| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

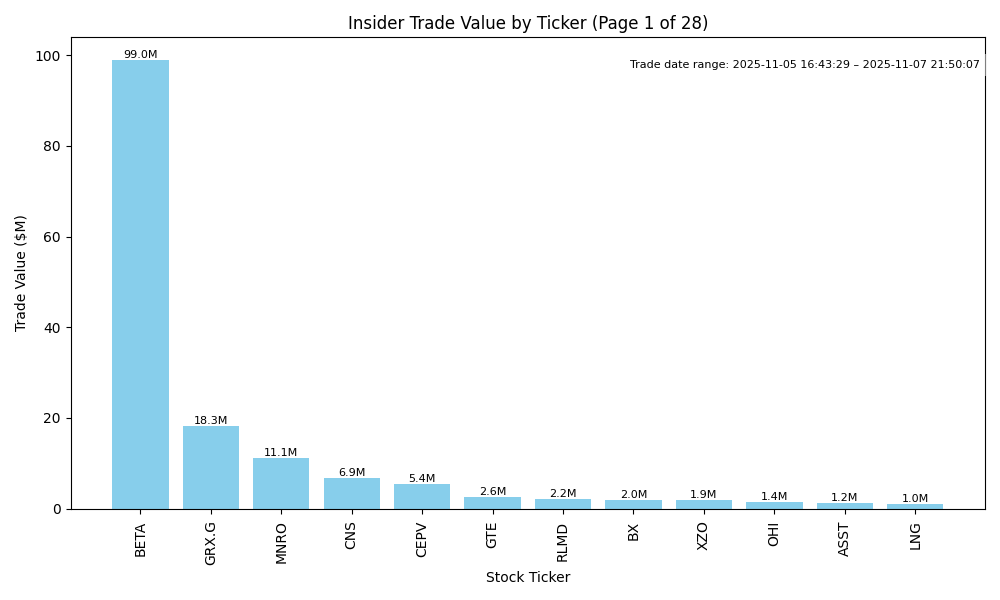

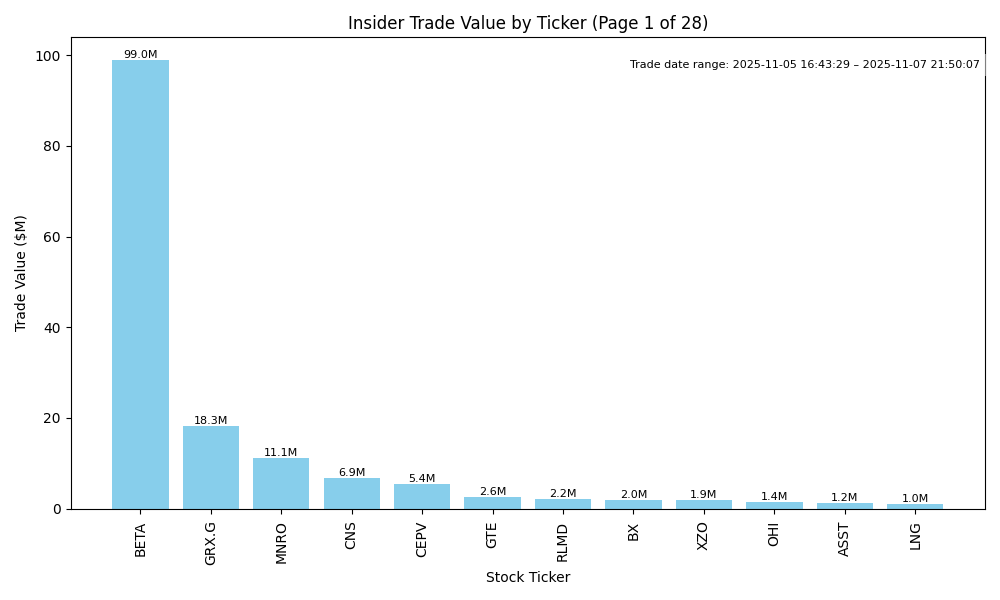

| BETA | UP | 0.70 | Insider buying activity is significant, led by the Director purchasing over 2.9 million shares at a relatively high average price. This suggests strong confidence in the company’s future prospects. However, further evaluation of company fundamentals, such as earnings trends and growth potential, is necessary and currently lacks detail. Additionally, without insight into industry positioning and macroeconomic factors, confidence in this analysis is somewhat tempered. | Industrials | Aerospace & Defense |

