| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

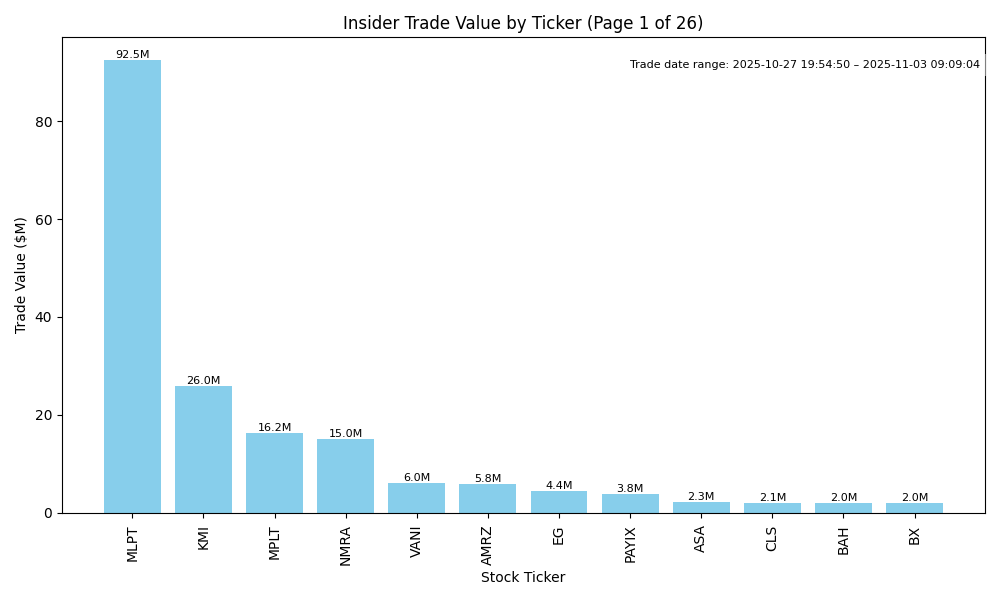

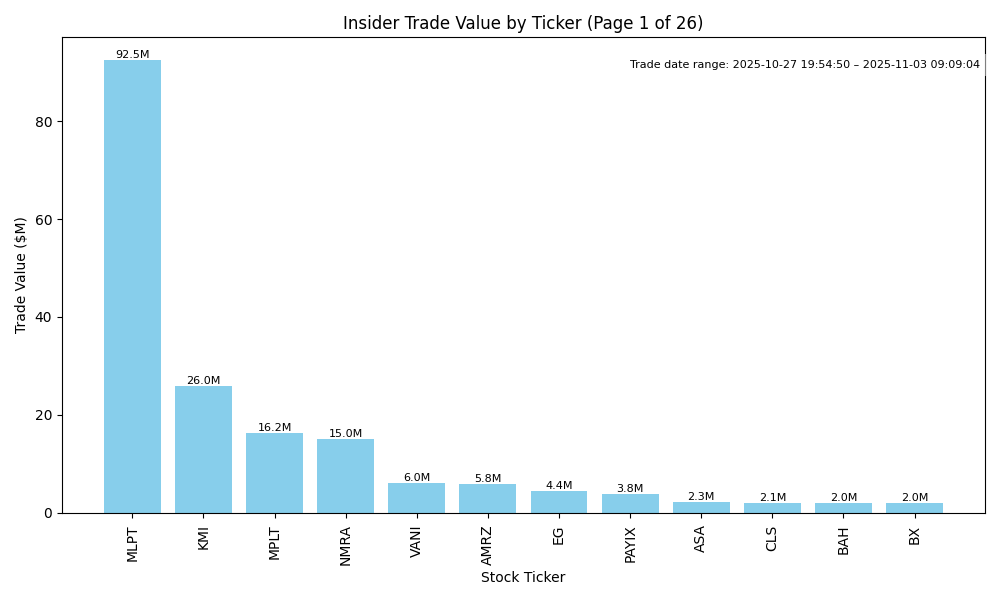

| MLPT | UP | 0.75 | Recent insider purchases from two significant stakeholders, totaling over 6 million shares at an average price of $17, suggest strong confidence in the company's prospects. However, without detailed information on the company's earnings trends, margins, or broader macroeconomic conditions, some uncertainty remains. If the fundamentals align positively with this buying activity and the sector shows growth potential, MLPT may experience upward momentum. The confidence is somewhat tempered by the lack of context regarding total shares outstanding and macroeconomic indicators. | N/A | N/A |

| KMI | NEUTRAL | 0.60 | Insider trading shows mixed signals, with a significant purchase by the Executive Chairman, Richard Kinder, reflecting strong confidence in KMI's future. However, there's heavy selling activity from various executives, suggesting concerns about current valuations or internal issues. Without concrete data on earnings trends, leverage, and growth potential, it's challenging to gauge the true financial health. Furthermore, the broader energy sector is under pressure from macroeconomic factors such as fluctuating interest rates and inflation, which could hinder overall performance. Therefore, while insider confidence is apparent, external pressures contribute to uncertainty. | Energy | Oil & Gas Midstream |

| MPLT | UP | 0.70 | Recent insider purchases from significant holders indicate strong confidence in the stock's future. Notably, Novo Holdings A/S purchased over 950,000 shares, suggesting a positive outlook. However, without additional context on company fundamentals, industry performance, or macroeconomic conditions, caution is warranted. The absence of recent earnings data limits a thorough assessment of financial health and growth prospects, but insider buying typically signals long-term value. Overall, the positive insider sentiment aligns with a bullish stance, though it's tempered by some uncertainty due to missing fundamental insights. | Healthcare | Biotechnology |

