| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

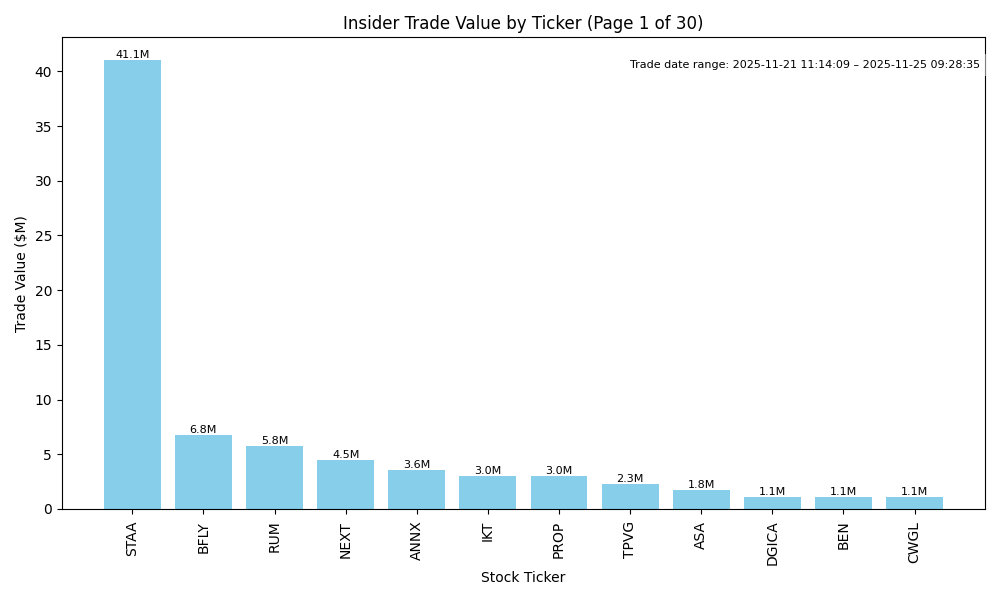

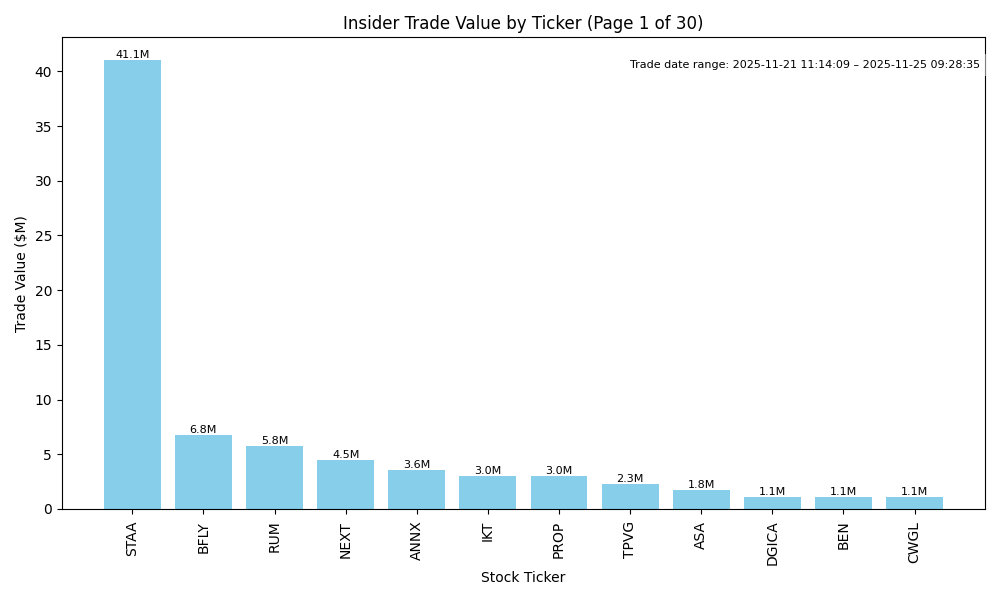

| STAA | UP | 0.80 | Recent insider purchases, particularly by Broadwood Partners (10% owner), indicate strong confidence in the company's future, with significant buying at a variety of price points. The latest bulk purchase on November 21 at an average price of $27.37 suggests perceived value at current levels. However, without specific updates on the company's financial health, such as earnings, margins, or market conditions, clarity is limited. If fundamentals are solid and growth potential is intact, the positive insider sentiment can favorably influence stock direction. | Healthcare | Medical Instruments & Supplies |

