| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

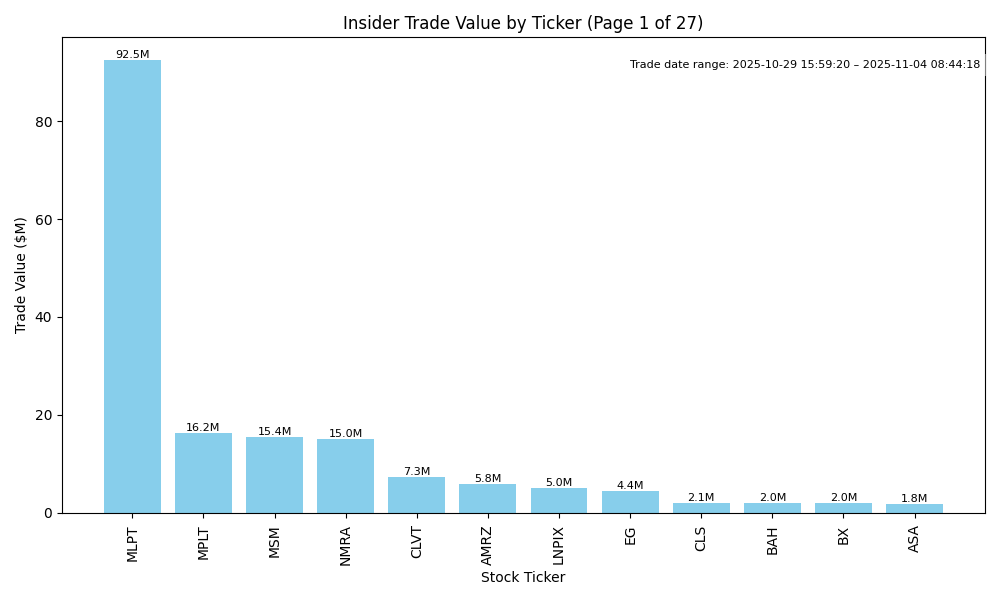

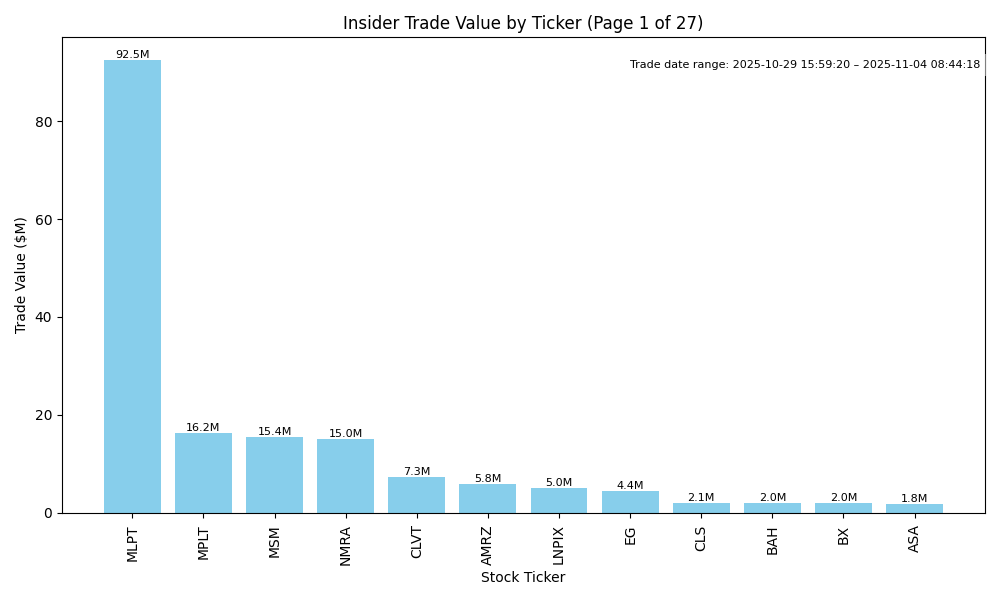

| MLPT | UP | 0.75 | Recent insider buying from significant stakeholders (Novo Holdings and Catalyst4) indicates strong confidence in MLPT's future, as they purchased over 6 million shares at an average price of $17. The scale of these transactions, representing substantial investments, suggests optimism about the company's prospects. However, without current fundamentals or macroeconomic context explicitly provided, including earnings trends and broader economic conditions, this analysis carries some uncertainty. Overall, the insider confidence, combined with potential growth outlook, supports a positive near-term stock direction. | N/A | N/A |