| GRX.G | UP | 0.80 | Insider buying has been substantial, particularly a significant purchase by Gabelli Mario J of 1.8 million shares at $10.18, indicating confidence in the stock. The consistent purchasing activity by Saba Capital Management also suggests strong belief in the company's prospects. However, without detailed company fundamentals, such as earnings trends, margins, and growth potential, the overall confidence is slightly diminished. The insights into industry and macroeconomic conditions are also not provided, which lowers confidence further. Despite this, the concentration and magnitude of recent insider purchases strongly point towards a likely upward movement in the stock's near-term direction. | N/A | N/A |

| MNRO | UP | 0.75 | Recent insider purchases by significant stakeholders, particularly Carl Icahn, indicate strong belief in MNRO's potential upside. His acquisition of over 1.2 million shares at varied prices suggests he sees value at current levels. However, the company's fundamentals, including the lack of recent earnings releases and specific leverage metrics, are unclear, limiting a full assessment. While insider activity is bullish, broader macroeconomic factors, such as interest rates and inflation dynamics, could still impact performance. Overall, given the strong insider buy signals and assuming no significant negative macro updates, a bullish outlook is warranted. | Consumer Cyclical | Auto Parts |

| CNS | NEUTRAL | 0.60 | Recent insider purchases by the Exec COB indicate a positive outlook from management, especially with significant transactions at lower price points compared to prior sales. However, there is also considerable insider selling that raises concerns about potential overvaluation and liquidity issues. Without additional information on the company's fundamentals, such as earnings trends, growth potential, or macroeconomic influence, reaching a definitive conclusion is difficult. Overall, the conflicting signals from insider activity and the lack of further context lead to a cautious outlook. | Financial Services | Asset Management |

| CEPV | UP | 0.75 | Insider buying by Cantor Ep Holdings V, LLC, acquiring 540,000 shares at $10 each, suggests positive sentiment and confidence in the company's future. While this suggests bullish sentiment, a comprehensive analysis of the company's fundamentals, growth potential, and current market conditions is necessary. However, without details on earnings trends, margins, or macroeconomic context, confidence in a sustained upward movement is somewhat limited. Overall, the insider purchase is a positive signal but should be weighed against other potential risks. | Financial Services | Shell Companies |

| GTE | NEUTRAL | 0.60 | Insider trading reflects mixed signals: a significant purchase by Equinox Partners (648,000 shares) suggests confidence in the company, while multiple smaller sales by directors raise concerns. The stock price has seen volatility, with recent purchases at lower prices ($3.94 to $4.86) amidst earlier sales at higher prices ($6.17 to $6.99). Company's fundamentals and market context remain unclear from the provided data, and external macroeconomic factors such as interest rates or credit conditions are not addressed. Hence, confidence in a clear direction is moderate. | Energy | Oil & Gas E&P |

| RLMD | UP | 0.75 | Recent insider buying by key executives, including the CFO, CEO, and COO, reflects strong confidence in the company's outlook, with substantial purchases at an average price of $2.20. The total insider purchases are notable, suggesting a belief in upside potential. However, the stock has fluctuated between lower prices and a 2024 peak above $3, indicating volatility and potential uncertainty. To strengthen this analysis, further insights into the company's earnings trends, sector performance, and macroeconomic conditions are needed, but the current insider actions lean positively. | Healthcare | Biotechnology |

| BX | DOWN | 0.70 | Recent insider activity shows a significant pattern of selling, particularly by directors, which typically indicates a lack of confidence in near-term performance. The sales outweigh recent purchases, suggesting insiders may believe shares are overvalued. Furthermore, there is a lack of recent fundamental data regarding earnings trends and company growth potential, which reduces conviction. Current macroeconomic conditions, including uncertainty around interest rates and inflation, may negatively impact market sentiment. Overall, while there are some recent purchases, the prevailing trend of insider selling coupled with economic uncertainty points to a downward direction for BX stock. | Financial Services | Asset Management |

