| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

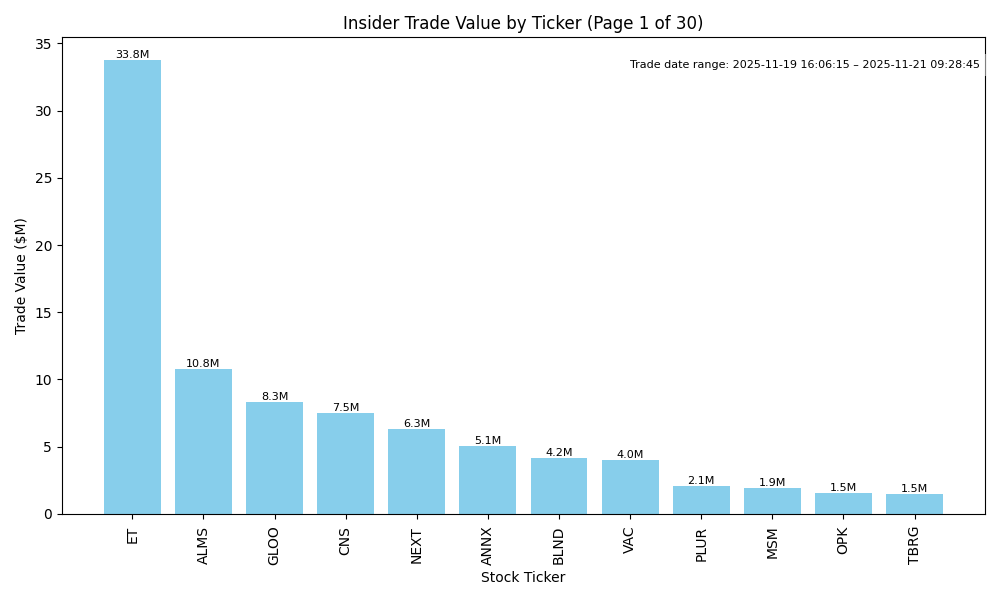

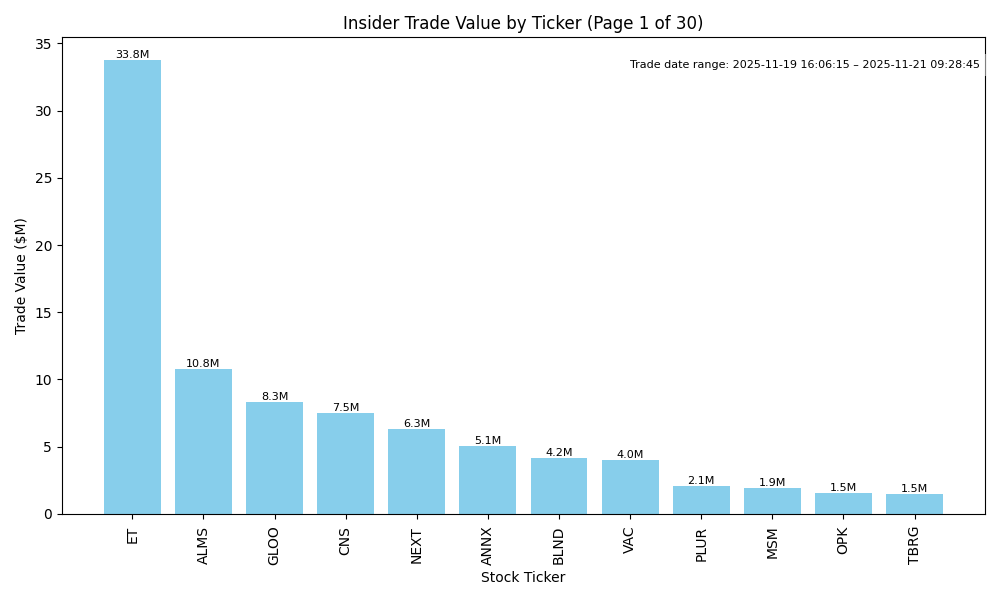

| ALMS | UP | 0.75 | Recent insider purchases indicate strong confidence in ALMS. Notably, multiple directors and significant stakeholders are buying substantial amounts at an average price of around $6.09, which exceeds prior prices. While these purchases suggest bullish sentiment, the historical data shows fluctuations in stock price, with earlier high prices at $16.00. Company fundamentals, such as earnings trends, are unclear, and key data on margins and growth potential is missing. Additionally, the macroeconomic environment regarding inflation and interest rates is uncertain. Given these factors, I lean towards a positive outlook but maintain caution due to the lack of comprehensive fundamental insights. | Healthcare | Biotechnology |