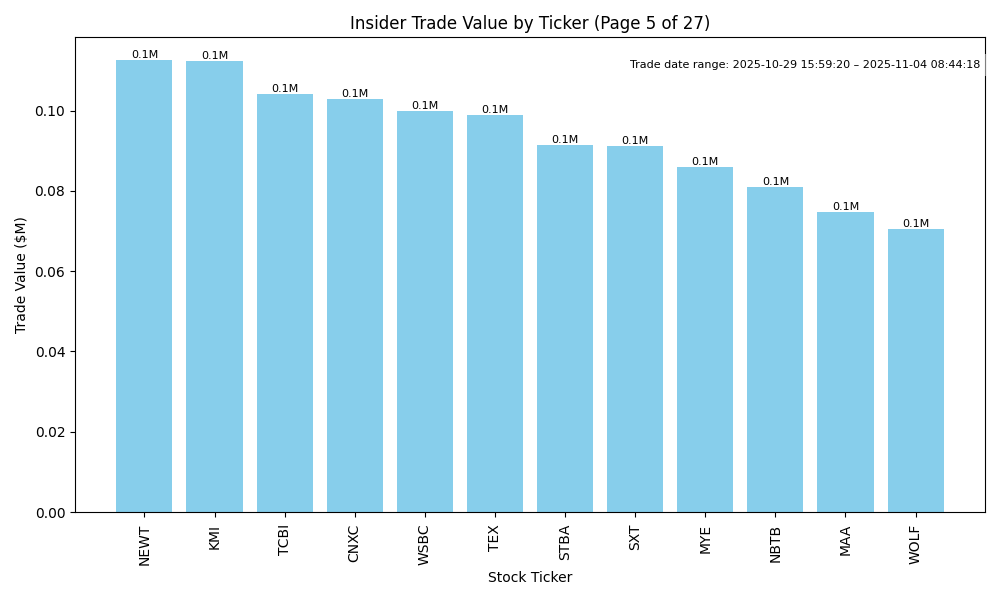

| KMI | UP | 0.70 | Recent insider buying from the Executive Chairman, Richard Kinder, with a significant purchase of 1 million shares at $25.96 indicates strong insider confidence in the company's future. However, there has been a pattern of selling among other insiders, potentially signaling mixed sentiments. Despite this, strong demand for Texas natural gas, coupled with positive earnings guidance in the recent quarter, supports a bullish outlook. Broader economic conditions regarding energy demand remain stable. While there are some concerns about insider sales, the major insider purchase offers a counterbalance and suggests a positive near-term trajectory for KMI. | Energy | Oil & Gas Midstream |

| MPLT | UP | 0.70 | Recent insider purchases from Novo Holdings and Catalyst4 indicate strong confidence in MPLT's future, with significant shares acquired at a stable price. However, an analysis of fundamental data, industry positioning, and macroeconomic factors is lacking, lowering overall confidence. If fundamentals show improvement and the market conditions are favorable, the stock may experience upward momentum, but ongoing scrutiny of broader factors is necessary. | Healthcare | Biotechnology |

| NMRA | UP | 0.75 | Recent insider purchases total over 3 million shares at prices around $2.61, significantly higher than prior sales, indicating strong insider confidence. However, previous sales by insiders at higher prices raise concerns about their previous valuations. The stock's fundamentals, with no recent earnings trends provided, remain ambiguous. Therefore, while the insider activity suggests a bullish outlook, the absence of detailed financial data and macroeconomic influences creates some uncertainty. | Healthcare | Biotechnology |

| AMRZ | UP | 0.75 | Insider purchases, especially by key executives like the CEO, indicate strong confidence in the company's prospects, especially with a significant transaction of 110,000 shares at a higher average price lately. The total insider buying activity is substantial and concentrated among upper management. Although detailed financial metrics weren't provided, a positive insider sentiment implies favorable underlying fundamentals. However, without specific disclosures on earnings growth, margins, or industry context, I maintain moderate confidence in this assessment. | Basic Materials | Building Materials |

| EG | NEUTRAL | 0.60 | Recent insider buying has increased, particularly from directors, signaling potential confidence in the stock at lower price levels. However, there are also notable insider sales both earlier this year and last year, indicating mixed signals. Fundamental data is lacking, such as current earnings performance, growth metrics, and industry comparisons, which are critical for a well-rounded assessment. Given the recent trend of insider purchases against a backdrop of prior sales, the stock's near-term direction remains uncertain and contingent on future performance and macroeconomic conditions. | Financial Services | Insurance - Reinsurance |