| NMRA | UP | 0.80 | Recent insider purchases, particularly significant ones by key stakeholders like Kristina Burow and Arch Venture Partners, imply strong confidence in NMRA's future prospects. Though past sales by some insiders existed, they were minor compared to the recent bulk purchases. Lack of company financial data limits understanding of fundamentals like earnings, leverage, and growth potential; however, the aggressive buying suggests positive sentiment. Industry and macroeconomic conditions remain unclear, but recent purchase activity heavily tilts sentiment towards an optimistic outlook for the stock. | Healthcare | Biotechnology |

| VRDN | UP | 0.75 | Recent insider purchases, particularly from significant stakeholders like Fairmount Funds Management LLC, suggest strong internal confidence in VRDN's future prospects. Notably, a large purchase of 1.6 million shares at $18.75 indicates a commitment to the company's growth potential at those price levels. However, while insider activity is positive, further evaluation of company fundamentals, including earnings trends and leverage, is needed for a complete picture. Additionally, macroeconomic conditions like interest rates and inflation may weigh on broader market sentiment, contributing to moderate confidence in a near-term upward movement. | Healthcare | Biotechnology |

| VANI | UP | 0.75 | Recent insider buying, particularly from the Director Williams Gregg, indicates strong confidence in VANI's future. Significant purchases totaling over $25 million at prices ranging from $0.88 to $1.62 suggest insiders believe the stock is undervalued. However, we lack detailed current fundamental data such as earnings trends or leverage metrics and broader macroeconomic conditions, including interest rates and inflation, which could impact short-term performance. If the overall market remains supportive, the insider buying could drive the stock price higher in the near term. | Healthcare | Biotechnology |

| AMRZ | UP | 0.75 | Recent insider trading shows significant purchases from key executives, especially the CEO acquiring 110,000 shares at a high price, which indicates strong confidence in the company's future. Additionally, the consistent pattern of insider buying at varied price levels suggests an optimistic outlook. While specific company fundamentals and macroeconomic conditions weren't detailed, the insider bullishness creates a positive sentiment. However, industry conditions and broader economic factors should be monitored to confirm ongoing strength. | Basic Materials | Building Materials |

