| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

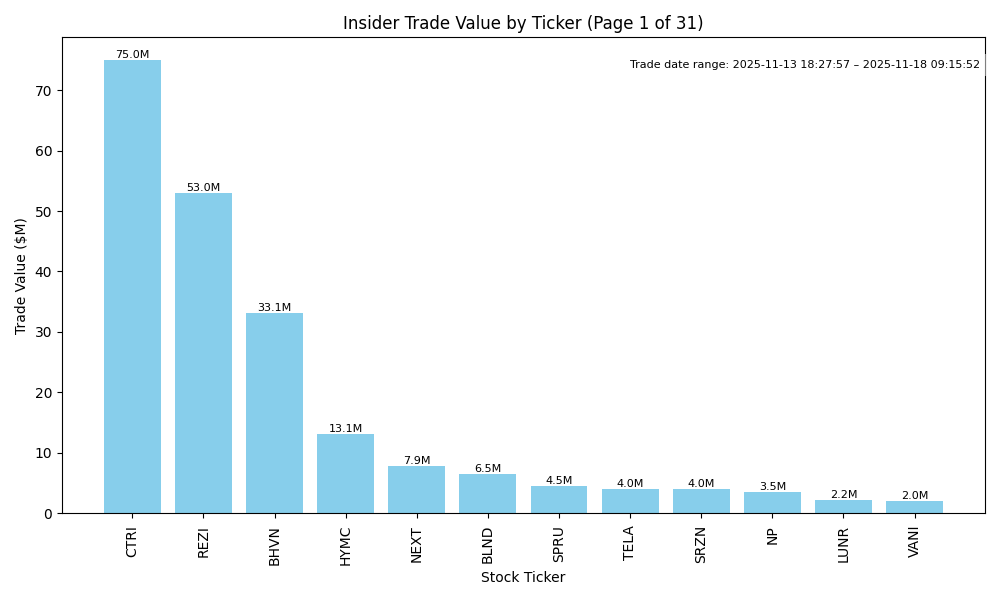

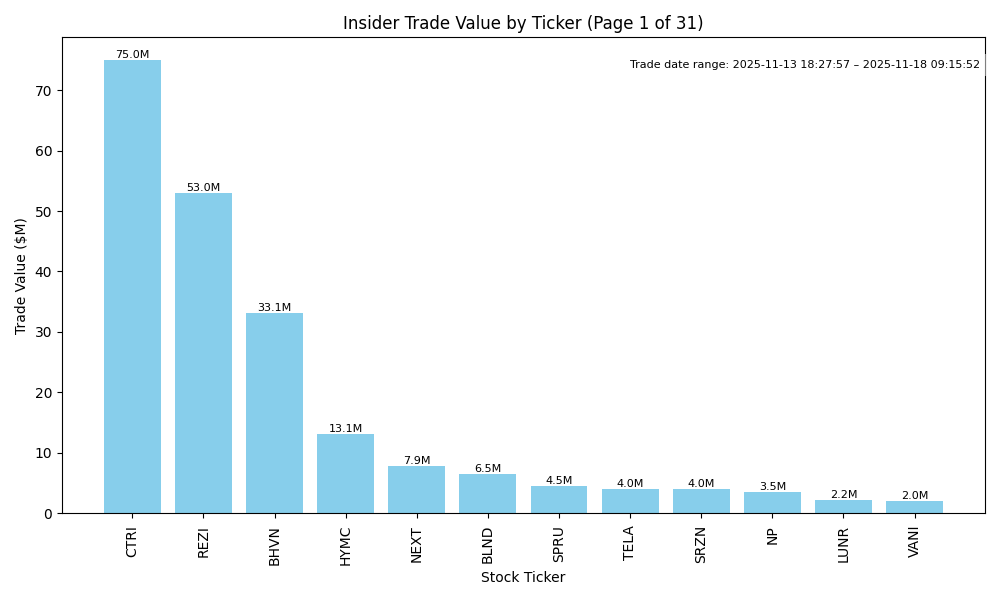

| CTRI | DOWN | 0.60 | Insider trading presents a mixed picture; a significant purchase by Carl Icahn is notable, indicating potential confidence in value recovery. However, the recent selling by Southwest Gas Holdings raises concerns about the stock's additional downside risk, as it involved large volumes at lower prices. Moreover, without comprehensive company fundamentals, industry health, and macroeconomic context available, uncertainty persists. The overall tensions suggest a potential downward trend in the near term. | Utilities | Utilities - Regulated Gas |