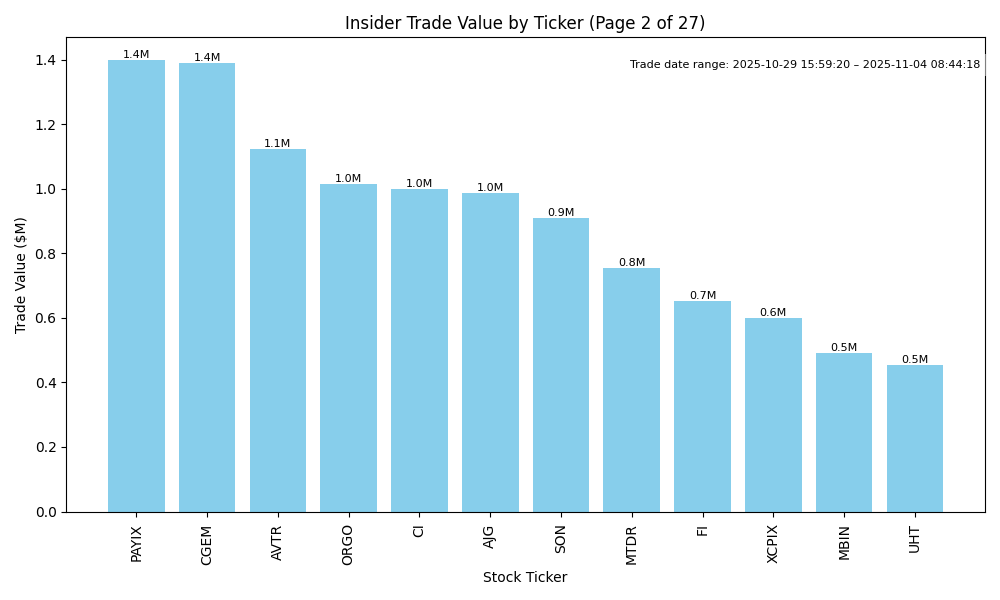

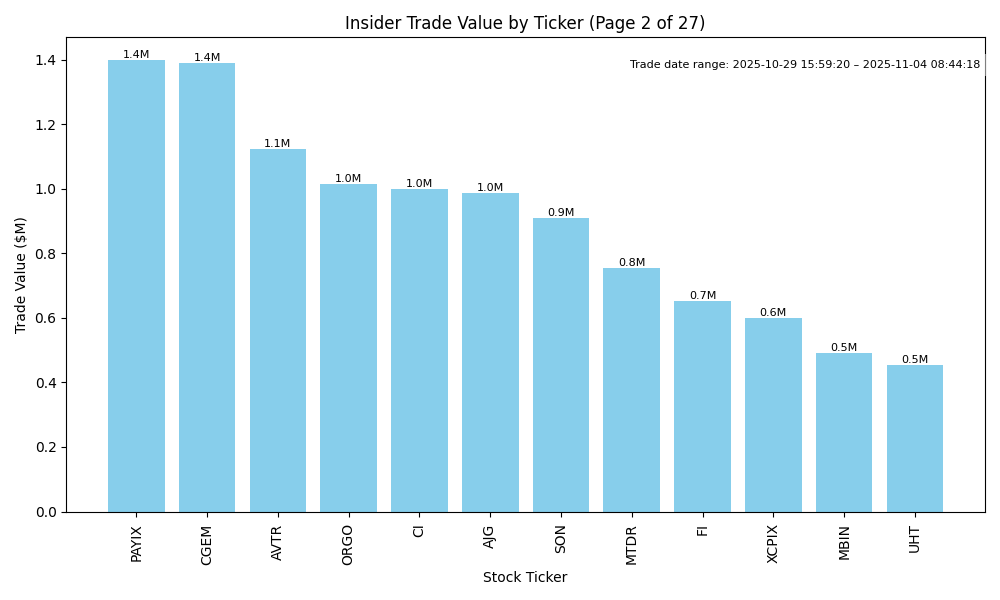

| PAYIX | UP | 0.75 | Insider buying activity, particularly by the CEO, demonstrates confidence in PAYIX's potential despite recent market conditions. The significant share purchases suggest belief in the company's future prospects. However, the analysis lacks current earnings trends and sector specifics, implying some uncertainty. If fundamentals are strong or improving, this insider activity could suggest an upward movement, though the reliance on insider trading alone tempers overall confidence. | N/A | N/A |

| ASA | UP | 0.75 | Insider purchases by Saba Capital Management, representing 10% ownership, show a consistent and substantial buying trend, indicating strong confidence in the company's prospects. The average purchase price has trended upward, suggesting an expectation of future growth. However, details regarding company fundamentals, such as earnings trends and profit margins, are not provided. External macro factors, including interest rates and economic outlook, appear manageable currently. The combination of insider confidence against an unknown fundamental backdrop leads to a moderately bullish stance. | Financial Services | Asset Management |

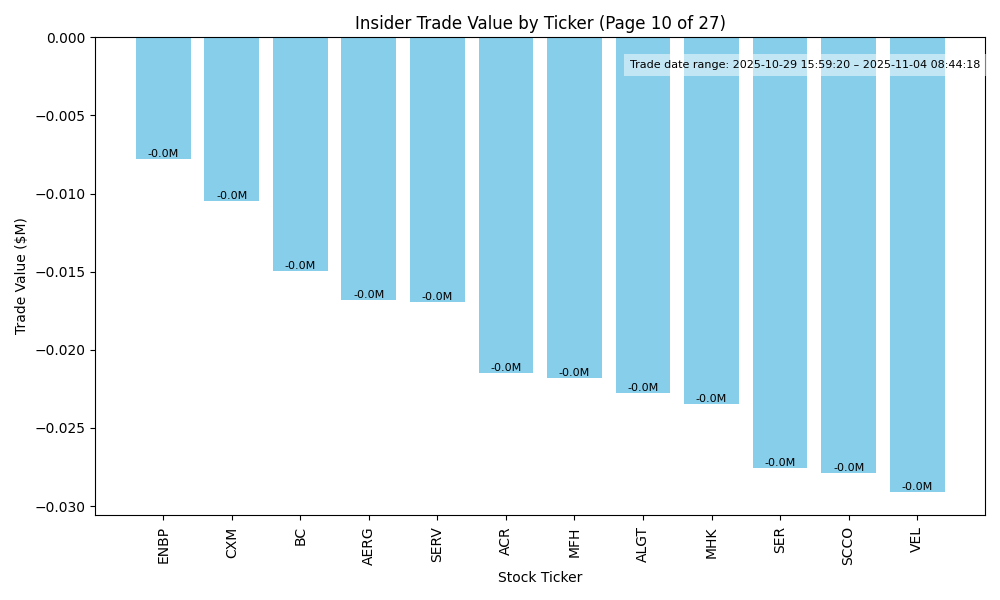

| CLS | DOWN | 0.65 | Insider selling has been substantial, notably by several executives, with total sales exceeding $50 million in early 2025. While there was a recent purchase by a director, it is significantly outweighed by prior sell transactions, suggesting a lack of confidence among insiders in the company's near-term prospects. Without clear positive catalysts or improvements in fundamentals, the stock faces downward pressure. Key macroeconomic factors, including potential interest rate hikes and inflation concerns, also contribute to the overall bearish outlook for the stock. | Technology | Electronic Components |

