| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

| CTRI | DOWN | 0.70 | Recent insider activity shows a significant purchase by Carl Icahn, suggesting some confidence, but it's overshadowed by a substantial sell-off from Southwest Gas Holdings. The large divestiture raises concerns about the company's outlook. Additionally, the overall macroeconomic environment has been challenging, with rising interest rates and inflation affecting consumer demand and spending. Without clear positive signals in company fundamentals, including earnings trends and growth potential, the balance leans towards a negative near-term outlook. | Utilities | Utilities - Regulated Gas |

| REZI | UP | 0.75 | Recent insider purchases, particularly by Cd&R Channel Holdings (10% holder), suggest strong confidence in REZI's future, with substantial purchases at escalating prices. However, there has been some selling activity among executives, which introduces caution. Without complete visibility on the company's current fundamentals and broader macroeconomic factors, including interest rates and inflation impacts, the outlook remains positive yet tempered. There is momentum from recent transactions, indicating potential growth, which supports a bullish perspective. | Industrials | Industrial Distribution |

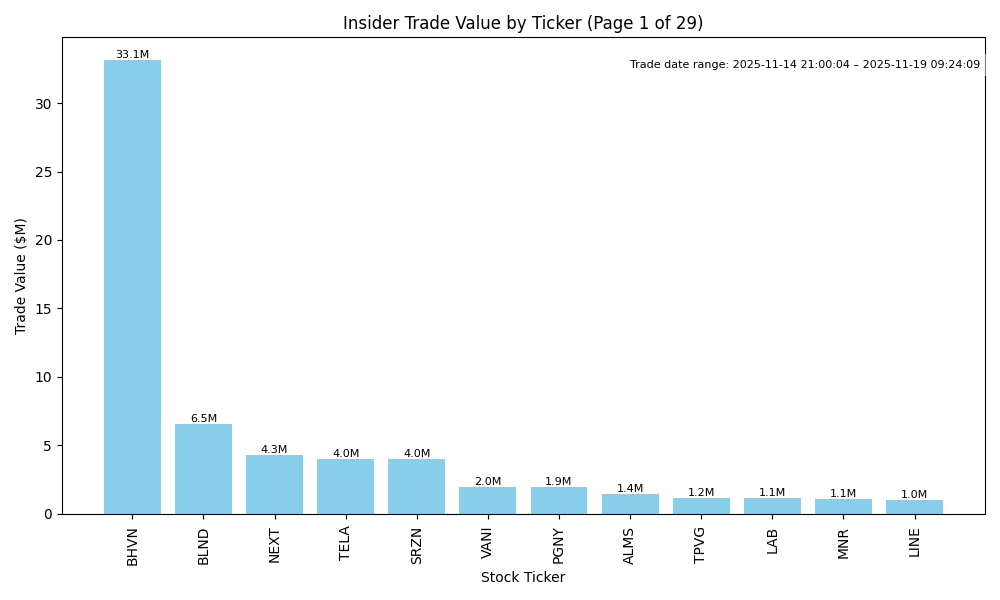

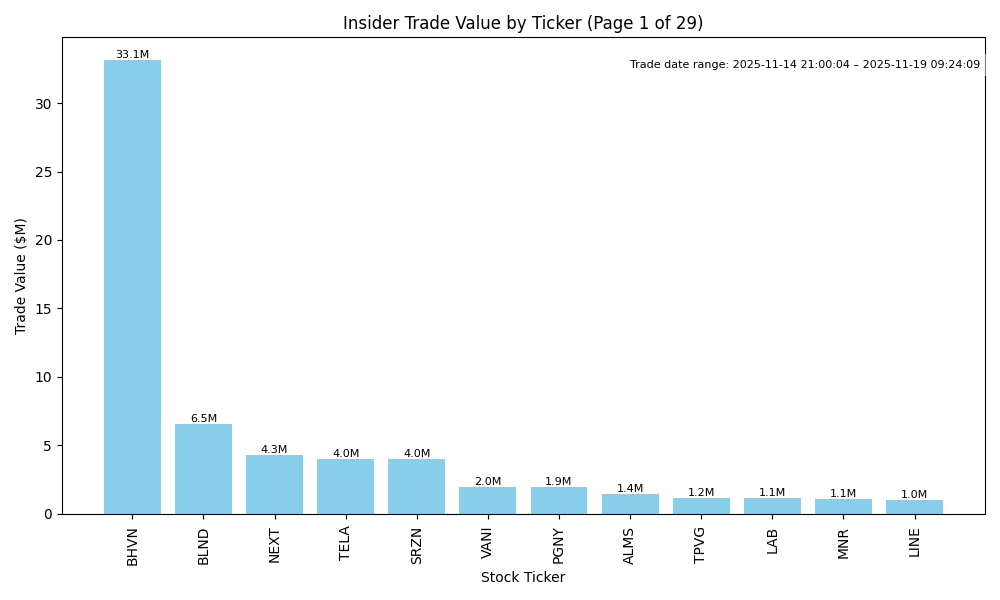

| BHVN | UP | 0.80 | Recent insider purchases by key executives and directors indicate strong confidence in the company's prospects, especially with substantial buys occurring at relatively lower prices. The significant volume of these transactions suggests a belief in potential recovery or growth. However, past prices in the $30-40 range raise concerns about fundamentals without updated information on earnings or growth potential. The healthcare sector's dynamics and broader macroeconomic variables, like interest rates and potential regulation, could influence this stock's performance. In the context of bullish insider sentiment, the near-term direction appears positive, but recent high prices coupled with economic uncertainty warrant caution. | Healthcare | Biotechnology |

| HYMC | UP | 0.70 | Recent insider activity shows significant purchases by key insider Eric Sprott, with a notable 15.1 million shares purchased recently at increasing prices. This suggests strong belief in the company's future. However, there are also ongoing sales by other insiders, potentially indicating mixed sentiment. Company fundamentals and specific metrics are missing, which adds uncertainty. The general market context appears challenging with rising interest rates and inflation concerns, yet strong insider purchasing may offset some of that negative sentiment. Overall, while there are indicators of potential growth, incomplete data reduces confidence. | Basic Materials | Gold |

