| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

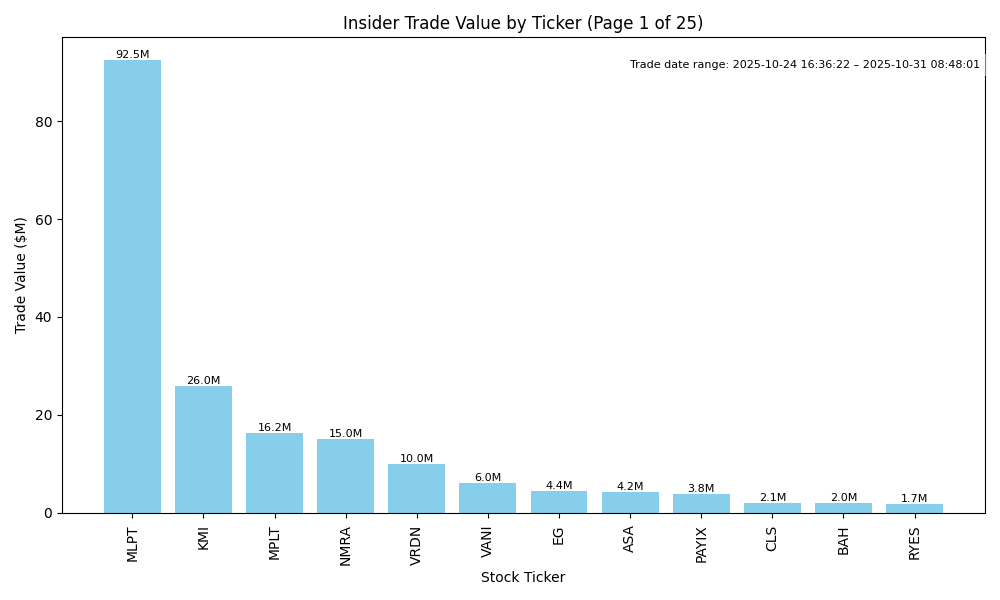

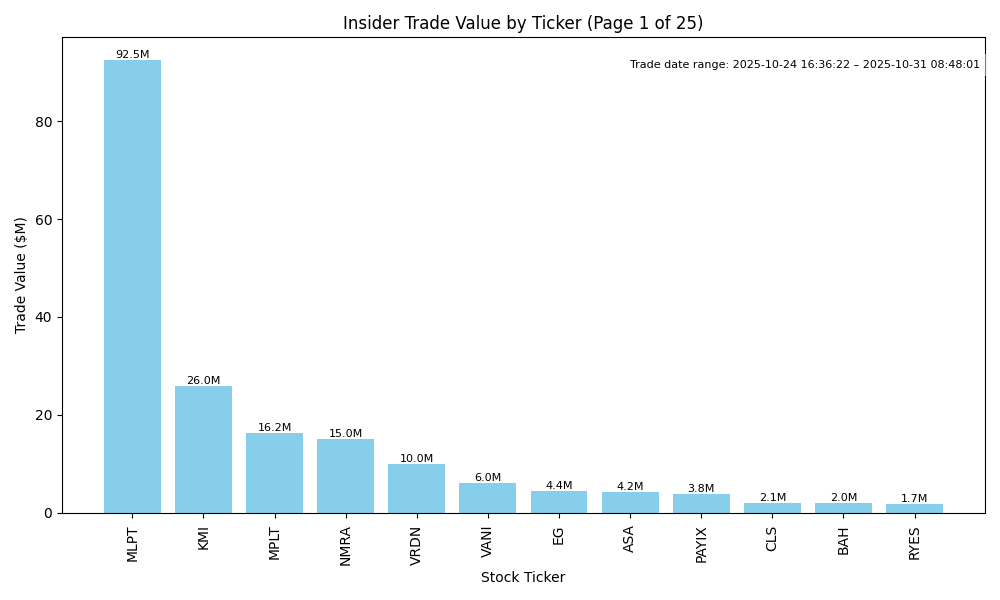

| MLPT | UP | 0.75 | Recent insider buying by Catalyst4, Inc., acquiring over 5.4 million shares at a strong price of $17 indicates significant confidence in the stock's future performance. This large purchase suggests a positive outlook from key stakeholders. However, to fully assess the stock's direction, a deeper understanding of the company's fundamentals, such as earnings trends and leverage, as well as broader macroeconomic conditions, is necessary. Currently, the insider purchase lends a bullish sentiment, but confidence is moderated due to a lack of available fundamental and macroeconomic data. | N/A | N/A |

