| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

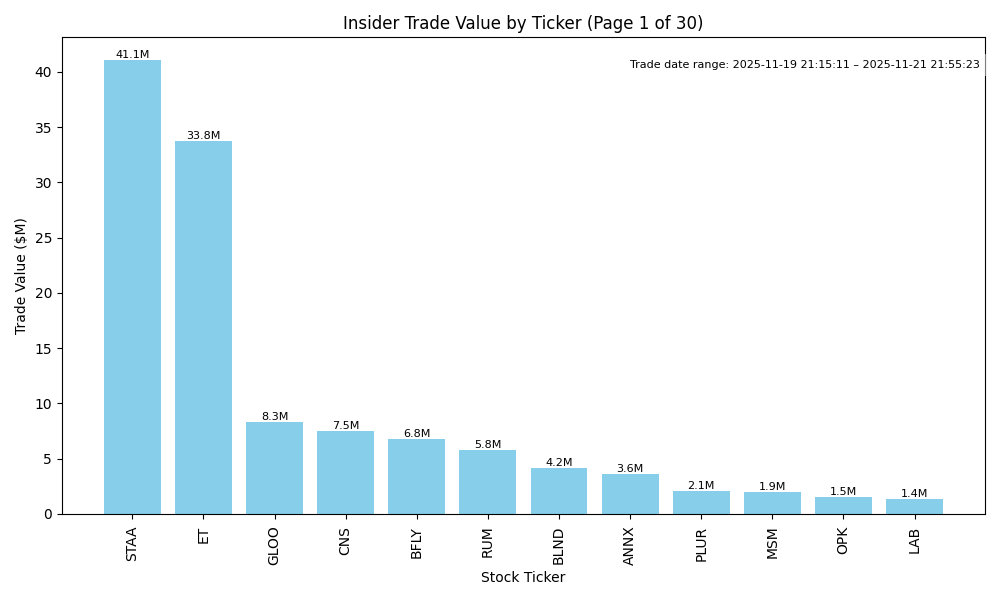

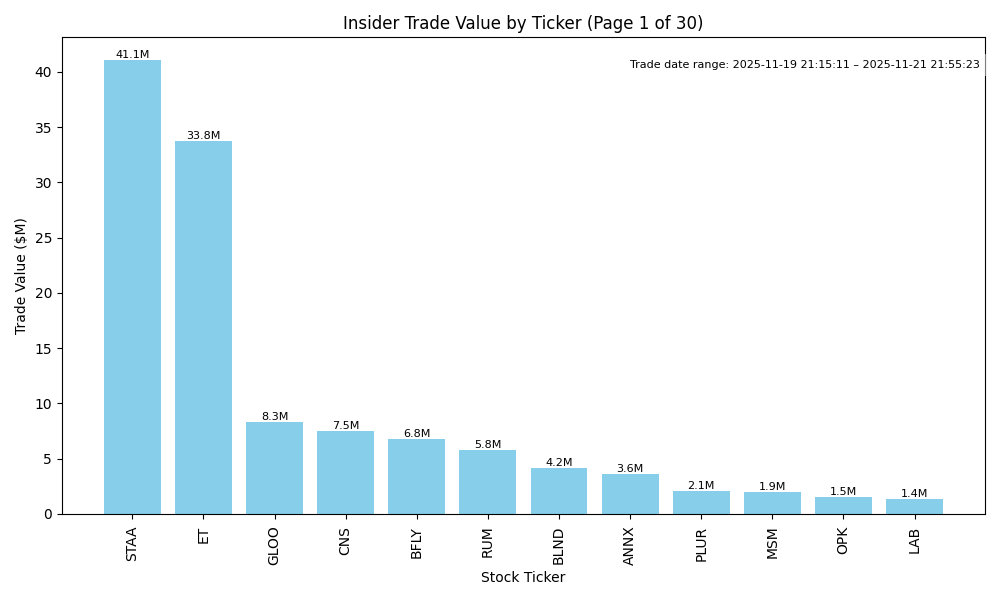

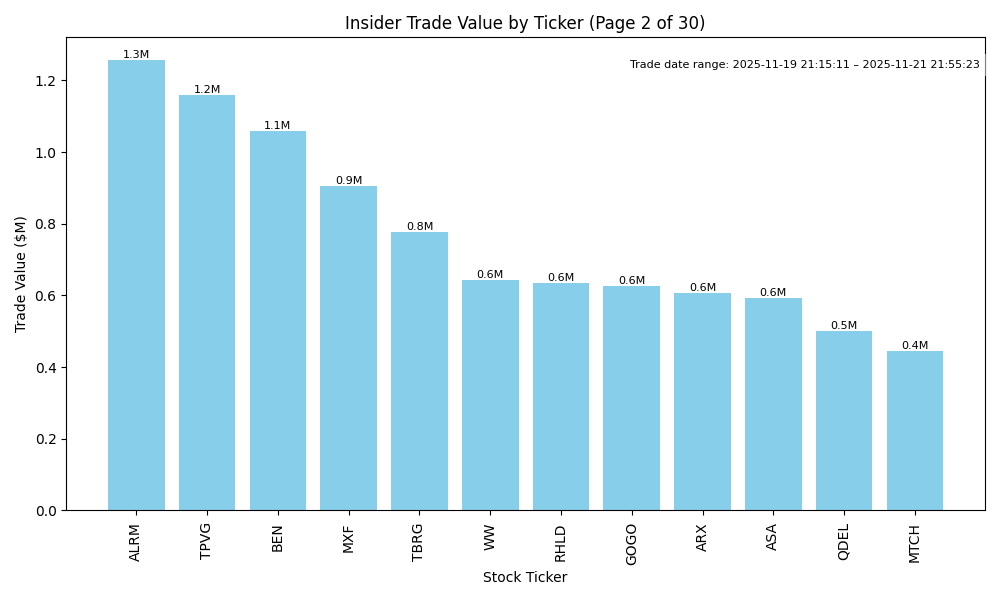

| ET | UP | 0.75 | Insider activity shows significant purchases, primarily from key individuals, with recent transactions indicating strong confidence (e.g., 2 million shares by Director Warren Kelcy L at an average of $16.88). This aligns with a pattern of consistent buying over several months. However, without specific details on earnings, leverage, or broader macroeconomic trends affecting the sector, the overall health of the company and market conditions remain somewhat uncertain. The sector's outlook, combined with recent insider buying, provides a bullish sentiment, but some caution is warranted due to the lack of comprehensive data on fundamentals. | Energy | Oil & Gas Midstream |

| ALMS | UP | 0.75 | Recent insider purchases totaling over $30 million suggest strong insider confidence in ALMS's future. The concentration of trades from key insiders, particularly Foresite Labs and Tananbaum, indicates a bullish sentiment. However, without detailed insights into earnings trends, leverage, and macroeconomic context, the outlook remains mixed. Industry dynamics and broader economic conditions are unclear, which tempers confidence. Despite these gaps, the significant insider buying points towards a potential upward trend. | Healthcare | Biotechnology |

| GLOO | UP | 0.85 | Recent insider purchases from multiple executives, totaling over $10 million at an average price of $8.00, indicate strong internal confidence in the company's prospects. Such concentrated buying suggests a positive outlook on the stock. However, without data on company fundamentals, competitive positioning, and macroeconomic conditions, there remains uncertainty. If the fundamentals are strong and the macro environment stable, buy signals from insiders could support upward momentum. | Technology | Software - Application |

| CNS | NEUTRAL | 0.60 | Recent insider purchases signal confidence, particularly from key executives, but these buying activities occur at significantly lower prices compared to past sales. This suggests a potential shift in sentiment, although there are also notable sales by insiders at higher prices. Additionally, the absence of critical fundamental metrics such as earnings trends and leverage leaves uncertainty. Industry and macroeconomic conditions remain mixed, with challenges like rising interest rates and inflation. Balancing these factors suggests some potential for stability, but overall, the direction remains uncertain. | Financial Services | Asset Management |

