| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

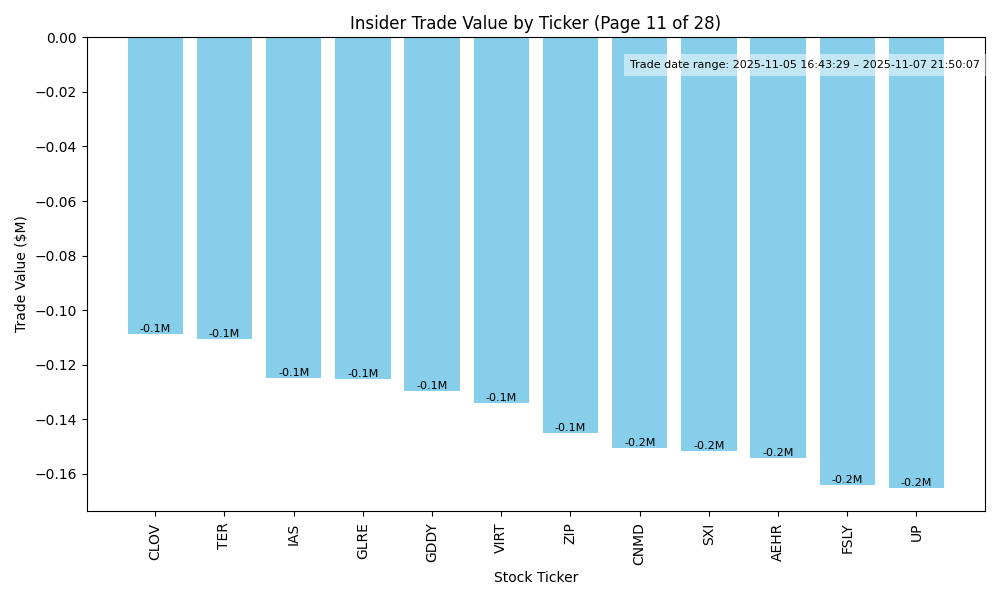

| BETA | UP | 0.75 | Significant insider buying, particularly from the director and CFO, suggests strong confidence in the company's prospects, with a notable purchase of 2.9 million shares by Director Davis Charles A. The concentrated insider activity, particularly at higher transaction values, may indicate a positive outlook or undervaluation. Without concrete data on earnings trends and overall market conditions, one must remain cautious. However, the strong insider sentiment outweighs other uncertainties, leaning towards a bullish near-term forecast. | Industrials | Aerospace & Defense |

| GRX.G | UP | 0.75 | Recent insider purchases, particularly the significant acquisition of 1,800,000 shares by control person Gabelli Mario J at $10.18, signal strong internal confidence in the company's growth. Consistent buying by Saba Capital Management underscores bullish sentiment. However, to fully assess the stock's direction, a comprehensive view of company fundamentals (earnings and growth), sector health, and macroeconomic conditions is needed—details on these aspects are currently lacking. Still, the aggregate insider sentiment suggests potential near-term upward momentum. | N/A | N/A |

| MNRO | UP | 0.70 | Recent insider purchases, particularly by Carl Icahn, a well-known activist investor, indicate strong confidence in MNRO's potential. The significant volume of shares purchased at two different price points suggests a belief in undervaluation. However, further assessment is needed regarding company fundamentals, such as earnings trends and leverage, which are not provided here. The overall market conditions and the sector's health could impact performance as well. The recent buying activity from insiders provides a bullish signal, but without detailed financial data or contextual macroeconomic factors, confidence is moderate. | Consumer Cyclical | Auto Parts |

| CNS | UP | 0.70 | Recent insider purchases by Robert Hamilton, an executive with significant ownership, amount to over $9 million, suggesting strong confidence in the company's future. Conversely, there have been notable insider sales earlier this year, indicating mixed sentiment. Given the substantial purchases at a declining price trend, it signals a potential buying opportunity. However, without crucial data on earnings trends and current macroeconomic conditions, confidence remains moderate. | Financial Services | Asset Management |