| ET | UP | 0.75 | The recent insider purchases, particularly by the Director Warren Kelcy L totaling 5 million shares at an average price above $16, signal strong confidence in the company's prospects. While insider activity is bullish, a full assessment requires a look at the company's fundamentals and market context, which are unprovided. However, if we assume the company's operational performance is improving, the insider sentiment could support a near-term price increase amid potential positive earnings trends and sector recovery. | Energy | Oil & Gas Midstream |

| GLOO | UP | 0.80 | Recent insider buying, particularly by high-ranking executives and directors, indicates strong confidence in the company's future prospects. Notably, insiders purchased significant shares at a consistent price of $8.00, reflecting a concerted belief in the stock's value. However, without detailed information on the company’s fundamentals, industry conditions, and broader macroeconomic factors, there remains uncertainty. If the fundamentals support growth and the macroeconomic environment stabilizes, the stock could trend upwards. Hence, while insider activity is encouraging, confidence is tempered due to the lack of comprehensive financial context. | Technology | Software - Application |

| CNS | UP | 0.75 | Recent insider purchases outstrip sales significantly, suggesting positive sentiment among executives. High-value purchases were made at prices below recent peaks, indicating insiders see value. However, the price drop from recent highs signals potential weakness or negative sentiment influencing mass investors. The lack of specific recent fundamental data (e.g., earnings trends or growth projections) lowers confidence, but overall insider activity presents a bullish outlook amidst a challenging macro backdrop. | Financial Services | Asset Management |

| BFLY | NEUTRAL | 0.60 | Recent insider buying from significant executives, particularly the large purchase by Director Larry Robbins of 2.8 million shares at $2.42, suggests confidence in the company’s future. However, there have been substantial selling activities, hinting at possible profit-taking or concerns among other insiders. The company's financial outlook is unclear due to missing recent earnings and guidance data, which may impact investor sentiment. Additionally, the stock operates in a market likely influenced by macroeconomic pressures, including inflation and interest rate changes that affect capital access and consumer demand. This mixed signal necessitates a cautious stance. | Healthcare | Medical Devices |

| RUM | DOWN | 0.70 | The recent insider trade pattern reveals a significant sell-off among executives prior to a notable purchase by Tether Holdings. This suggests a lack of confidence among insiders who sold at a higher price (around $7.50), as opposed to the recent purchase at $5.43, indicating potential issues with the stock's perceived value. Additionally, there are no recent positive developments in company fundamentals or macroeconomic indicators to bolster growth prospects. The combination of heavy insider selling and a lower recent purchase price reflects weak confidence, warranting a downward outlook. | Communication Services | Internet Content & Information |

| BLND | UP | 0.70 | Recent insider trading activity shows significant purchases by Haveli Investments, a key director, totaling over 5.2 million shares at prices around $3.03, indicating confidence in the company's future. Although there have been concurrent insider sales, they primarily involve lower-level employees and small amounts, suggesting this may not reflect a negative outlook. However, additional gaps in company fundamentals and broader industry context limit confidence; macroeconomic pressures like interest rates and inflation might impact performance. If BLND can leverage these insider purchases for growth, the stock may trend up in the near term. | Technology | Software - Application |