| NEXT | UP | 0.70 | Insider trading has shown strong buy patterns, particularly from major stakeholders like Hanwha Aerospace, accumulating over 2 million shares in recent months at prices between $6.07 and $6.08. This indicates confidence in the company's outlook. However, the latest sale by York Capital and an absence of recent key financial metrics raise uncertainties about the overall health of the company. Given potential growth dynamics and strong insider purchases, there's a bullish sentiment, but caution is warranted due to macroeconomic pressures such as rising interest rates and inflation, which could impact performance. | Energy | Oil & Gas Equipment & Services |

| BLND | UP | 0.75 | Recent insider purchases by Haveli Investments, L.P., amounting to over 4 million shares and executed at prices between $2.98 and $3.03, indicate strong insider confidence in the stock. While there has been some insider selling, it appears to be from different insiders and relatively smaller amounts compared to recent purchases. The stock is currently trading below its recent highs, presenting an valuation opportunity. However, without detailed company fundamentals or macroeconomic data, including earnings trends and market conditions, my confidence remains moderate. | Technology | Software - Application |

| SPRU | UP | 0.70 | Recent insider purchases, particularly a significant one from Steel Partners, suggest strong internal confidence in the stock. The buying activity is concentrated among directors and may indicate positive sentiment regarding future growth or recovery. However, the stock's fundamentals and broader market trends may not be fully clear without additional financial metrics or recent earnings reports. Thus, while insider activity is promising, the overall economic environment and specific company performance must be monitored closely for a more comprehensive view. | Technology | Solar |

| TELA | NEUTRAL | 0.60 | Insider buying from key executives and a major fund like Ew Healthcare suggests some confidence in TELA's future, particularly with large recent purchases at lower prices. However, significant previous sales and ongoing insider selling raise concerns about potential overvaluation. Current fundamentals and macroeconomic indicators, including interest rates and inflation trends, remain unclear without specific financial data on earnings and leverage. The stock's near-term direction appears uncertain, warranting a balanced view with moderate confidence. | Healthcare | Medical Devices |

| SRZN | DOWN | 0.60 | Insiders, particularly a significant shareholder (Column Group III Gp, LP), have been purchasing shares consistently, indicating confidence in the stock. However, recent sales by the CFO and another executive may suggest some internal concerns. The overall trend is positive with large purchases, but the transition from higher transaction prices to more recent prices suggests potential downward pressure. Moreover, without comprehensive details on company fundamentals, competitive positioning, or broader market context, confidence remains moderate as external economic factors could negatively influence stock performance. | Healthcare | Biotechnology |

