| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

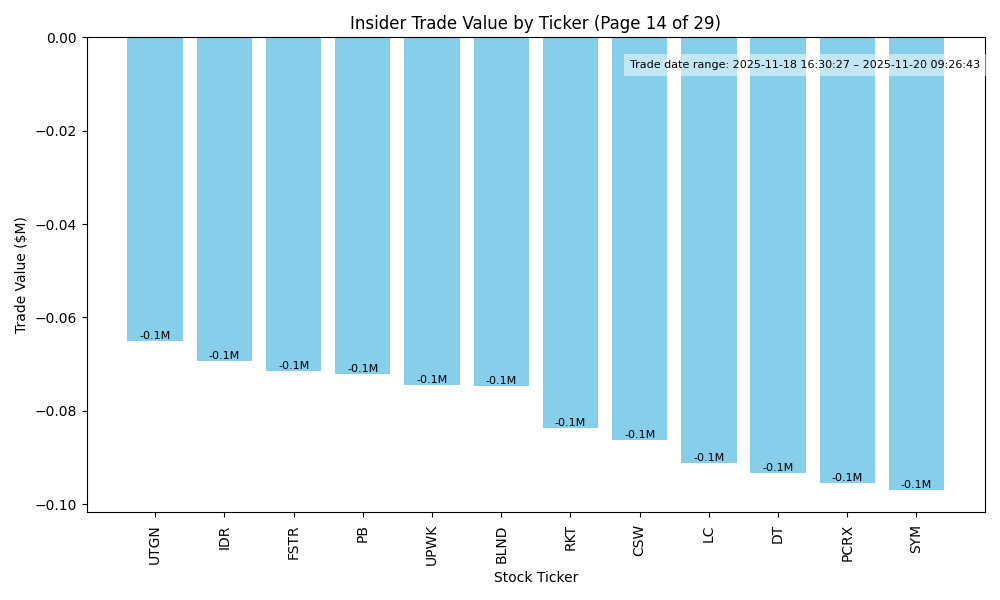

| BLND | UP | 0.70 | Recent insider trading by Haveli Investments, a major shareholder, shows a strong pattern of accumulation, indicating confidence in the company's future. Despite some insider selling, which is common, the significant purchases at prices around $3.00 suggest a positive outlook. However, without current earnings data, margins, and macroeconomic context regarding interest rates and inflation, uncertainty remains. Given these factors and the recent buying activity, BLND is likely to experience an upward direction, though with moderate confidence. | Technology | Software - Application |