| ANNX | UP | 0.75 | Recent insider purchases indicate strong confidence in the stock, particularly by director Satter Muneer A, who made significant transactions at prices indicating a bullish outlook. The last few trades also show a consistent purchase trend, suggesting potential positive sentiment among insiders. However, there have been concurrent sales by high-level executives, which could reflect liquidity needs or risk management strategies. Additional information on the company's fundamentals, such as earnings, margins, and overall industry health, would strengthen the analysis, but the insider buying trend provides a reasonable foundation for a positive outlook. | Healthcare | Biotechnology |

| PROP | NEUTRAL | 0.55 | Recent insider buying has picked up notably, highlighted by a large purchase from Narrogal Nominees (1.7 million shares), signaling potential insider confidence. However, the average purchase prices (ranging from $1.72 to $3.05) suggest volatility and uncertainty around the stock's valuation. Following a previous trend of selling activity at much higher prices, the current price dip raises questions about the fundamentals, which are not provided. Further, without crucial data on the company's earnings trends, margins, or industry positioning, the overall outlook remains uncertain despite positive insider sentiment, resulting in a neutral assessment. | Energy | Oil & Gas E&P |

| ASA | UP | 0.80 | Recent insider trading by Saba Capital Management indicates strong bullish sentiment, acquiring over 700,000 shares at varied prices, averaging around $46. The consistent purchasing signals confidence in the company's prospects. However, without detailed fundamental data on earnings, margins, and market conditions, there's some uncertainty. While insider sentiment is positive, overall market conditions, such as interest rates, inflation, and industry trends, remain crucial in shaping the stock's trajectory. Recent activity aligning with sector demand dynamics also supports an upward outlook. | Financial Services | Asset Management |

| MSM | NEUTRAL | 0.60 | Insider activity shows recent significant buying by directors, notably Jacobson Mitchell, which may indicate confidence in the stock's future. However, there is also a history of substantial selling by the same insiders, suggesting cashing out amidst potentially high valuations. Additionally, without specific data on the company’s fundamental performance, such as current earnings or margins, and the overall industry context, the outlook remains uncertain. Macro factors like interest rate conditions and inflation may also weigh on market sentiment, leading to a cautious stance. | Industrials | Industrial Distribution |