| REZI | UP | 0.80 | Recent insider purchases, particularly by Cd&R Channel Holdings, indicate strong confidence in REZI's prospects, especially with a significant acquisition of nearly 1.7 million shares at an average of $31.35. The string of purchases suggests a favorable outlook despite a recent minor selling trend by some insiders. However, assessing the broader company's fundamentals, including potential earnings growth and margin stability, is essential. Industry trends toward resilience and growth may support upward momentum, though macroeconomic pressures like inflation and interest rates remain a concern. Still, the bullish insider activity adds weight to a positive trajectory. | Industrials | Industrial Distribution |

| BHVN | UP | 0.75 | Recent insider purchases are highly concentrated and significant, with key executives like the CEO and directors buying large shares at $7.50, substantially lower than previous purchase prices. This indicates strong internal confidence in future prospects. However, the stock's past price trends show a drop from higher levels, raising concerns about overall performance. The broader macroeconomic context may also pressure the stock, yet the recent insider buying offset gives a positive outlook. Overall, while the insider activity is bullish, external factors introduce uncertainty, meriting a moderate level of confidence. | Healthcare | Biotechnology |

| HYMC | UP | 0.75 | Recent insider buying by Eric Sprott, a significant stakeholder, at increasing prices indicates strong confidence in the company's prospects. Despite some insider selling by executives, the volume and value of purchases outweigh this activity. Fundamental assessments are lacking, particularly about earnings and growth metrics, which diminishes full certainty. Nonetheless, the broader market conditions need to be considered, including potential economic pressures like inflation and interest rate changes that may impact sentiment. Overall, given the significant insider purchases, the stock has upward momentum. | Basic Materials | Gold |

| SPRU | UP | 0.75 | Recent insider buying, particularly by Steel Partners Holdings with a significant purchase of over 1.1 million shares, indicates strong confidence in the stock's future performance. However, there are mixed signals as one director recently sold shares, suggesting potential concerns or liquidity needs. The overall trend of insider purchases, along with a low entry price relative to potential growth, suggests positive sentiment. Company fundamentals and the broader macroeconomic context weren't provided, limiting confidence in the forecast. Therefore, the expected near-term direction is cautiously optimistic. | Technology | Solar |

| UPST | DOWN | 0.70 | Recent insider trading shows a significant sale concentration, particularly from executives, including the CEO and CFO, indicating a lack of confidence from insiders in the stock's near-term performance. Although there is a notable purchase by the CTO, it amounts to 100k shares compared to the higher overall selling activity. Furthermore, UPST's performance may be hampered by broader macroeconomic pressures, such as potential rising interest rates and inflation, which could negatively affect company fundamentals. However, without specific recent earnings data or additional fundamental metrics, confidence in the assessment is modest. | Financial Services | Credit Services |

| NEXT | UNKNOWN | 0.50 | Insider buying by key stakeholders, including significant purchases from Hanwha Aerospace and various directors, suggests confidence in the company's future. However, the stock has experienced substantial selling, notably a large sale by a director at a similar share price. The company's overall fundamentals and external macroeconomic conditions are unclear, limiting confidence in a definitive upward movement. The high volume of shares traded and ongoing fluctuating sentiment creates uncertainty in predicting short-term stock performance. | Energy | Oil & Gas Equipment & Services |

| NP | DOWN | 0.60 | While there has been significant insider buying by key executives, which typically signals confidence in the company's future, the recent insider selling from major shareholders raises concerns. The total shares sold greatly exceed the bought shares, suggesting potential issues with the company's fundamentals or outlook. Without additional information on earnings trends, growth potential, or market conditions, it's challenging to establish a clear upward momentum. The current market context, interest rates, and broader economic conditions are also crucial factors, and if they remain unfavorable, the stock may face downward pressure despite insider optimism. | Financial Services | Insurance Brokers |