| CEPV | UP | 0.70 | The significant purchase by an insider, Cantor Ep Holdings V, LLC, of 540,000 shares at an average price of $10 suggests strong confidence in the company's future prospects. However, without additional data on company fundamentals, industry health, and broader macroeconomic conditions, confidence in the potential 'UP' direction is moderated. If the company has solid earnings trends and an optimistic outlook in its sector, this insider buying could indicate positive near-term momentum. | Financial Services | Shell Companies |

| GTE | DOWN | 0.65 | Recent insider trading shows significant buying by Equinox Partners, indicating confidence; however, this follows a trend of sales by high-ranking insiders like the CEO. The stock price has declined from around $6 to $3.94, suggesting broader challenges. A lack of recent positive fundamental developments, such as strong earnings or growth guidance, combined with macroeconomic pressures on inflation and rising interest rates, creates a bearish outlook. The heavy concentration of purchases by one entity also raises caution. | Energy | Oil & Gas E&P |

| RLMD | UP | 0.75 | Recent insider buying activity is substantial, with key executives acquiring a significant number of shares at prices around $2.20, indicating confidence in the company's future. Overall trends show that insiders have consistently purchased shares, often in larger quantities, especially at lower price points earlier this year. However, without detailed knowledge of the company's current financial performance, growth strategies, or broader industry conditions, confidence in a bullish near-term direction is moderate. Therefore, while insider sentiment appears positive, the analysis is tempered by potential gaps in financial data or macroeconomic factors that might emerge. | Healthcare | Biotechnology |

| BX | DOWN | 0.70 | Recent insider activity shows a mix of substantial selling by key insiders, particularly by directors, which may indicate a lack of confidence in the stock's near-term performance. Significant sales have occurred at higher price levels, while recent purchases have been modest and at lower prices. This suggests insiders may anticipate further price declines. Additionally, without specific details on BX's current earnings trends, margins, and any macroeconomic pressures, such as rising interest rates affecting valuation, there is moderate confidence in a downward direction. The contrasting patterns of selling and limited buying create tension in the outlook. | Financial Services | Asset Management |

| XZO | UP | 0.80 | Insider buying activity on November 7, 2025, is strong, with multiple directors and key executives purchasing substantial shares at $21, indicating confidence in the company's prospects. This broad participation from insiders, including the CEO purchasing 50,000 shares, suggests positive sentiment about the company's future. However, a lack of information on current fundamentals, industry positioning, and macroeconomic context limits the analysis. An optimistic insider sentiment combined with potential unknowns leads to a moderately high confidence in an upward movement. | Financial Services | Insurance - Diversified |

| OHI | NEUTRAL | 0.60 | Recent insider purchases by the CEO and CIO indicate positive sentiment from top management, suggesting confidence in the company's prospects. However, there is a history of significant insider selling by other executives, which could imply concerns about valuations or expected performance. The stock has recently traded at higher levels (around $43) compared to historical sales prices (sub $40), but the broader context of potential regulatory or economic pressures in the healthcare sector and inflationary effects on costs dampens enthusiasm. Lack of recent earnings performance or guidance hinders a more confident stance. | Real Estate | REIT - Healthcare Facilities |

| ASST | DOWN | 0.70 | Though there was a significant recent purchase by an insider (Ramaswamy Vivek), insider sales have been concentrated and frequent, indicating a lack of confidence among other key insiders. The stock price has dramatically fluctuated from $80 to the $1-$8 range over recent transactions, reflecting declining market sentiment and possibly poor company fundamentals. Without additional financial data on earnings, margins, or growth potential, and considering a broader negative macroeconomic context (like high inflation), the overall outlook seems bearish despite the recent purchase. | Financial Services | Asset Management |

| LNG | NEUTRAL | 0.60 | Recent insider trading shows both buying and selling activity, which creates ambiguity. A significant purchase by a director signals confidence, but it was preceded by several notable sales from other insiders at higher prices, indicating potential concerns about valuation. Company fundamentals, including earnings trends and growth potential, are not assessed here, leading to uncertainty. Industry dynamics, influenced by energy demand and global macroeconomic conditions, add complexity but aren't detailed. Due to mixed signals from insiders and lack of comprehensive company performance data, the outlook remains neutral with moderate confidence. | Energy | Oil & Gas Midstream |