| NEXT | UP | 0.75 | Insider buying has been significant, particularly from Hanwha Aerospace Co., who has consistently purchased large amounts at varying prices, indicating strong internal confidence. The recent purchases outpace prior sales by insiders, suggesting a bullish sentiment among key stakeholders. While there's a historical insider sale, the overall net insider activity is positive. However, the analysis lacks information on current company fundamentals such as earnings trends and leverage, and macroeconomic conditions could affect stock performance. Given the strong insider buying juxtaposed with potential external uncertainties, a cautious but optimistic outlook is warranted. | Energy | Oil & Gas Equipment & Services |

| ANNX | UP | 0.80 | Recent insider buying, particularly a significant purchase of 1.5 million shares by Director Satter Muneer A at $3.37, indicates strong confidence in the stock. Despite a history of insider selling, the volume and value of the recent purchases suggest insiders believe the stock is undervalued. However, without clear information on the company's current fundamentals, such as earnings and broader market conditions, confidence is moderated. The stock is currently positioned positively due to strong insider sentiment, despite potential risks from macroeconomic factors and market volatility. | Healthcare | Biotechnology |

| VAC | UP | 0.70 | Recent insider buying activity has been significant, with multiple acquisitions at lower price points, indicating a strong belief in the company's prospects. However, the earlier high purchases at prices above $70 suggest volatility. A thorough evaluation of VAC's fundamentals, including earnings trends and growth potential, is necessary to assess the overall health of the company. The current market condition may be influenced by broader macroeconomic factors, which could introduce volatility despite the positive insider sentiment. Confidence remains moderate due to the lack of recent detailed fundamentals and macroeconomic context. | Consumer Cyclical | Resorts & Casinos |

| HYMC | UP | 0.75 | Recent insider purchases by a significant stakeholder, Eric Sprott, indicate strong confidence in HYMC's potential, with purchases totaling over $49 million in November alone. Although there are some insider sales, they seem minor relative to total purchases. However, the lack of detailed information on the company's earnings trends, leverage, and market dynamics limits a full assessment. Macroeconomic indicators such as rising interest rates and inflation may pressure margins. Still, the bullish insider activity coupled with potential growth suggests an upward trajectory for the stock in the near term. | Basic Materials | Gold |

| PLUR | UP | 0.70 | Insider purchasing activity is strong, with significant buys by a director (over 1.4 million shares total) at a consistent average price of $4.61, indicating confidence in the company's prospects. However, without recent data on fundamentals, industry health, and macroeconomic conditions, there is uncertainty regarding growth potential and external market influences. If company fundamentals are solid (e.g., earnings growth and manageable leverage), these insider purchases could signal a positive near-term outlook. Yet, the lack of comprehensive context on broader factors reduces my confidence. Therefore, I lean towards an upward direction but acknowledge potential risks. | Healthcare | Biotechnology |

| TBRG | UP | 0.75 | There has been a significant recent insider buying trend, particularly from major stakeholders like Pinetree Capital Ltd. and L6 Holdings, with large purchases occurring at prices below current levels. This suggests strong confidence in the company's future from insiders. However, there have also been recent sales by insiders at higher prices, indicating some profit-taking. Without detailed current company fundamentals, industry context, or macroeconomic indicators available, confidence is somewhat lower but still leans towards a potential price increase driven by insider optimism. | Healthcare | Health Information Services |

| OPK | UP | 0.70 | Insider buying has been significant, with the CEO purchasing over 6 million shares in the last year, indicating confidence in the company's future. However, the assessment of company fundamentals, such as earnings trends and overall financial health, is currently lacking, which raises uncertainty. The stock may benefit from favorable news or developments that could improve its outlook, but macroeconomic conditions, including inflation and interest rates, create headwinds. Therefore, while insider confidence suggests a bullish short-term outlook, overall confidence is moderated due to the lack of specific financial data. | Healthcare | Diagnostics & Research |

