| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

| BETA | UP | 0.75 | Significant insider buying on November 7 reflects strong confidence among management, particularly the purchase of over 2.9 million shares by a director at an average price of $32.98. This concentration of insider purchases suggests a positive outlook despite potential missing financial data on earnings trends and macroeconomic factors. It’s crucial to monitor external conditions, such as inflation and interest rates, which could impact performance. The overall trend in insider activity leans bullish, raising expectations for the stock's near-term direction. | Industrials | Aerospace & Defense |

| GRX.G | UP | 0.75 | Recent insider purchases, particularly a significant acquisition by Gabelli Mario J of 1.8 million shares at $10.18, indicate strong insider confidence. The purchasing trend is consistent, with multiple smaller purchases by Saba Capital Management, suggesting growing confidence in the stock. However, without specific data on the company's fundamentals, growth potential, and macroeconomic conditions, the analysis carries some uncertainty. The market's macro environment, including interest rates and inflation, also remains an important factor but is not fully detailed here, impacting overall conviction. | N/A | N/A |

| MNRO | DOWN | 0.60 | While insider purchases by notable figures like Carl Icahn indicate potential confidence in MNRO, the average buying price of $17.38 and $15.19 suggests a weaker outlook, especially compared to the CEO's earlier purchase at $32.30. Overall, if recent fundamentals are not provided, such as earnings trends or industry health, and given current macroeconomic pressures like rising interest rates and inflation, the market may not react positively to insider activity alone. Without holistic improvements in fundamentals or macro conditions, there is a likelihood of downward pressure. | Consumer Cyclical | Auto Parts |

| CNS | UP | 0.75 | Recent insider buying by the Executive COB indicates strong confidence, especially with significant transactions occurring at prices lower than previous sales. While previous sales by different executives suggest some insider caution, the high volume of recent purchases amidst a declining price trend adds positive sentiment. However, without detailed current company fundamentals and market conditions, such as earnings and growth forecasts, confidence in this upward direction is moderately reduced. | Financial Services | Asset Management |

| CEPV | UP | 0.60 | Insider buying from a significant stakeholder suggests positive sentiment about the company's prospects. The purchase of 540,000 shares at $10 each indicates a strong belief in the stock's valuation. However, to fully assess directionality, additional information on company fundamentals, earnings trends, and macroeconomic conditions is necessary. Without broader data on sector health and economic indicators, confidence in a sustained upward trend is moderate. | Financial Services | Shell Companies |

| GTE | NEUTRAL | 0.60 | Recent insider activity shows strong purchasing by Equinox Partners, suggesting bullish sentiment, particularly with a significant purchase of 648,000 shares at $3.94. However, this contrasts with historical insider selling at higher prices, indicating mixed perspectives. Company fundamentals appear to be lacking clarity as there are no recent earnings releases or guidance provided in the data. Additionally, broader economic conditions, including inflation and interest rates, may introduce volatility. Without more solid fundamentals to support the insider buying, I maintain a neutral outlook. | Energy | Oil & Gas E&P |

| RLMD | UP | 0.75 | Recent insider purchases by high-ranking executives, including the CEO, CFO, and COO, totaling over $2 million at an average price of $2.20 suggest strong internal confidence in the company's future. This concentrated insider activity indicates optimism. However, without recent earnings data or sector-specific performance details, there is some uncertainty. Overall market conditions are mixed, indicating a modestly favorable outlook despite potential macroeconomic headwinds, leading to a 'UP' projection with moderate confidence. | Healthcare | Biotechnology |

| BX | NEUTRAL | 0.60 | Recent insider activity shows a mixed picture; while Director Breyer James has made significant purchases, other insiders, notably Baratta Joseph, have sold large quantities of stock recently. This divergence could indicate differing perspectives on the company's future. Additionally, while the company may have robust fundamentals given its recent earnings trends, specifics on margins and leverage are lacking. The broader market context remains uncertain with potential challenges in the macroeconomic environment including interest rate fluctuations and inflation concerns, which may impact investor sentiment. Therefore, a more cautious outlook appears warranted. | Financial Services | Asset Management |

| XZO | UP | 0.80 | Recent insider purchases indicate strong confidence from management and directors, with significant total purchases averaging $21 per share. The concentration of purchases from high-level insiders, including the CEO, suggests they believe in the company's prospects. However, without recent earnings performance data, macroeconomic conditions, or insights into the company's fundamentals or industry standing, the analysis carries some uncertainty. Despite this, the bullish insider sentiment supports a likely upward trajectory for the stock. | Financial Services | Insurance - Diversified |

