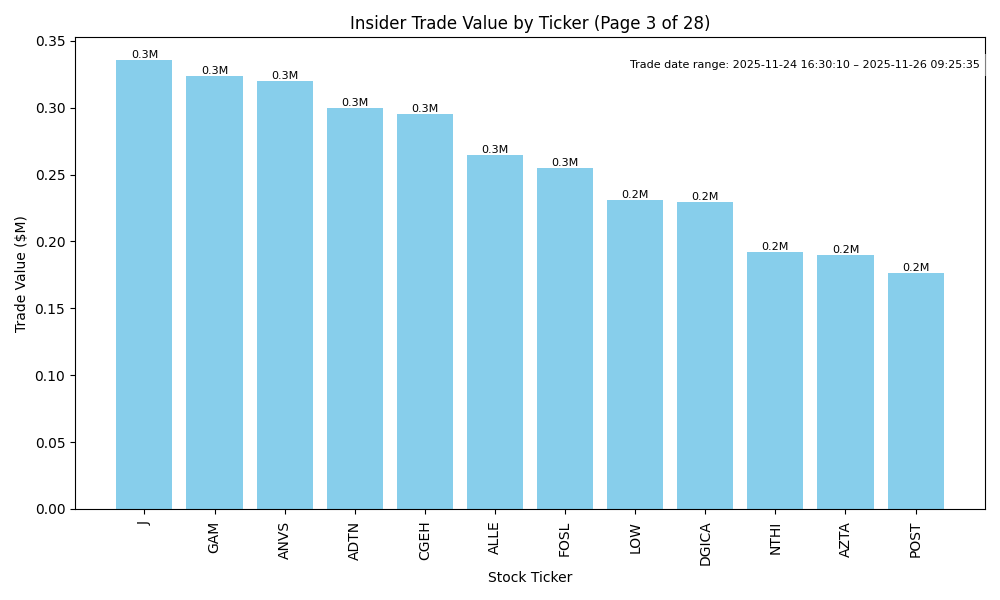

| DGICA | UP | 0.70 | Recent insider purchases are substantial, particularly from Donegal Mutual Insurance Co, who has consistently bought shares at increasing prices, indicating strong internal confidence. However, multiple insider sales by executives may signal profit-taking or concerns about future performance. Company fundamentals are not provided, leaving uncertainty about growth and profitability. The broader macroeconomic environment is critical but also not mentioned, which might influence the stock's direction. Overall, the bullish insider activity suggests potential upside, but the mixed signals from insider sales and missing fundamental data decrease confidence. | Financial Services | Insurance - Property & Casualty |

| BEN | UP | 0.75 | Recent insider buying from CEO and significant stakeholders indicates strong internal confidence in the company's future prospects. Large purchases at prices between $19.08 and $22.80 suggest belief in growth as the stock recently trades below these levels. However, there's a recent pattern of insider selling, particularly in the operations department, which introduces caution. Company fundamentals weren't explicitly reviewed, nor were broader industry and macroeconomic factors detailed, which limits confidence in this analysis. Overall, strong insider buying suggests a likely upward trend, tempered by potential external pressures. | Financial Services | Asset Management |

| CWGL | UP | 0.70 | Insider buying activity has been significant, especially from key directors acquiring large blocks of shares, indicating confidence in the company's future. Recent purchases occurred at prices ranging from $4.86 to $6.05, suggesting insiders view current valuations as favorable. However, a holistic assessment is hampered by a lack of recent earnings data or information on broader market conditions impacting the stock. Given the notable insider enthusiasm contrasted with potential market volatility and economic uncertainty, my confidence is moderate. | Consumer Defensive | Beverages - Wineries & Distilleries |