| LUNR | DOWN | 0.70 | Insider selling has significantly dominated recent activities, indicating a lack of confidence among key stakeholders. Although Michael Blitzer's recent large purchase may suggest a potential bottoming out, it does not offset the heavy selling pressure from other insiders, including significant sales by Ghaffarian and Crain. From a fundamental perspective, potential concerns exist regarding company performance, especially considering the historical decline in average sale prices. Additionally, macroeconomic factors like rising interest rates and inflation could further strain demand in the sector. Overall, the cumulative picture suggests downward pressure on the stock in the near term. | Industrials | Aerospace & Defense |

| VANI | UP | 0.70 | Insider buying has been significant and persistent, particularly from Williams Gregg, who has purchased over 10 million shares this year at various price points. This reflects strong insider confidence in the company's prospects despite the lack of detailed public fundamentals. There is no recent public information on earnings or macroeconomic conditions that specifically impacts VANI. However, the consistent insider purchases suggest optimism about the company's future position, which may help drive up the stock price, although external market factors remain uncertain. Thus, there is moderate confidence in a near-term upward direction. | Healthcare | Biotechnology |

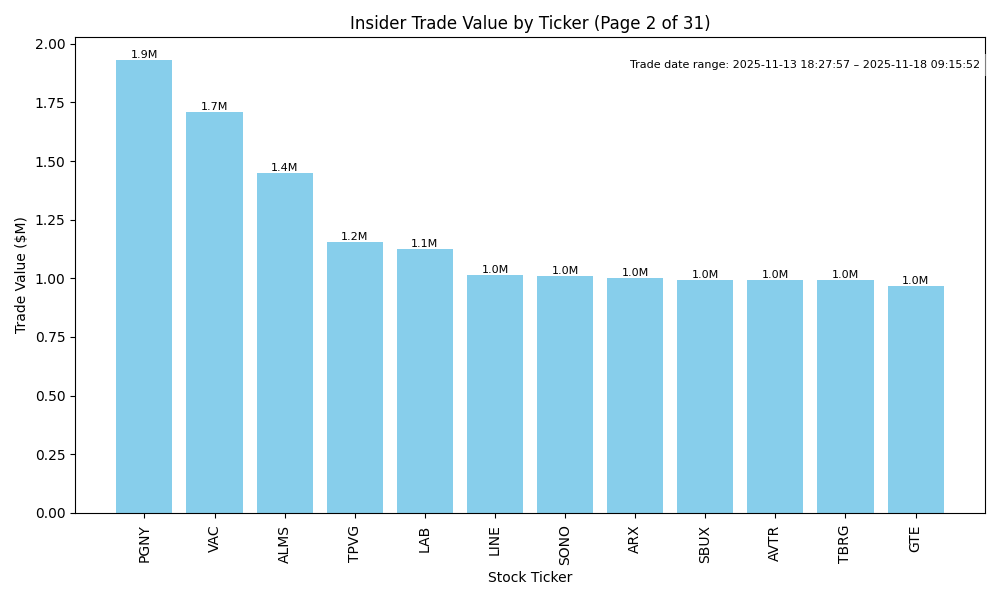

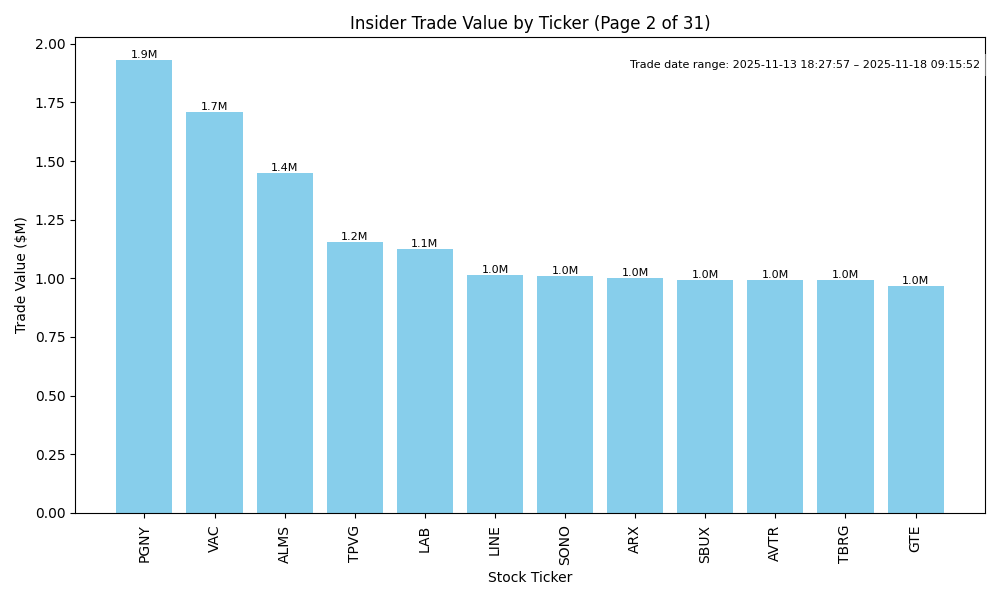

| PGNY | UP | 0.70 | Recent insider activity shows significant purchases by the CEO and another executive, indicating their confidence in the company's future. The CEO's recent purchase of 79,500 shares at $24.29 is particularly noteworthy. However, there has also been a substantial amount of selling, mainly by executives, raising concerns about potential short-term sentiment. Fundamental analysis is limited due to lack of recent earnings data, but the recent purchases suggest a potential positive outlook, particularly if supported by favorable macro conditions and sector performance. Overall, the strong insider buying alongside selling creates a mixed picture, warranting cautious optimism. | Healthcare | Healthcare Plans |

| VAC | DOWN | 0.70 | Recent insider buying, particularly from directors, indicates a belief in future value; however, substantial purchases were made at significantly higher prices earlier in the year, suggesting declining sentiment. Current average purchase prices around $45-47 are well below prior highs of $71+. Without current earnings data or macroeconomic indicators affecting travel and leisure (VAC's sector), the outlook is cautious amidst apparent market weakness and past performance trends. | Consumer Cyclical | Resorts & Casinos |