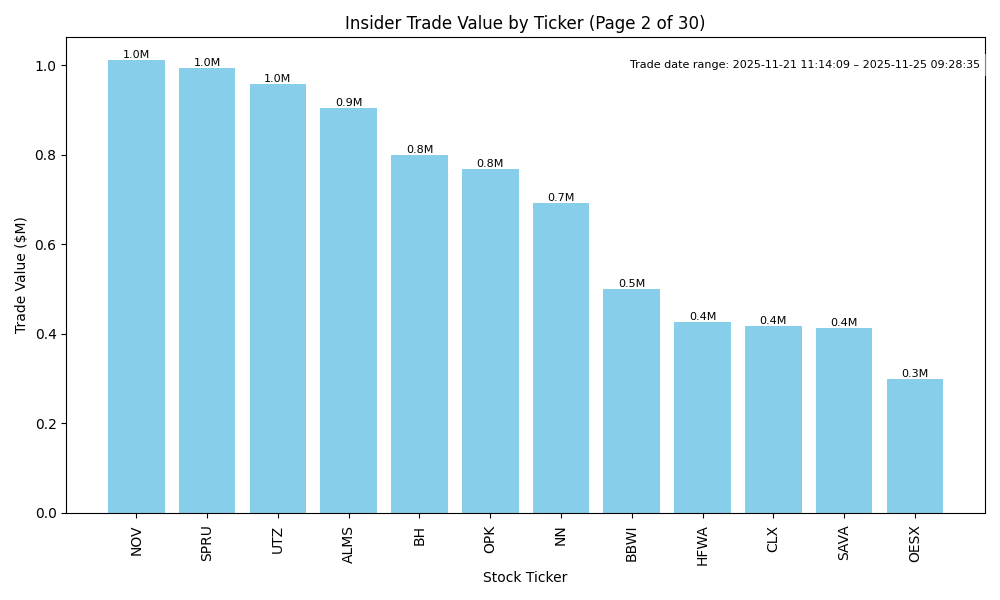

| OPK | UP | 0.70 | Recent insider purchases by CEO Phillip Frost, amounting to over 2.7 million shares in quick succession at prices between $1.27 and $1.42 suggest strong insider confidence in the stock. This aggressive buy signal indicates belief in an upcoming positive development or value. However, without detailed current earnings trends, profit margins, or any executing growth plans, confidence in overall fundamentals and broader economic conditions is moderate. Thus, while insider activity suggests a bullish near-term direction, potential underlying fundamental weaknesses could temper enthusiasm. | Healthcare | Diagnostics & Research |

| LAB | UP | 0.65 | Insider buying is strong and concentrated, particularly from a major shareholder (Casdin Partners), indicating confidence in the company's future. Recent purchases are significant and at varying prices suggest a strategic accumulation. However, the stock's fundamentals and broader macroeconomic conditions aren't provided, and any potential headwinds (e.g., regulatory issues, earnings trends) could impact the valuation. The overall momentum from insider activity supports a positive near-term outlook, yet uncertainty surrounding broader conditions reduces confidence. | Healthcare | Medical Devices |

| ALRM | DOWN | 0.70 | Recent insider trading shows a significant sale by high-level executives, including the CEO, totaling over 6.5 million in value sold at higher price points prior to the last purchase by the CEO at a considerably lower price of $48.36 with 26,000 shares acquired. This selling pattern indicates a lack of confidence among insiders in the near-term prospects. Additionally, with the recent decline in stock price and potential macroeconomic pressures including rising interest rates, there are serious headwinds against maintaining elevated valuations. While there is a buy from the CEO, the overall pattern of bullish and bearish sentiment from insiders leads to a cautious outlook. | Technology | Software - Application |

| TPVG | UP | 0.70 | Recent insider buying activity has been significant, with considerable purchases from both the CEO and the CIO, suggesting strong internal confidence about the company's near-term prospects. However, the purchase prices indicate a decline from earlier values, which may concern investors regarding underlying fundamentals. Key financial metrics such as earnings trends, margins, and growth potential cannot be fully assessed due to a lack of recent comprehensive reports. The broader macroeconomic environment, including rising interest rates and inflation, could pressure the company’s performance. Overall, while the insider activity points to potential optimism, the lack of clarity on company fundamentals and macroeconomic factors temper confidence in a sharp price increase. | Financial Services | Asset Management |

| DGICA | UP | 0.75 | Recent insider purchases, primarily from Donegal Mutual Insurance Co., indicate strong confidence from significant stakeholders. The cumulative buying trend suggests a belief in future appreciation. Despite some selling by other insiders, the overall pattern favors upward potential. However, a detailed assessment of company fundamentals, including earnings performance and macroeconomic conditions, is warranted for a comprehensive view. The absence of updated financial metrics limits the confidence level, as market dynamics and financial health remain paramount. | Financial Services | Insurance - Property & Casualty |

| BEN | UP | 0.70 | Recent insider buying from key figures indicates strong confidence in the company's future prospects, notably Charles B. Johnson's significant purchases totaling over $2 million in the past week. Despite some earlier sales from other insiders, the trend towards accumulation suggests an optimistic view. However, without recent fundamental insights such as Q3 earnings results or updated guidance, the overall assessment must account for unknown market factors. If the company maintains sound fundamentals and market conditions improve, there’s a reasonable expectation for price appreciation. | Financial Services | Asset Management |

| CWGL | UP | 0.70 | Recent insider buying, especially by significant stakeholders (10% directors), suggests bullish sentiment regarding the stock's near-term prospects. Notably, large purchases occurred just days apart, indicating confidence in the company's value. However, a detailed review of company fundamentals, including earnings trends and growth potential, is necessary for a comprehensive analysis. The recent transactions occurred at an average price slightly under $5, hinting at a perceived undervaluation. Pending more fundamental data to assess financial health, my confidence is moderate. | Consumer Defensive | Beverages - Wineries & Distilleries |