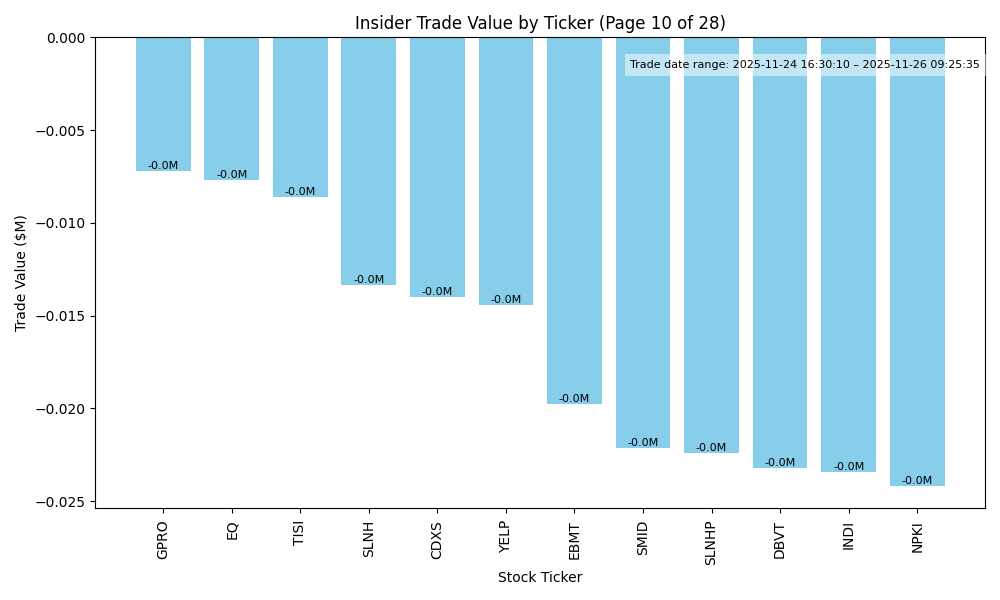

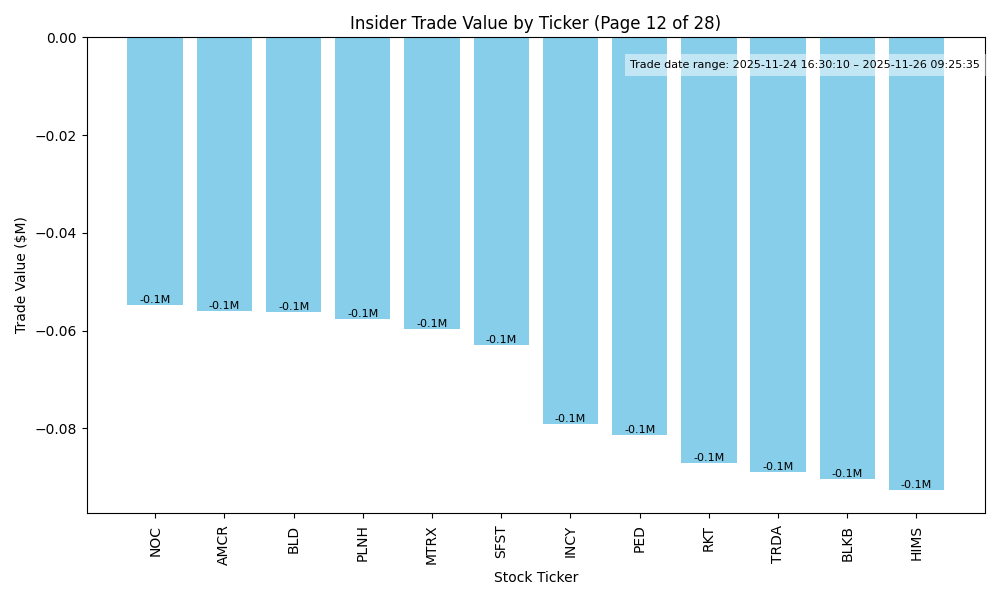

| CARR | DOWN | 0.60 | The recent insider trading activity reveals a concerning trend. While CEO David Gitlin made a notable purchase of 19,300 shares at $52.62, there has been a significant wave of selling among other insiders, including almost 4.3 million shares sold by Director Maximilian Viessmann. The scale of insider selling may signal a lack of confidence in the company's near-term performance. Additionally, if fundamental metrics such as earnings growth, margins, and debt levels are under strain, along with broader macroeconomic pressures like rising interest rates, it adds to a bearish outlook. However, without specific details on recent earnings or guidance changes, the analysis retains moderate uncertainty. | Industrials | Building Products & Equipment |