| NP | NEUTRAL | 0.60 | Recent insider purchases, especially by the CFO and CEO, suggest confidence in the company's direction. However, these are counterbalanced by significant insider sales from major shareholders, indicating potential liquidity concerns or profit-taking. An ongoing evaluation of company fundamentals is critical; missing data on earnings trends and industry health weakens conviction. Additionally, broader macroeconomic factors like interest rates and inflation could pressure growth. Without comprehensive insights into these areas, a balanced outlook is warranted. | Financial Services | Insurance Brokers |

| TBRG | UNKNOWN | 0.50 | Recent insider purchases by significant players, particularly by the Chief Business Officer and Pinetree Capital, suggest a bullish outlook on TBRG. However, notable selling activity from insiders at higher prices indicates potential skepticism. Company fundamentals, including growth prospects and sector trends, are not provided, preventing a thorough assessment of underlying health. Additionally, the overall macroeconomic landscape remains uncertain. The lack of detailed financial metrics and recent earnings performance underlines this uncertainty, yielding a neutral-to-weak conviction in any near-term price movement. | Healthcare | Health Information Services |

| VANI | UP | 0.70 | Recent insider purchasing by significant figures, particularly Director Williams Gregg, suggests strong internal confidence in the company's prospects despite low share prices. Multiple large purchases at various intervals denote a bullish outlook. However, without detailed company fundamentals and macroeconomic conditions, confidence is tempered. Industry and broader macroeconomic factors remain unspecified, which leaves uncertainty regarding demand and competitive positioning. Overall, heavy insider buying implies potential growth, but caution is warranted due to the lack of additional supporting data. | Healthcare | Biotechnology |

| PGNY | UP | 0.70 | Recent insider purchases, especially by the CEO and other executives, suggest positive sentiment about the company's prospects. The significant purchase of 79,500 shares by CEO Anevski Peter at $24.29 indicates strong alignment with shareholder interests. However, a history of sales by insiders, including substantial volume at higher prices, raises concerns about their long-term confidence. Company fundamentals, such as growth potential and earnings, are not provided in the summary, which limits confidence in this analysis. Industry dynamics and macroeconomic conditions may be shifting but are also unspecified. Given the recent buying activity, the stock appears likely to move upward in the near term, but uncertainties remain due to mixed insider behavior and lack of comprehensive fundamentals. | Healthcare | Healthcare Plans |