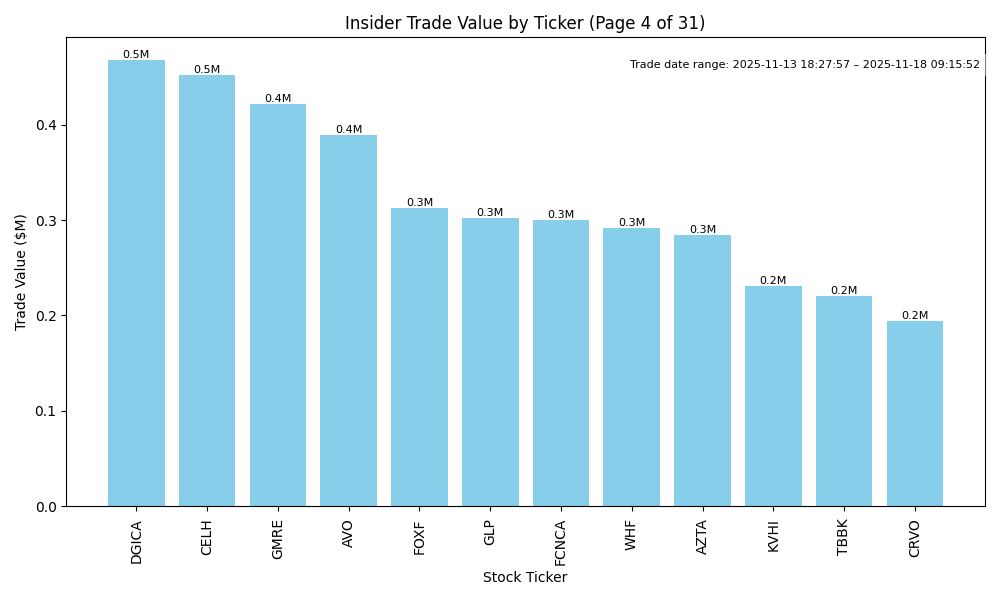

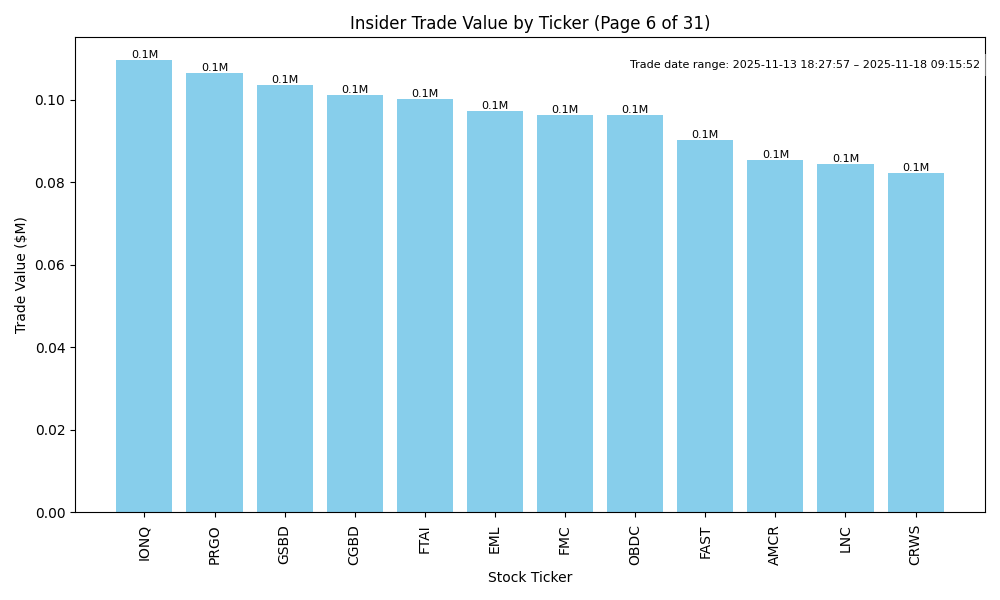

| FTAI | UP | 0.70 | Recent insider buying by key executives including the CEO and CFO indicates a strong belief in the company's prospects, with multiple purchases at higher share prices, reflecting confidence in future growth. Company fundamentals appear positive, but specifics on earnings trends, margins, and leverage are lacking. The industry context is generally favorable, although insights on supply/demand dynamics are not provided. The broader macroeconomic environment remains uncertain, but the continued insider confidence suggests potential for upward movement in the stock price. | Industrials | Rental & Leasing Services |