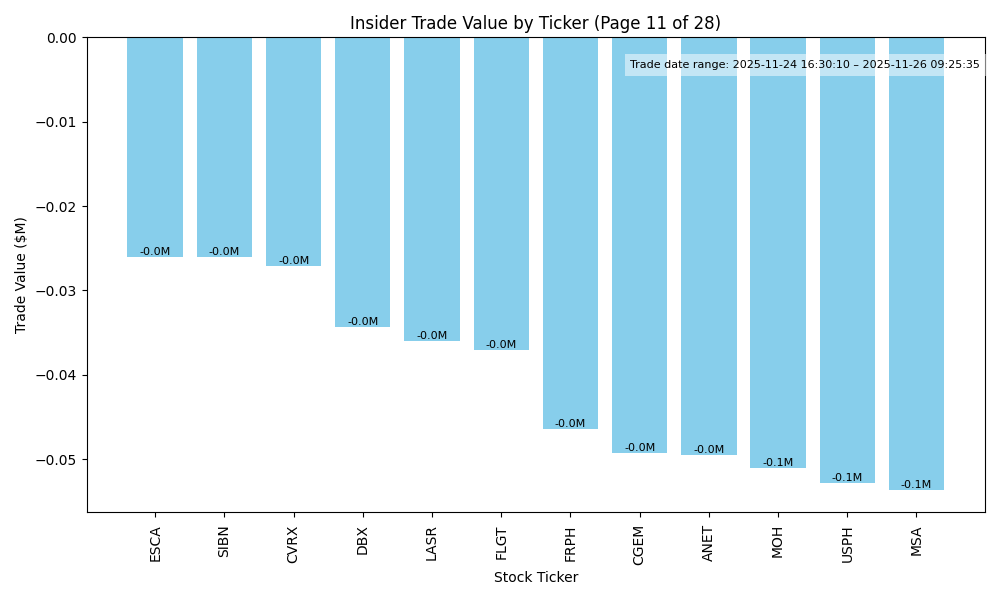

| NOV | DOWN | 0.65 | Insider trading activity presents a mixed picture. While Kendall Christian S purchased a significant number of shares, multiple insiders sold substantial portions within a short timeframe, indicating potential concern over future performance. The average sale price exceeds the recent purchase price, suggesting selling at higher valuations. Fundamental analysis data is missing, particularly regarding earnings trends and company growth potential. However, if company fundamentals remain weak or uncertain, the strong insider selling might indicate lack of confidence in the company's near-term outlook. Overall, the weight of insider selling relative to the buying leads to a downward direction prediction. | Energy | Oil & Gas Equipment & Services |