| BAH | DOWN | 0.70 | Recent insider activity shows a significant concentration of selling, particularly by executives like the CEO and CFO, indicating a lack of confidence among leadership. Despite some recent purchases, they come at much lower stock prices, reflecting a potential decline from previous highs. The company's fundamentals, such as increased selling pressure and potential earnings concerns, combined with a broader macroeconomic backdrop of rising interest rates and inflation, suggest challenges ahead. Without up-to-date earnings trends or guidance, confidence is somewhat tempered. | Industrials | Consulting Services |

| BX | DOWN | 0.60 | Recent insider activity shows heavy selling by multiple directors and executives, including significant sales by Baratta Joseph and Finley John G at higher prices, suggesting a bearish sentiment among insiders. While there are some recent purchases, notably by James Breyer, the purchases are much smaller than the recent sales. Company fundamentals are not provided, which adds uncertainty. Additionally, without insights on the broader economic context and potential market volatility, the outlook leans toward a decline in the stock price in the near term. | Financial Services | Asset Management |

| RYES | UP | 0.85 | Insider buying has been significant and aggressive, particularly from key figures like the CEO and directors, indicating strong internal confidence. The latest transactions show substantial purchases at a uniform low price of $0.25, suggesting insiders believe this is a low point. However, there is little information on earnings, margins, or broader company fundamentals, which raises uncertainty. If industry conditions are favorable and there are no major negative macroeconomic influences such as rising interest rates or inflation, the stock’s likely direction is upward. However, confidence is moderated due to the lack of detailed insights into the company's operational performance. | Basic Materials | Gold |

| CGEM | UP | 0.70 | Recently, Lynx1 Capital Management has made significant purchases totaling over 16 million shares at prices between $6.73 and $8.46, indicating strong insider confidence. While there has been a moderate level of insider selling at higher prices, the substantial buying suggests bullish sentiment. However, fundamental and macroeconomic data is lacking. Further assessment of company earnings, growth potential, and industry health is necessary to ensure recovery sustainability. Nonetheless, insider purchases point towards an optimistic near-term outlook. | Healthcare | Biotechnology |