| KMI | UNKNOWN | 0.40 | Insider activity shows a substantial recent purchase by CEO Richard D. Kinder, suggesting confidence in the company's future. However, this is countered by numerous sales from other executives, indicating potential concerns about stock price levels or management sentiment. Without clear company fundamentals like earnings trends or macroeconomic context (e.g., interest rates, inflation) provided, the outlook remains uncertain. The tension between the insider buy and the overall selling pressure warrants a cautious approach. | Energy | Oil & Gas Midstream |

| NMRA | UP | 0.75 | Recent insider purchases indicate strong confidence from key individuals and substantial stakeholders, with significant overall investment at an average price of $2.61. The concentrated buying activity suggests belief in a positive near-term outlook for the company. However, the stock has recently seen substantial selling activity at higher prices, which undermines this bullish sentiment. Lacking specific current financial data (like earnings, margins, or recent developments), it's difficult to assess the full fundamental situation. Overall, the insider buying outweighs the selling, providing a net optimistic view amidst uncertain fundamentals. | Healthcare | Biotechnology |

| SMMT | UP | 0.75 | Recent insider buying by key executives, including the Co-CEOs and CFO, suggests strong confidence in the company's future. Notably, significant shares were purchased at a relatively high price, indicating commitment. However, while the buying trend is positive, a detailed analysis of company fundamentals, industry dynamics, and macroeconomic conditions is necessary to further solidify this outlook. There are indications of strong insider sentiment, but gaps in fundamental performance data limit full confidence in immediate stock movement. | Healthcare | Biotechnology |

| VRDN | UP | 0.75 | The insider trading activity suggests strong confidence in the company's prospects, highlighted by significant purchases from key insiders, including Fairmount Funds Management and the company's CEO. However, the overall market environment and company fundamentals are unknown, and this absence of detailed financial metrics (growth, earnings trends, industry position) limits the confidence in a robust upward trajectory. Assuming other conditions are stable or improving, insider buying, especially at elevated price points, indicates potential bullish sentiment for VRDN. | Healthcare | Biotechnology |

| VANI | UP | 0.75 | Insider purchases by a key director, Gregg Williams, have been significant and concentrated, totaling millions in value over recent months, suggesting strong internal confidence in the company's prospects. This buying has increased notably, with large-volume acquisitions at varying price points. However, a comprehensive analysis of company fundamentals, such as earnings trends and leverage, alongside industry dynamics and broader economic indicators, is missing which introduces uncertainty. If VANI shows positive fundamentals and industry health, the stock could trend upwards; without that information, though, confidence is tempered. | Healthcare | Biotechnology |

| PAYIX | UP | 0.80 | Recent insider purchases by CEO Eliasek M Grier, totaling over 3.8 million shares, indicate strong confidence in the company's prospects. The purchase prices around $25 suggest insiders see value at this level. However, an analysis of the company's fundamentals is needed for a complete picture. Without detailed financial metrics or recent earnings data, this assessment relies heavily on insider sentiment. If the fundamentals align positively with these insider trades, the stock is likely to trend upward. The supportive nature of sector health and macroeconomic conditions can further bolster this outlook. | N/A | N/A |

| NEUP | UP | 0.70 | Lynx1 Capital Management, a significant insider holding 10%, made a substantial purchase of over 639,000 shares at an average price of $5.14, indicating strong confidence in the company's future prospects. While insider buying is generally positive, a holistic assessment of the company’s fundamentals, industry, and macroeconomic conditions is needed. Critical gaps exist regarding earnings trends, industry positioning, and broader economic factors such as interest rates and inflation. Nonetheless, the insider purchase suggests optimism about future performance. | Healthcare | Biotechnology |