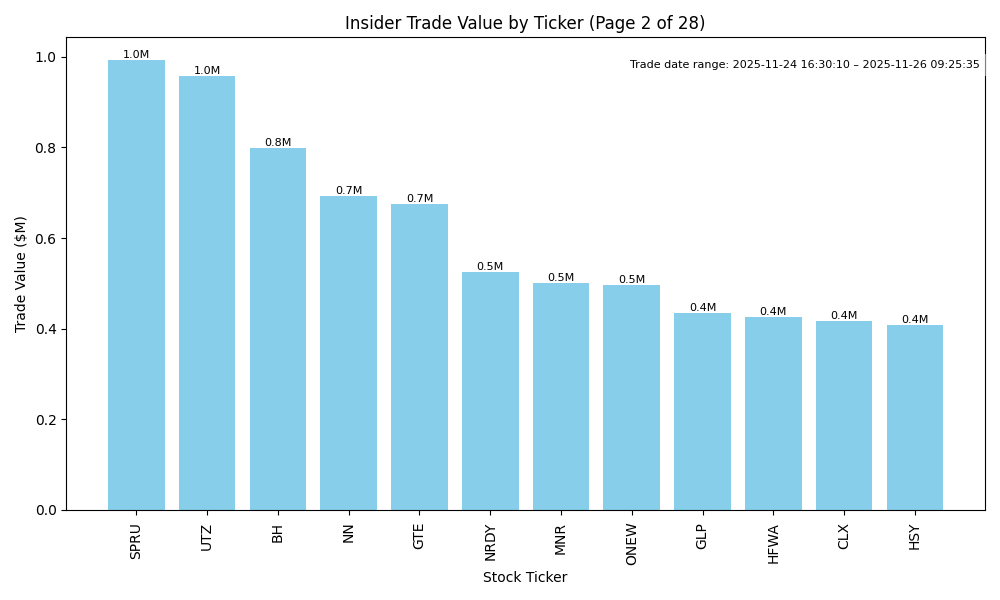

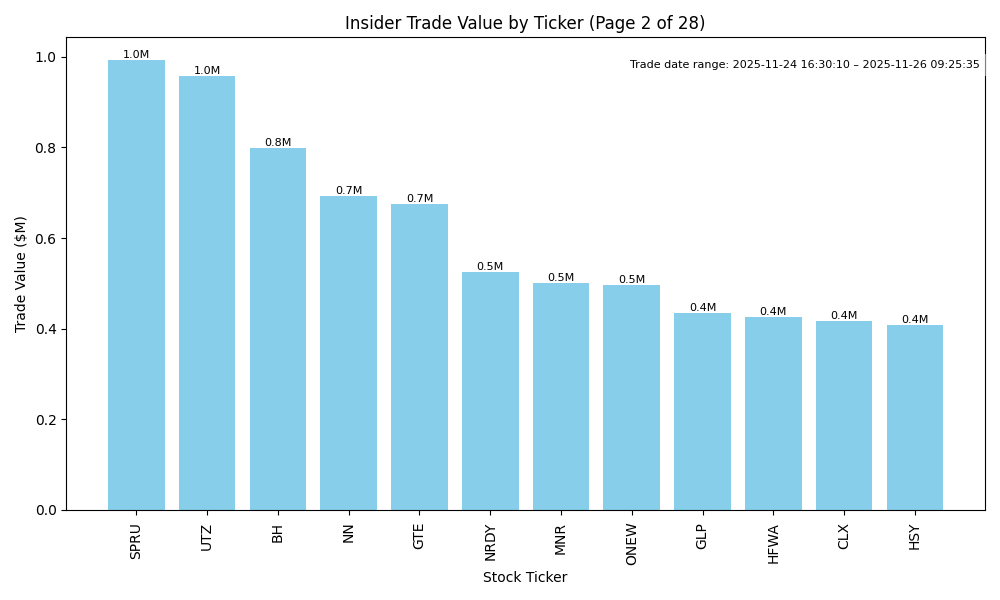

| SPRU | UP | 0.70 | Recent insider purchases from Steel Partners Holdings suggest strong internal confidence in SPRU's prospects, especially with several large transactions occurring at increasing average prices. Meanwhile, the overall market environment and recent fundamental data need to be evaluated for clarity. Insider purchases could indicate a turnaround, yet without concrete earnings trends or macroeconomic context, caution is warranted. Overall, strong insider buying bolsters the likelihood of a positive price direction, though potential liquidity and operational challenges might still exist. | Technology | Solar |

| UTZ | DOWN | 0.65 | Recent insider purchases indicate confidence at lower price levels, with significant buying at around $9.59-$10.58. However, previous insider selling occurred at higher prices, hinting at potential issues, including poor stock performance as it declined from around $19 to current levels. This drop could be due to weakened fundamentals in earnings and margins, possibly exacerbated by increased industry competition or macroeconomic factors. The overall momentum suggests a bearish trend despite insider confidence, decreasing confidence in a near-term price increase. | Consumer Defensive | Packaged Foods |

| ALMS | UP | 0.75 | Recent insider buying is notably strong, with significant purchases by directors and substantial institutions at prices well below the current average. These transactions suggest a bullish outlook on the company's future. However, to fully assess ALMS's trajectory, company fundamentals such as earnings growth, margin stability, and leverage need to be analyzed, which are currently unspecified. The broader economic environment, including potential impacts of interest rate changes and inflation, could also affect stock performance. Overall, the insider activity projects an optimistic outlook, but confidence is moderated by the absence of fundamental operational data. | Healthcare | Biotechnology |

| BH | DOWN | 0.70 | Sardar Biglari, CEO and COB, has been actively buying shares, indicating confidence in the company's future. However, the declining average purchase prices over recent months suggest potential weakening in the stock's market perception. Substantial insider buying does not always translate to strong fundamentals if company metrics (earnings trends, margins) are not favorable, and no data on recent earnings or guidance changes is provided. The broader macroeconomic context of rising interest rates and possible inflationary pressures may also negatively affect stocks. Thus, despite the insider buying sentiment, there are signs that could lead to downward pressure on the stock. | Consumer Cyclical | Restaurants |

| OPK | UP | 0.70 | Recent insider purchases, particularly by CEO Phillip Frost, indicate strong confidence in OPK's future performance despite the low stock price currently. Significant buying activity has occurred over the past several weeks, suggesting belief in the company's undervalued status. However, the broader macroeconomic environment, including high inflation and fluctuating interest rates, adds uncertainty. Additionally, I lack detailed information on current earnings trends and any recent material developments, which could impact the company's fundamentals. Thus, while the insider activity leans towards a bullish outlook, the confidence level is moderated by these uncertainties. | Healthcare | Diagnostics & Research |

| NN | DOWN | 0.70 | Recent insider activity shows a mixed signal: a significant purchase by a substantial insider (Samberg Joseph D) contrasts with significant sales by various other insiders, including the COO and CFO. The stock has traded significantly lower from previous highs, indicating potential weakness in fundamentals. Without detail on overall earnings trends, margins, and leverage, and considering the broader macroeconomic environment facing rising interest rates and inflation pressures, there are headwinds to growth. The mixed insider activity feeds into this narrative, suggesting caution and a likely downward trajectory in the near term. | Technology | Software - Infrastructure |