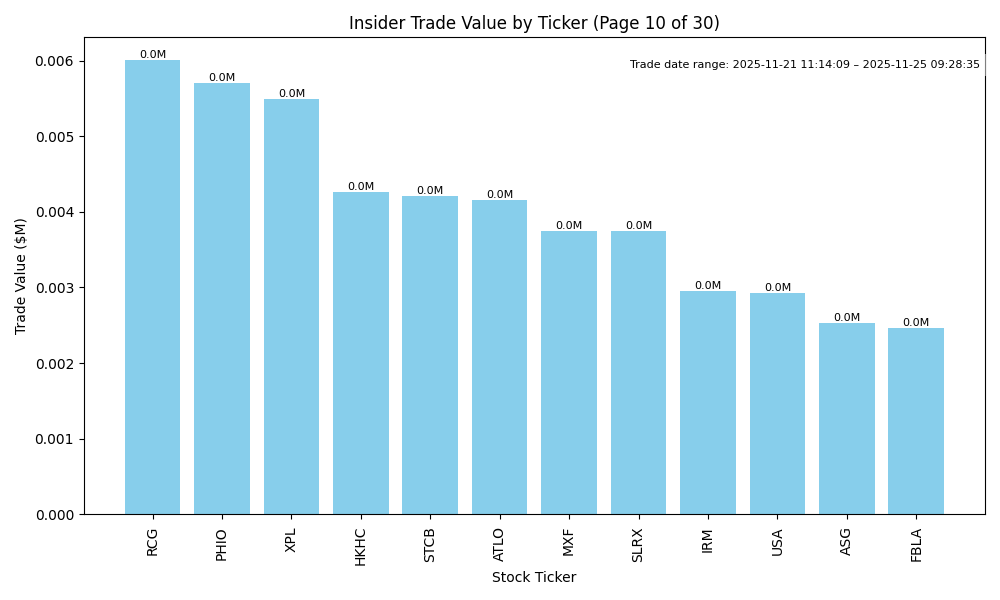

| MXF | UP | 0.70 | Significant insider buying by Saba Capital Management and other directors indicates strong confidence in the company's prospects. Recent purchases at increasing prices suggest bullish sentiment despite broader economic uncertainties. However, a detailed analysis of company fundamentals, such as current earnings trends and leverage, remains unprovided, which slightly lowers confidence. It is essential to monitor sector conditions and macroeconomic indicators to gauge potential risks. | Financial Services | Asset Management |

| RHLD | UP | 0.75 | Recent insider purchases by key executives indicate strong internal confidence in the company's prospects, particularly with significant acquisitions at varying price points. Though the stock price shows fluctuations, persistent buying suggests an optimistic outlook. However, without data on revenue growth, profitability, and macroeconomic impacts on the industry, overall confidence is tempered. The strong insider activity is a positive signal, but potential external pressures must be evaluated further. | Industrials | Specialty Business Services |

| ARX | UP | 0.75 | Recent insider buying by multiple executives, particularly the CEO and Co-Founder purchasing significant shares, suggests strong insider confidence in ARX's potential. Although there was a large sale by one insider earlier, the recent purchases at lower prices might indicate a strategic repositioning. However, more context on company fundamentals, such as earnings trends and leverage, is needed. If growth prospects remain solid and align with insider confidence, the stock could likely trend upward, albeit with some caution due to prior insider selling and potential macroeconomic pressures. | Financial Services | Insurance Brokers |