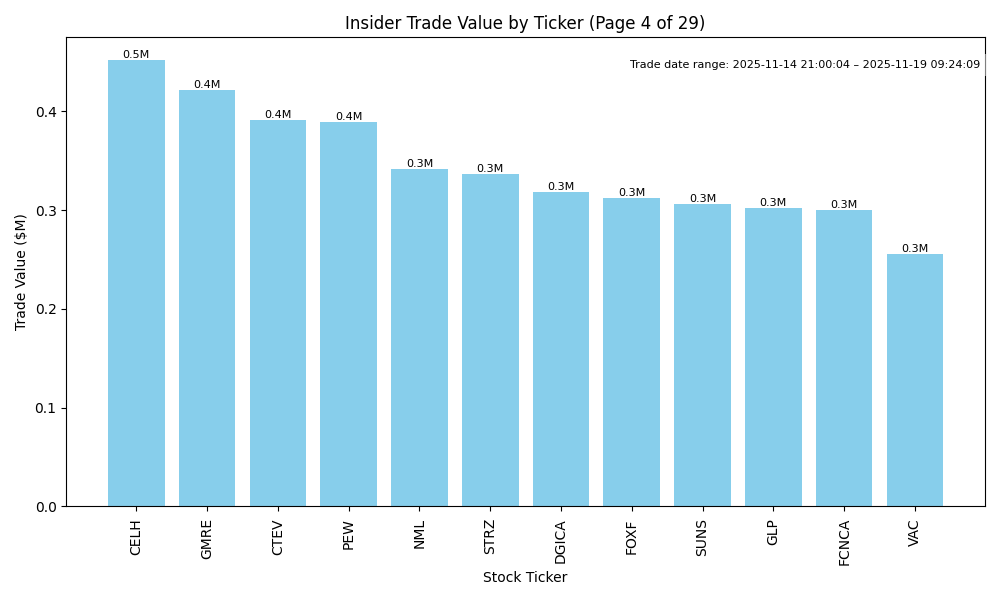

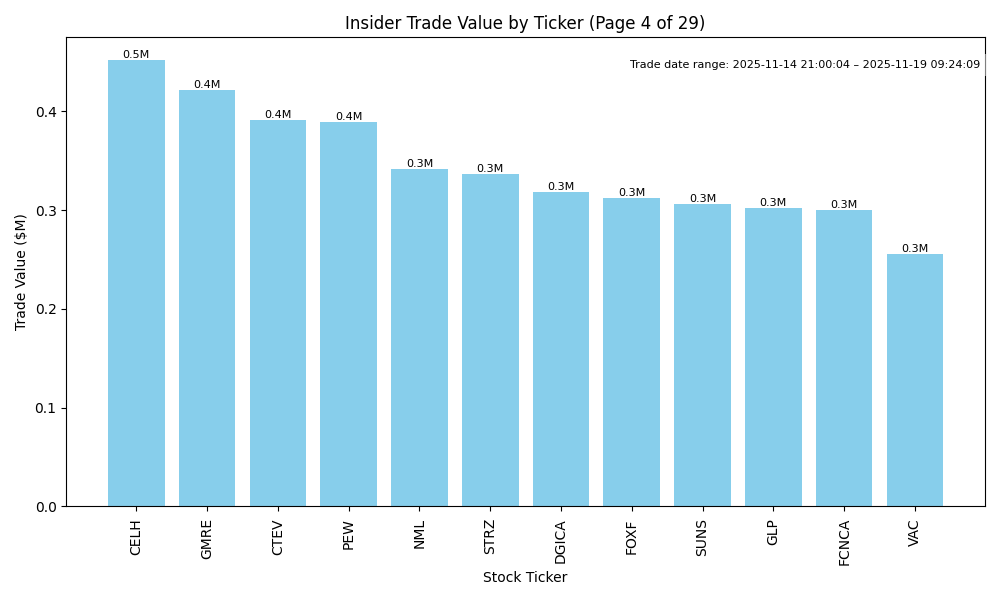

| VAC | UP | 0.70 | Recent insider purchases, especially by directors totaling over 122,000 shares at significantly lower prices than the recent highs, indicate positive sentiment among insiders. However, there's a notable concentration of buy orders recently alongside previous significant purchases at much higher prices, suggesting insiders are optimistic despite a declining trend from earlier highs. Without updated earnings data or broader industry analysis, the outlook is cautiously positive given the encouraging insider activity, though market conditions and company performance need further assessment. | Consumer Cyclical | Resorts & Casinos |

| ALMS | DOWN | 0.70 | Although there has been significant insider buying at lower price levels indicating some confidence from management, the recent purchases were made at high valuations, notably $16, which is much higher than the current price of $5.25. The divergence in insider purchases suggests potential optimism, but the high initial prices could indicate that insiders expect the stock to fall further before rebounding. Additionally, without updated company fundamentals or broader market context provided, there’s a risk that macroeconomic conditions like interest rates and economic trends could adversely affect ALMS's growth potential. | Healthcare | Biotechnology |

| TPVG | DOWN | 0.60 | Recent insider purchases indicate confidence, particularly from key executives with significant stakes. However, the stock price has been declining from recent highs above $6.74 to current levels around $5.96, signaling potential market concerns. The macroeconomic landscape, characterized by rising interest rates and inflation, could pressure growth and profitability. Without additional context on earnings trends or industry dynamics, the positive insider sentiment is somewhat overshadowed by broader market headwinds. Thus, the overall outlook remains cautious. | Financial Services | Asset Management |

| LAB | UP | 0.70 | Recent insider purchases by Casdin Partners, who hold a significant position, suggest strong confidence in the company's potential upside. However, the financial picture lacks clarity due to missing data on earnings trends and margins, which lowers confidence. The stock's recent price activity shows a recovering trend, potentially fueled by insider sentiment. Despite recent sales by other executives, indicating some liquidity needs, the overall insider buying activity indicates a positive outlook. Attention should be paid to fundamental and macroeconomic conditions which may be impacting investor sentiment, but the bullish insider activity is a favorable sign. | Healthcare | Medical Devices |