| OHI | UP | 0.75 | Recent purchases by significant insiders, including the CEO and Chief Investment Officer, indicate strong internal confidence in the company's outlook. While previous sales from other insiders raise some concerns, the magnitude of the recent purchases may suggest improved sentiment. Company fundamentals, however, should be closely monitored as no current earnings trends or growth projections were provided in the summary. Additionally, the overall healthcare REIT sector can be sensitive to macroeconomic factors such as interest rates and economic conditions, which require further analysis. Hence, while there's insider optimism, economic uncertainties warrant a cautious approach. | Real Estate | REIT - Healthcare Facilities |

| ASST | DOWN | 0.70 | Recent insider trading indicates a strong negative sentiment with multiple sales from key executives, including high-volume transactions. The most recent insider purchase was substantial, but it may not outweigh the strong selling pressure observed over the past year, particularly in light of the significant reduction of stock price from above $80 to the single digits. Further, without detailed information on the company’s earnings trends or recent shifts in growth potential, overall sentiment appears weak, and macroeconomic headwinds are also present, which makes it likely that the stock could face downward pressure in the near term. | Financial Services | Asset Management |

| LNG | DOWN | 0.60 | Recent insider transactions show a mixed sentiment, with significant selling from multiple directors and executives earlier this year, although a recent buy from a director could indicate some confidence. The company fundamentals are unclear based on the provided data, but the presence of notable sales raises concerns about potential internal outlooks. Furthermore, without insight into earnings trends and broader macroeconomic conditions like interest rates and inflation, caution is warranted. The conflicting signals from insider behavior suggest a cautious short-term outlook. | Energy | Oil & Gas Midstream |

| ASA | UP | 0.75 | Insider trading by Saba Capital Management shows consistent buying activity, indicating strong conviction about the company's future. There are significant purchases, particularly in the recent weeks, and most transaction prices are higher than previous levels, suggesting a positive sentiment. While specific company fundamentals and macroeconomic factors are not provided, the growth in insider ownership coupled with ongoing buying pressure suggests potential bullish momentum. However, without current financial metrics, there is uncertainty in overall company performance. | Financial Services | Asset Management |

| NCLH | DOWN | 0.60 | Recent insider purchases indicate some confidence from key executives, particularly at lower price levels, which may suggest undervaluation or future optimism. However, significant insider sales in the past year, including large transactions at higher prices, raise concerns about their long-term outlook. Furthermore, the overall macroeconomic environment, characterized by high inflation and rising interest rates, could negatively impact consumer discretionary spending, particularly in the travel and leisure sectors. This tension, alongside potential scrutiny on the cruise industry and past earnings trends, leads to a cautiously bearish outlook. | Consumer Cyclical | Travel Services |

| OSPN | UP | 0.75 | Recent insider purchases, particularly by directors, indicate a positive outlook from those with intimate company knowledge. Directors Zenner and McConnell have made significant purchases at prices below the current market, suggesting they see value despite past sales. However, the mixed signals from previous insider sales raise some caution. Without further details on the company's fundamentals, industry positioning, and broader macroeconomic conditions, confidence is somewhat limited. Overall, the recent insider activity leans toward increased stock price, but external factors must be monitored. | Technology | Software - Infrastructure |

| AVO | DOWN | 0.70 | Recent insider transactions show significant selling pressure, particularly by high-level executives and major shareholders, with substantial share volume sold at prices above the current trading level. Although there was a recent purchase by Globalharvest Holdings, the overall pattern points toward profit-taking and pessimism among insiders. Furthermore, critical company fundamentals and macroeconomic conditions remain unspecified, creating uncertainty. If margins and leverage are under pressure or if the market environment is unfavorable (e.g., high interest rates), it could exacerbate downward pressure. Thus, while the recent purchase slightly supports a more bullish outlook, the dominant selling activity leads to a bearish near-term forecast. | Consumer Defensive | Food Distribution |

| NSC | UP | 0.75 | Recent insider purchases indicate strong confidence among directors, particularly with significant buys by directors like Fahmy Sameh and Anderson Richard H at higher prices. While there has been some selling activity from former executives, the trend of recent acquisitions suggests optimistic sentiment about NSC's near-term outlook. However, clarity on current fundamentals such as earnings performance and macroeconomic conditions remains limited, as well as the impact of inflation and interest rates on the industrial sector. This supportive insider activity bolsters a bullish near-term view despite potential broader market headwinds. | Industrials | Railroads |

| NBTB | NEUTRAL | 0.60 | Recent insider buying, particularly by director Timothy Delaney, suggests some positive sentiment towards the stock, with notable purchases at prices lower than recent trading values. However, historical sales from multiple insiders indicate selling pressure, suggesting a lack of confidence in sustained price appreciation. Additionally, without current data on fundamentals such as earnings trends or industry dynamics, the overall outlook remains uncertain. The stock’s ability to maintain its price in the face of significant insider selling combined with the broader economic conditions necessitates caution. | Financial Services | Banks - Regional |

