| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

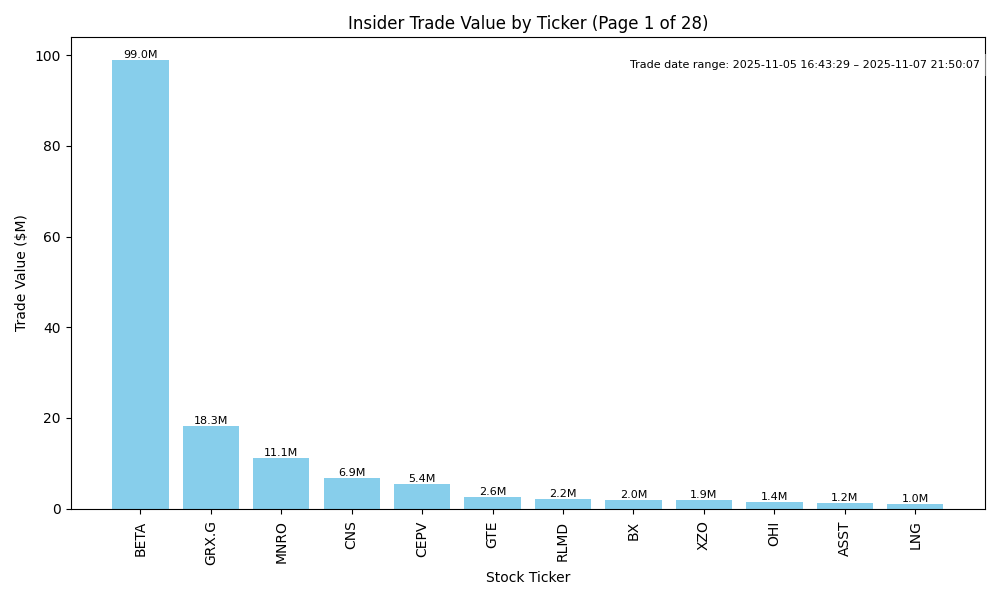

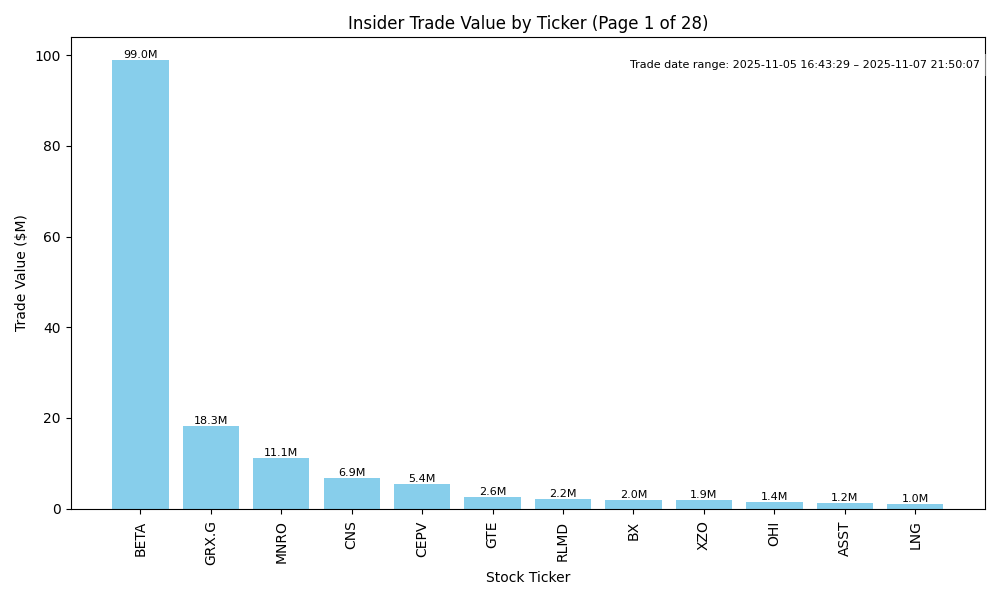

| BETA | UP | 0.75 | Recent insider purchases are substantial, particularly by key executives, indicating strong confidence in the company’s future. The largest transaction by a director involved over 2.9 million shares, suggesting a potentially significant positive outlook. The average purchase price is close to the current trading price, which may indicate undervaluation. However, lacking detailed financial metrics such as earnings trends, margins, and leverage limits the assessment. Additionally, insights into industry conditions and macroeconomic factors are missing, which reduces overall confidence but still points towards a favorable near-term direction due to insider sentiment. | Industrials | Aerospace & Defense |