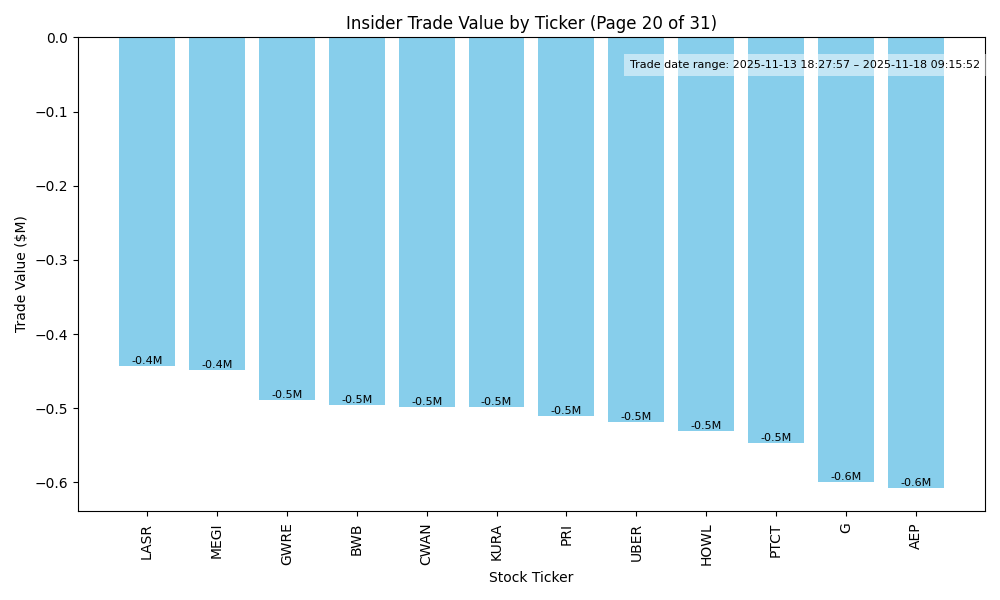

| SBUX | NEUTRAL | 0.60 | Insider trading shows a mixed picture with some recent purchases by a director, which may indicate confidence in the company, while several higher-level executives have sold shares at prices exceeding current levels. The company has strong margins, but concerns over consumer spending and inflation might pressure growth. The broader sector faces challenges from changing consumer habits and competition. Additionally, macroeconomic factors like rising interest rates may further dampen growth potential. The lack of recent significant earnings releases limits predictive accuracy, hence a cautious 'neutral' outlook with moderate confidence. | Consumer Cyclical | Restaurants |

| TBRG | DOWN | 0.60 | Recent insider purchases by Pinetree Capital Ltd. and L6 Holdings Inc. suggest some confidence in the stock, but the pattern of sales by executives like Christopher Fowler indicates potential leadership concerns or profit-taking. Additionally, the stock's previous trading range suggests it is experiencing volatility. Without up-to-date company fundamentals or macroeconomic conditions, such as earnings reports or changes in interest rates, the overall outlook remains uncertain. Thus, while insider activity is positive, broader indicators are weak, leading to a cautious downward direction. | Healthcare | Health Information Services |

| RGP | NEUTRAL | 0.60 | Recent insider purchases, particularly by directors, suggest some confidence in RGP's prospects, despite a mixed history of insider sales. The company's stock price has seen a decline from earlier highs, indicating potential challenges. Without current fundamental data on earnings trends or sector health, it's difficult to predict future performance confidently. Macroeconomic factors like rising interest rates and inflation may also pressure the stock. Thus, while insider activity is positive, overall market conditions warrant a cautious outlook. | Industrials | Consulting Services |