| BBWI | NEUTRAL | 0.50 | Recent insider buying (17,000+ shares) suggests some confidence in the stock at lower price levels; however, it follows significant insider selling (approximately 60,000 shares) at much higher prices. The overall market and macroeconomic conditions (potential rising interest rates) create uncertainty. Additionally, lacking current earnings trends and industry health specifics limits confidence in growth potential. Overall sentiment appears mixed, warranting a neutral outlook. | Consumer Cyclical | Specialty Retail |

| HFWA | NEUTRAL | 0.60 | Insider trading shows mixed signals. Recent purchases by the President indicate confidence, while significant sales by key executives suggest possible concerns about current valuations. Company fundamentals are unclear without specific revenue and earnings details, but the industry context and SEC regulations might impact growth potential. Given mixed insider activity and the lack of clear fundamental strength, the stock's near-term direction is uncertain. | Financial Services | Banks - Regional |

| CLX | DOWN | 0.60 | Recent insider activity shows a mixed sentiment: while there has been a notable purchase from Director Breber Pierre R, this is overshadowed by significant sales, particularly from high-level executives, which may indicate concerns regarding the stock's valuation or future performance. Moreover, there are no recent earnings or guidance updates provided, leaving a potential gap in understanding current fundamentals. Additionally, the broader macroeconomic context, including potential inflationary pressures and interest rates, could negatively impact consumer spending and therefore affect demand for Clorox products. Overall, the insider sales suggest caution, leading to a downtrend in near-term stock direction. | Consumer Defensive | Household & Personal Products |

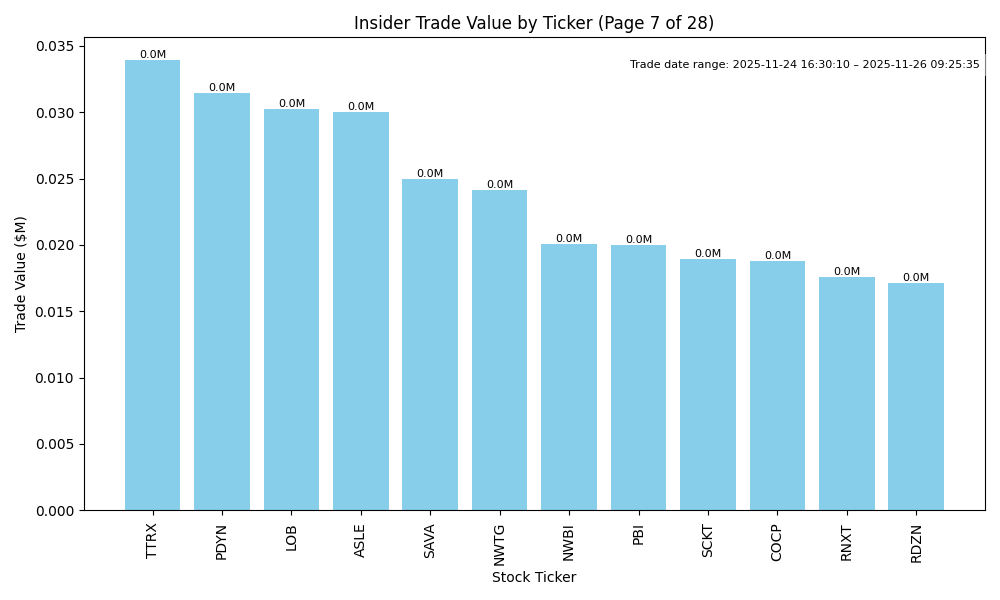

| SAVA | NEUTRAL | 0.60 | Recent insider purchases by the CEO and COO suggest confidence in the company's prospects; however, sizable sales by senior executives raise caution. The stock's price is around $2.76, significantly lower than recent sales by insiders around $3.87, indicating potentially overextended valuations. There’s a lack of detailed information on company fundamentals and macroeconomic conditions affecting the sector. Without recent earnings data or insights into industry trends, assessing growth potential is challenging, leading to moderate confidence. | Healthcare | Biotechnology |

| ADTN | UP | 0.60 | The recent insider purchase by CEO Thomas R. Stanton of 40,928 shares at $7.33 suggests strong confidence in the company's future, potentially indicating an undervaluation. However, without additional context on company fundamentals, industry health, and macroeconomic conditions, it's challenging to assess near-term stock direction. Insider buying can be a positive signal, but it should be weighed against broader market factors and company performance metrics, which are currently unspecified. | Technology | Communication Equipment |