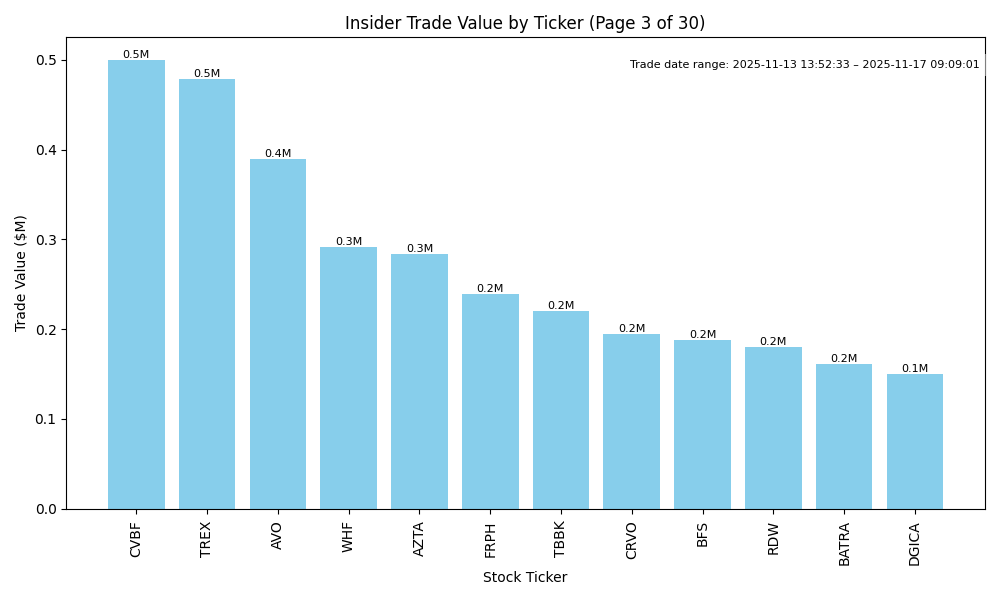

| DGICA | UP | 0.70 | Recent insider activity shows significant buying, particularly by Donegal Mutual Insurance Co., which holds a 10% stake. This indicates strong insider confidence despite some selling, including notable sales by directors and SVPs, which may reflect personal finance reasons rather than a lack of confidence in the company. Company fundamentals are not detailed, but the concentration of purchases suggests potential undervaluation or expected positive developments. The insurer sector is currently gaining attention due to favorable pricing and demand dynamics. However, specific financial metrics and macroeconomic conditions are required for improved conviction. | Financial Services | Insurance - Property & Casualty |

| NCDL | UP | 0.70 | The recent insider trading activity indicates significant confidence from key executives, especially the CEO and CFO, who have made substantial purchases at higher prices over time. This trend suggests they believe the stock is undervalued. However, the fundamental financial context, including not provided earnings trends and macroeconomic factors such as interest rates and inflation, is uncertain. Additionally, while insider buying is often a bullish signal, without clear evidence of strong company fundamentals and market conditions, confidence is moderated. | Financial Services | Asset Management |

| MTDR | DOWN | 0.60 | Recent insider trading shows a strong pattern of purchases by multiple executives, which typically signals confidence in the company's future. However, these purchases are occurring at prices significantly above current values, suggesting potential negative sentiment. Additionally, without comprehensive information on company fundamentals, industry trends, and broader economic factors, the overall market dynamics pose significant risks. The substantial leverage from insiders may clash with broader market weaknesses, leading to uncertainty about near-term performance. | Energy | Oil & Gas E&P |

| CMPR | DOWN | 0.70 | There is a concerning trend of insider selling at CMPR, particularly by key executives at high prices, coupled with a recent purchase from the CFO. The ratio of shares sold far exceeds purchases, indicating potential lack of confidence in the stock's near-term performance. Additionally, without specifics on current earnings trends, margins, and growth potential, the analysis is incomplete. Macroeconomic conditions also appear challenging, with rising rates likely impacting consumer sentiment and spending. Given these factors, I assess that CMPR is likely to trend downward in the near term. | Industrials | Specialty Business Services |

| EXP | DOWN | 0.70 | The recent insider trading activity shows significant selling by multiple executives, including large recent sales by the CFO and CEO, which raises concerns about insider sentiment. Although there have been purchases, they are relatively minor compared to the large volume of shares sold. Additionally, the downward trend in stock price since early 2024 suggests weakened market confidence. Without detailed insights into earnings trends or macroeconomic influences, the overall indicators point towards negative sentiment for EXP in the near term. | Basic Materials | Building Materials |