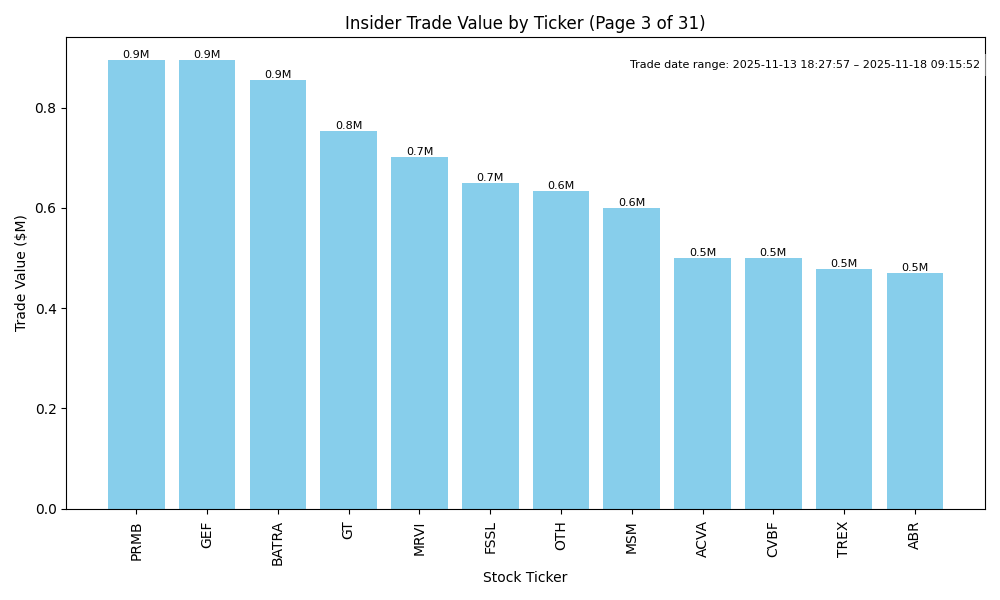

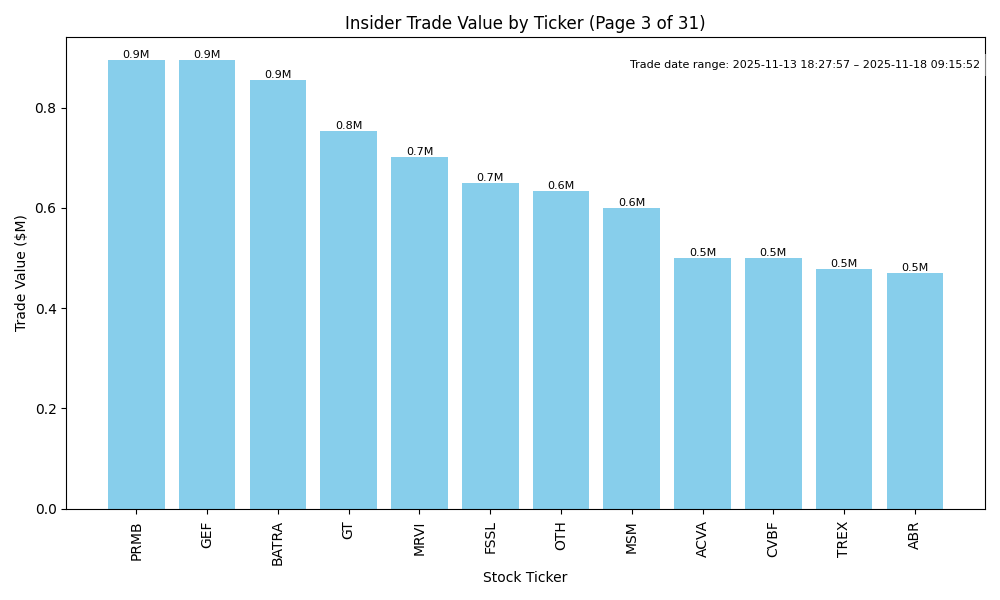

| PRMB | DOWN | 0.65 | Recent insider purchases suggest management confidence; however, significant past sell-offs by major insiders, including substantial sales earlier this year at much higher prices, indicate a negative sentiment. This tension between insider buying and historical selling, coupled with no available data on recent earnings, margins, or industry dynamics, leads to a cautious outlook. Potential macroeconomic pressures also introduce uncertainty. Overall, while management's recent confidence is evident, strong selling and lack of clear company fundamentals temper enthusiasm. | Consumer Defensive | Beverages - Non-Alcoholic |

| MRVI | DOWN | 0.70 | The recent insider purchase by CEO Bernd Brust indicates confidence in the company, but the overall insider trading activity reflects tension. Notably, significant insider sales occurred, including a large transaction by Gtcr Investment Xi LLC. Fundamentals should be scrutinized as the stock has decreased significantly in value from past prices, suggesting potential struggles. Lack of recent positive developments and broader economic uncertainties, such as interest rate pressures and market conditions, might indicate challenges ahead. The degree of insider buying is insufficient to outweigh the negative sentiment from major sell-offs and market weakness. | Healthcare | Biotechnology |