| XZO | UP | 0.80 | Insiders have made substantial purchases, totaling over $2 million in just one day, indicating strong confidence in the company's prospects. However, without detailed insight into the company's fundamentals, such as earnings trends and macroeconomic factors, confidence is tempered. If the company's financial health is stable and aligns with positive insider sentiment, the stock's near-term direction may be up. The recent activity could signal bullish sentiment, though it's essential to monitor broader economic conditions that might impact performance. | Financial Services | Insurance - Diversified |

| OHI | NEUTRAL | 0.60 | Recent insider purchases by key executives, including the CIO and CEO, suggest insider confidence in OHI's prospects at current valuations. However, the past selling by senior management raises concerns about possible negative sentiment towards the company’s performance. Additionally, there are no recent material developments or earnings reports provided, which creates uncertainty about the company's financial health and growth potential. Without further context on fundamentals and market conditions, the outlook remains ambiguous. | Real Estate | REIT - Healthcare Facilities |

| ASST | DOWN | 0.70 | The recent insider activity reveals a significant trend of selling, especially by key executives including the CEO and CFO. Notably, substantial shares were sold at much lower prices compared to recent purchases, indicating a loss of confidence from insiders. The single purchase indicated might suggest a partial positive sentiment but is overwhelmed by the overall selling pressure. Furthermore, past sales at much lower prices (around $1.84) during a period of concentrated selling suggest concerns about the company's fundamentals. Without additional context on earnings trends, margins, or macro factors influencing the sector, the general sentiment appears bearish for the near term. | Financial Services | Asset Management |

| LNG | DOWN | 0.65 | There is mixed insider trading activity with a significant recent purchase by a director on November 5, 2025, suggesting some confidence in value at lower prices. However, there have been substantial insider sales earlier this year, indicating possible concerns about stock overvaluation. Company fundamentals, including earnings trends and growth potential, have not been provided, creating uncertainty. Additionally, sentiment in the industry is affected by broader macroeconomic conditions, which may include rising interest rates impacting capital costs. These conflicting signals lead to a cautious outlook for LNG in the near term. | Energy | Oil & Gas Midstream |