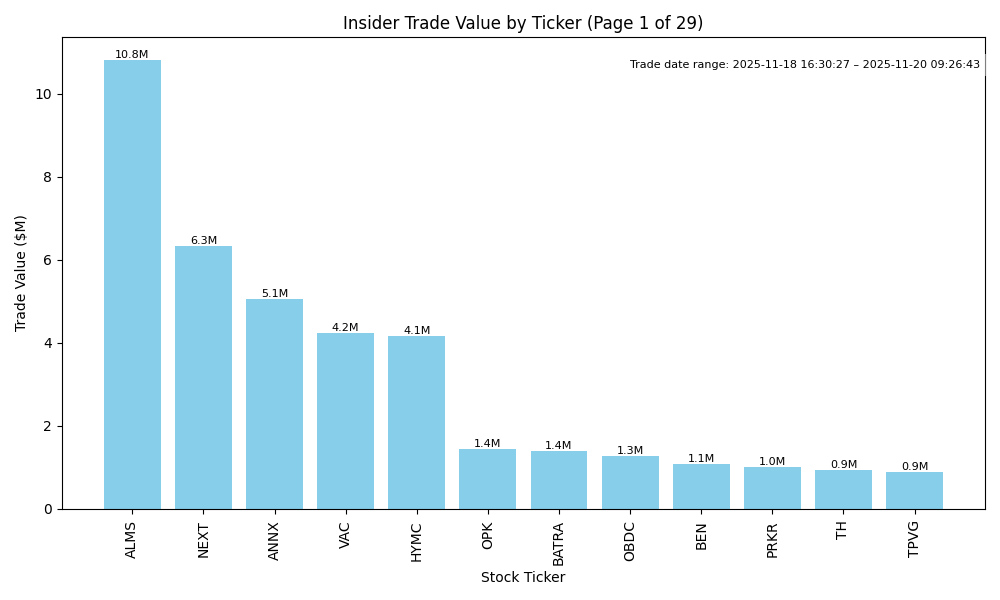

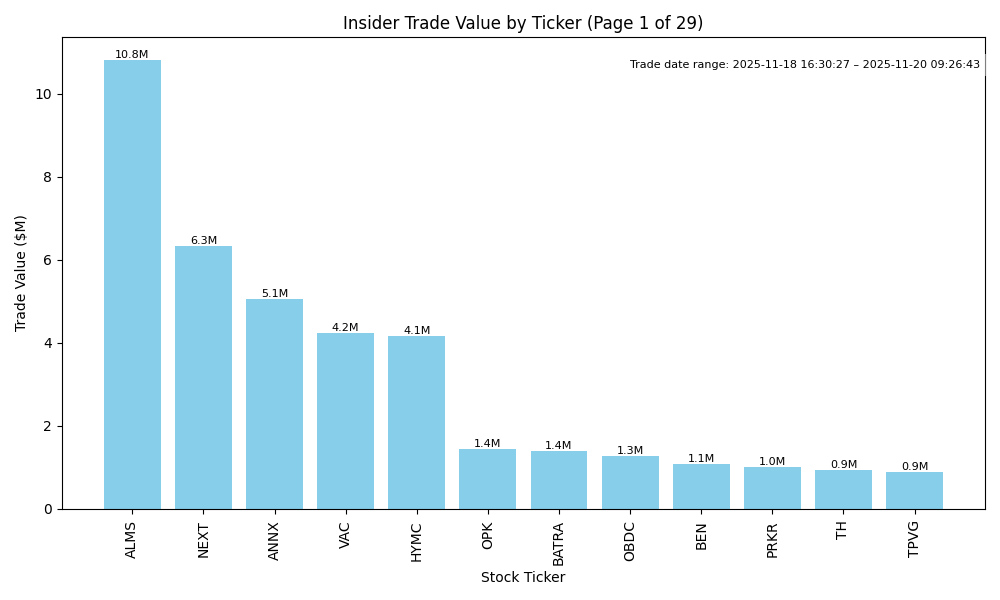

| NEXT | UP | 0.75 | Recent insider purchases, especially large acquisitions by Hanwha Aerospace and other insiders suggest strong confidence in the company's prospects. The involvement of major stakeholders alongside the high volume of shares being acquired indicates a bullish sentiment. However, the significant past sale by York Capital Management raises concerns about potential overvaluation. Company fundamentals and specific details on earnings or sector dynamics are not provided, which adds some uncertainty. Overall, positive insider activity signals potential growth amid mixed signals regarding overall valuation and market sentiment. | Energy | Oil & Gas Equipment & Services |

| TELA | DOWN | 0.65 | Insider buys, particularly from the Ew Healthcare Partners, signal confidence, but the significant previous sales and higher recent average transaction prices indicate potential weakness. Additionally, TELA's financial fundamentals—valuation, EPS trends, and market conditions—are unclear. The stock has experienced substantial insider selling at higher averages, which may suggest overvaluation or concerns about future performance. Without clarity on current company earnings, growth outlook, or macroeconomic pressures, there remains considerable uncertainty, justifying a cautious downward outlook. | Healthcare | Medical Devices |