| EG | DOWN | 0.70 | Recent insider activity shows significant purchasing, particularly by directors, which typically signals confidence. However, the stock's recent sales by key insiders indicate profit-taking at higher prices, suggesting a cautious outlook. Additionally, as the stock price declined from its previous highs (approximately 370 to around 307), this might reflect weakening fundamentals or broader market pressures. Without concrete indicators of revenue growth or earnings stability, and with the current macroeconomic challenges (high interest rates and inflation), the outlook leans towards a potential decline despite insider buying. Therefore, while insider purchases suggest bullish sentiment, the tension with market conditions leads to a downward evaluation. | Financial Services | Insurance - Reinsurance |

| ASA | UP | 0.80 | Recent insider trading by Saba Capital Management indicates strong confidence in the company's future, as they have consistently purchased significant amounts of shares at increasing prices. This buying spree suggests they expect the stock's value to rise. While detailed company fundamentals and broader macroeconomic conditions aren't provided, the positive sentiment from insiders combined with potential growth drivers could signal upward momentum for ASA in the near term. | Financial Services | Asset Management |

| PAYIX | UP | 0.75 | Recent insider purchases by key executives, particularly the CEO, indicate strong confidence in PAYIX's future. The scale of these transactions, involving over 1.5 million shares at prices around $25, suggests insiders believe the stock is undervalued. However, without qualitative data on earnings trends, competitive positioning, or broader economic conditions, the analysis remains partially incomplete. If company fundamentals are solid and the sector is healthy, this would further validate the bullish sentiment. Macro factors like interest rates and inflation need monitoring for potential pressure, but the current insider activity leans towards an upward direction. | N/A | N/A |

| CLS | DOWN | 0.70 | Recent insider trading shows significant selling from multiple top executives, including the CEO and other directors, with sizeable amounts and at lower historical price points. This suggests a lack of confidence in the company's near-term prospects. While there is a recent purchase by a director, it is overshadowed by the larger trend of selling. Without additional information on the company's fundamentals such as earnings performance, growth rates, or macroeconomic factors, this creates uncertainty. Given the current indicators, the overall sentiment appears bearish. | Technology | Electronic Components |

| BAH | NEUTRAL | 0.60 | Recent insider purchases, particularly by the CEO, suggest a belief in the company's potential despite recent substantial insider selling. The volatility in stock price, with insiders selling at much higher prices earlier this year, indicates uncertainty. Fundamentals such as earnings trends, margins, and capital structure remain opaque due to a lack of specific financial data. Additionally, industry and broader macroeconomic factors are factors to consider that could influence performance positively or negatively. The mixed signals from insider trading and a lack of clarity in fundamentals lead to a neutral stance on stock direction. | Industrials | Consulting Services |

