| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

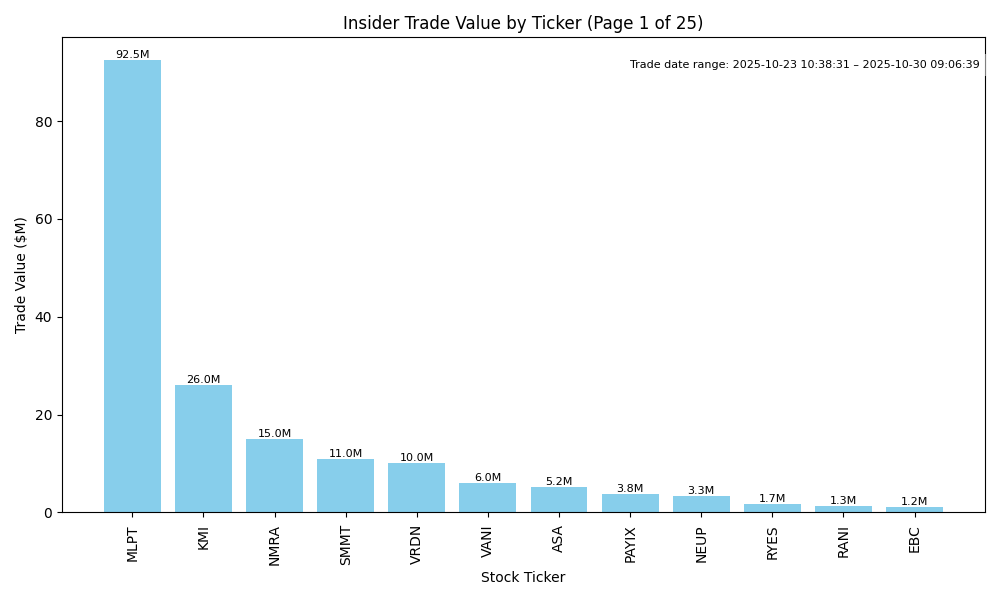

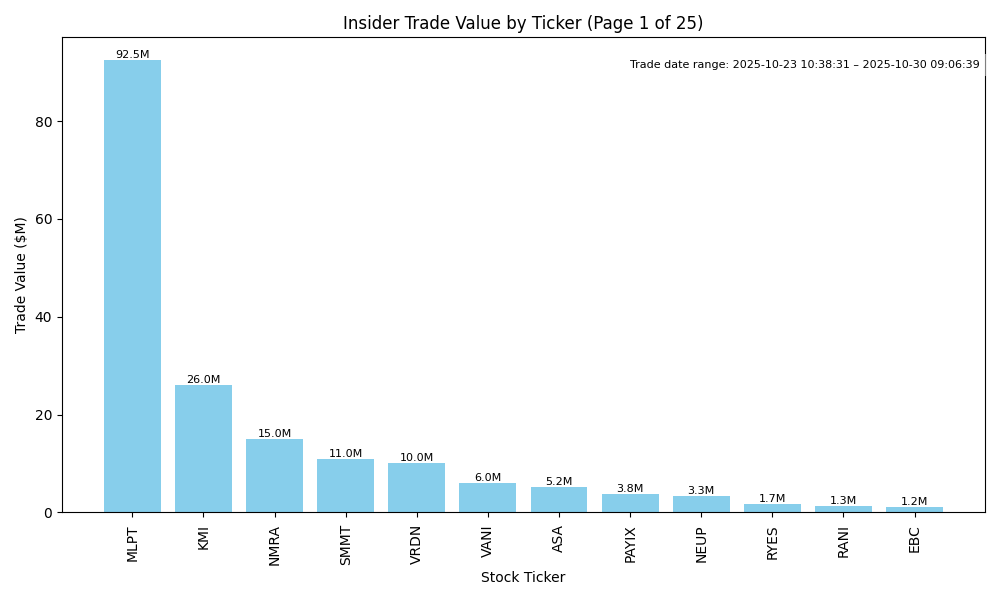

| KMI | UP | 0.70 | Recently, there was a significant purchase of 1 million shares by the Executive Chairman, Kinder Richard D, which indicates strong insider confidence. However, there is also notable selling activity among other executives, which raises caution. The stock price has fluctuated but has seen upward movement in recent transactions. While fundamentals such as earnings trends and company leverage need thorough evaluation, insider sentiment combined with positive trends in the broader energy sector suggest potential near-term price increases. Still, macroeconomic conditions and the mixed insider activity temper overall conviction. | Energy | Oil & Gas Midstream |