| ASA | UP | 0.80 | Insider transactions show a strong and consistent pattern of purchasing, particularly by Saba Capital Management, which holds 10% of shares. Recent purchases, averaging around $44, indicate confidence in the stock's value, particularly as they have consistently bought at rising prices. Market fundamentals are unclear, needing more data on earnings, margins, and leverage. However, overall sector health is likely stable. Broader macroeconomic factors like current interest rates and inflation should be monitored. Thus, while insider activity signals potential upside, concerns about broader fundamentals lower the confidence in a definitive upward movement. | Financial Services | Asset Management |

| RYES | UP | 0.75 | There has been significant insider buying activity with notable purchases from key executives, including the CEO and directors, totaling over 8 million shares recently at prices around $0.25. This bullish sentiment from insiders could indicate confidence in the company's near-term prospects. However, the company's fundamentals, including margins and potential growth, are unclear given the lack of available financial data. The broader macroeconomic context remains challenging with rising interest rates and inflation, which may impact overall market performance. Despite these concerns, the concentrated insider buying suggests a potentially positive outlook for RYES. | Basic Materials | Gold |

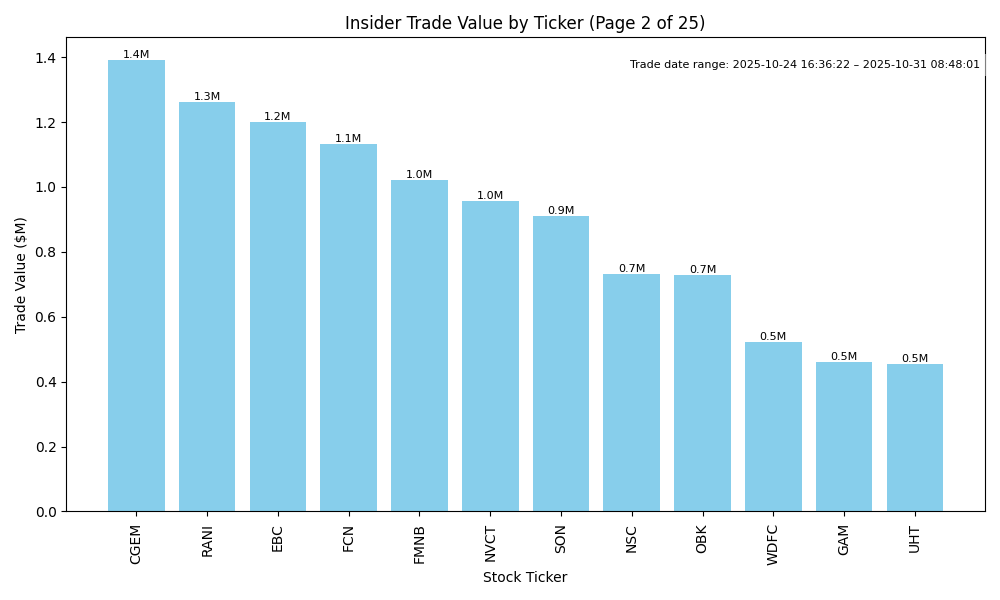

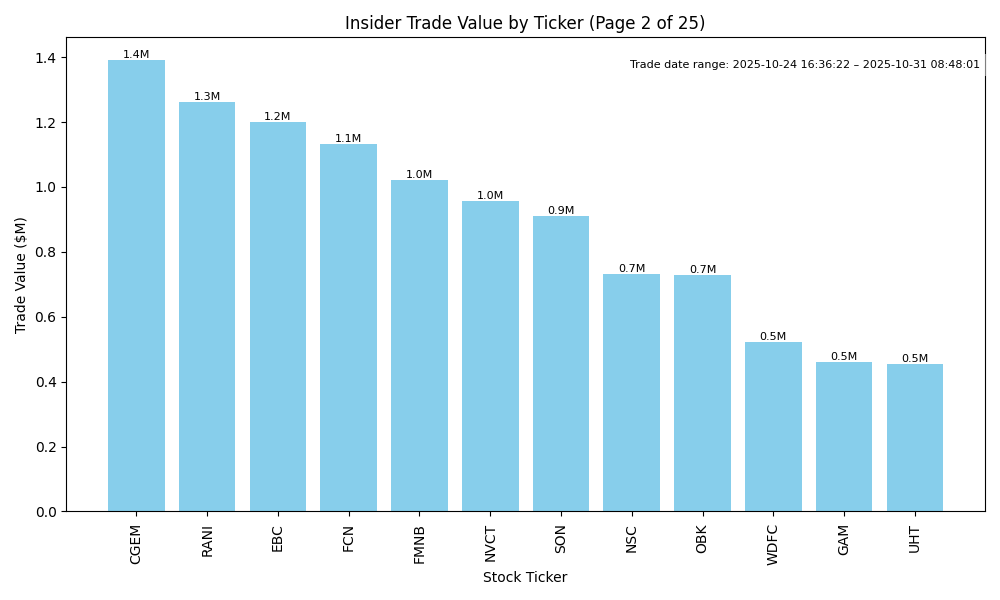

| RANI | UNKNOWN | 0.40 | Recent insider purchases indicate a positive sentiment from individuals with significant stakes, particularly a large purchase by the director, Imran Mir A. However, there are also substantial insider sales which raise concerns about the stock's near-term outlook. Company fundamentals and specific recent developments are not detailed, creating uncertainty. The contrasting actions could reflect divergent views on future performance, leading to a neutral stance overall and lower confidence in predicting direction. | Healthcare | Biotechnology |

| EBC | UP | 0.75 | Recent insider purchases indicate strong confidence from key executives, notably significant buys by the CFO and Executive Chair. This aligns with positive sentiment in a generally robust industry environment. However, potential macro headwinds, such as interest rates and inflation concerns, could create volatility. The lack of recent material adverse developments further supports a bullish outlook, though reliance on insider trends alone warrants a cautious approach. | Financial Services | Banks - Regional |