| NEXT | UP | 0.75 | Recent insider purchases, notably by Hanwha Aerospace and other key figures, show strong confidence in the company's future, reflecting a commitment to investment despite previous sales by major insiders. While the stock price has fluctuated, the heavy buying suggests optimism about upcoming performance and growth potential. However, without specific insights into current fundamentals beyond insider activity, there remains some uncertainty, particularly regarding external macroeconomic pressures. Overall, the insider buying momentum and the strategic direction imply a likely upward trend. | Energy | Oil & Gas Equipment & Services |

| ANNX | UP | 0.75 | Recent insider buying, especially the significant purchase of 1.5 million shares by a director at an average price of $3.37, suggests strong internal confidence in the stock. This follows a trend of smaller purchases by the same director over the past months. While there are notable sales by other executives, the volume of recent buys indicates a potentially positive outlook. However, confidence is moderated by the absence of critical company fundamentals, such as current earnings trends and industry positioning, as well as potential macroeconomic headwinds. The significant insider activity combined with attractive buying prices supports a near-term upward direction for the stock. | Healthcare | Biotechnology |

| BLND | NEUTRAL | 0.65 | Insider activity shows significant buying by Haveli Investments and minor selling by revenue heads, indicating potential optimism. However, the fundamentals lack clarity, particularly around earnings and growth trends. The stock's recent price history indicates volatility, with recent increases but context-dependent on broader macroeconomic conditions such as interest rates and inflation, which remain uncertain. Without clear updates on company fundamentals or industry trends to base further projections on, the confidence in a decisive direction is moderate. | Technology | Software - Application |