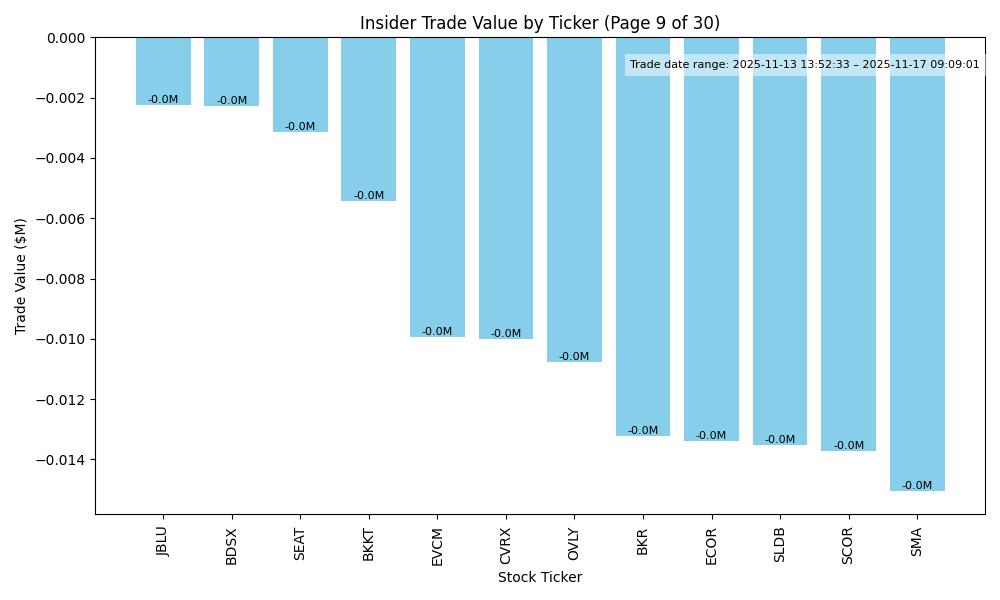

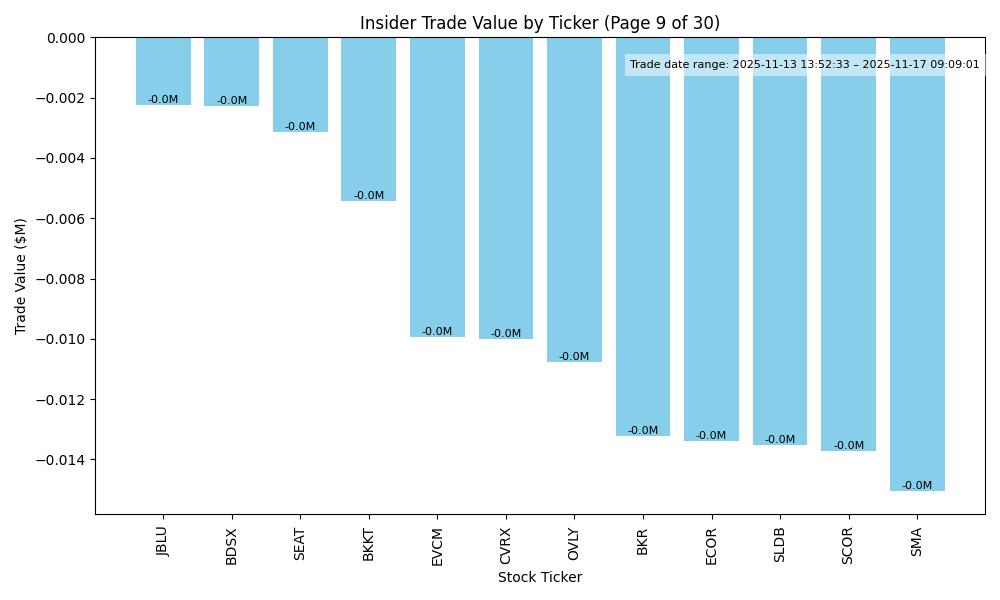

| JBLU | NEUTRAL | 0.60 | Recent insider purchases by directors suggest some bullish sentiment, particularly with Peter Boneparth acquiring 50,000 shares at $4.12 after a significant purchase by Nik Mittal. However, the CFO's recent sale of 15,000 shares at $7.50 indicates a mixed outlook. The stock price has declined, possibly reflecting challenges in fundamentals, such as demand in the airline sector and rising operational costs amid macroeconomic pressures like inflation and interest rates. While institutional support may be present, concerns around earnings trends and competitive positioning dilute the outlook, leading to a neutral assessment. | Industrials | Airlines |

| AMRZ | UP | 0.75 | Recent insider purchases demonstrate strong confidence from multiple key executives, notably the CEO acquiring a substantial number of shares at sizes indicative of conviction. The stock has shown historical buying at lower prices, suggesting insiders believe current valuation presents a buying opportunity. However, without recent earnings data or insights on company fundamentals, such as margins and leverage, confidence in sustained growth remains moderate. The broader market context remains mixed with macro uncertainty, but insider sentiment points to potential bullish momentum in the near term. | Basic Materials | Building Materials |