| LINE | DOWN | 0.65 | Recent insider purchases indicate a belief in the company's future potential, but significant past buying occurred at much higher price levels (over $60). The current market prices below $35 suggest potential erosion of confidence in company fundamentals or market conditions. Broader macroeconomic challenges, including high inflation and uncertain interest rates, may also impact sentiment negatively. While insider activity is bullish, it contradicts overall market conditions and possible fundamental weakness, suggesting a cautious outlook. | Real Estate | REIT - Industrial |

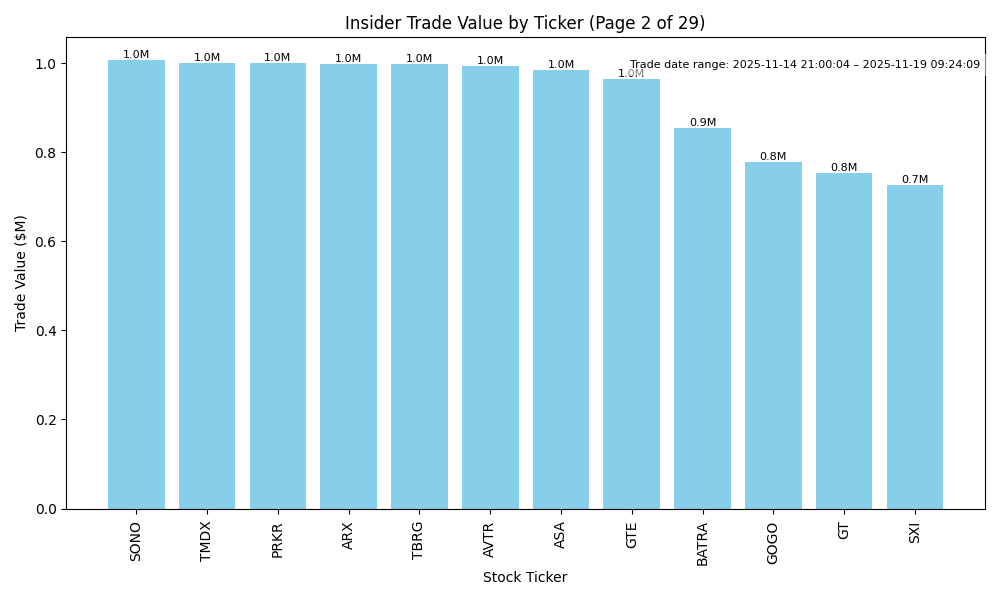

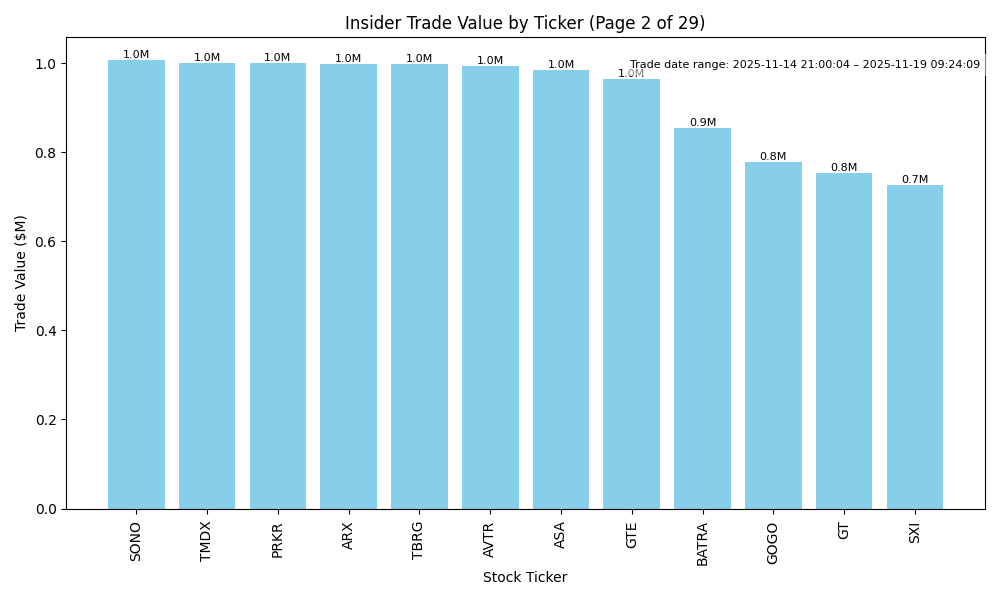

| SONO | UP | 0.75 | Recent insider purchases, especially significant investments from CEO Conrad Thomas and 10% stakeholder Coliseum Capital, signal strong insider confidence in SONO's potential. These purchases occurred at varying prices, indicating a belief in long-term value. However, there are multiple recent insider sales, particularly by directors, suggesting some cautious profit-taking at higher valuations. Company fundamentals remain uncertain without specific data on earnings trends and growth metrics, and broader market conditions such as fluctuating interest rates may introduce volatility. Despite these factors, the insider buying interest points towards a potential upward trend. | Technology | Consumer Electronics |

| ARX | NEUTRAL | 0.50 | Insider activity shows mixed signals: the CEO recently purchased a significant number of shares, indicating confidence in the company's future, while a director made a substantial sale, which could raise concerns about future performance. Without additional information on company fundamentals, such as earnings trends, leverage, or macroeconomic context, it's difficult to determine a clear direction. Additionally, sector and industry dynamics, as well as recent material developments, are not provided, which limits the confidence in the analysis. | Financial Services | Insurance Brokers |

| SBUX | UNKNOWN | 0.50 | Recent insider activity shows mixed signals: while Jorgen Knudstorp bought 11,700 shares at $85, a substantial purchase, other insiders, particularly Kelly Sara and Rachel Ruggeri, have frequently sold shares at higher prices, indicating potential concerns about the stock's future valuation. The company's fundamentals, including margins and earnings trends, are unclear from the provided data. Moreover, with ongoing pressures from inflation and interest rate fluctuations impacting discretionary spending, the near-term direction is uncertain. The mix of buying and selling, combined with macroeconomic factors and missing detailed financials, leads to a neutral outlook. | Consumer Cyclical | Restaurants |