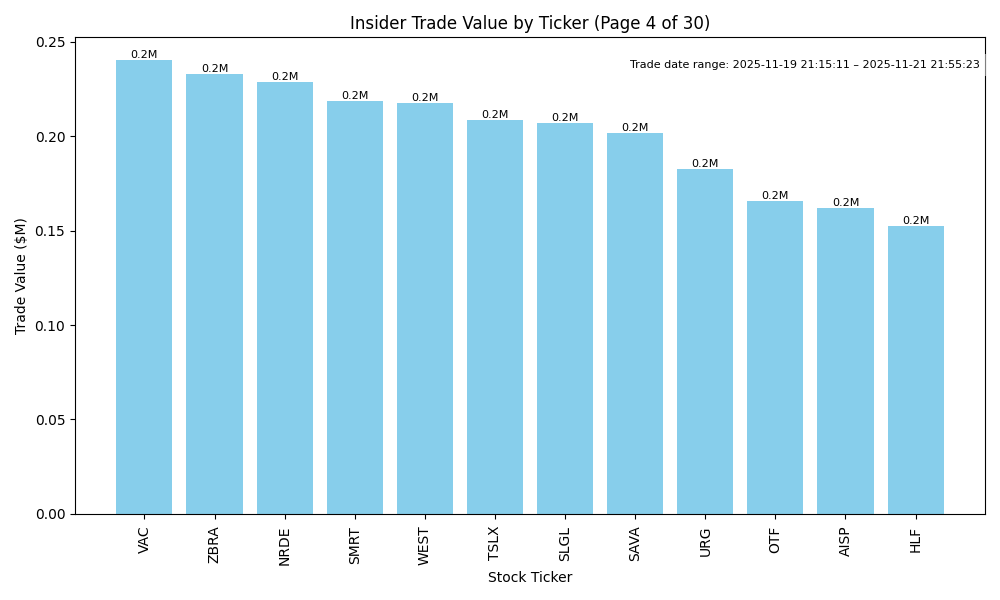

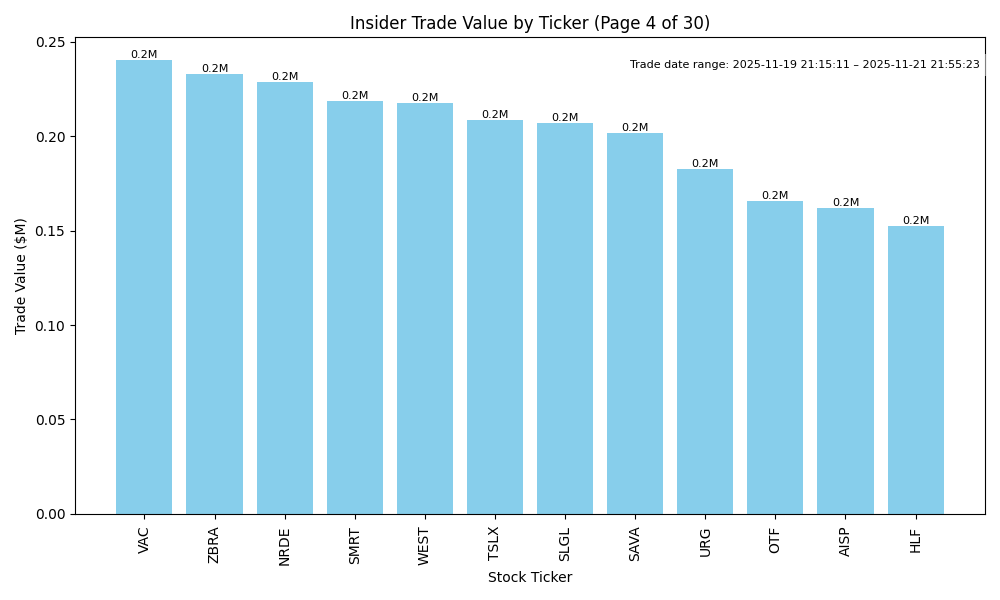

| VAC | UP | 0.70 | Recent insider purchases, especially by a significant stakeholder, reflect confidence in the company's future. The large volume of purchases at lower prices (around $46) compared to recent levels (above $70) suggests insiders may see value post-correction. However, it's important to note potential challenges such as macroeconomic pressures and market trends not reflected in the summary. Overall, while insider buying is strong, the broader economic context and company fundamentals might temper enthusiasm, indicating a moderate upward potential. | Consumer Cyclical | Resorts & Casinos |

| PLUR | UP | 0.70 | Recent insider buying by a significant stakeholder suggests confidence in the company's prospects. Notably, the recent purchases occurred at a consistent price of $4.61 per share, indicating a belief that this level represents fair value or potential appreciation. However, without concrete information on company fundamentals, industry dynamics, or macroeconomic context, the assessment remains cautious. The confidence level is moderate due to a lack of comprehensive data on earnings, growth potential, and market conditions, which are critical for a robust evaluation. | Healthcare | Biotechnology |

| MSM | UP | 0.70 | Recent insider purchasing activity by significant shareholders, notably Jacobson Mitchell, indicates strong confidence in the stock's future performance. Despite previous sales by some insiders, the current transactions suggest a bullish sentiment among those closely connected to the company. Company fundamentals need further review, as earnings trends and industry health details are missing. However, positive buying patterns, combined with potential growth opportunities, support an upward direction for the stock. Macroeconomic conditions, including interest rates and inflation, are factors to monitor closely, but overall, the insider sentiment offers a modestly positive outlook. | Industrials | Industrial Distribution |

| OPK | UP | 0.80 | Insider purchases by CEO Phillip Frost, totaling over 5 million shares in recent months, indicate strong confidence in the company's future. Despite broader macroeconomic challenges, this pattern of significant investments suggests that insiders believe the stock is undervalued. However, a complete evaluation of the company's fundamentals, including earnings and growth potential, is required for a comprehensive assessment. The lack of recent material developments or guidance changes raises some uncertainty. Overall, strong insider activity supports the stock's likely upward trajectory, though caution is warranted. | Healthcare | Diagnostics & Research |