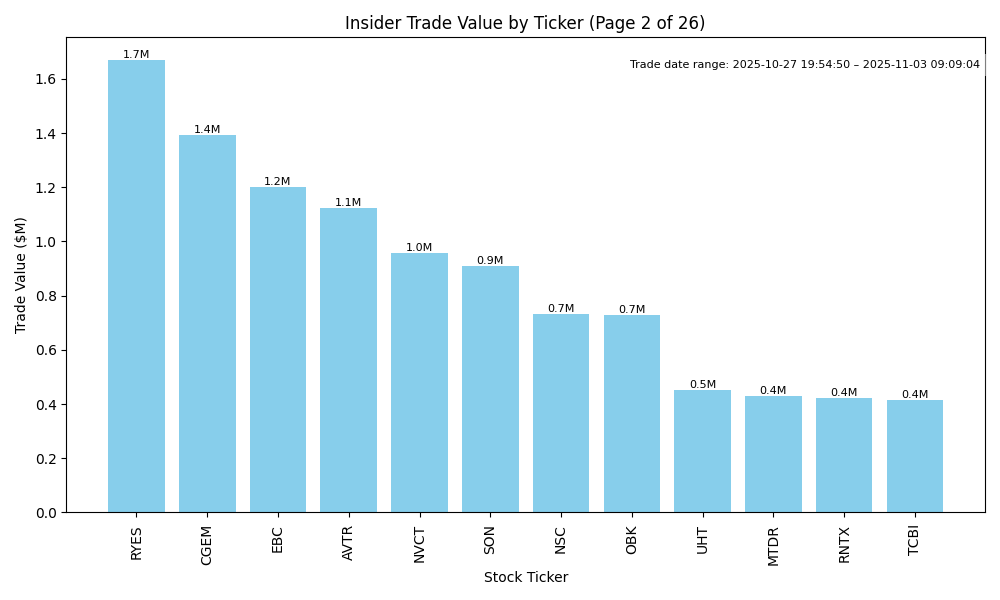

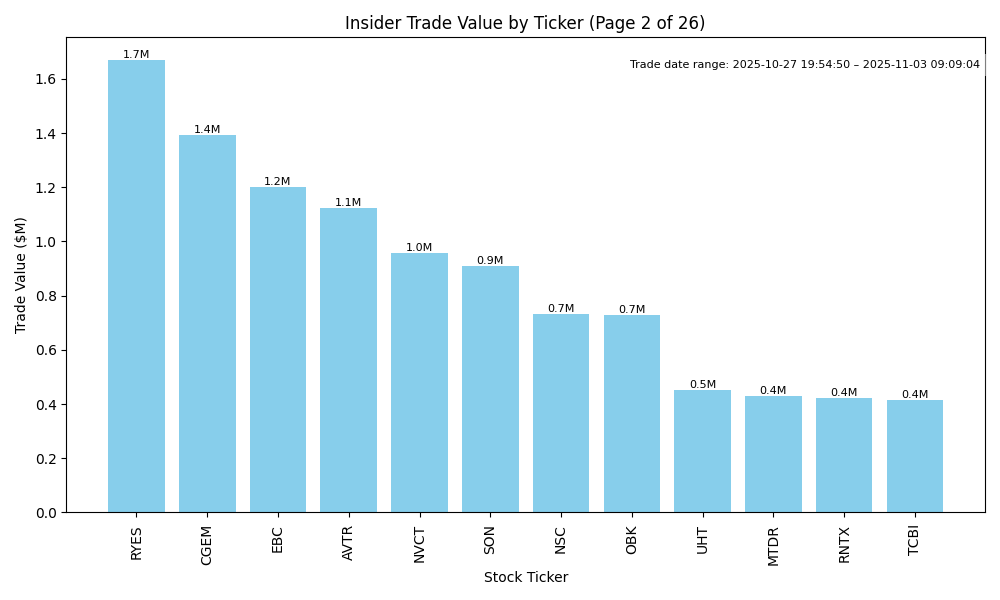

| RYES | UP | 0.80 | Recent insider purchases indicate strong internal confidence in RYES, with significant transactions from key executives and large stakeholders. The latest purchases total over 7 million shares at an average price of $0.25, signaling a positive outlook. However, without additional context on the company's fundamentals, such as recent earnings performance and industry conditions, confidence is tempered. The stock may benefit from this insider activity, assuming no detrimental macroeconomic factors hinder momentum, but clarity on long-term growth and operational health is needed for stronger conviction. | Basic Materials | Gold |

| CGEM | UP | 0.70 | Lynx1 Capital Management's aggressive purchasing of over 2 million shares at increasing prices signals strong insider confidence in CGEM's potential upside. Despite recent insider selling, the substantial purchases suggest belief in the company's growth. However, the current macroeconomic environment, including rising interest rates, may create headwinds. Additionally, understanding the company's fundamentals, earnings trends, and competing positioning is vital; these are not provided, lowering confidence. Nonetheless, the positive insider sentiment and significant buying trend suggest an upward direction in the near term. | Healthcare | Biotechnology |