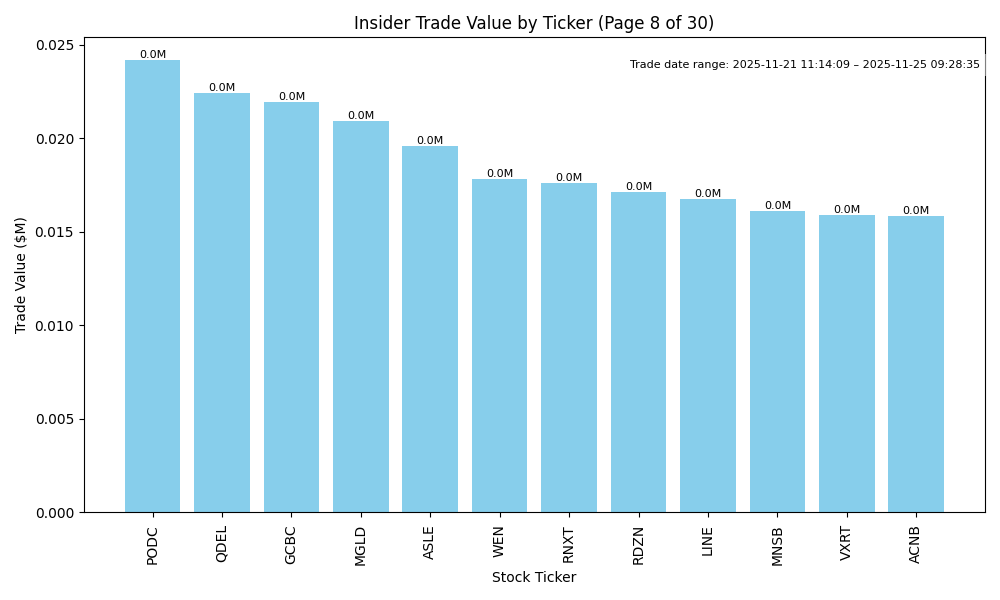

| QDEL | DOWN | 0.70 | Recent insider activity shows significant selling by Carlyle Group, which sold millions of shares at declining price points, suggesting lack of confidence in future stock performance. Meanwhile, CEO Blaser's smaller recent purchases may indicate personal belief in the stock but do not outweigh the overall selling sentiment. Without clear positive developments in earnings trends or strong fundamental support, the outlook remains cautious. Broader macroeconomic concerns, such as interest rates and inflation, could also pressure stock performance. Overall, confidence in a downward trajectory is moderate due to insider sales outweighing recent purchases. | Healthcare | Medical Devices |