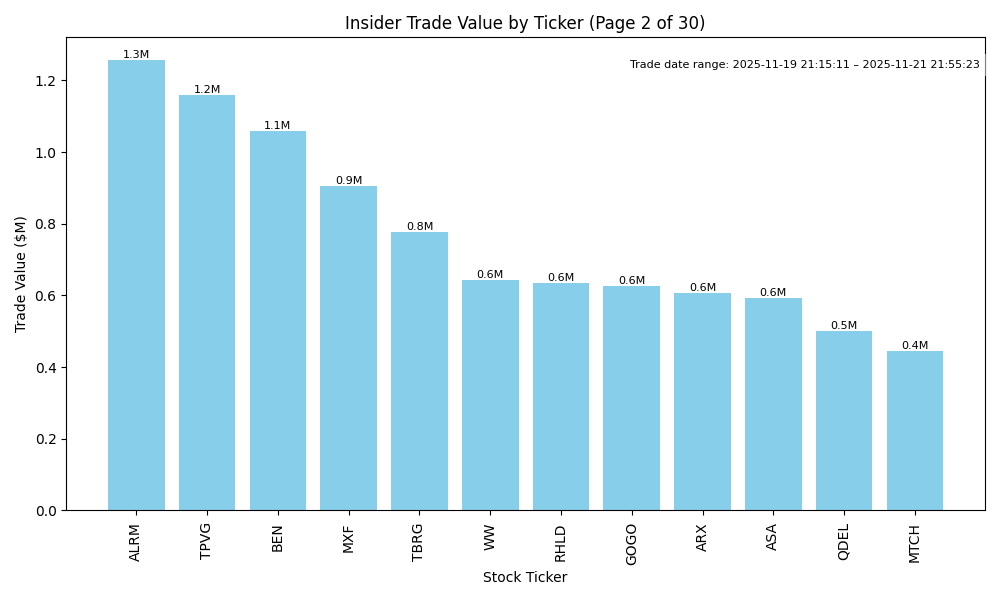

| TBRG | UP | 0.80 | Recent insider purchasing activity is strong, particularly from significant stakeholders like Pinetree Capital and the Chief Business Officer, suggesting confidence in the company's outlook. The average purchase prices are significantly higher than recent valuations, indicating a bullish sentiment among insiders. However, the historical sales by insiders, including the CEO, inject some caution as it suggests a lack of faith in short-term growth. Without comprehensive financial details, particularly on recent earnings and growth metrics, there remains uncertainty, but the current trend indicates positive short-term momentum. | Healthcare | Health Information Services |