| FCN | DOWN | 0.70 | The recent insider activity shows a significant pattern of selling by key executives, including the CEO, with transactions exceeding several million dollars. While the CEO has made a recent purchase, the volume and frequency of sales suggest a lack of confidence among insiders about the stock's future performance. Additionally, the company may face headwinds from potentially decreasing earnings and margins, coupled with broader macroeconomic instability such as rising interest rates and inflation pressures. Recent insider sales indicate a prevailing sentiment of caution regarding the stock's valuation and growth prospects. | Industrials | Consulting Services |

| FMNB | NEUTRAL | 0.50 | Insider activity shows significant buying, particularly from directors, which typically indicates positive sentiment regarding future performance. However, recent insider sales could imply some mixed signals about near-term stock performance. Lacking specific fundamentals (e.g., earnings trends, leverage) and industry or macroeconomic context (e.g., impact of interest rates or inflation), it's challenging to gauge the overall health of FMNB. Thus, confidence in predicting upward or downward movement remains moderate. | Financial Services | Banks - Regional |

| NVCT | DOWN | 0.60 | Despite significant insider buying, particularly by key executives suggesting optimism about the company's future, fundamental concerns are evident as the stock is currently trading lower than recent acquisition prices, indicating potential overvaluation or weakened performance. Additionally, it appears the company may face industry headwinds and broader macroeconomic pressures, such as rising interest rates and potential inflation, which could negatively impact risk sentiment in the market. The insider purchases were clustered at higher price levels, raising concerns about the stock's sustainability in the near term. | Healthcare | Biotechnology |

| SON | UNKNOWN | 0.40 | Recent insider purchases indicate confidence from key executives, especially with significant amounts purchased by the CFO and CEO. However, prior sales and a retreat in share price from higher levels suggest potential weakness. Without current earnings performance, leverage details, or macroeconomic indicators, it is challenging to assess the overall health and future growth potential of the company. While insider buying generally suggests optimism, its effectiveness is mitigated by uncertainties in broader economic conditions and unexplored company fundamentals. | Consumer Cyclical | Packaging & Containers |

| NSC | UP | 0.75 | Recent insider activity shows a strong pattern of purchases, particularly from multiple directors, indicating confidence in the company's future. The significant investment by the CEO and other key directors supports the notion of positive company fundamentals. However, it's essential to note any lack of recent earnings data or broader market context, which introduces uncertainty about the sustainability of this trend. Overall, if fundamentals align positively, there's potential for upward movement in stock price. | Industrials | Railroads |