| SRZN | NEUTRAL | 0.60 | Recent insider activity shows significant purchases by the major stakeholders, indicating confidence in the company's prospects. However, insider sales, particularly from executives, suggest mixed signals. Moreover, without information on current earnings trends, margins, and any broader macroeconomic indicators, the stock's near-term direction remains uncertain. The overall indicators suggest a bullish sentiment but lack of comprehensive fundamental context diminishes confidence. | Healthcare | Biotechnology |

| ALMS | DOWN | 0.60 | While there is significant recent insider buying, especially by directors at higher prices ($16.00), the current market price of $5.25 indicates a substantial decline. The insider purchases could indicate a belief in recovery or undervaluation, but this contrasts with the apparent drop in share price. Without key information on company fundamentals, industry conditions, or macroeconomic influences affecting ALMS, there is uncertainty. Thus, the overall outlook is cautious, leaning towards a downward direction given the substantial price discrepancy. | Healthcare | Biotechnology |

| TPVG | DOWN | 0.60 | Recent insider buying signals confidence from executives, but the stock's average purchase price reflects a decline from prior highs around $9 to $6. Current macroeconomic conditions, including rising interest rates and inflation, pose risks to equity valuations. Additionally, without solid earnings performance or growth potential in the current market context, the positive sentiment from insider activity may not be enough to offset broader market pressures. Overall, while insider purchases suggest potential upside, the deteriorating price trends and macroeconomic headwinds lead to a cautious outlook. | Financial Services | Asset Management |

| LAB | UP | 0.75 | The recent insider buying activity, primarily by a significant stakeholder (Casdin Partners Master Fund), signals strong confidence in the company's prospects. Over the past few months, these purchases have concentrated around lower price levels, indicating a value-oriented approach. However, the stock's fundamentals and broader market conditions remain unclear, as there is no disclosed information about earnings trends, leverage, or competitive positioning. This lack of data introduces uncertainty about growth potential amidst potential macroeconomic pressures. Overall, while insider enthusiasm is evident, the confidence level is moderated due to fundamental and contextual gaps. | Healthcare | Medical Devices |

| MNR | DOWN | 0.60 | Recent insider activity shows significant purchasing by key insiders, notably McMullen William Wallace, indicating confidence in the company's future. However, the earlier higher average purchase prices ($14-$19) contrast with recent trades at $11.85 and $12.00, suggesting potential concerns about declining valuations. Fundamental analysis was not provided, and market conditions could be challenging with rising interest and inflation rates potentially impacting capital flows. The concentrated insider buying shows belief in recovery, but the overall market backdrop and possible deterioration in fundamentals suggest caution. More information on earnings, margins, and industry specifics would improve confidence. | Energy | Oil & Gas E&P |

| LINE | UNKNOWN | 0.50 | Recent insider purchases indicate strong confidence from executives, particularly from the CFO and co-executives, totaling over $4 million in buys at significantly lower prices than earlier this year. However, the company’s fundamentals, including earnings trends and growth potential, are unclear as this data is missing. Furthermore, industry and macroeconomic conditions, including inflation and interest rates, might pose risks. Thus, while insider buying suggests bullish sentiment, unknown fundamentals and potential macro pressures create uncertainty. | Real Estate | REIT - Industrial |

| SONO | UP | 0.75 | Recent insider buying by the CEO and significant investment from a major shareholder suggests strong confidence in the stock's future. The purchases were made at prices substantially lower than the current market price, indicating belief in the company's undervaluation. However, the absence of detailed company fundamentals such as earnings trends and leverage, as well as broader market conditions like inflation or interest rates, limits full confidence in a sustained uptrend. Despite potential headwinds from the macroeconomic environment, the concentrated insider buying points to a positive sentiment around SONO's near-term prospects. | Technology | Consumer Electronics |

| TMDX | DOWN | 0.70 | Recent insider purchases by the CEO indicate some level of confidence, yet significant sales by multiple insiders, particularly larger dispositions by directors, suggest a lack of alignment with future price appreciation. While overall market sentiment may be challenging due to macroeconomic factors like rising interest rates and inflation, the company's specific fundamentals are not provided, making it difficult to gauge long-term growth potential. The current trend in insider selling outweighs buying, pointing toward potential near-term downward pressure for the stock. | Healthcare | Medical Devices |