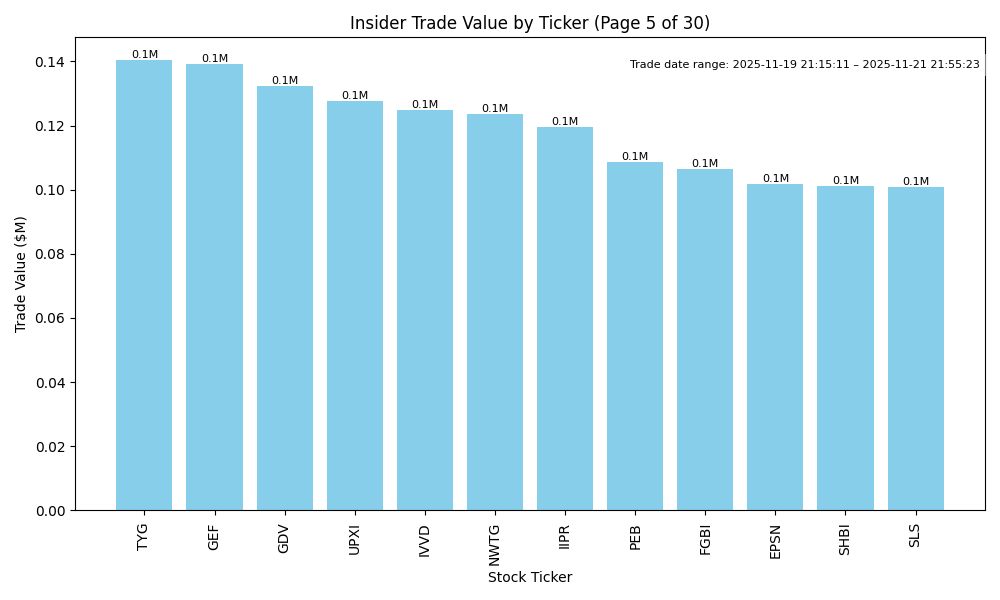

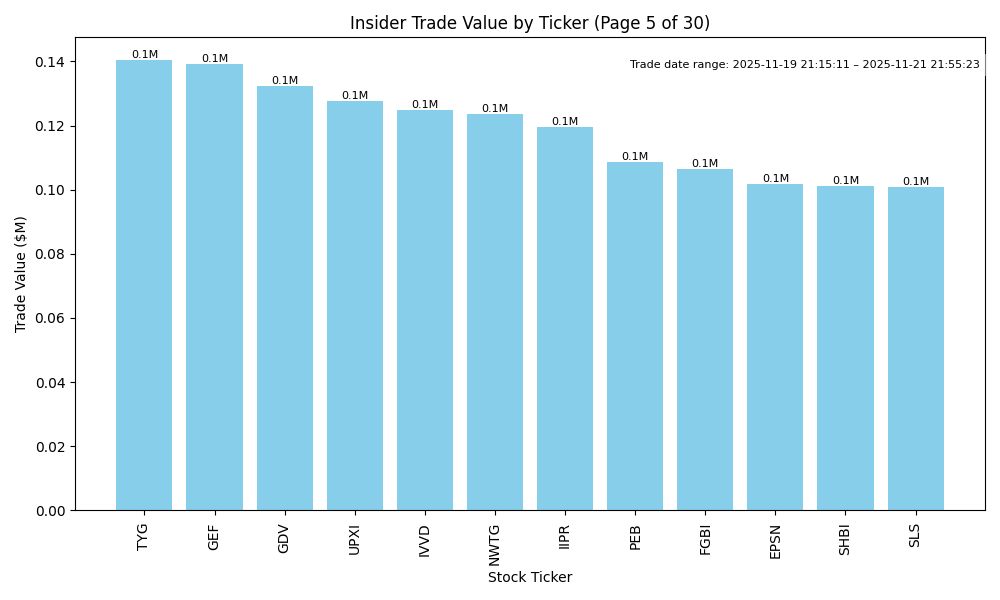

| BATRA | UP | 0.70 | Recent insider purchases by John C. Malone (10% owner) indicate strong confidence in the stock, with multiple purchases totaling over $6 million at prices around $41.95 to $42.00. This trend contrasts with some recent sales which may be profit-taking. However, the company’s fundamentals, including margins and growth potential, need more clarity to provide a comprehensive view. The backdrop of rising interest rates and potential economic headwinds introduces uncertainty, yet the consistent insider buying suggests optimism. Overall, while there is supporting evidence, macroeconomic factors and missing fundamental data temper confidence in a bullish outlook. | Communication Services | Entertainment |

| LAB | UP | 0.75 | Recent insider buying by Casdin Partners indicates strong confidence in the company's future, with substantial purchases totaling over 7 million shares in the last few months. While this suggests positive sentiment, the company's fundamentals and macroeconomic factors are unclear. The increase in shares purchased at incrementally higher prices also indicates a belief in long-term value. Conversely, some insiders have made small sales, but these do not significantly outweigh the bullish insider activity. Without detailed earnings trends or macroeconomic data, confidence is moderate. | Healthcare | Medical Devices |