| GRX.G | UP | 0.75 | Significant insider purchases, particularly by control persons, indicate strong insider confidence in GRX.G's prospects. The recent purchase of 1.8 million shares at an average price of $10.18 suggests a bullish outlook. However, a detailed analysis of company fundamentals is missing, which lowers confidence; earnings trends, leverage, and growth details should be assessed. Additionally, while insider buying is a positive signal, further context from the industry dynamics and macroeconomic factors such as interest rates and inflation could impact the stock's performance. Overall, the mix of substantial insider optimism with some underlying uncertainty in fundamentals leads to a positive outlook tempered by cautious consideration of broader risk factors. | N/A | N/A |

| MNRO | UP | 0.80 | Recent significant insider purchases by Carl Icahn indicate strong confidence in MNRO's valuation, with two large transactions at increasing prices. While the CEO's prior purchase was much smaller and at a higher price point, it adds some positive sentiment. However, understanding of MNRO's fundamentals, including earnings trends and growth potential, is limited, which introduces uncertainty. Additional macroeconomic conditions and industry dynamics are also not provided, but the insider activity suggests a bullish outlook in the near term. | Consumer Cyclical | Auto Parts |

| CNS | UP | 0.70 | Recent insider purchases by Robert Hamilton, the Executive Chairman, totaling over 10 million dollars, indicate strong confidence in the company's outlook, especially given the recent purchase values were lower than prior sales. The significant insider buying contrasts with the past selling activity by other insiders, possibly reflecting a strategic shift. However, without current data on earnings trends or macroeconomic impact, including inflation and interest rates, there's uncertainty in the overall market environment. The mixed nature of sales earlier in the year, combined with the recent bullish insider activity, warrants a moderate positive outlook. | Financial Services | Asset Management |

| CEPV | UP | 0.70 | The recent insider purchase of 540,000 shares by a significant stakeholder indicates confidence in the company's future performance. This transaction suggests potential positive sentiment about the company's fundamentals. However, without detailed insights into the company’s earnings trends, growth potential, and industry dynamics, complete confidence is tempered. The macroeconomic context, including interest rates and inflation, should also be monitored, but the insider's bullish move typically signals an upward near-term direction. | Financial Services | Shell Companies |

| GTE | NEUTRAL | 0.60 | Insider activity shows significant recent purchases from Equinox Partners, indicating positive sentiment. However, this is contrasted by sales from other insiders, including the CEO and a director, suggesting mixed signals. Company fundamentals such as earnings trends and competitive positioning are unclear based on the provided data. Broader macroeconomic conditions are also uncertain, with interest rates and inflation impacting sentiment. Given these mixed signals and the lack of clear fundamental support, the stock's near-term direction remains uncertain. | Energy | Oil & Gas E&P |

| RLMD | UP | 0.75 | Recent insider purchases from multiple key executives, including the CEO and CFO, suggest strong confidence in the company's future prospects. The latest transactions were at an average price of $2.20, showing a collective belief in the stock's undervaluation at this level. However, past performances and trends in earnings, margins, and leverage are not provided, which introduces uncertainty. Additionally, consideration of industry and macroeconomic factors could further influence stock direction. The insiders' aggregate commitment of over $1 million in recent purchases points towards potential upside in the near term. | Healthcare | Biotechnology |

| BX | DOWN | 0.65 | Recent insider trades show a significant uptick in selling, particularly by key directors, with notable sales at higher prices and purchases at lower prices. This selling pressure suggests a lack of confidence among insiders regarding near-term prospects. While recent purchases by some insiders indicate potential optimism, the overall pattern leans bearish due to the high volumes of shares sold. Company fundamentals may be under pressure due to broader macroeconomic factors such as rising interest rates and potential inflation concerns, which could affect company performance. Overall, while there are positive signals, the stronger selling activity and external pressures lead to a downward expectation. | Financial Services | Asset Management |