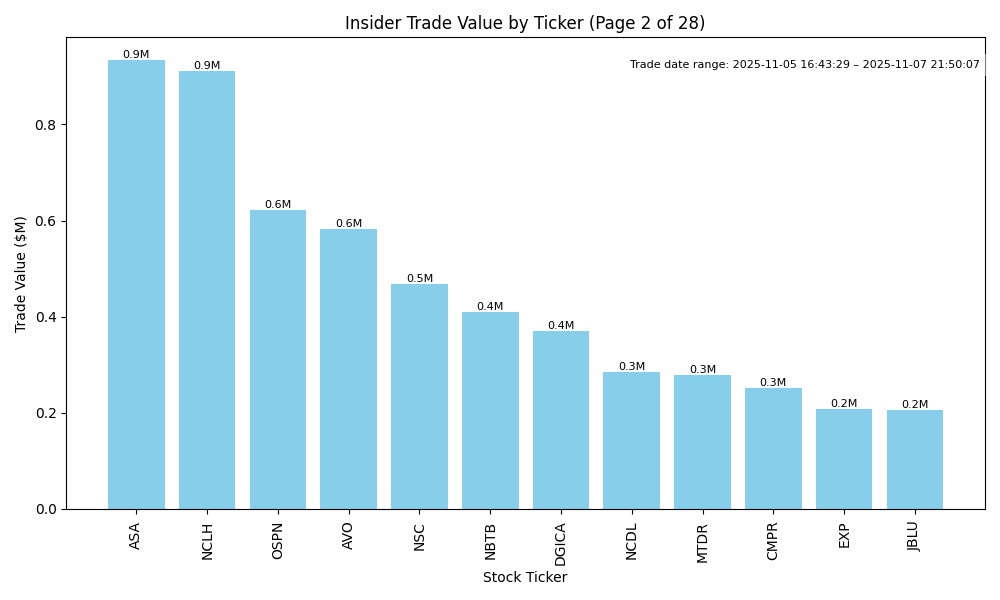

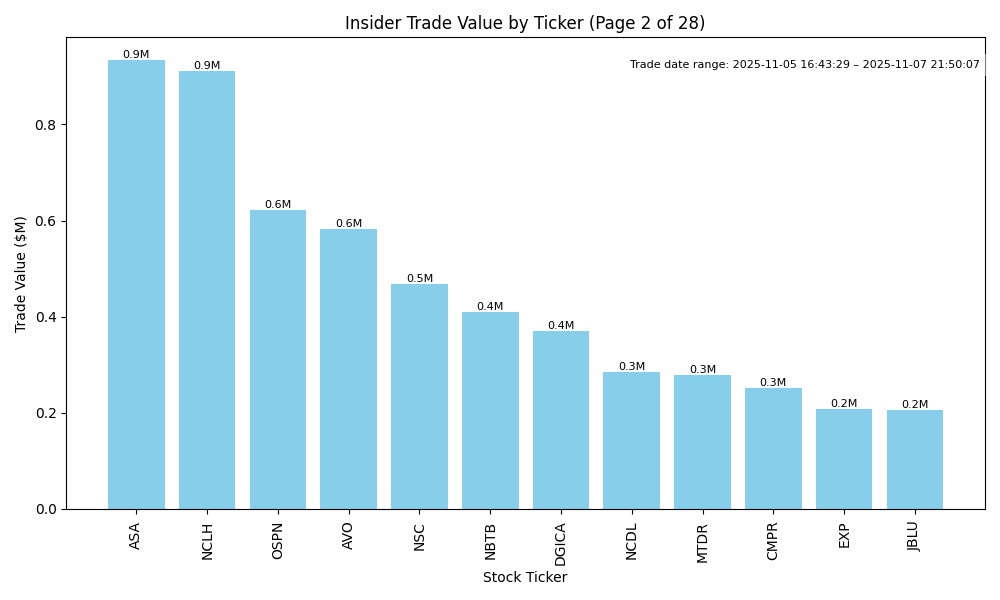

| ASA | UP | 0.80 | Insider purchases have surged significantly, with Saba Capital Management making consistent, large transactions over the past month, indicating strong confidence in ASA's future. While fundamentals such as margins and leverage are not detailed here, the aggressive buying suggests that insiders believe in potential growth or recovery. Additionally, macroeconomic context regarding interest rates and inflation may be favorable, as lower rates encourage investment. However, ongoing monitoring of company and industry fundamentals is essential to assess the full picture, which slightly lowers overall confidence. | Financial Services | Asset Management |

| NCLH | DOWN | 0.70 | Recent insider purchases by senior executives suggest some confidence in NCLH's prospects, especially as they buy at lower prices than previous sales. However, substantial insider selling over the past year indicates potential cashing out or dissatisfaction with share performance. Fundamental data is lacking on earnings trends and growth potential beyond the recent trades. The CCL (Carnival Corporation & plc) and RCL (Royal Caribbean Group) trajectory highlights sector struggles in travel and leisure post-pandemic, exacerbated by macroeconomic pressures like inflation and interest rates. These factors lead to a cautious outlook while still acknowledging insider buying interest. | Consumer Cyclical | Travel Services |

| OSPN | NEUTRAL | 0.60 | Recent insider purchases by directors suggest confidence in the company's future, particularly by McConnell, who bought 50,000 shares at an average price of $11.96. However, the previous sale of 53,000 shares at $18.51 raises concerns about timing and potential underlying issues. Company fundamentals and broader market conditions, including inflation and interest rates, remain unclear. Without clarity on earnings performance and industry trends, the overall outlook remains uncertain. | Technology | Software - Infrastructure |

| AVO | DOWN | 0.70 | Insider activity shows a concerning pattern, with significant sales concentrated among key insiders, particularly the CFO and directors, indicating a lack of confidence in the stock's near-term prospects. Although there was a noteworthy purchase by Globalharvest Holdings, it's overshadowed by the large volume of shares sold recently. Without recent positive developments or improved company fundamentals to support the stock—like strong earnings or growth in a competitive environment—the predominance of insider selling signals bearish sentiment. Given the mixed macroeconomic context, especially around inflation and possible rising interest rates, these factors further bolster a bearish outlook. | Consumer Defensive | Food Distribution |