| PRKR | UP | 0.70 | The significant insider purchase by Director Lewis Titterton of over 4.76 million shares suggests a strong belief in the company's future prospects. This indicates positive sentiment, potentially contrasting with market conditions. However, to fully evaluate PRKR's near-term direction, additional information on the company's earnings trends, debt levels, and industry conditions is needed. Current macroeconomic factors such as interest rates and inflation remain critical; a favorable economic environment could support the stock's upward movement. Given the strong insider activity and assuming no major negatives in fundamentals or macro, the outlook is cautiously optimistic. | Technology | Semiconductors |

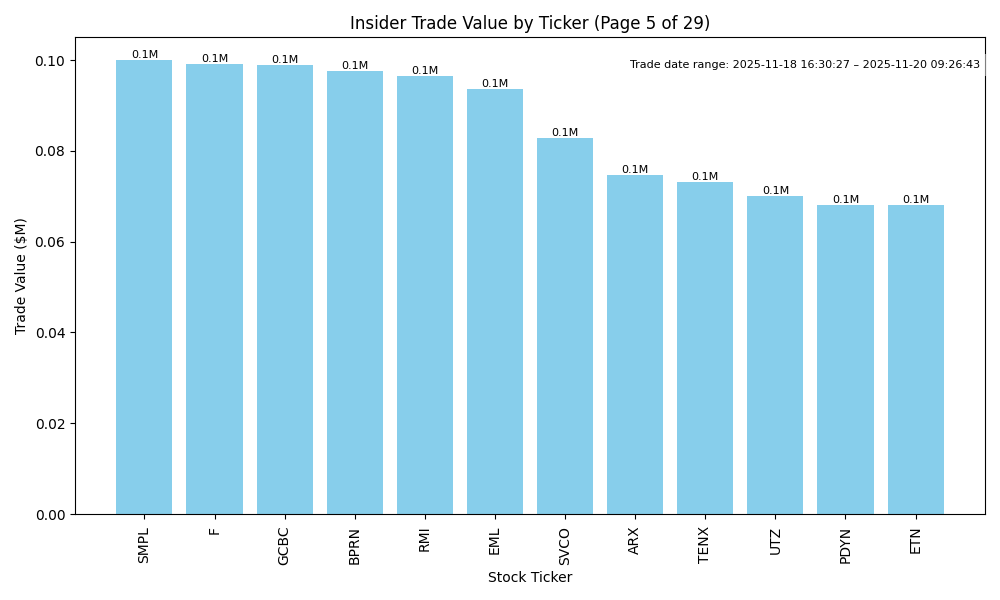

| ARX | DOWN | 0.60 | Insider trading presents a mixed signal. Notably, the CEO purchased shares, which could be interpreted as positive; however, a significant sale by a director raises concerns about insider sentiment. The large sale corresponds to a high price point, suggesting potential overvaluation or insider belief in future downturns. Additionally, without information on earnings trends or other fundamental indicators, confidence in the stock's outlook is tempered. Broader economic conditions may also be affecting sentiment, such as rising interest rates impacting corporate borrowing, which complicates the stock's trajectory. | Financial Services | Insurance Brokers |

| TBRG | NEUTRAL | 0.65 | Recent insider purchases, particularly by high-ranking executives like the Chief Business Officer and a significant 10% holder, suggest confidence in the company’s future despite recent price declines. However, the pattern of both sales and purchases indicates mixed signals. The overall company fundamentals are unclear due to a lack of recent financial data or guidance changes, which lowers conviction. The industry context and broader macroeconomic conditions related to credit and inflation will also factor into TBRG's near-term performance but remain unelaborated. Thus, the stock's direction appears uncertain with moderate insider optimism. | Healthcare | Health Information Services |