| RANI | NEUTRAL | 0.60 | Recent insider buying, particularly by key executives, signifies confidence in the company's near-term prospects. However, large insider selling activities, especially from a significant stakeholder, raise concerns about stock valuation or company issues. The stark contrast between the purchase price of $0.61 and recent sales around $2.01-$2.65 suggests volatility and uncertainty. Without specific insights into company fundamentals, macroeconomic conditions, or industry trends, it's challenging to gauge a definitive direction. Current data points to mixed signals. | Healthcare | Biotechnology |

| EBC | UP | 0.75 | Recent insider buying by high-ranking executives, including the CFO and Executive Chair, suggests strong confidence in the company's future. These transactions occurred at prices generally higher than recent historical values, indicating positive sentiment. However, previous sales may indicate some caution among certain insiders. Without current earnings data, growth trajectories, or insights on the broader market environment impacting EBC, caution is warranted. The overall environment of rising interest rates and inflation could be a headwind. Still, insider purchases heavily outweigh the sales, providing a favorable outlook. | Financial Services | Banks - Regional |

| FCN | DOWN | 0.70 | Recent insider activity shows a mixed picture; notable purchases by CEO Steven Henry are countered by multiple large sales by himself and others, indicating potential profit-taking or lack of confidence. Company fundamentals are unclear without earnings data or leverage information, and macroeconomic factors such as rising interest rates and inflation could pressure valuations. The mix of insider transactions suggests uncertainty, leading to a likely downward trajectory for the stock in the near term. | Industrials | Consulting Services |

| AVTR | DOWN | 0.70 | Insider buying by Gregory L. Summe indicates some confidence, but the recent purchases occurred at higher prices, while AVTR is now at lower levels (around $11.25). The significant insider selling, particularly from key executives at much higher prices, raises concerns about share value deterioration. Additionally, without detailed fundamentals or macroeconomic data, such as revenue trends and market conditions, we maintain a cautious outlook. Thus, while insider buying is a positive signal, the context suggests a potential bearish short-term trend. | Healthcare | Medical Instruments & Supplies |

| FMNB | UP | 0.70 | Recent insider activity shows significant purchases, particularly by directors with large transactions indicating their confidence in the company's prospects. However, there are sales that could introduce caution. The company's fundamentals appear unclear without context on earnings trends, margins, and growth projections. Additionally, sector and macroeconomic dynamics such as interest rates and inflation remain uncertain, which could impact future performance. While the insider buying suggests a bullish sentiment, the lack of detailed company financials and the presence of insider selling temper overall confidence. | Financial Services | Banks - Regional |

| NVCT | DOWN | 0.70 | Despite significant insider purchases by key figures like Mosseri Marlio Charles and Ron Bentsur indicating confidence in NVCT, the stock price has been trending downward, with recent transactions showing a buying concentration at higher prices that are now below the average transaction prices. Additionally, if the company fundamentals, including earnings and growth potential, remain weak or uncertain, this insider buying may not suffice to counteract potential declines in market sentiment, particularly amid broader macroeconomic pressures like rising interest rates and inflation that could affect equity valuations. | Healthcare | Biotechnology |

| SON | UP | 0.70 | Recent insider purchases, particularly by the CEO and CFO, signify strong confidence in the company's prospects, suggesting potential undervaluation at current prices. However, historical trends show a pattern of sales leading to higher prices, and the stock has recently declined from higher price levels. Overall, while the insider activity leans positive, gaps in company fundamentals and broader macroeconomic conditions weaken the certainty of a price increase. | Consumer Cyclical | Packaging & Containers |

| NSC | UP | 0.70 | Recent insider trading is heavily skewed towards purchases, indicating a positive outlook from directors. Notably, the CEO and multiple directors are consistently buying shares at increasing prices, suggesting strong confidence in the company's future. Additionally, the trend of rising share prices and significant investment by insiders is generally a bullish sign. However, broader macroeconomic conditions such as persistent inflation and potentially rising interest rates may introduce headwinds. Overall, while insider buying provides a positive sentiment, external market conditions temper confidence. | Industrials | Railroads |