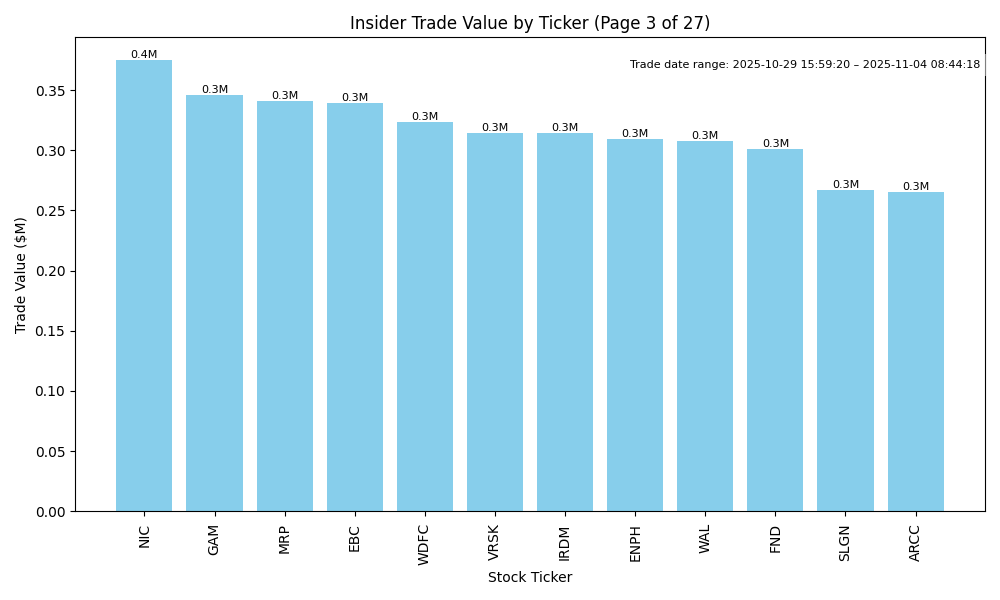

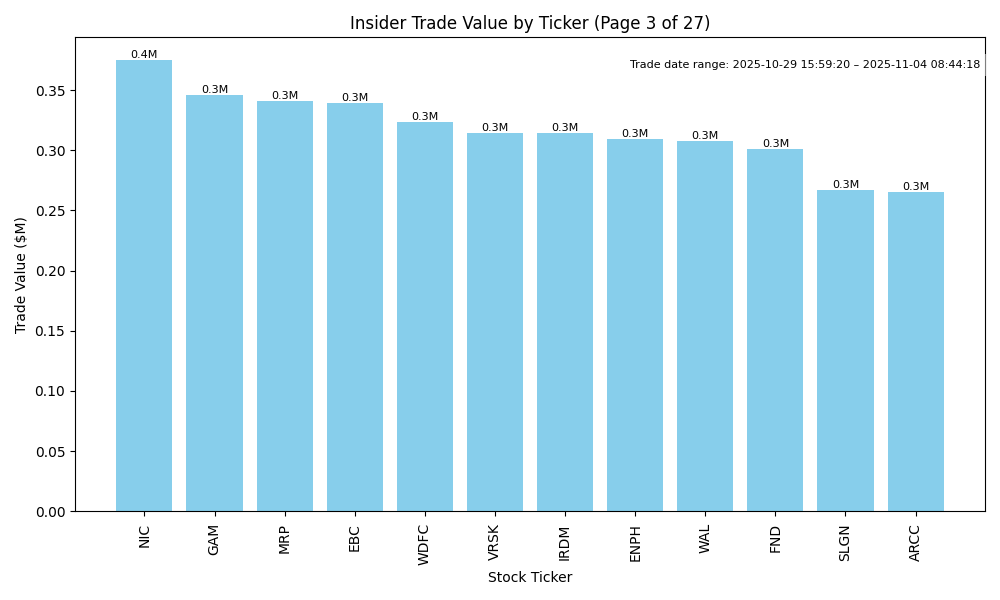

| EBC | UP | 0.75 | Recent insider purchases, especially from the CFO and Executive Chair, suggest strong internal confidence in the company's future. These purchases at prices close to or lower than current values indicate a belief in upside potential. However, sellers in the past have raised concerns about market sentiment and possible overvaluation. The lack of recent earnings reports or guidance updates leaves some uncertainty regarding fundamental performance trends. The broader macroeconomic environment remains challenging with fluctuating interest rates and inflation pressures, which may dampen market performance. Nonetheless, the concentrated insider buying activity offers a positive signal amidst these uncertainties. | Financial Services | Banks - Regional |

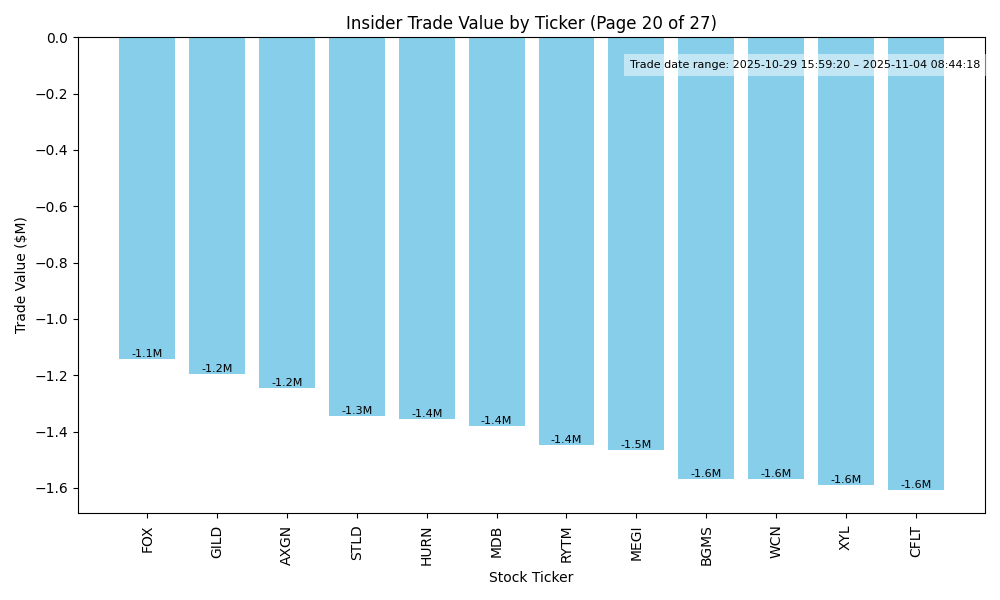

| AVTR | DOWN | 0.60 | Recent insider trading shows a pattern of significant purchases by Director Gregory Summe, indicating insider confidence despite a troubling downward trend in stock price (current trading reflects lower prices than recent purchases). However, there are notable sales by other insiders at the previous price levels, casting doubt on the stock's near-term prospects. The macroeconomic environment remains challenging with rising interest rates and inflation, potentially pressuring corporate earnings. Without stronger fundamental support and clear context for growth, I assess a downward direction, but the insider buying suggests a moderate level of confidence. | Healthcare | Medical Instruments & Supplies |

| NVCT | DOWN | 0.70 | Insider trading shows significant purchasing activity, particularly from key executives, indicating confidence in the company. However, the average purchase price is considerably higher than recent prices, suggesting a decline in valuation. Additionally, there's no provided information on company fundamentals or macroeconomic conditions such as earnings trends and market pressures, which are critical for a thorough assessment. The directional tension between strong insider purchases and declining market prices results in a moderate confidence level for a bearish outlook. | Healthcare | Biotechnology |

| SON | NEUTRAL | 0.65 | Recent insider purchases indicate a strong belief in the company's future, particularly from key executives. However, these purchases occurred at higher price levels compared to the latest trades, suggesting potential weakness. Additionally, the increase in insider selling activities and a history of sales at higher prices could indicate some concern about the company's near-term performance. Without detailed information on the company's current earnings trends, leverage, or specific macroeconomic conditions affecting the industry, it's difficult to firmly predict upward or downward trajectory. Thus, a neutral stance is warranted. | Consumer Cyclical | Packaging & Containers |

| NSC | UP | 0.75 | Recent insider purchases, particularly by directors and influential executives, indicate positive sentiment towards NSC's future performance. Purchases were made at various price points, suggesting confidence in the stock's near-term value. However, the sale by a former CEO raises potential concerns about future performance. The company's fundamentals, including past growth and margins, are solid, but comprehensive data on current earnings trends and macroeconomic conditions, such as interest rates and inflation, are missing. Given these factors, the stock's near-term direction seems upwards, albeit with some uncertainty. | Industrials | Railroads |