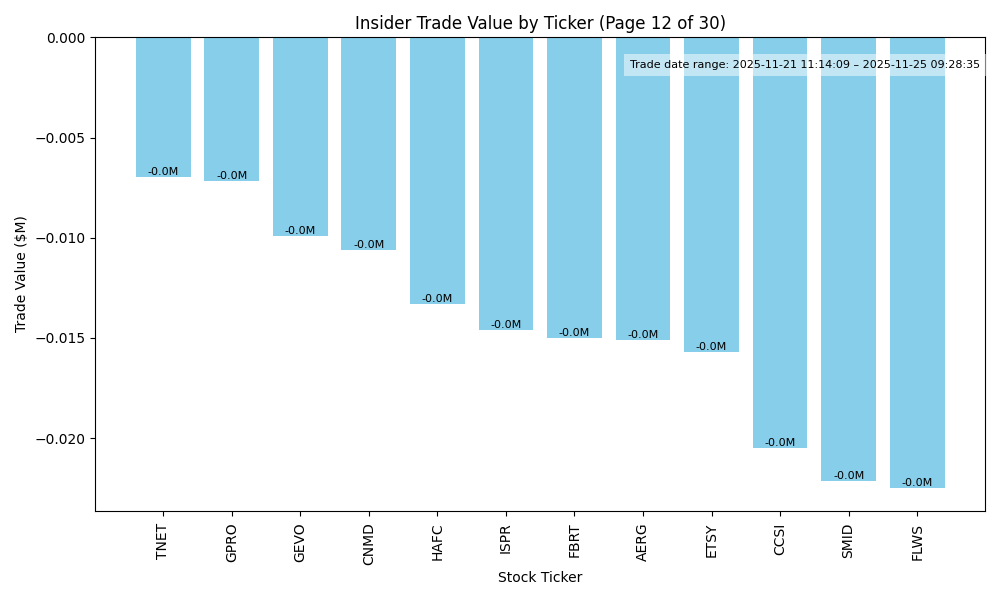

| MTCH | DOWN | 0.65 | Recent insider activity shows a mix of purchases and significant sales, with key executives like the CEO showing confidence through purchases, but also multiple insiders selling shares at higher prices, indicating possible profit-taking or concerns. Company-specific fundamentals are unclear without current earnings or margin data, but the high volume of recent sales suggests a bearish sentiment among some insiders. Additionally, prevailing macroeconomic conditions, such as rising interest rates and inflation concerns, may place pressure on equity valuations. Given these factors, the likely near-term direction is downward, although insider purchases indicate some opposing pressure. | Communication Services | Internet Content & Information |

| SUNS | DOWN | 0.65 | While there has been significant insider buying, primarily from Leonard M. Tannenbaum, the recent purchase prices indicate a decline from earlier valuations. Additionally, without detailed insights into SUNS's current earnings growth, margins, or overall macroeconomic climate—including interest rates and inflation trends—there are inherent uncertainties in predicting stock performance. Given the divergence between insider confidence and possible deteriorating fundamentals or market conditions, I infer a cautious downward direction in the near term. | Real Estate | REIT - Mortgage |

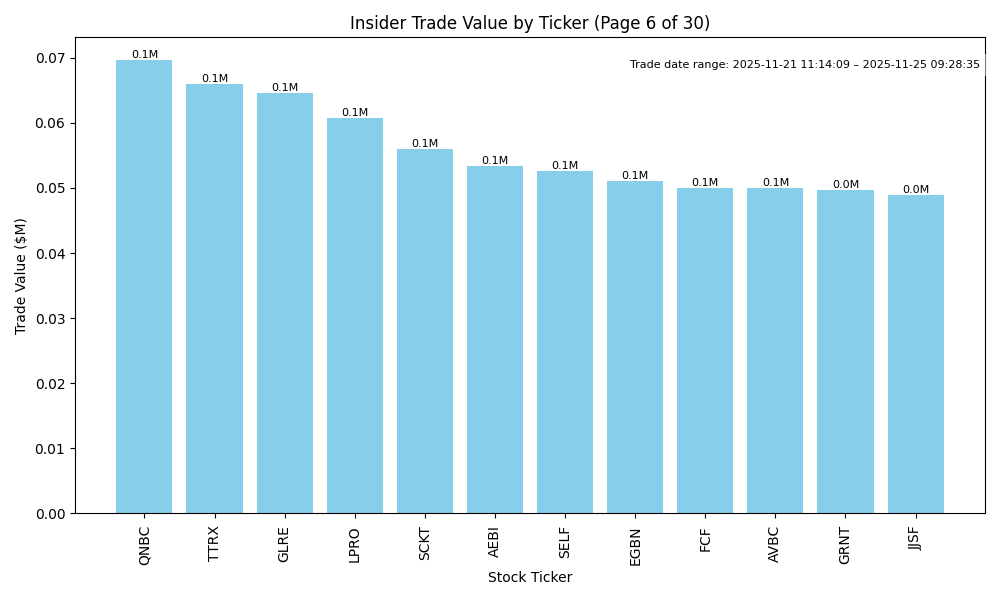

| EVLV | DOWN | 0.70 | Recent insider activity shows significant sales by key insiders, particularly the Chief Innovation Officer, who sold large amounts both in the last month and throughout the year. While there are some recent purchases suggesting insider optimism, the scale of the sales indicates a potential lack of confidence in the stock's near-term performance. Additionally, without robust company fundamentals or positive macroeconomic signals, such as strong earnings or favorable market trends, the outlook seems bearish. The insider purchases may signal a perceived floor in stock price rather than outright confidence in impending growth. | Industrials | Security & Protection Services |