| GLXY | DOWN | 0.70 | Recent insider sales, especially by top executives like the CEO and the President, significantly outweigh the recent purchases. The scale of these sales suggests a lack of confidence in the stock’s near-term outlook. While recent purchases by a director indicate some positive sentiment, they are insufficient to counteract the broader trend of insider selling. Furthermore, insights into company fundamentals, such as current earnings trends and industry context, would be vital for a more nuanced analysis, but the dominant insider activity signals caution. | Financial Services | Capital Markets |

| OTH | UP | 0.70 | Recent insider purchases, notably by the CEO and another director, suggest strong confidence in the company's future at current stock levels. However, without recent earnings data or macroeconomic context, such as inflationary pressures and interest rates, the overall market environment remains uncertain. While insider buying can indicate potential price appreciation, investor sentiment and external economic factors could influence stock behavior adversely, leading to caution in overall confidence. | Consumer Cyclical | Auto & Truck Dealerships |

| MSM | NEUTRAL | 0.60 | Recent insider buying activity, particularly by Mitchell Jacobson and Philip Peller, may indicate confidence in MSM's future. However, this is tempered by a history of significant insider selling, suggesting potential concerns about the stock price sustainability. Without detailed fundamental data on earnings, margins, and growth rates, as well as broader market conditions like interest rates and inflation, confidence in a clear direction is limited. The inconclusive nature of these indicators leads to a neutral stance. | Industrials | Industrial Distribution |