| AVTR | UP | 0.70 | Recent insider purchases suggest confidence in the company's prospects, with key executives acquiring shares at prices below current trading levels, signaling potential undervaluation. However, substantial insider selling at higher prices in the past indicates that insiders may have capitalized on previous highs. Company fundamentals, which aren't detailed here, remain a concern along with broader macroeconomic pressures, including rising interest rates and inflation, which impact consumer demand. Still, the significant insider buying amidst these headwinds reflects a cautiously optimistic outlook for AVTR in the near term. | Healthcare | Medical Instruments & Supplies |

| GTE | UP | 0.75 | Recent insider buying by Equinox Partners Investment Management LLC, particularly large purchases at decreasing average prices, suggests strong confidence in GTE's upside potential. Although some directors have sold shares, the overall trend favors accumulation. However, without current fundamental data like earnings trends or industry conditions, uncertainty remains. The macroeconomic environment, including interest rates and inflation, could impact performance but is currently not captured in this data, leading to moderate confidence in a near-term upward movement. | Energy | Oil & Gas E&P |

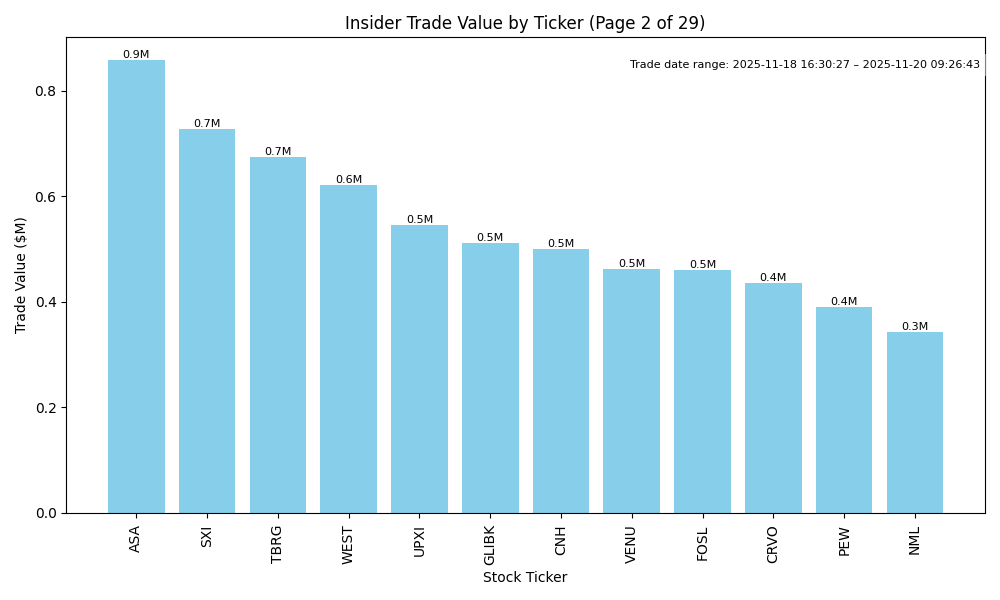

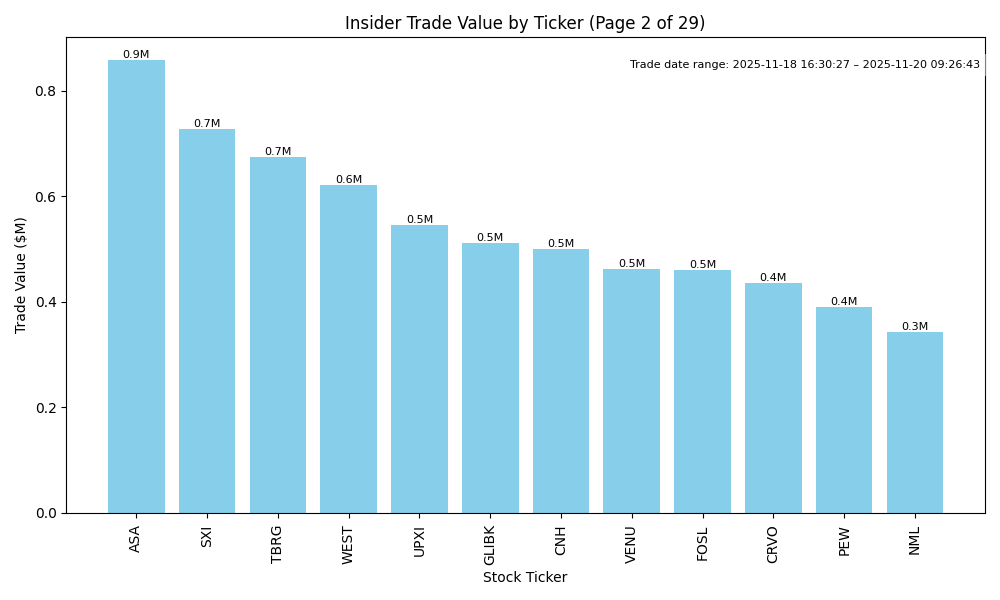

| ASA | UP | 0.75 | Insider buying, particularly by Saba Capital Management, has significantly increased in volume and price over the past month, indicating strong confidence in the company's future. This collective purchasing suggests that insiders believe the current valuation is attractive. However, the lack of fundamental data regarding earnings trends, margins, and industry conditions limits the confidence of this outlook. The current macroeconomic environment, including rising interest rates and inflationary pressures, could also pose risks. Despite these concerns, the aggressive insider purchases provide a bullish signal. | Financial Services | Asset Management |