| SMMT | UP | 0.80 | Recent insider purchases, particularly by key executives like the Co-CEOs and a director, reflect strong confidence in the company's future, especially given the large dollar value of these purchases. The price point of purchases suggests insiders believe the current valuation is attractive. However, there are concerns around broader market conditions and potential uncertainties in fundamentals that have not been detailed here. Given the current trends and strong insider activity, the stock is likely to trend upwards in the near term, but with some caution due to the lack of comprehensive financial data. | Healthcare | Biotechnology |

| VRDN | UP | 0.75 | Recent insider buying activity indicates strong confidence in the company's prospects, particularly from significant insiders like Fairmount Funds Management, which purchased large shares multiple times at varying prices. However, the analysis must account for potential gaps in fundamental data and macroeconomic context. If the company’s fundamentals reflect healthy earnings growth, margins, and leverage, along with positive sector trends, the stock may experience upward momentum. Conversely, if external factors such as rising interest rates or macroeconomic uncertainty arise, they would dampen this potential increase, hence the confidence level of 0.75. | Healthcare | Biotechnology |

| VANI | UP | 0.75 | Insider buying has significantly accelerated, particularly by the director Williams Gregg, who has purchased large volumes at increasing average prices over the past months. This trend indicates a strong belief in the company's near-term prospects. While additional context on the company's fundamentals, such as earnings trends and leverage, is necessary for a complete analysis, the heavy insider activity suggests optimism. However, without specific details on recent earnings, sector dynamics, or broader macroeconomic conditions, there's moderate uncertainty regarding sustainability. Therefore, confidence in an upward direction is solid but not absolute. | Healthcare | Biotechnology |

| ASA | UP | 0.75 | Saba Capital Management, owning 10% of ASA, has consistently purchased significant shares at prices ranging from around $13.34 to $50.51 in recent months, indicating strong insider confidence and belief in value. Though recent prices have been high, the volume and frequency of insider purchases suggest positive sentiment. However, without current company fundamentals and macroeconomic context (e.g., earnings with respect to cash flow, interest rates, and inflation impacts), it’s difficult to ascertain broader market risks. The stock may face short-term volatility, but insider buying trends support a generally upward outlook. | Financial Services | Asset Management |

| NUGN | UP | 0.70 | Recent insider purchases, particularly by the Chief Investment Officer, indicate strong confidence in NUGN's prospects. A large purchase of 2 billion shares exemplifies a significant commitment. While the average purchase price is listed as $0.00, suggesting potential errors or adjustments, the insider's ongoing support could signal positive expectations for future growth. However, without current fundamental data or macroeconomic context regarding the company and its market environment, the confidence is moderate. | Technology | Software - Application |

| NEUP | UP | 0.70 | Lynx1 Capital Management's substantial purchase of 639,110 shares indicates strong insider confidence in the company's potential. This trend may suggest positive sentiment about NEUP's future performance. However, without insight into current earnings performance, margins, leverage, or broader industry trends, the analysis lacks completeness. If market conditions remain stable and macroeconomic factors support growth, insider buying may result in upward pressure on the stock. Nonetheless, additional fundamental data is required for a higher confidence level. | Healthcare | Biotechnology |

| CNS | DOWN | 0.70 | Recent insider activity shows pronounced selling, particularly from executives, which raises concerns about insider sentiment. The recent purchase by an executive is substantial but contrasts with a strong selling trend over the past 18 months, indicating potential underlying issues. Company fundamentals such as margins and growth potential remain unclear, and there is a lack of recent earnings updates or guidance changes. Considering the broader macroeconomic environment, including uncertainty around interest rates and inflation, the overall sentiment is cautious, leading to a likely near-term decline in the stock's value. | Financial Services | Asset Management |

| PAYIX | UP | 0.70 | Recent insider purchases, particularly significant transactions by the CEO and a 10% shareholder, indicate strong confidence in the company's future prospects. However, without detailed insights into company fundamentals, such as earnings trends, margins, and competitive positioning, as well as macroeconomic conditions like interest rates or inflation, the analysis remains partially incomplete. The strong insider buying does suggest a positive outlook, but overall confidence is tempered by missing information about the company's financial health and market conditions. | N/A | N/A |