| XZO | UP | 0.75 | Insider purchases, involving key executives and directors culminating in a total of over $2 million invested at $21/share, indicate strong confidence in the company's future. The concentration of purchases on a single day by multiple insiders can signal a positive outlook. However, without current financial performance metrics, sector performance, or macroeconomic indicators, there's uncertainty regarding the sustainability of this sentiment. Overall, insider optimism combined with the potential for positive corporate developments may suggest a near-term upward direction. | Financial Services | Insurance - Diversified |

| OHI | NEUTRAL | 0.60 | Recent insider buying by the CEO and CIO suggests some confidence in OHI's potential upside, but previous insider selling by key executives raises concerns about their longer-term outlook. Fundamental data such as earnings trends and overall market conditions are unclear, especially regarding any recent developments or industry challenges. Without more context on the company's financial health and the broader macroeconomic conditions, the outlook remains cautiously optimistic but not strongly bullish. | Real Estate | REIT - Healthcare Facilities |

| ASST | DOWN | 0.65 | Recent insider trading shows a concerning trend with multiple higher-level executives, including the CEO and CFO, consistently selling shares, with many transactions around a significantly lower price range (below $3) compared to the recent purchase at $80. While the recent purchase by Vivek Ramaswamy indicates potential optimism, it contrasts sharply with the prior insider sales, which suggest a lack of confidence from other insiders. Additionally, without clear visibility on current earnings, margins, and macroeconomic conditions affecting the sector, the overall sentiment leans negative, resulting in a moderate level of confidence in the stock's downward direction. | Financial Services | Asset Management |

| LNG | DOWN | 0.65 | Recent insider activity shows a mix of purchases and significant sales, indicating potential lack of confidence in the stock's short-term outlook. The recent purchase by Benjamin, while notable, is overshadowed by the larger sales from other insiders, especially the notable sales indicating a willingness to sell at higher prices previously. Furthermore, without clear positive catalysts in company fundamentals or macroeconomic factors, combined with possible investor wariness due to inflation and interest rate pressures, the overall sentiment may lean towards a downward trajectory. | Energy | Oil & Gas Midstream |