| BATRA | UP | 0.75 | The recent insider buying by key investor Malone John C., particularly significant purchases totaling over 150,000 shares at prices around $41, suggests strong internal confidence in the company's prospects. Although there have been some sales by other insiders like Gamco Investors, the overall trend indicates a bullish sentiment from major stakeholders. The stock might face headwinds from broader industry challenges and macroeconomic factors, including inflation and interest rate uncertainty, but the insider buying pattern could signal potential positive developments or earnings growth. However, the lack of current earnings reports or financial metrics necessitates a cautious interpretation of the buying trend. | Communication Services | Entertainment |

| GOGO | NEUTRAL | 0.60 | Recent insider activity shows mixed signals; while there are significant purchases by key insiders (e.g., Townsend's purchase of 110,009 shares) suggesting confidence in future growth, previous large sales by insiders indicate possible concerns around valuation or cash needs. Fundamentals and macroeconomic conditions are unclear, with no recent earnings data provided and broader market pressures around inflation and interest rates. Given these conflicting signals and lack of comprehensive data, direction remains uncertain. | Communication Services | Telecom Services |

| GT | NEUTRAL | 0.60 | Insider transactions show strong buying activity from directors, with multiple purchases at prices around $7.55 to $8.20, indicating confidence in the stock's future. However, there are also notable insider sales, particularly from the Chief Admin Officer, which raises concern. Without access to current company fundamentals, sector outlook, or macroeconomic conditions, it becomes challenging to assert a clear upward or downward trend. The mixed signals from insider activities warrant a cautious approach. | Consumer Cyclical | Auto Parts |

| SXI | DOWN | 0.70 | Recent insider trading shows significant selling pressure, led by high-ranking executives, while two recent purchases from a director appear relatively minor. This suggests a lack of confidence among insiders regarding the company's near-term outlook. Although the fundamentals and macroeconomic context were not provided for thorough analysis, the prevailing insider sentiment strongly leans toward caution, indicating a bearish trend for SXI stock. | Industrials | Specialty Industrial Machinery |