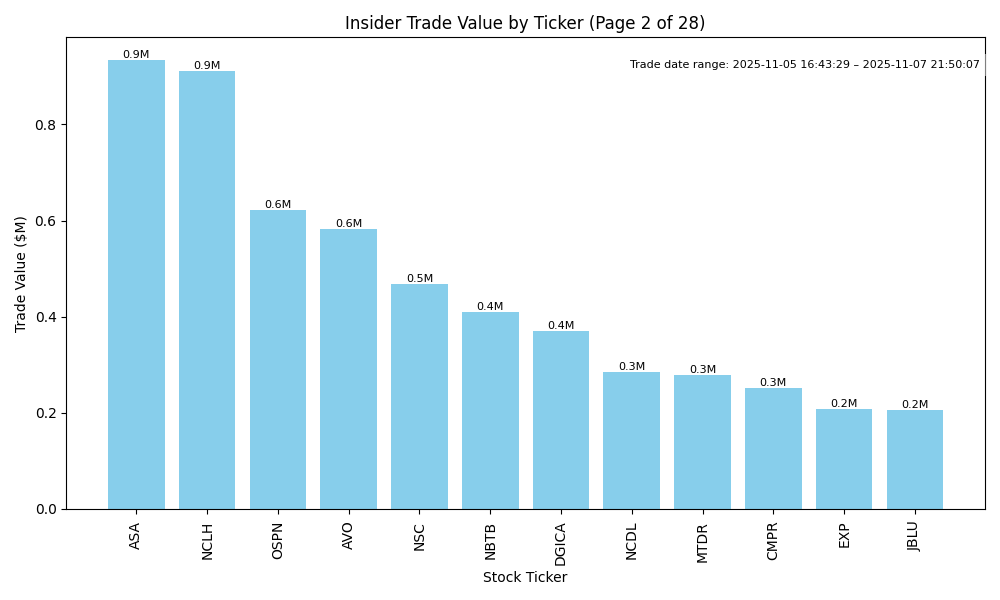

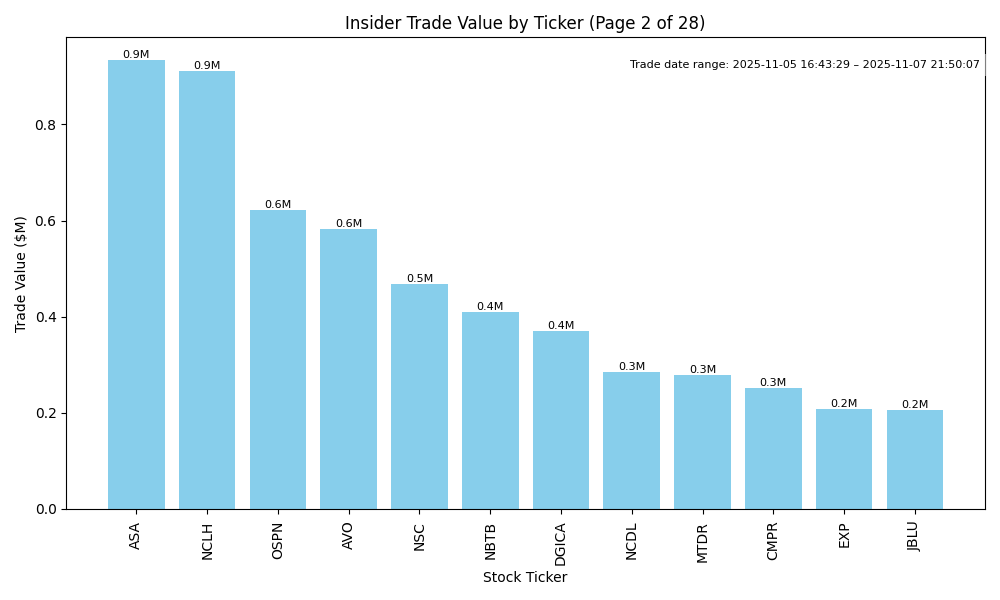

| ASA | UP | 0.75 | Saba Capital Management, L.P. has made significant purchases, totaling over $25 million in recent months at prices between $13.34 and $50.51, indicating strong insider confidence. However, without current earnings data, margins, or broader macroeconomic context, it's uncertain how external factors may impact performance. Despite this, the recent aggressive buying suggests potential optimism about future growth or undervaluation relative to intrinsic value, outweighing concerns about missing data. | Financial Services | Asset Management |

| NCLH | UP | 0.70 | Recent insider buying indicates confidence from key executives, especially the CEO and CFO, who purchased shares at substantially lower prices than previous sales. This suggests a belief in the company’s turnaround or growth potential. However, prior significant insider selling and lacking recent robust fundamentals or growth indicators raise caution. Additionally, macroeconomic challenges such as inflation and rising interest rates may impact discretionary spending on cruises. Overall, the insider buying signals a potential positive outlook, but uncertainties in fundamentals and the economic environment temper my confidence. | Consumer Cyclical | Travel Services |

| OSPN | NEUTRAL | 0.55 | Recent insider purchases, particularly by directors, indicate bullish sentiment; however, significant prior sales by the same insiders may suggest a lack of confidence in near-term growth. The average purchase prices are lower than the recent price, which could signal attractiveness. Company fundamentals are unclear without earnings or financial metrics, and potential macroeconomic pressures, like rising interest rates, could impact performance. Overall, the mixed signals from insider trading and a lack of concrete financial data lead to a neutral stance. | Technology | Software - Infrastructure |