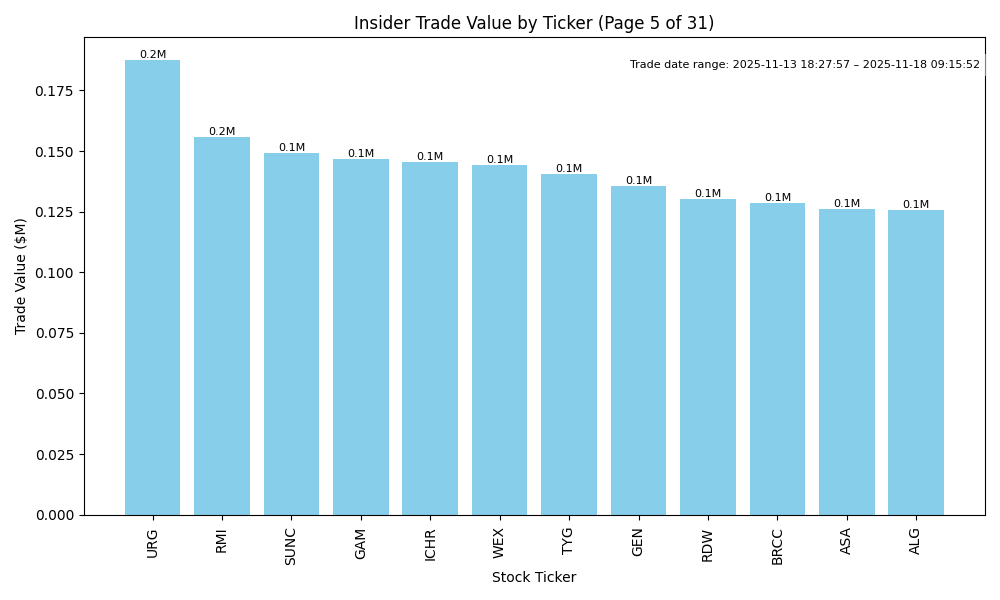

| GAM | UP | 0.75 | Recent insider buying by Chairman Spencer, consistently at prices around $24.98 to $25.00, strongly indicates management confidence in the company's value. The concentration of purchases from insiders, particularly during a period with no significant declines in prices, reinforces this bullish sentiment. However, without detailed company fundamentals, such as earnings trends or leverage levels, my assessment lacks completeness. Additionally, macroeconomic factors like interest rates and inflation trends could impact investor sentiment. Overall, the insider buying gives a strong buy signal, although fundamental gaps reduce my confidence. | Financial Services | Asset Management |

| OGN | UP | 0.75 | Recent insider purchases, particularly from top executives, indicate strong confidence in the company's future, with significant transactions occurring at varying prices suggesting a positive sentiment. Despite the overall market environment and potential external headwinds, the concentration of insider buying (directors and executives) may signal underlying confidence in the company's performance. However, potential gaps in the company’s fundamental performance metrics such as earnings trends, growth potential, and current market conditions warrant cautious optimism rather than strong conviction. | Healthcare | Drug Manufacturers - General |

| ACVA | DOWN | 0.75 | Recent insider buying from directors (Hirsch and Goodman) is a positive signal; however, it is tempered by a significant history of insider selling, especially at higher price points. The substantial sales by executives like the CEO and CFO indicate a lack of confidence in the stock's near-term outlook. Additionally, macroeconomic conditions such as rising interest rates and inflation could pressure growth sectors. Without up-to-date financial data on earnings trends and any recent material developments, there is heightened uncertainty, leading to a lower confidence level for a bullish outlook. | Consumer Cyclical | Auto & Truck Dealerships |

| CVBF | NEUTRAL | 0.65 | Recent insider purchases by George Borba suggest confidence in the stock, with significant buys at lower prices. However, there are concurrent insider sales indicating some level of profit-taking. Fundamentals, including earnings and growth potential, were not addressed in the provided summary, leaving uncertainty regarding their health. Additionally, the macroeconomic environment remains challenging with potential impacts on credit conditions and interest rates. Overall, the mixed signals from insider trading, absence of updated financials, and macroeconomic pressures lead to a neutral outlook. | Financial Services | Banks - Regional |