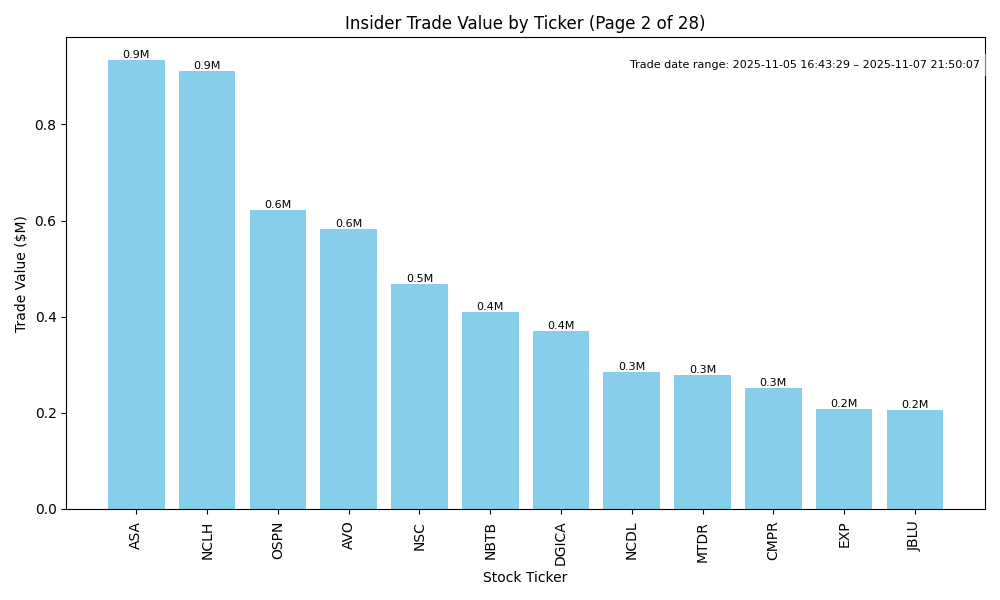

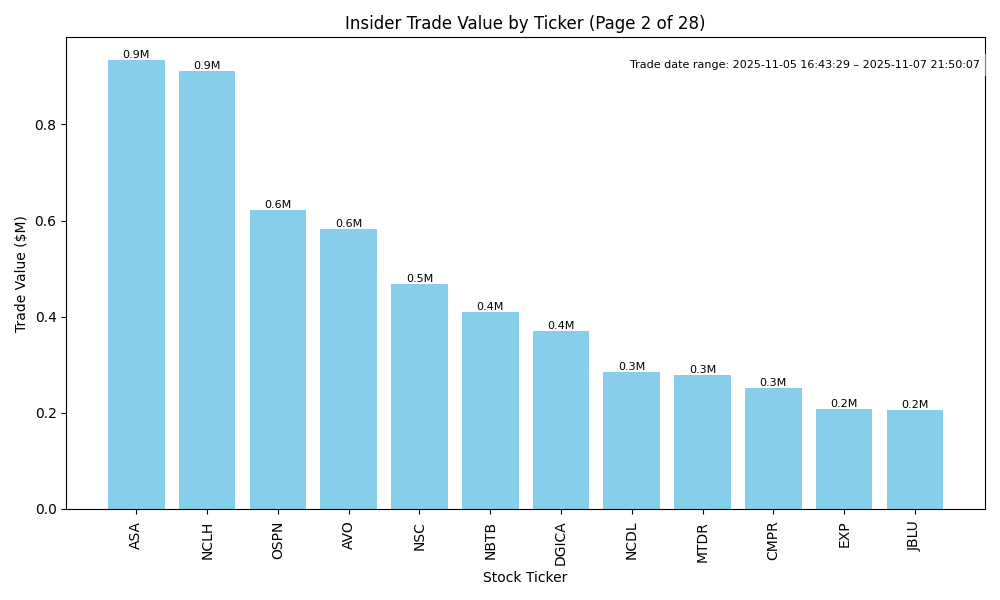

| ASA | UP | 0.75 | Recent insider purchases by Saba Capital Management, acquiring significant amounts of shares at ascending prices suggest strong confidence in the company's future prospects. Accumulation over a short period reflects bullish sentiment. However, the analysis lacks current company fundamentals, such as earnings trends and financial metrics, which are crucial for assessing intrinsic value. Moreover, the broader economic landscape, including inflation and interest rates, remains fluid, adding uncertainty. Given the positive insider activity and without significant adverse developments, I lean towards an upward direction for ASA stock. | Financial Services | Asset Management |

| NCLH | NEUTRAL | 0.60 | Recent insider purchases from key executives indicate confidence in the company's future, especially at lower price levels (~$18.50) compared to previous sales (~$24.70). However, significant previous insider sales suggest a mixed sentiment about the company's near-term outlook. Additionally, without current fundamental metrics—such as earnings trends and growth projections—it's challenging to ascertain the financial health of NCLH. The cruise industry is facing pressures from macroeconomic factors like interest rates and inflation, which may affect discretionary consumer spending. Recent insider buying does show potential upside but is tempered by the historical context of selling and the current market environment. | Consumer Cyclical | Travel Services |

| OSPN | UP | 0.70 | Recent insider buying shows strong conviction, particularly large purchases by directors, indicating positive sentiment. The concentration and volume of these purchases are supportive. However, there is a notable past insider sale that could indicate profit-taking, and the context of fluctuating share prices in previous periods raises concerns. Without comprehensive company fundamentals or recent developments, confidence is moderate. | Technology | Software - Infrastructure |

| AVO | NEUTRAL | 0.50 | Recent insider purchasing by Globalharvest Holdings indicates a positive sentiment, yet this is balanced by significant selling activity from executives and directors over the past year. The stock has seen a high concentration of sales, especially near peak prices. While the recent purchase may suggest confidence in future performance, the number of shares sold and the prevailing downward trend in stock prices raise concerns. Moreover, without comprehensive insights into the company's earnings, leverage, and overall macroeconomic conditions—such as inflation and interest rates—the outlook remains uncertain. | Consumer Defensive | Food Distribution |

| NSC | UP | 0.75 | Recent insider buying is concentrated and significant, indicating bullish sentiment among key directors. The most recent purchases have occurred at higher price levels, showing confidence in the stock's potential. However, the stock previously experienced a notable insider sale by a former CEO, which could signal caution. On the fundamentals side, data on earnings trends, margins, growth potential, and critical macroeconomic factors are not explicitly provided, creating uncertainty. Economic conditions remain mixed, with rising interest rates and inflation impacting equity markets. Overall, the positive insider activity coupled with uncertainties in broader market and fundamental factors leads to a positive but cautious near-term outlook. | Industrials | Railroads |