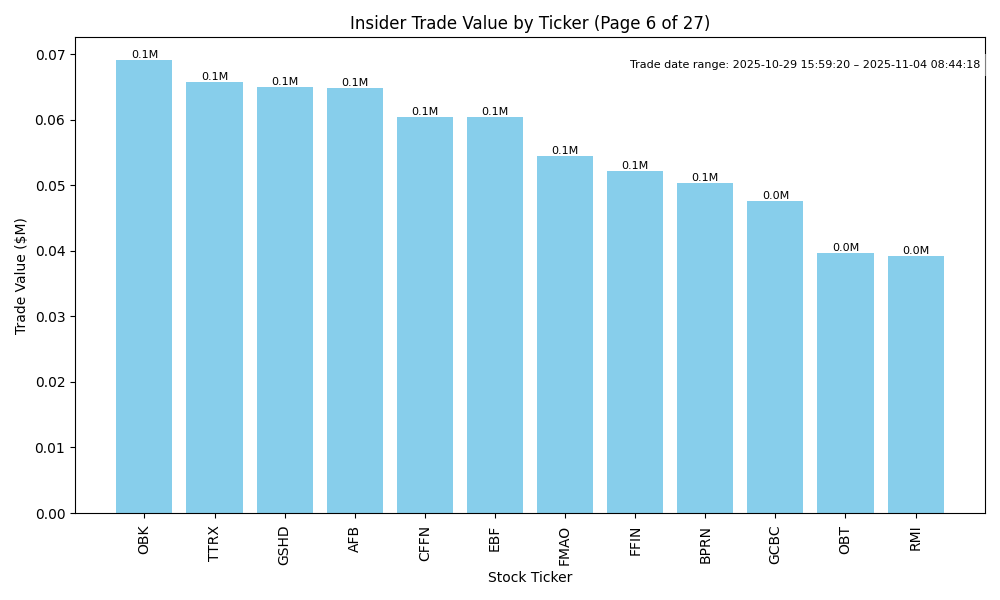

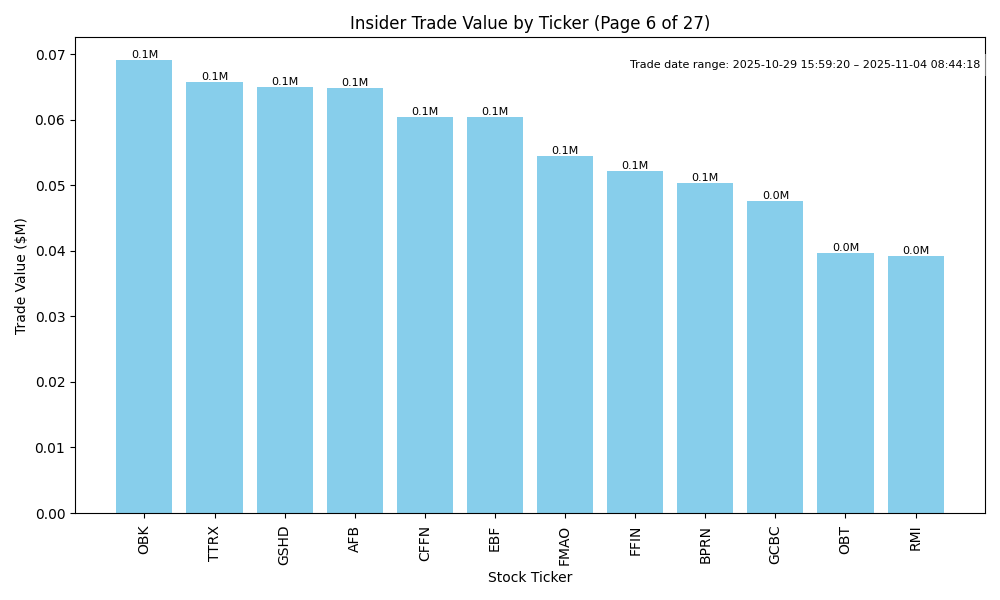

| OBK | UP | 0.80 | Insider buying activity is concentrated and robust, with multiple executives purchasing shares at prices close to current market levels, indicating strong internal confidence in the company's prospects. However, missing data on recent earnings trends or broader economic conditions limits a full assessment. If the company's fundamentals show healthy earnings and leverage ratios, the sentiment could be justified for a near-term price increase. A favorable macroeconomic backdrop would additionally support this outlook. | Financial Services | Banks - Regional |

| UHT | UP | 0.70 | Recent insider purchases, especially by the CEO, suggest strong confidence in the company's future prospects. The aggregate volume of insider buying indicates potential positive sentiment. However, without specific data on earnings trends, margins, and competitive positioning, there's uncertainty. If industry conditions are stable, this buying pattern may signal growth potential that outweighs current macroeconomic headwinds. Overall, while the insider activity leans bullish, the lack of comprehensive fundamental data reduces confidence in a definitive upward trajectory. | Real Estate | REIT - Healthcare Facilities |