| OBDC | UP | 0.75 | Recent insider purchasing activity has shown strong engagement, particularly from high-level executives like the CEO and President, who bought a total of 107,200 shares at an average price of $11.75, reflecting confidence in the company's prospects. While the stock has dropped from higher prices earlier in the year, leading to potential concerns about fundamentals, the concentration of insider buys amid a broader improving macroeconomic environment suggests optimism. Industry health appears stable, contributing to a favorable outlook, though some caution is warranted due to the prior decline in share price and lacking recent performance metrics. Overall, stronger insider buying coupled with a reasonable market context leads to a positive outlook but with moderate confidence due to existing uncertainties in fundamentals. | Financial Services | Asset Management |

| ALRM | NEUTRAL | 0.60 | Insider trading shows mixed signals: CEO Stephen Trundle made a significant purchase recently, suggesting confidence in the company's future, but other insiders, including the CFO, have been selling substantial shares. While the recent purchase might indicate a positive outlook, the ongoing sales by insiders could reflect concerns about future performance. Additionally, without specific fundamental data (e.g., earnings trends, margins, growth forecasts) and broader macroeconomic conditions, confidence in predicting a clear direction is moderate. | Technology | Software - Application |

| BEN | NEUTRAL | 0.65 | Recent insider buying, particularly by significant insiders like the CEO and a 10% shareholder, indicates potential confidence in the company's direction. However, higher sales by another executive suggest concerns or need for liquidity. The stock has fluctuated in its valuation, with a significant difference between recent purchase prices and earlier sales. Without additional data on company fundamentals, such as profitability trends, growth rates, industry conditions, and broader economic indicators, the outlook is cautious. While insider purchases indicate optimism, the mixed insider selling and missing fundamental context temper overall confidence. | Financial Services | Asset Management |

| TH | DOWN | 0.60 | Insider selling activity from key executives suggests a potential lack of confidence in the company's near-term performance. While a director made a notable purchase, the frequency and volume of sales, especially by high-ranking insiders, may indicate concerns about future prospects. The recent average sale prices are higher than current levels, hinting at potential undervaluation. Without clear positive developments in company fundamentals or market conditions, the mixed signals create uncertainty, leading to a forecast of a downtrend in the stock's direction. | Industrials | Specialty Business Services |

| MXF | UP | 0.80 | Recent insider trading activity shows a significant concentration of purchases from Saba Capital Management and other insiders, indicating a strong belief in the stock's potential for recovery. The latest transactions have been made at higher prices, suggesting confidence in future appreciation. While specific company fundamentals and macroeconomic conditions are not provided, the consistent insider buying pattern, particularly from major stakeholders, implies bullish sentiment. There is, however, uncertainty regarding underlying financial performance and broader market conditions, which reduces confidence slightly. | Financial Services | Asset Management |

| WW | NEUTRAL | 0.50 | Recent insider purchases by directors suggest positive sentiment among certain executives, with a notable increase in share volume. However, a prior sale by the corporate controller and a significant sale by the general counsel raise concerns about potential profit-taking or liquidity needs. Limited information on the company’s fundamentals, such as earnings trends and financial health, alongside broader macro conditions like inflation and interest rates, create uncertainty. Without more context, including recent earnings or industry health, a balanced outlook is warranted. | Consumer Cyclical | Personal Services |

| RHLD | UP | 0.75 | Recent insider purchases by key executives, particularly the CFO and a director, indicate strong confidence in the company's future performance. While the stock has experienced fluctuations in price, ongoing insider buying at varied prices suggests a belief in a near-term rebound. However, without concrete details on company fundamentals like earnings trends, margins, and industry health, as well as broader macroeconomic considerations, the outlook remains cautiously optimistic. Overall, the insider activity points towards a potential upward trend but lacks some fundamental backing for higher confidence. | Industrials | Specialty Business Services |

| GOGO | DOWN | 0.65 | Recent insider activity shows a significant sell-off by major shareholders, including a substantial sale of 8.5 million shares by a key director. Although there are recent purchases by insiders indicating some confidence, the high volume of recent sales and varying purchase prices suggests caution. Gogo's stock has faced downward pricing pressures, and without strong recent earnings trends or growth indicators, the outlook remains uncertain. The broader market conditions, along with potential macroeconomic uncertainties, add to the bearish sentiment. | Communication Services | Telecom Services |