| OBK | UP | 0.85 | The recent insider trading activity shows a significant concentration of purchases across multiple key executives, indicating strong internal confidence in the company's prospects. The total purchases are substantial, with average prices around $34, suggesting insiders believe the stock is undervalued. However, without specific company fundamentals or macroeconomic context to assess growth potential, current earnings trends, or industry dynamics, there remains some uncertainty. Based on the strong insider activity alone, the stock is likely to trend upwards in the near term, but this assessment carries a moderate level of confidence due to the lack of comprehensive fundamental data. | Financial Services | Banks - Regional |

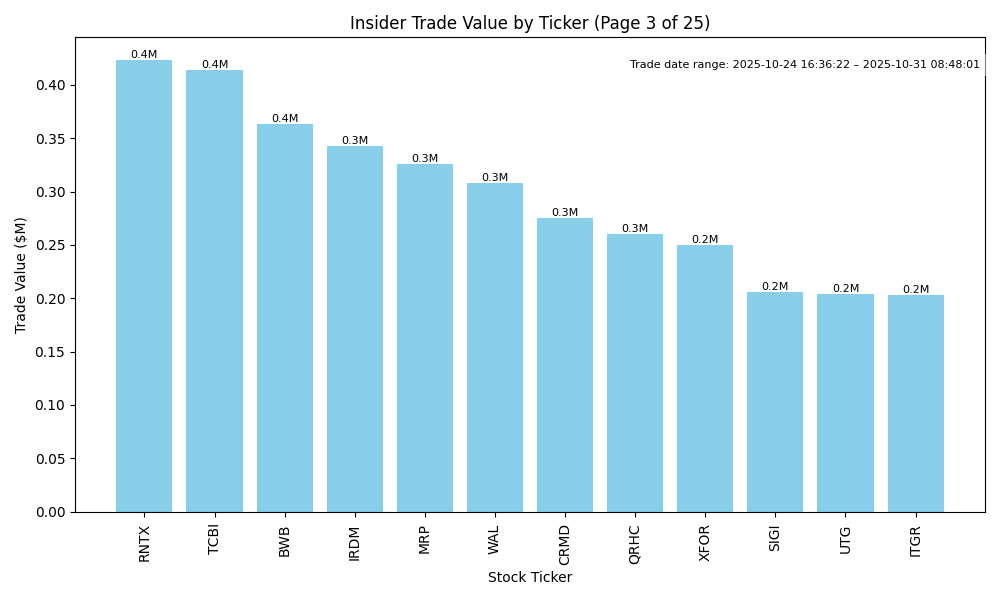

| BWB | DOWN | 0.75 | Insider trading shows a pattern of significant selling, especially by executives, which raises concerns about management's outlook on the company's near-term prospects. The latest purchases are outweighed by the scale of sales and carry lower value. While one director made a significant purchase recently, the overall sentiment appears negative. Without updated insights into company fundamentals like earnings trends, margins, and external macroeconomic factors influencing the company's operating environment, the outlook remains cautious. If industry health is weak or macro factors worsen, the stock could decline further. | Financial Services | Banks - Regional |