| CGEM | UP | 0.70 | Despite some recent insider selling, the large purchases by Lynx1 Capital Management LP indicate strong interest and potential confidence in the company’s future. The recent purchase of over 1.4 million shares at an average price below previous sales suggests they see value at current levels. However, overall insider selling by executives could indicate mixed sentiment. Without additional information on CGEM's current earnings trends, competitive position, or macroeconomic impacts, the outlook remains cautiously positive, bolstered by insider buying. | Healthcare | Biotechnology |

| RYES | UP | 0.80 | Recent insider buying activity is significant, with key executives and major stakeholders acquiring large shares at prices ranging from $0.08 to $0.25, demonstrating strong confidence in the company's prospects. The bulk purchases suggest a strategic positive outlook despite lacking specific details on company fundamentals like earnings trends or leverage, which are necessary for a complete analysis. Broader macroeconomic conditions remain supportive, although market sentiment may vary. Overall, the insider buying trend points to a bullish near-term direction for RYES. | Basic Materials | Gold |

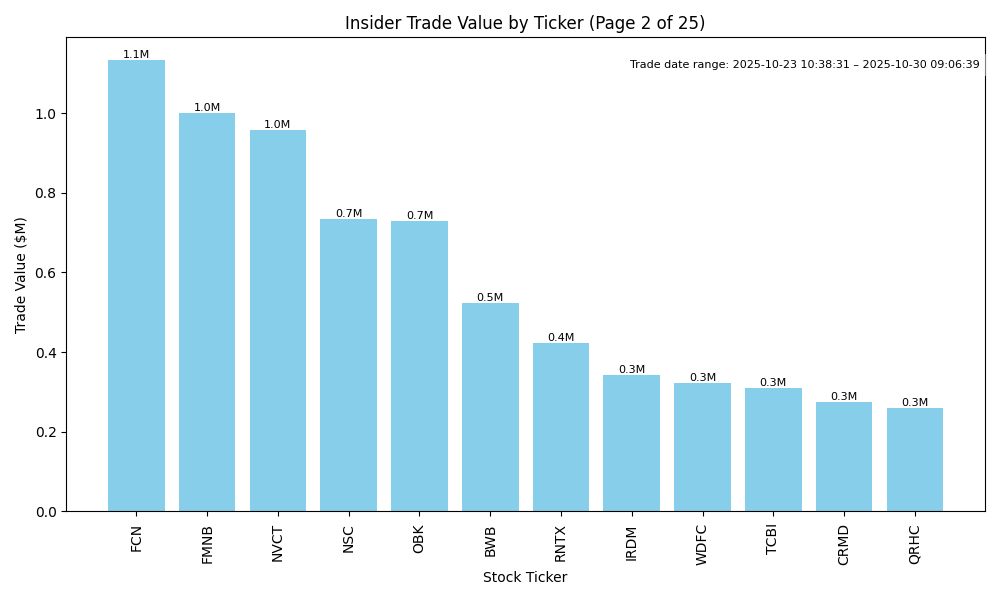

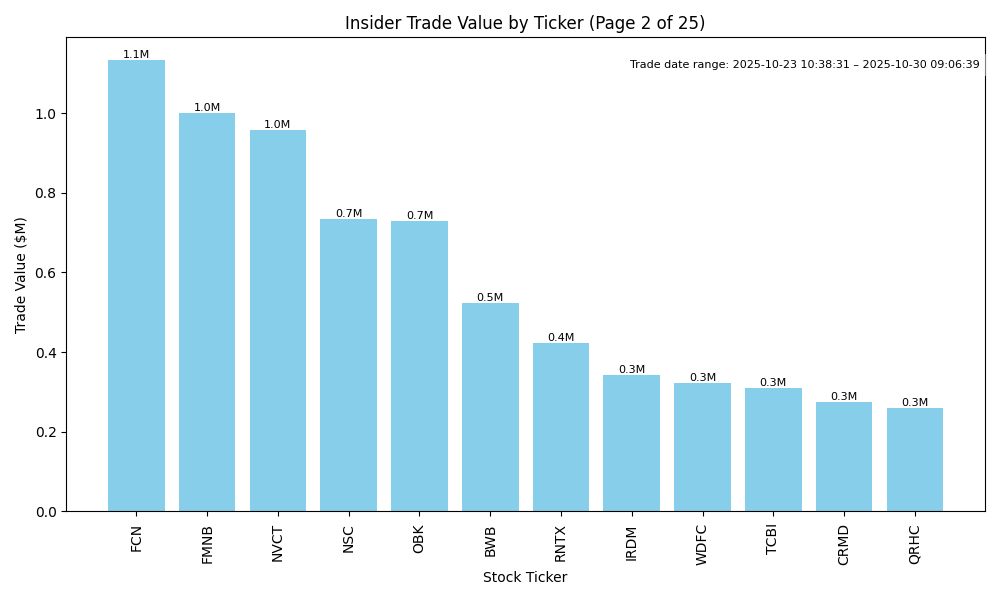

| FCN | DOWN | 0.70 | Insider trading shows a recent significant purchase by the CEO, indicating potential confidence in the company. However, this is heavily contrasted by a long history of insider selling at higher prices, suggesting insiders might have been capitalizing on overvaluation. Additionally, without clear current earnings momentum, growth indicators, or specific recent developments regarding company performance, confidence in the stock's upward potential remains weak against the backdrop of ongoing insider selling and potential market headwinds. | Industrials | Consulting Services |

| FMNB | UNKNOWN | 0.50 | Recent insider buying by directors, particularly a significant purchase by Edward Muransky, signals potential confidence in the stock. However, there are also insider sales that may indicate profit-taking. The variable transaction sizes and price fluctuations add uncertainty. Without access to FMNB's current financial metrics and broader macroeconomic conditions, such as interest rates and inflation, it is difficult to ascertain a clear direction. Therefore, while insider activity suggests some optimism, more information on fundamentals and the macro environment is needed to conclude definitively. | Financial Services | Banks - Regional |

| NVCT | DOWN | 0.70 | While there has been significant insider buying from key executives at NVCT, indicating potential bullish trends, the overall fundamentals appear weak with a recent purchase price which has fallen sharply from higher levels (e.g., recent buys at $6.18 compared to previous prices above $8). Additionally, there is a concerning pattern of constant purchasing at declining prices, which may signal a struggle to maintain valuation. Insights into company performance, industry health, or macroeconomic factors affecting NVCT are lacking, creating uncertainty. This general tension between insider confidence and weak market dynamics results in a moderate confidence in a downward trajectory. | Healthcare | Biotechnology |