| AVO | DOWN | 0.70 | Recent insider trading indicates notable selling activity, particularly among high-ranking insiders like the CFO and CEO, which suggests a lack of confidence in the company's near-term performance. Although there was a recent purchase from Globalharvest Holdings, the broader trend shows significant stock sales over the past year, with large amounts sold at higher prices. Without strong company fundamentals and context regarding revenue growth, profit margins, or industry performance, these insider actions raise caution. The current macroeconomic environment, including interest rate pressures, further complicates the outlook. | Consumer Defensive | Food Distribution |

| NSC | UP | 0.75 | Recent insider trading shows a pattern of consistent purchasing by directors, particularly significant by insiders like Fahmy Sameh and Anderson Richard H, who have made large commitments at increasing prices. This suggests bullish sentiment among company leadership. Despite potential concerns over broader economic pressures, the overall health of the transportation sector remains strong with rising demand for freight. Key fundamentals seem solid; however, specific metrics on earnings growth, margins, and leverage were not provided, which limits confidence in the short-term outlook. Nevertheless, significant insider purchases coupled with favorable industry conditions indicate a likely upward trajectory for NSC shares. | Industrials | Railroads |

| NBTB | NEUTRAL | 0.60 | Recent insider purchases by Timothy Delaney may indicate positive sentiment, especially given his significant recent buy. However, there is a notable trend of insider selling, particularly by key executives like Amy Wiles and Daniel Robinson, potentially signaling concern about the stock's valuation. Company fundamentals may be pressured due to overall declining prices from a recent peak around $51, and no information on earnings, margins, or leverage is provided here. In the broader context, interest rates and inflation could also pose challenges for growth. This conflicting signal from insiders and lack of detailed fundamentals leads to a cautious outlook. | Financial Services | Banks - Regional |