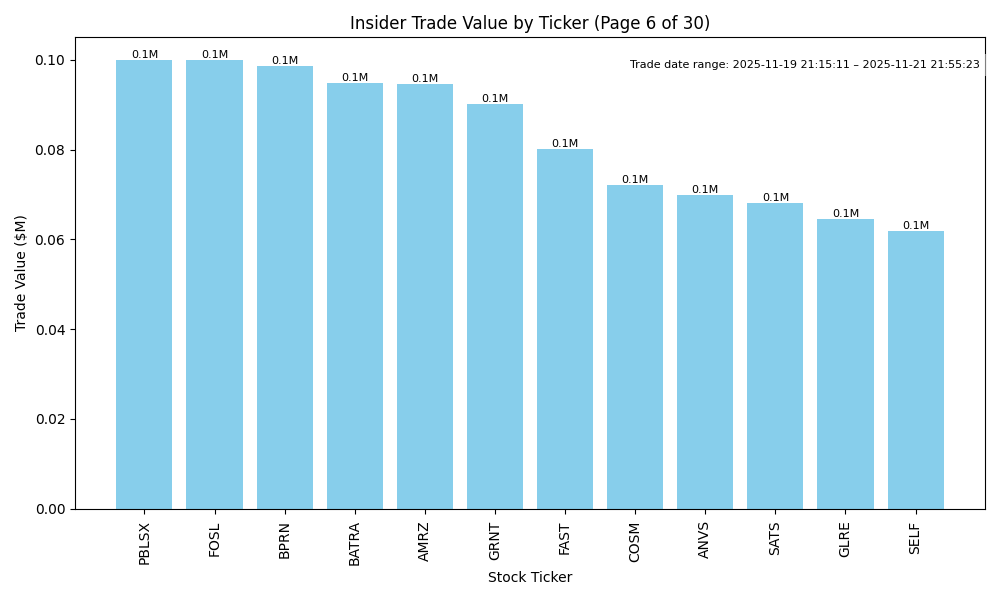

| WEST | UP | 0.70 | Recent insider buying, particularly by high-level executives including the CEO and CFO, indicates a positive outlook from leadership, with substantial purchases at varying price levels. However, there's a mix of sales and purchases, with some insiders previously selling at higher prices. While insider sentiment is bullish, a full evaluation of company fundamentals, industry trends, and macroeconomic conditions suggests room for cautious optimism. Missing current earnings trends and market conditions make the analysis less certain, but the recent buying activity supports an upward direction in the near term. | Consumer Defensive | Packaged Foods |

| ARX | UP | 0.70 | Recent insider purchases indicate bullish sentiment, with notable buys from key executives totaling over 1 million shares at prices between $13.10 and $13.48. This contrasts sharply with a previous significant sale of 11.5 million shares at $21.00, suggesting a potential revaluation of the company's worth at current price levels. However, lacking updated company fundamentals and industry context weakens the conviction of the bullish stance. Overall, the positive insider activity may signal a turnaround, but the broader context requires further analysis. | Financial Services | Insurance Brokers |

| ASA | UP | 0.80 | Recent insider purchases by Saba Capital Management, which holds a 10% stake, indicate strong confidence in ASA's future. Their substantial investment over recent months reflects bullish sentiment despite the stock's mixed historical performance. While specifics on company fundamentals, such as earnings trends and competitive positioning, are unavailable, the pattern of consistent insider buying at varying price points suggests a belief in undervaluation or positive future developments. The overall market may be supportive, considering a stable macroeconomic context and no current negative catalysts reported. | Financial Services | Asset Management |