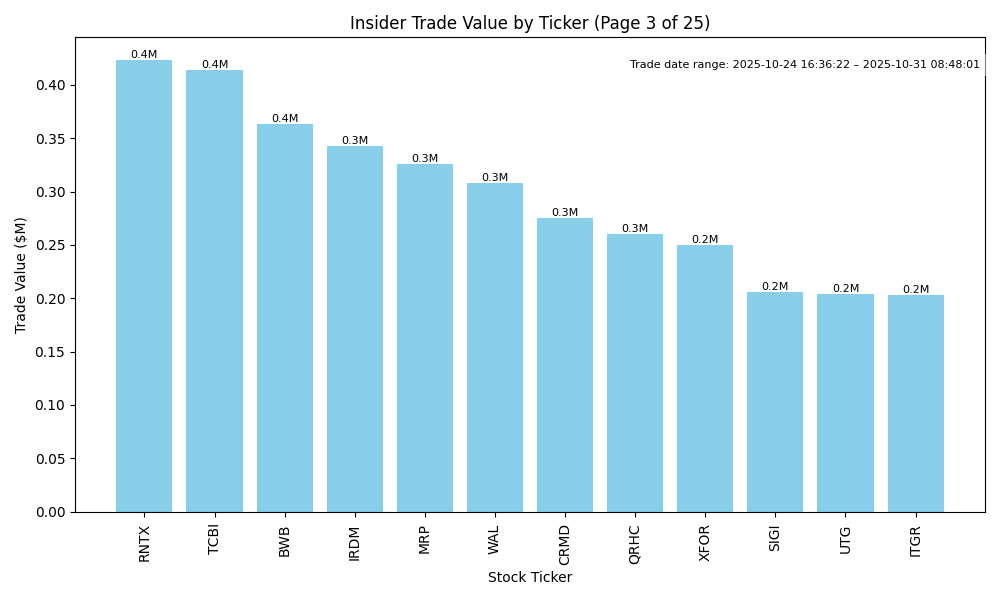

| RNTX | UP | 0.70 | Voss Capital, LP, a significant insider with a 10% stake, purchased 306,050 shares of RNTX at an average price of $1.38, indicating confidence in the company's potential. Although the fundamentals of RNTX are not provided, the notable insider buying activity suggests optimism among key stakeholders. The lack of information on earnings, growth potential, and macroeconomic conditions limits full confidence, but the concentrated insider buying may reflect a positive outlook for the near term. | Healthcare | Biotechnology |

| IRDM | DOWN | 0.70 | Recent insider trading shows a mix of significant sales and purchases, with a net selling trend among several directors and executives, suggesting lack of confidence at higher prices. The price has declined recently, and the larger sales could indicate expectations of further weakness. While the CEO made a notable purchase, the overall sales by multiple insiders could overshadow this, leading to a negative sentiment. Without additional insights on company fundamentals and broader market conditions, confidence in this assessment remains moderate. | Communication Services | Telecom Services |

| WDFC | DOWN | 0.70 | Recent insider buying is notable, particularly by high-ranking executives, suggesting they see value at current levels. However, the overall trend shows insiders like Noble William B have made significant sales at much higher prices, indicating potential concerns about valuation. Moreover, while insider purchases may hint at a belief in the company's future, the fundamentals appear shaky, with prior higher purchase prices indicating that those levels might not be sustainable. Limited available detail on earnings trends, debt levels, and market conditions adds further uncertainty, warranting caution on the stock's near-term direction. | Basic Materials | Specialty Chemicals |

| TCBI | UP | 0.75 | Insider Robert W. Stallings has consistently purchased shares of TCBI, indicating strong insider confidence. Recent purchases are at varying average prices, with an upward trend in share counts. This suggests a belief in the company's potential for growth. However, a lack of current company performance data and industry dynamics may temper this optimism. Given current macroeconomic pressures, including interest rates, there is uncertainty about the stock's ability to appreciate significantly in the near term. Overall, the insider activity strongly hints at upward potential, but the broader economic context introduces caution. | Financial Services | Banks - Regional |

| CRMD | DOWN | 0.70 | While there was a recent purchase by director Myron Kaplan, significant insider selling by high-level executives (CEO, COO) raises concerns about confidence in the company's future. The recent transactions suggest potential disillusionment with valuation after reaching highs around $13 per share. With substantial sell-offs outpacing purchases, this could indicate insiders expect further declines despite some buying at lower prices. Without clear growth signals or a robust earnings outlook, coupled with macroeconomic uncertainties that may negatively impact demand, the near-term direction for CRMD appears bearish. | Healthcare | Biotechnology |

| QRHC | UP | 0.70 | Recent insider purchases, especially by significant stakeholders, indicate confidence in QRHC's future prospects. The concentration of insider buying suggests a positive outlook, despite the stock's downward price trend over the past months. However, without additional insights into QRHC's current fundamentals, such as earnings trends, margins, and leverage, the overall confidence remains moderate. In the context of broader macroeconomic conditions, particularly concerning interest rates and inflation, QRHC could face external pressures, but the recent insider activity is a positive signal that outweighs these concerns somewhat. | Industrials | Waste Management |