| NBTB | DOWN | 0.70 | Recent insider trading shows a mix of significant selling by multiple directors, including large sales by Delaney Timothy and Robinson V Daniel II, indicating potential confidence issues among executives. While there are recent purchases by some insiders, the overall pattern of selling outpaces buying. Additionally, without access to current earnings data or broader economic updates, concerns remain about underlying fundamentals potentially weakening. Overall, the indication from insider behavior suggests caution. | Financial Services | Banks - Regional |

| DGICA | UP | 0.75 | Recent insider buying by Donegal Mutual Insurance Co, a 10% shareholder, highlights strong confidence in DGICA's prospects, totaling over 380,000 shares purchased since late 2024. In contrast, insider selling appears more sporadic and less substantial. However, broader macroeconomic factors such as rising interest rates and inflation concerns could pose risks to company performance. The absence of critical financial metrics (e.g., earnings trends, margins) limits full analysis of fundamentals, but existing buying activity suggests bullish sentiment. Given these dynamics, DGICA's stock likely trends upwards in the near term, though caution is warranted due to potential economic headwinds. | Financial Services | Insurance - Property & Casualty |

| NCDL | NEUTRAL | 0.60 | Insider buying is notable, particularly from top executives, which often signals confidence in the company's future. However, the increased purchases occurred at a declining stock price, indicating possible underlying concerns. Without current data on financial performance or broader market conditions, such as interest rates or inflation, the direction remains unclear. Moreover, past purchases at higher prices could signal vulnerability if recent trends persist. Overall, there is bullish insider sentiment but conflicting signals from price action and lack of comprehensive fundamentals analysis lead to a moderate level of confidence. | Financial Services | Asset Management |

| MTDR | DOWN | 0.70 | Recent insider purchases indicate confidence from multiple directors and executives, adding a bullish sentiment. However, the stock has shown a significant decrease in price, and the latest purchases occurred above the current price (approximately $37-$39). Broader industry trends and macroeconomic factors such as rising interest rates and inflationary pressures hint at potential challenges. Without recent results or guidance data, the fundamental outlook remains uncertain, aligning the overall sentiment toward a short-term downturn despite insider optimism. | Energy | Oil & Gas E&P |

| CMPR | DOWN | 0.75 | The recent insider trading activity shows significant selling, particularly by key executives (CEO and CTO), indicating potential concern over the company's prospects or valuation. Notably, the CFO also bought shares recently, but the scale of sales by others is alarming. In terms of fundamentals, if recent earnings trends are weak or leverage is rising, that would further support a bearish outlook. Incremental macroeconomic pressures, such as rising interest rates, could also negatively impact growth prospects. Overall, the mixed signals from insiders, alongside potential weakness in fundamentals and macro factors, suggest a downward direction with moderate confidence. | Industrials | Specialty Business Services |

| EXP | DOWN | 0.70 | Recent insider activity presents a mixed picture; significant sales have been made by top executives, notably in large volumes and at high prices, indicating potential pessimism about the stock's future performance. While David Rush's recent purchases may signal some confidence, they are outweighed by the increased selling pressure shown by others. Company fundamentals appear weak if recent earnings or outlook have deteriorated; industry trends and macroeconomic factors related to interest rates and inflation are concerning. Without clearer positive developments, such as robust earnings growth or strategic initiatives, the overall sentiment supports a downward direction. | Basic Materials | Building Materials |

| JBLU | NEUTRAL | 0.50 | Insider activity presents a mixed picture: while a director's recent purchase of 50,000 shares indicates some optimism, the CFO's sale of shares suggests insider confidence may be wavering. Additionally, key fundamental data is missing, such as earnings trends, growth outlook, and the company’s leverage. Broader industry conditions and macroeconomic factors like interest rates and inflation could impact stock performance as well. Therefore, without clearer direction from these aspects, the stock's near-term direction remains uncertain. | Industrials | Airlines |