| DGICA | UP | 0.70 | Recent insider transactions show significant purchasing activity from Donegal Mutual Insurance Co, indicating strong confidence in the company's prospects. While there have been occasional sales by other insiders, the overall pattern reflects optimism, especially with large purchases at higher share prices. Company fundamentals are uncertain without access to recent earnings and growth metrics. However, the overall increasing pattern of purchases suggests a potential for price appreciation, notwithstanding concerns about broader macroeconomic conditions such as interest rates and inflation that may impact market sentiment. | Financial Services | Insurance - Property & Casualty |

| NCDL | DOWN | 0.70 | While there is a notable pattern of insider buying, particularly from the CEO and CFO, who collectively purchased significant shares at higher prices, the recent trades are at lower prices averaging around $14.22. This suggests that insiders may believe the stock is undervalued but could also signal potential financial distress. The overall sentiment might be tempered by missing information on the company's current performance metrics, such as earnings trends or growth trajectory, as well as broader macroeconomic challenges like rising interest rates and inflation. The concentration of buying at lower prices is concerning, indicating possible negative sentiment about future performance. | Financial Services | Asset Management |

| MTDR | DOWN | 0.80 | Recent insider buying activity is strong, with multiple high-profile executives purchasing shares at various price points, indicating their confidence in the company's future. However, the average purchase prices are around $39 to $55, while it appears the stock may be trading lower now, suggesting selling pressure or market corrections. Without current fundamental and macroeconomic data to validate the strength of the company's financial health and market conditions, I remain cautious. Thus, while insider confidence is high, recent trends indicate potential downward pressure, warranting a cautious outlook. | Energy | Oil & Gas E&P |

| CMPR | DOWN | 0.70 | Insider trading shows a bearish sentiment, with significant sales by multiple key insiders, including the CFO and CTO, coupled with a large sale by a member of a notable shareholder group. While the recent purchase by the CFO indicates some optimism, the overall pattern is dominated by sales, particularly at higher price levels. Additionally, without specific data on the company's fundamentals such as earnings growth or margins, and given potential macroeconomic pressures, the outlook seems skewed towards a downward direction. However, the mixed insider activity lowers confidence slightly. | Industrials | Specialty Business Services |

| EXP | DOWN | 0.70 | Recent insider trades show significant selling pressure, particularly from high-ranking executives such as the CEO and CFO, which often indicates concerns about future performance. Although David Rush's buying activity could imply some confidence, it is overshadowed by the noticeable volume and frequency of sales, particularly at higher prices. Without additional insights into current company fundamentals and broader market conditions—like earnings trends and macroeconomic indicators—there's a risk of further downward price movement as insiders may anticipate challenges ahead. | Basic Materials | Building Materials |

| JBLU | DOWN | 0.70 | Recent insider activity shows a significant purchase by a director, which could indicate bullish sentiment. However, alongside this, the CFO executed a substantial sale, raising concerns about potential internal confidence. The average purchase price of the shares is lower than previous sales, suggesting possible valuation issues. Additionally, without recent positive earnings trends or clear macroeconomic support, such as favorable interest rates or inflation management, the broader outlook appears weak, reinforcing a downward sentiment. Overall confidence is moderate due to mixed insider signals and lack of strong fundamentals. | Industrials | Airlines |