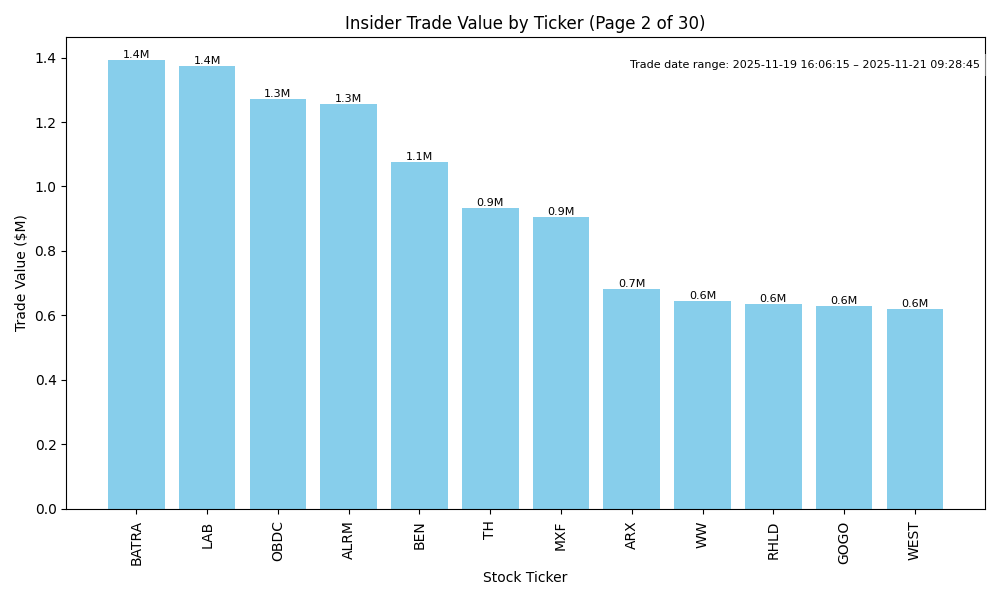

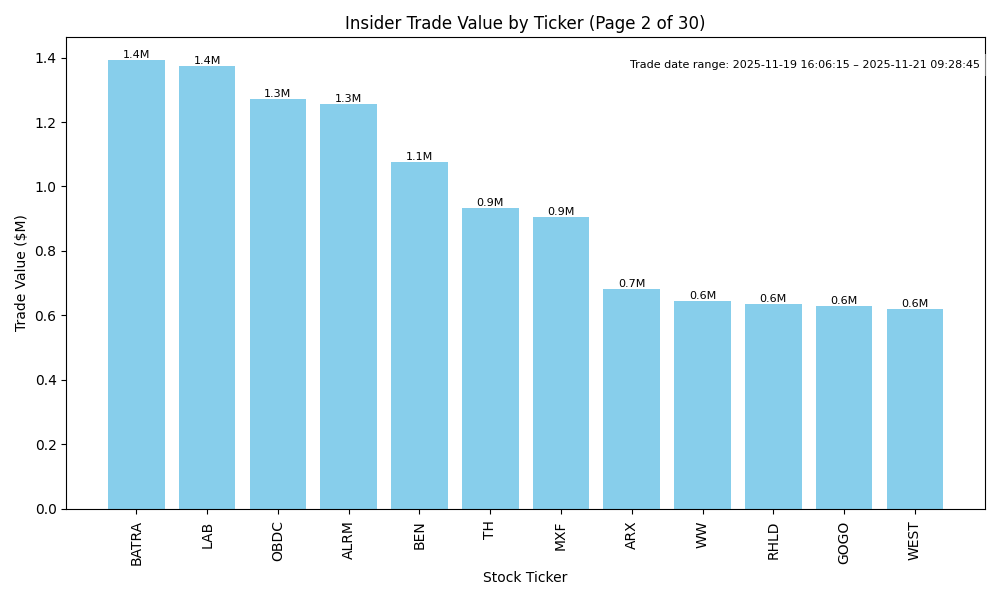

| BATRA | UP | 0.75 | Recent insider purchases, particularly from major shareholder John Malone, indicate strong insider optimism. This buying trend has occurred consistently, signaling confidence in the company's potential. However, recent sales by other insiders, particularly around higher price levels, suggest some caution. Without current fundamental data on earnings, growth potential, or macroeconomic factors, confidence is moderated. If earnings and market conditions remain stable, insider buying could drive shares higher in the near term. | Communication Services | Entertainment |