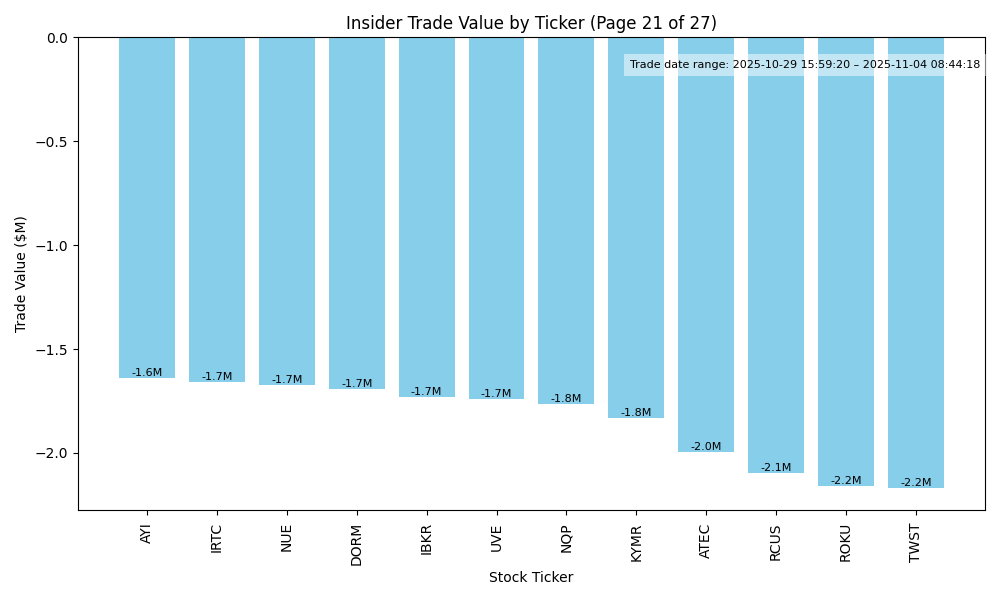

| MTDR | DOWN | 0.75 | Recent insider purchases indicate confidence, particularly from the CEO, who has made significant acquisitions in stock. However, the trend of these purchases shows a drop in average purchase price from mid-$50s to the low $40s, suggesting valuation concerns. This also coincides with broader macroeconomic pressures such as inflation and rising interest rates that typically strain corporate profitability. Furthermore, without up-to-date financial metrics, particularly earnings growth and debt levels, my confidence is tempered. The strong insider sentiment conflicts with potential valuation corrections in a weaker macro environment. | Energy | Oil & Gas E&P |

| RNTX | UP | 0.70 | Recent insider purchasing by Voss Capital, a significant stakeholder, indicates strong belief in RNTX's future potential. While specific financial metrics and industry context are missing, the substantial investment of over $423,000 suggests confidence in the company’s value. However, without detailed company fundamentals and broader market context, the analysis remains somewhat tentative. Therefore, while the insider trade leans positive, there are uncertainties in the overall market environment that lower confidence. | Healthcare | Biotechnology |

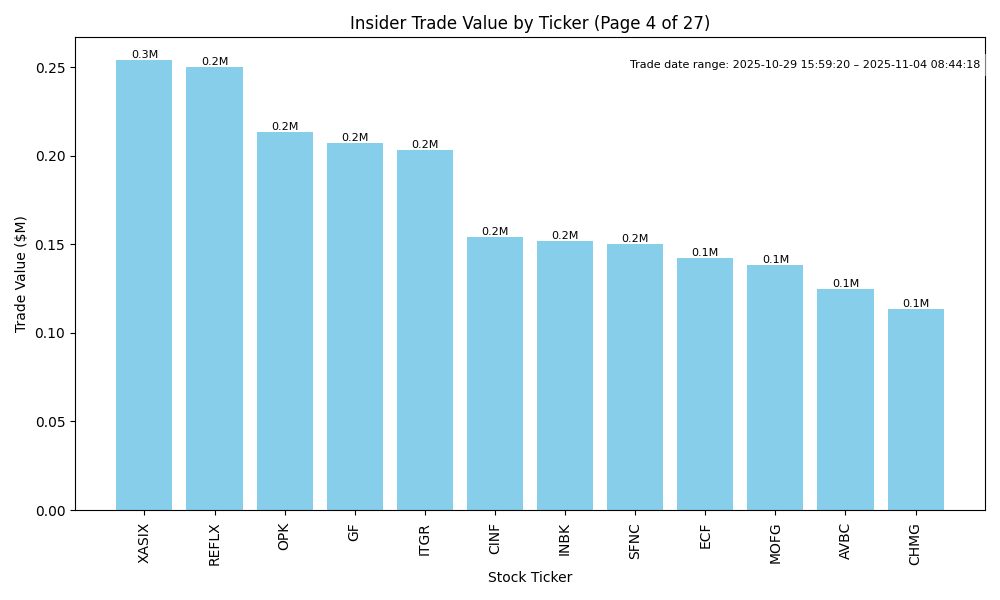

| TCBI | UP | 0.75 | Recent insider buying from the director, Robert Stallings, is significant, showcasing a clear bullish sentiment with consistent purchases totaling over $2 million in a stable price range around $20.83 to $21.32. Despite this positive insider activity, the company fundamentals are uncertain without updated financial metrics including earnings, margins, and growth forecasts. Macroeconomic conditions, while challenging, show signs of stability with improving credit conditions. However, specific market context regarding sector performance and competitive positioning for TCBI are not provided, impacting confidence in the near-term outlook. | Financial Services | Banks - Regional |