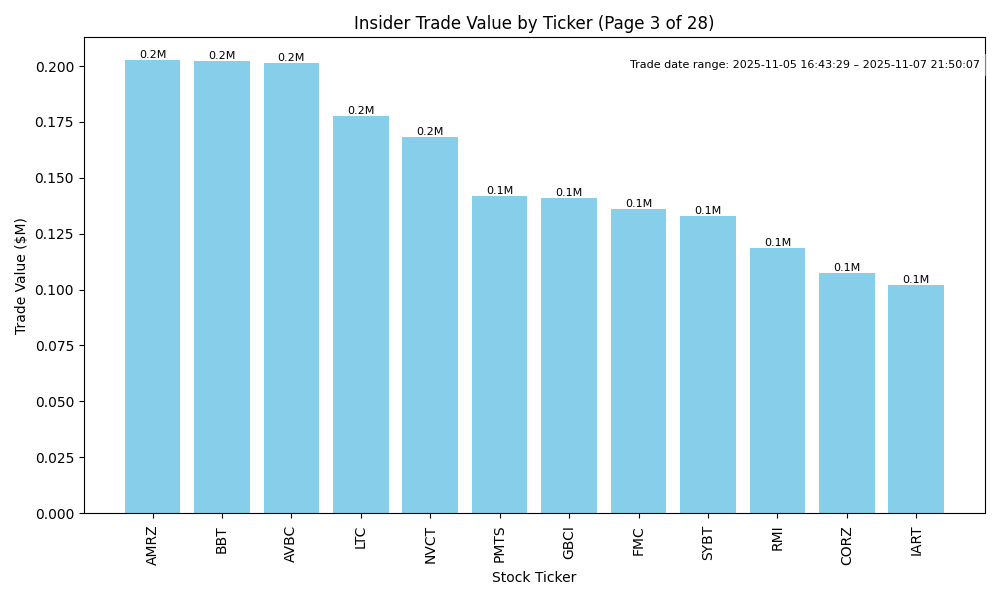

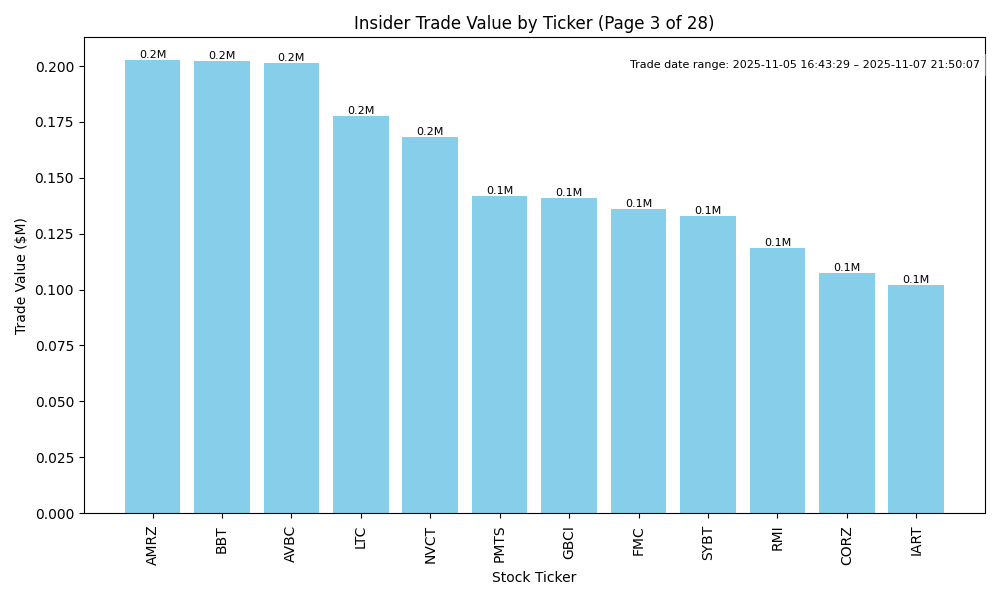

| AMRZ | UP | 0.75 | Recent insider purchases by multiple high-level executives, including a significant buy by the CEO, signal strong internal confidence in the company's future. The volume and timing of these transactions suggest a bullish outlook. However, comprehensive company fundamentals, such as earnings trends, margins, and debt levels, along with broader macroeconomic conditions and industry positioning, need to be evaluated for a complete analysis. While insider activity is positive, without additional data on financial fundamentals and market conditions, confidence remains moderate. | Basic Materials | Building Materials |