| OBDC | DOWN | 0.70 | Insider buying in recent months is significant, especially by high-ranking officials like the CEO and President, indicating their confidence in the company's prospects. However, recent purchases occurred at prices higher than current levels (around $11.75 vs previous higher prices). Additionally, the macroeconomic environment may weigh on stock performance, including potential impacts from higher interest rates and inflation. A lack of other fundamental data (earnings trends, profitability, and industry position) makes this analysis less robust, contributing to a moderate confidence level. | Financial Services | Asset Management |

| BEN | UP | 0.75 | Recent insider purchases, particularly large transactions by key figures (like Johnson Charles B), suggest confidence in the company's future performance. Consistent buying at increasing price levels may indicate belief in potential growth. However, recent sales by an EVP could raise concerns about possible challenges. Overall, strong insider buying is a positive signal against a backdrop of a recovering market, but caution is warranted due to some mixed signals. Limited data on current company fundamentals and macro conditions prevent a higher confidence rating. | Financial Services | Asset Management |

| PRKR | UP | 0.75 | The recent insider purchase by Director Lewis H Jr, acquiring a significant number of shares (4.76 million) at $0.21 each, suggests a strong belief in the company's future prospects. While this is a positive signal, the overall market and sector conditions are not examined, and potential risks from regulatory or macroeconomic factors are not detailed. Absence of negative news or poor fundamentals strengthens the bullish case, but without further financial details, such as earnings trends and market dynamics, confidence is moderated. | Technology | Semiconductors |

| TH | DOWN | 0.70 | Insider trading presents mixed signals; while a director purchased a significant amount (145,000 shares), multiple executives have sold shares recently, including substantial sales by key insiders like the EVP and CCO. This pattern of selling, particularly by high-ranking officials, suggests potential concerns about the company's outlook. Given the recent share price decline from over $8 to around $6.85, coupled with the possibility of broader economic challenges such as rising interest rates and inflation, investor sentiment may be cautious. Additional data regarding company fundamentals and macroeconomic conditions is needed for a more complete analysis. | Industrials | Specialty Business Services |

| TPVG | UP | 0.75 | Insider buying for TPVG has increased sharply, with multiple large purchases by key executives (CEO and CIO) in recent months, indicating strong internal confidence. The average purchase price of around $6.06 shows that insiders are willing to invest even as the stock price fluctuates. However, a comprehensive analysis of fundamentals, sector dynamics, and macroeconomic conditions is needed. While insider activity is bullish, there is no recent financial data provided on earnings trends or overall market conditions affecting TPVG, limiting confidence in this assessment. Thus, while indications are positive, the lack of clear macroeconomic support or fundamental performance metrics tempers the outlook slightly. | Financial Services | Asset Management |