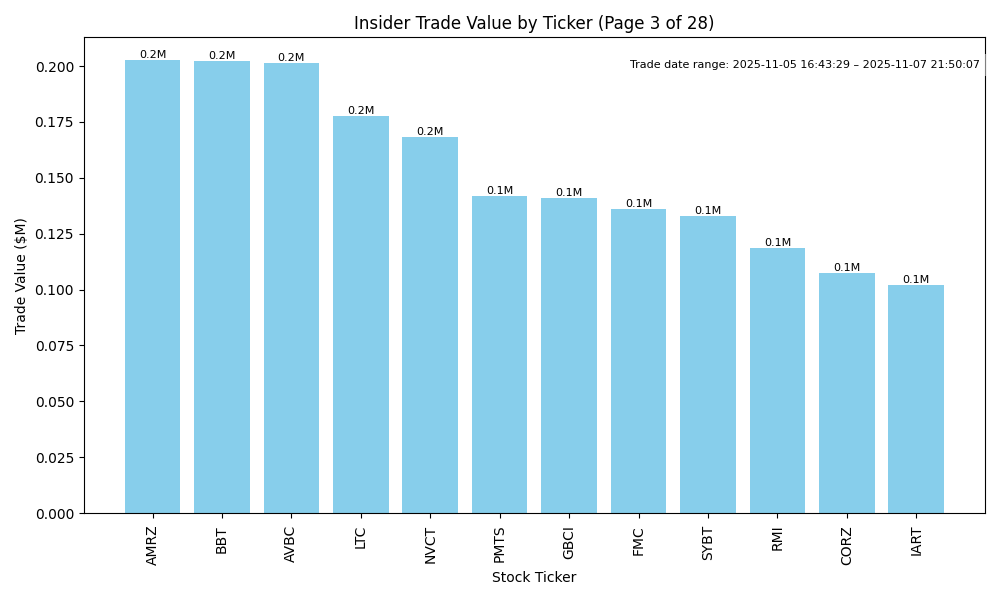

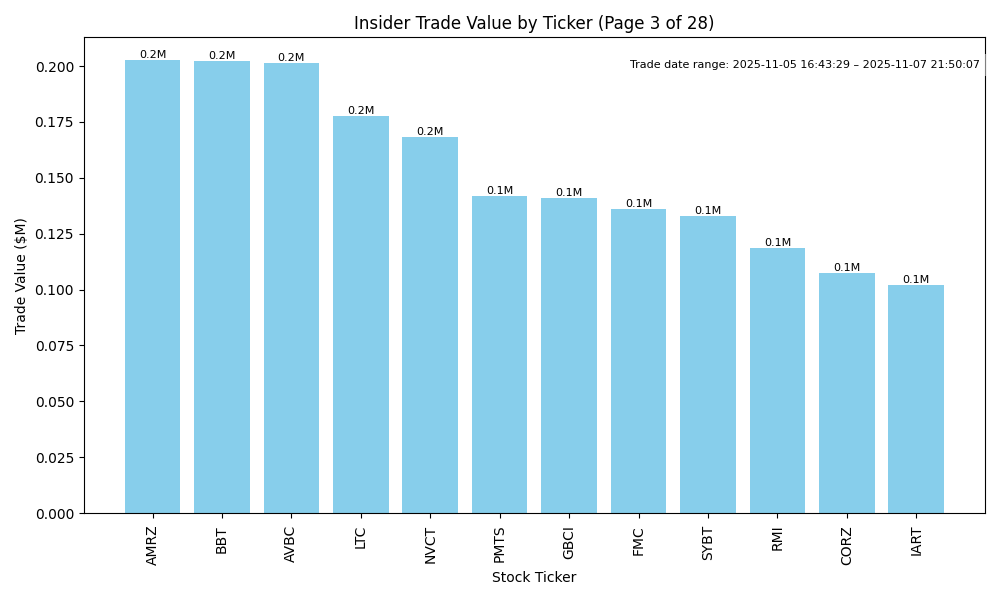

| AMRZ | UP | 0.75 | Recent insider purchases indicate strong confidence from key executives, notably a large buy from the CEO, suggesting a belief in future value appreciation. The transactions have been concentrated among senior leadership, which typically signals strong internal sentiment. However, without recent earnings data or broader macroeconomic context, such as interest rates and inflation impacts, the analysis is less definitive. Assuming fundamentals are stable, the insider activity leans positive, indicating a likely near-term price increase. | Basic Materials | Building Materials |