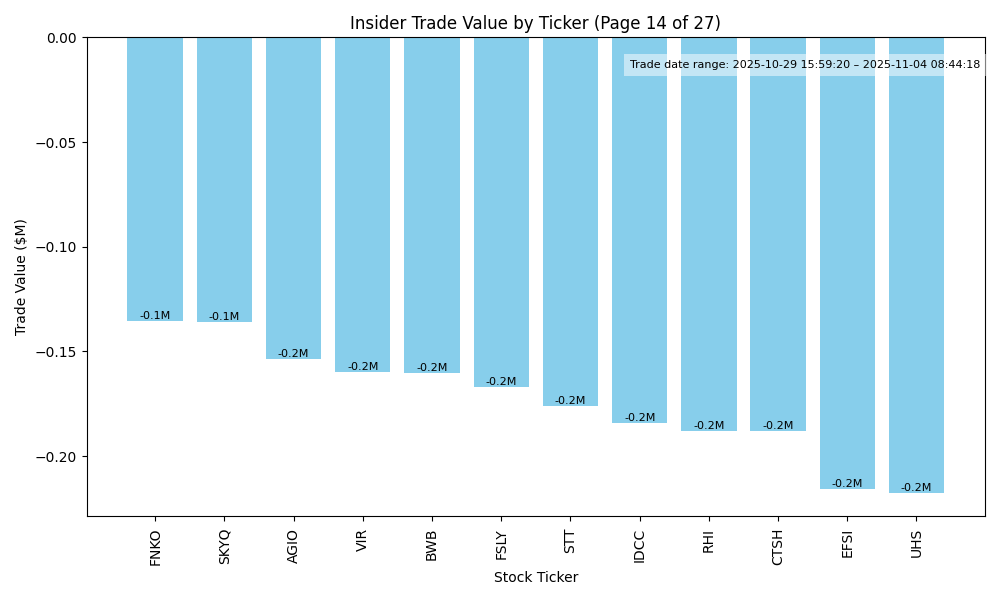

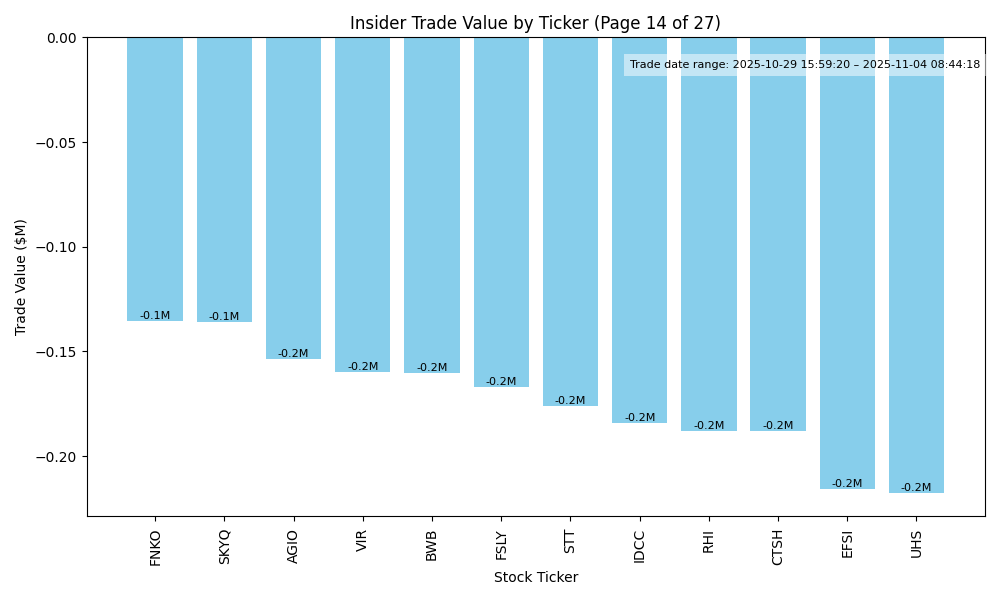

| BWB | DOWN | 0.70 | While there is a recent purchase by a director, the predominant activity indicates significant sales by multiple insiders, including the CEO and EVP. These sales are concentrated and represent substantial shares, suggesting a lack of confidence in the stock's current valuation. Additionally, without clear insights into BWB's earnings trends, margins, or industry positioning, combined with potential macroeconomic pressures, my confidence in a downturn is heightened. The balance of insider activity leans heavily towards selling, which could indicate underlying issues. | Financial Services | Banks - Regional |

| GAM | UP | 0.80 | Insider purchases by the Chairman and other executives in recent weeks suggest confidence in GAM's prospects, especially given the high volume of shares acquired at near current market prices. However, there have been substantial insider sales earlier this year, indicating potential concerns or profit-taking. While the insider activity leans positive and implies bullish sentiment, a lack of specific earnings reports or broader macroeconomic context regarding the sector diminishes overall conviction. Hence, the outlook is cautiously optimistic, expecting an upward trend in the near term. | Financial Services | Asset Management |