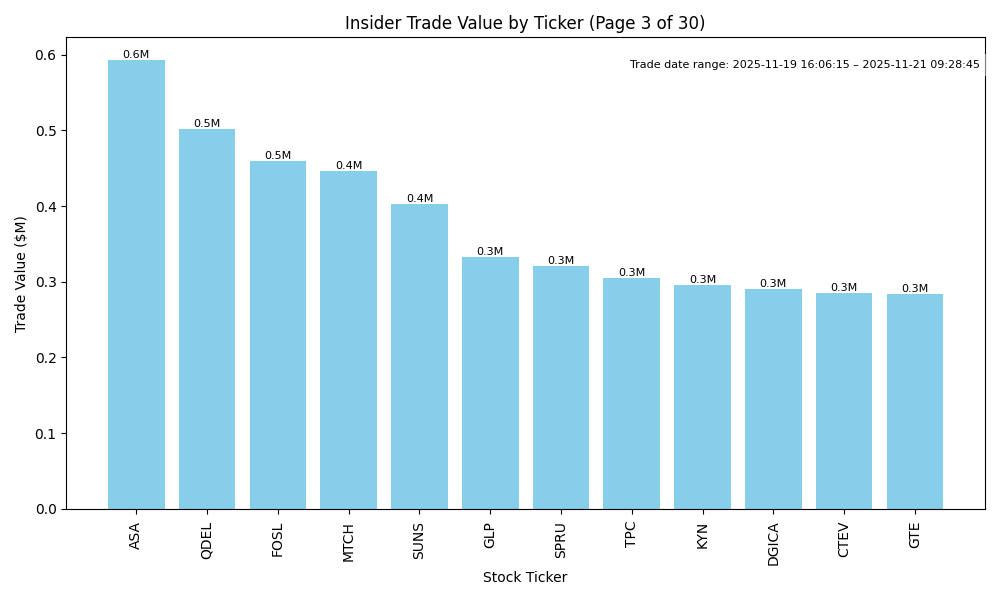

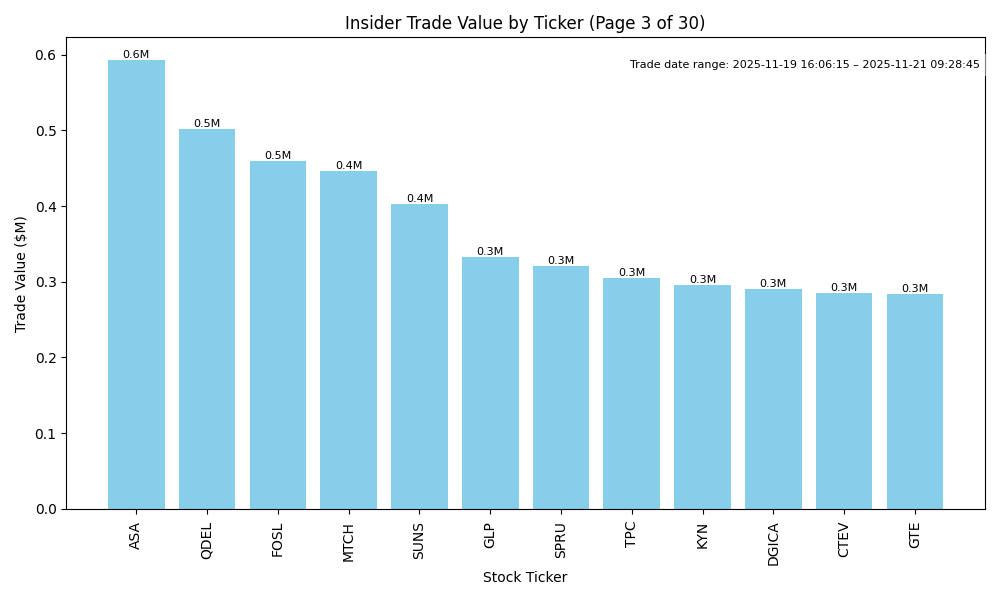

| ASA | UP | 0.80 | Saba Capital Management, a significant insider owning 10% of shares, has been consistently purchasing large quantities, indicating strong confidence in the company's future. While details on the company's fundamentals and broader market conditions are absent, the unrelenting buying suggests bullish sentiment among key insiders. However, the lack of recent earnings data and macroeconomic indicators introduces some uncertainty. If the company continues demonstrating sound fundamentals and industry conditions remain stable, the stock is likely to trend upwards. | Financial Services | Asset Management |

| SXI | DOWN | 0.70 | Recent insider activity suggests bearish sentiment. While there's been some director buying, it is significantly overshadowed by major sales from key insiders like the CEO and CFO, indicating a lack of confidence in the stock’s current value. This selling was at higher prices compared to recent purchases, highlighting potential overvaluation. In terms of fundamentals, the lack of recent earnings data and clarity on growth trends limits assessment. The sector also faces economic headwinds from rising interest rates and inflation concerns, further compounding uncertainty. Given these dynamics, a cautious outlook is warranted. | Industrials | Specialty Industrial Machinery |

| WEST | UP | 0.75 | Recent insider buying, particularly from key executives like the CEO and CFO, indicates strong internal confidence in the company's prospects. The volume of shares purchased is substantial, signaling belief in value at current prices. However, the past month has seen strong selling from a significant stakeholder (Hf Direct Investments Pool, LLC), which raises some concern about potential liquidity or profitability issues. Additionally, broader macroeconomic conditions, while generally supportive, are subject to volatility, given current interest rate levels and inflation rates. Overall, insider confidence combined with the prevailing macroeconomic environment suggests a likely upward trajectory, albeit with caution. | Consumer Defensive | Packaged Foods |