| OBK | UP | 0.85 | Insider trading for OBK shows a strong buying trend, with significant purchases by high-level executives, including the CEO and CFO, totaling over $450,000 on the same day. This concentrated insider buying suggests confidence in the company's outlook. However, a complete assessment of company fundamentals, industry dynamics, and macroeconomic conditions is necessary for a thorough evaluation. There is limited data available about current earnings trends and macroeconomic factors. Overall, the insider activity indicates a potential upward direction for the stock, but the confidence level reflects some uncertainty due to gaps in comprehensive financial data. | Financial Services | Banks - Regional |

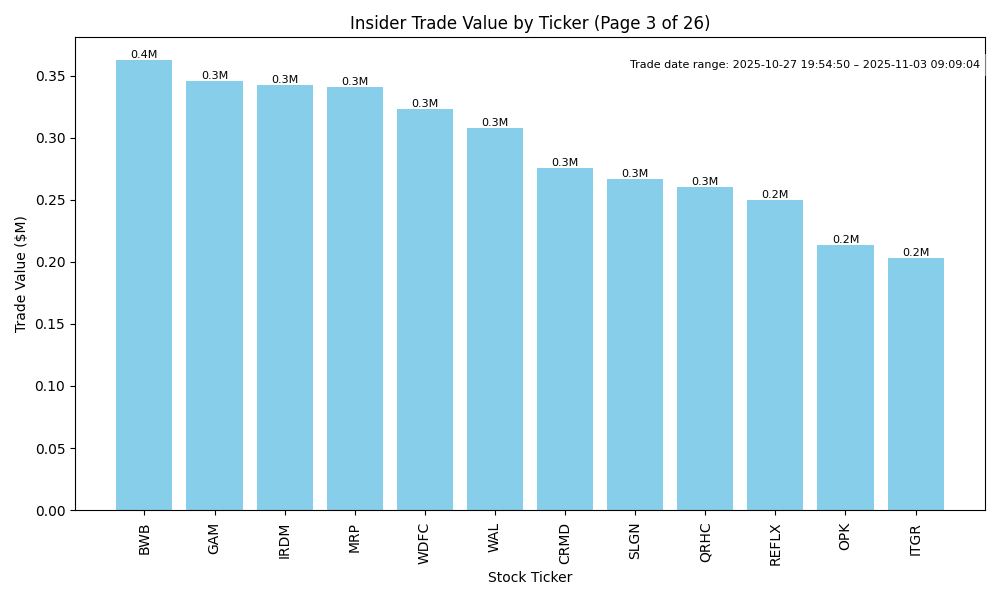

| WDFC | DOWN | 0.70 | Recent insider purchases suggest confidence from executives, with several directors and officers buying shares. However, the historical data shows a significant amount of insider selling at much higher prices, indicating potential decline in stock perceived by insiders as the shares traded above $250 last year. Current price levels close to $200 imply a significant drop without clear catalysts for recovery. Industry dynamics and macroeconomic factors currently lean unclear, especially accounting for rising interest rates and inflation concerns, which may impact consumer spending. Therefore, while insider buys offer some optimism, overall market conditions and historical selling pressure lead to a bearish outlook. | Basic Materials | Specialty Chemicals |

| UHT | UP | 0.70 | Recent insider purchases by the CEO and a director indicate confidence in the stock's future, especially with a substantial purchase of over 12,000 shares. However, to fully assess the stock's trajectory, evaluation of earnings trends, industry health, and macroeconomic conditions is necessary. There is a lack of detailed company fundamentals and broader economic context in the data provided, which introduces some uncertainty. Despite this, the strong insider activity is a positive indicator. | Real Estate | REIT - Healthcare Facilities |