| NSC | UP | 0.75 | Recent insider purchases, particularly by directors and executives, indicate growing confidence in NSC's performance. The latest purchases are at higher price points compared to earlier transactions, suggesting bullish sentiment. However, it would be crucial to examine the company's current earnings trends, leverage, and market conditions to provide a more comprehensive forecast. The broader economic landscape, including interest rates and inflation, may influence the stock’s trajectory but the insider activity is strongly positive. Gaps in macroeconomic data and current financial metrics reduce confidence slightly. | Industrials | Railroads |

| NBTB | NEUTRAL | 0.60 | Recent insider purchases indicate some confidence from management, particularly with Timothy E. Delaney buying significant shares at lower prices. However, there's a history of larger insider sales, especially in the past year, suggesting potential skepticism about the stock's outlook. Company fundamentals and macroeconomic context appear weak, with many recent sales at higher prices. Without clearer company financials or recent performance trends, the mixed signals lead to a cautious stance. | Financial Services | Banks - Regional |

| DGICA | UP | 0.70 | Recent insider purchases, particularly from Donegal Mutual Insurance Co (holding 10%), indicate strong insider confidence despite some sales by directors. The consistent purchasing pattern over the past months, averaging between $15 and $20, suggests they believe the stock is undervalued or has growth potential. Furthermore, the broader insurance sector is generally stable, though external factors like rising interest rates could impact growth. However, without specific earnings or guidance data, uncertainty remains high, leading to moderate confidence in an upward direction. | Financial Services | Insurance - Property & Casualty |

| NCDL | DOWN | 0.70 | Insider buying has been prominent, particularly from key executives like the CEO and CFO, which typically suggests confidence in the company's future. However, a recent decline in average purchase prices indicates a deteriorating stock price trend, with the latest insider purchases occurring at lower price points. This, combined with a lack of detailed information on company fundamentals, industry conditions, and macroeconomic factors, suggests a potential downward pressure on the stock's short-term performance despite insider optimism. | Financial Services | Asset Management |

| MTDR | UP | 0.80 | Recent insider purchasing activity indicates strong confidence among management and directors, with multiple significant purchases at various price points. Notably, the CEO purchased over $430,000 worth recently, suggesting a positive outlook on the company's future. However, while insider sentiment is bullish, I lack information on current company fundamentals such as earnings, cash flow, and macroeconomic conditions (interest rates, inflation) which may affect stock performance. Despite these gaps, the concentrated and high-value insider purchases provide a strong bullish signal, enhancing my confidence in an upward direction for MTDR. | Energy | Oil & Gas E&P |

| CMPR | DOWN | 0.70 | Insider trading reveals a notable pattern of selling, particularly by high-ranking officials, including significant sales by the CEO and other executives totaling millions. Despite some purchasing by the CFO, the volume of sales indicates a lack of confidence among insiders. From a fundamental perspective, while there are no specifics provided about earnings or growth trends, the overall trend suggests weakened momentum. Moreover, broader macroeconomic conditions, including rising inflation and interest rates, may pressure stock valuations in the sector. Collectively, these factors lean towards a bearish near-term outlook. | Industrials | Specialty Business Services |

| EXP | DOWN | 0.70 | Insider selling has been substantial, particularly from top executives, indicating potential concerns about the company's future performance. While there were some insider purchases, they are minimal compared to the volume of shares sold. The recent trend shows a price decline, with sales occurring at significantly higher prices than recent purchases. Critical company fundamentals such as earnings growth, margins, and leverage are not provided, but high insider selling suggests a negative outlook. Additionally, ongoing macroeconomic pressures, such as rising interest rates, could further dampen performance expectations for the company. | Basic Materials | Building Materials |

| JBLU | NEUTRAL | 0.60 | Insider activity shows a mix of buying and selling. Recent purchases by executives, particularly a director who bought 50,000 shares at $4.12, suggest some confidence in the stock at a lower price point. However, the CFO's recent sale of 15,000 shares at $7.50 raises concerns about the stock's near-term outlook. On the fundamental side, further analysis is needed regarding JBLU's earnings trends and leverage, as well as the broader macroeconomic conditions such as interest rates and inflation, to determine the potential for long-term growth versus short-term volatility, but the mixed signals limit strong conviction in direction. | Industrials | Airlines |