| MRVI | DOWN | 0.75 | Recent insider purchases by the CEO and other directors indicate confidence in the company's future, particularly at lower price points. However, the significant insider sale by a major shareholder raises concerns about confidence at higher valuations. Additionally, there is a lack of information on company fundamentals (e.g., earnings trends, leverage, and growth potential), as well as macroeconomic headwinds such as rising interest rates and inflation, which could pressure stock prices. Without strong fundamentals to support the insider buying activity, the outlook is cautiously negative. | Healthcare | Biotechnology |

| OPK | UP | 0.70 | CEO Phillip Frost has consistently increased his holdings, demonstrating strong confidence in OPK's future. Recent purchases show a significant volume, suggesting a bullish sentiment despite the stock being relatively low-priced. However, without specific data on company fundamentals such as earnings trends or growth potential, and considering potential market headwinds like interest rates and inflation, the overall outlook remains cautiously optimistic. The high concentration of insider buying adds a layer of credibility to his bullish stance, warranting a positive but measured outlook. | Healthcare | Diagnostics & Research |

| FSSL | UP | 0.70 | Michael C. Forman's recent purchase of 48,370 shares at an average price of $13.45 suggests insider confidence in FSSL's near-term prospects. However, without detailed information on the company's fundamentals, such as earnings trends and leverage, or the sector's health, the assessment remains somewhat speculative. If the broader macroeconomic conditions are favorable and no critical issues are affecting the company, the insider buying could indicate a positive shift. Nevertheless, uncertainties exist due to missing fundamental data. | N/A | N/A |

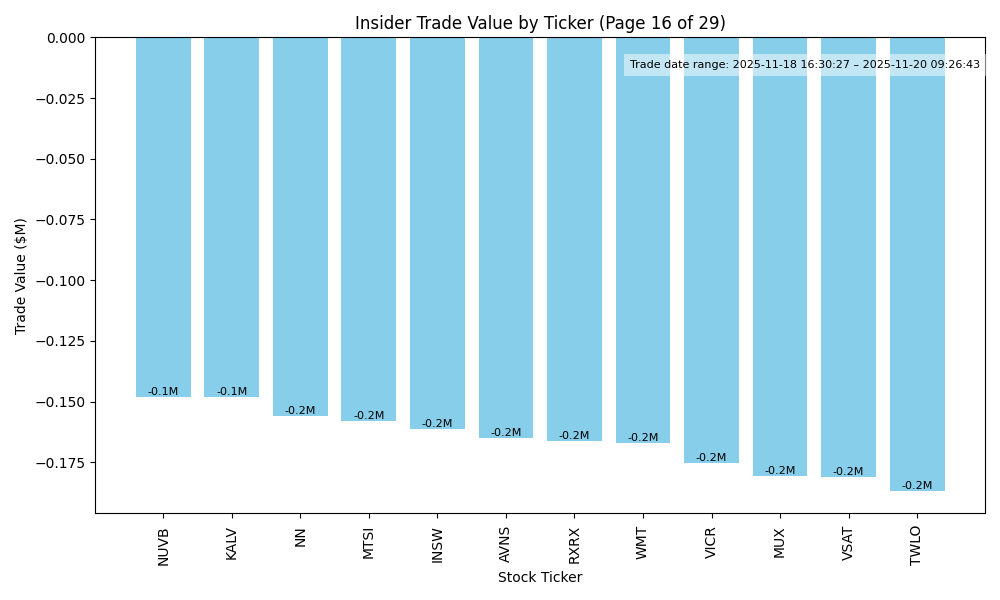

| GEF | NEUTRAL | 0.60 | Recent insider purchases by key executives (such as the CFO) suggest some level of confidence in the company's future. However, there are notable sales occurring simultaneously, indicating potential concerns or profit-taking. The stock's recent price actions show volatility near recent highs (around $72) and lows (around $60), with mixed signals from insiders. Additionally, lacking company fundamentals, such as revenue and earnings growth data, and potential macroeconomic pressures (e.g., interest rates and inflation), contribute to uncertainty. While insider buying is a positive signal, the overall mixed signals lead to a neutral stance. | Consumer Cyclical | Packaging & Containers |