| UPXI | UP | 0.70 | Recent insider trading activity shows strong buying interest from key executives, particularly the CEO, suggesting confidence in the company's future prospects. Multiple transactions at varying prices indicate a commitment to the company's growth potential. However, it is important to consider the absence of current company fundamentals or recent earning trends, as these elements could influence the stock's trajectory. Industry and macroeconomic factors are also not detailed, but given strong insider purchases, the near-term direction appears positive. | Communication Services | Internet Content & Information |

| GLIBK | UP | 0.75 | The recent insider buying, especially by a significant stakeholder, John C. Malone, indicates strong confidence in the company's future. Notably, the transactions are substantial and consistent, reflecting a bullish sentiment. However, without details on company fundamentals, industry conditions, or macroeconomic factors, there's inherent uncertainty in the forecast. If the overall market or sector is under pressure, it could dampen the expected positive direction. Thus, while insider activity strongly suggests upward movement, the lack of comprehensive data on external factors moderates confidence. | Communication Services | Telecom Services |

| CNH | NEUTRAL | 0.60 | Recent insider purchases by directors indicate positive sentiment, with increasing purchases over several days, suggesting confidence in the firm's outlook. However, the stock has seen significant selling earlier in the year, which may signal underlying concerns or profit-taking. Further analysis of company fundamentals, such as earnings trends and growth potential remains necessary to provide a clearer outlook. The company operates in a sector experiencing challenges such as inflation and fluctuating demand, which could weigh on performance. Overall, while some insider buying is promising, mixed signals from past insider sales and broader market conditions temper confidence. | Industrials | Farm & Heavy Construction Machinery |

| VENU | DOWN | 0.70 | Recent insider activity shows significant selling by executives including CEO and CFO at higher price levels, indicating a lack of confidence in near-term price stability. The notable purchase of 55,000 shares by Kevin O'Neil adds positive sentiment but is overshadowed by the broader trend of insider selling. Without further details on company fundamentals, current earnings trends, or macroeconomic conditions impacting overall stock sentiment, the analysis is cautious. The overwhelming selling trend and limited buying frequency suggest a likely downward pressure on the stock. | Consumer Cyclical | Restaurants |

| FOSL | UP | 0.70 | Recent insider purchases from key executives, including the CEO and Chief Commercial Officer, indicate strong internal confidence in FOSL's future performance. The cumulative shares purchased suggest significant belief in the company's growth potential. However, without robust company fundamentals or macroeconomic data provided, confidence in a sustained uptrend is moderated. Given current uncertain market conditions, particularly regarding interest rates and inflation, further clarity is needed before strong conviction can be asserted. | Consumer Cyclical | Footwear & Accessories |

| CRVO | UP | 0.75 | Recent insider buying activity is significant, particularly by key executives like the CEO and CFO, suggesting confidence in the company's future prospects. The average purchase price has increased, but still appears relatively attractive compared to recent stock performance. However, with no clear information on company fundamentals or recent material developments, there may be risks. Market dynamics could positively influence the stock if overall market conditions stabilize. Overall, while insider confidence is high, the lack of detailed financial metrics lowers the conviction somewhat. | Healthcare | Biotechnology |

| PEW | UP | 0.70 | Recent insider purchases, particularly by the CEO who bought 100,000 shares at $3.89, indicate significant confidence in the company's future. However, the stock's prior trading price around $5 suggests a notable drop, requiring analysis of fundamentals and macro conditions. Without additional data on earnings trends, margins, or industry health, uncertainty remains. If the company is facing macroeconomic challenges, the positive sentiment from insider activity may not fully translate into stock price appreciation. Thus, while insiders are bullish, the overall outlook is moderate. | Industrials | Aerospace & Defense |

| NML | UP | 0.60 | Insider purchases, particularly by a portfolio manager, can indicate positive sentiment towards the stock's future performance. The purchase of 40,000 shares at $8.55 suggests confidence in the company's valuation. However, without detailed information on the company's fundamentals, such as earnings trends, margins, or broader macroeconomic conditions, the analysis remains cautious. Given the lack of additional context about recent developments in the industry and the macroeconomic environment, confidence is moderated. | Financial Services | Asset Management |