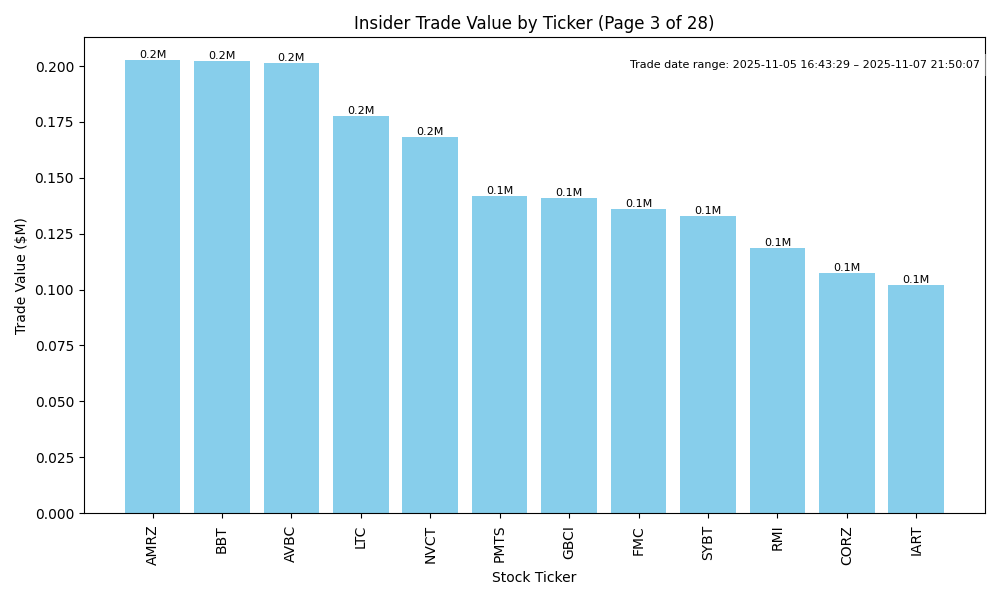

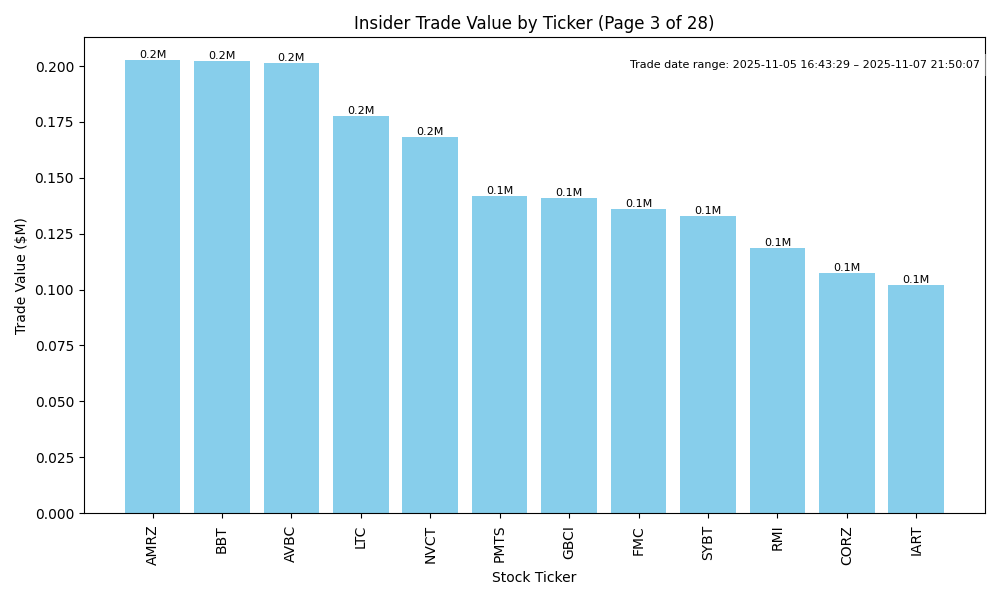

| AMRZ | UP | 0.70 | Recent insider buying across multiple executives, including large purchases by the CEO and CTO, suggests confidence in the company's future prospects. This activity is concentrated and involves significant investments, indicating strong insider sentiment. However, without specific recent earnings reports or detailed company fundamentals available for evaluation, the overall confidence is moderate. If AMRZ's operational performance aligns positively with insider sentiment and the broader industry outlook, the stock may trend upward. | Basic Materials | Building Materials |