| AVTR | NEUTRAL | 0.60 | Insider trading shows a concerted effort by key executives to buy shares at lower prices, indicating confidence in the company's potential. However, the recent trades are significantly lower than past prices, reflecting potential underlying concerns. Company fundamentals, such as earnings trends and margins, are not provided, creating a gap in analysis. The general market environment also appears cautious, as broader macroeconomic factors like interest rates and inflation remain of concern. Overall, while insider buying indicates optimism, the lack of stronger supporting fundamentals reduces confidence in a definite upward trend. | Healthcare | Medical Instruments & Supplies |

| GTE | NEUTRAL | 0.60 | Recent insider activity suggests confidence as a notable investor, Equinox Partners, has made substantial purchases, totaling over 1.6 million shares in November alone. However, the company’s stock price has declined from earlier highs, reflecting potential vulnerabilities in fundamentals or external factors. Additionally, while insider purchases are positive, there's a concurrent showing of sales by other insiders. Without more context on earnings trends, growth potential, and industry health, the outlook remains cautious, leading to a neutral stance despite the positive insider sentiment. | Energy | Oil & Gas E&P |

| PRMB | DOWN | 0.70 | Recent insider buying from multiple executives (CEO, CFO, and directors) suggests confidence in the company's direction, particularly at lower prices. However, this is tempered by significant insider selling earlier in the year, with millions of shares sold at much higher prices, indicating cashing out by major shareholders. The abrupt decline in insider sentiment from prices above $30 to recent purchases below $25 raises concerns about the company's fundamental health. Potential issues like rising rates, inflation, and broader market pressures also weigh negatively on growth prospects, necessitating cautious interpretation of the recent buying activity. | Consumer Defensive | Beverages - Non-Alcoholic |

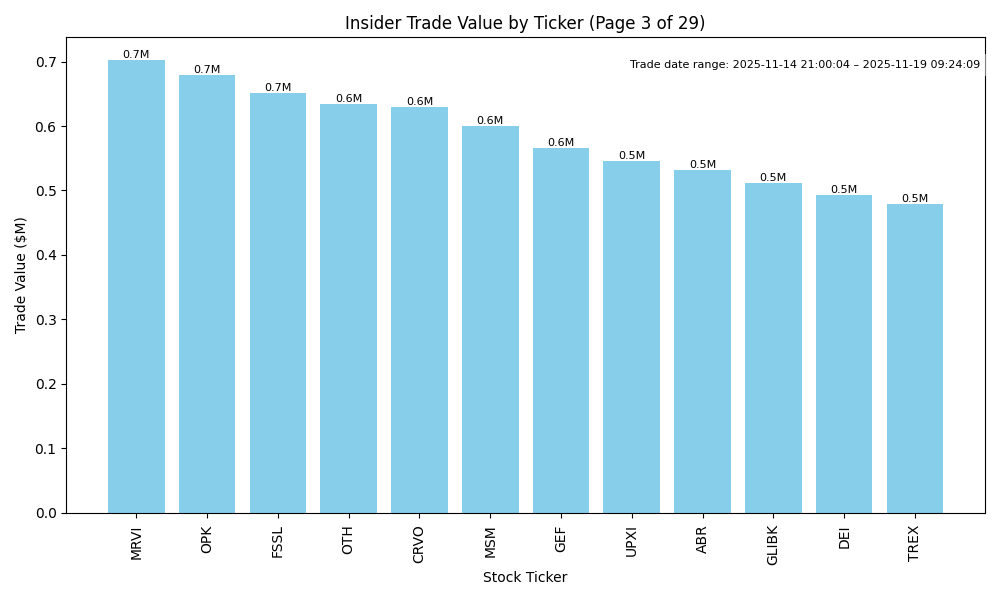

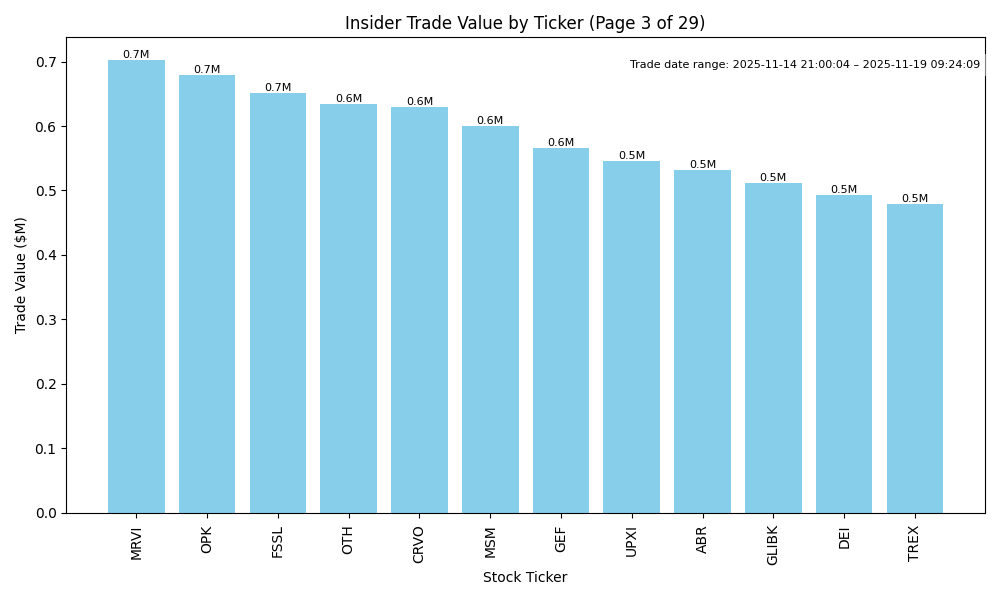

| GEF | NEUTRAL | 0.60 | Recent insider purchases from executives, particularly the CFO, suggest some positive sentiment about the company's near-term outlook despite ongoing selling activity, especially from the General Counsel and COO. The stock price has seen fluctuations, and while insider buying typically indicates confidence, the recent sales may indicate a lack of consensus about the stock's value or internal strategies. Without comprehensive financial metrics or industry analysis, along with potential macroeconomic pressures such as interest rates and inflation, I remain cautious in assessing the stock's direction. | Consumer Cyclical | Packaging & Containers |