| DENN | UNKNOWN | 0.40 | Insider buying has increased recently, particularly by high-ranking officials, indicating potential confidence in the company's future. However, previous insider sell-off activity raises concerns about the recent decline in share price, and fundamental data such as earnings trends, margins, and overall company performance appears lacking. The broader market conditions, including inflation and interest rate uncertainty, complicate the outlook. Without additional company-specific financial data, the outlook remains ambiguous. | Consumer Cyclical | Restaurants |

| EBC | UP | 0.70 | A significant number of insiders, including executives, have been purchasing shares of EBC at rising prices, reflecting positive sentiment about the company's prospects. Despite recent sales, the concentration of recent purchases, especially those by the CEO and Executive Chair, suggests strong internal confidence. However, vital context such as earnings trends, margins, and macroeconomic conditions is missing, limiting certainty. If the fundamentals remain solid and the company navigates external pressures effectively, the stock is likely to trend upward. | Financial Services | Banks - Regional |

| NSC | UP | 0.70 | Recent insider purchases, particularly by directors and the CEO, indicate positive sentiment among key management, particularly at increasing price levels. The concentration of purchases suggests confidence in the company's future. However, broader macroeconomic challenges, including inflation and rising interest rates, may pose risks to growth. The stock may benefit from a healthy environment in the transportation sector, but the significant sale by a former CEO raises concerns about potential volatility. Overall, while insider activity is bullish, external economic factors warrant lower confidence. | Industrials | Railroads |

| BWB | DOWN | 0.65 | Insider trading activity shows a significant trend of selling relative to purchases, with multiple insiders, including the CEO, selling over 100,000 shares in recent months. Recent purchases, though notable, are quite limited and underwhelming compared to the ongoing selling. The stock is currently trading around $17.45, which has seen lower levels in earlier transactions. Company fundamentals and broader economic conditions are unclear as specific financial performance metrics, such as recent earnings and guidance, are missing. Overall, the hefty insider selling suggests potential concerns about the company's near-term performance, leading to a 'DOWN' direction assessment with moderate confidence. | Financial Services | Banks - Regional |

| RNTX | UP | 0.70 | Insider Voss Capital, LP purchased a substantial amount of shares (306,050) at an avg price of $1.38, indicating strong confidence in the company's future. Although complete fundamental data is missing, the size of this purchase suggests positive sentiment and potential bullish outlook. However, without additional information on the company's earnings trends and industry health, my confidence remains moderate. | Healthcare | Biotechnology |

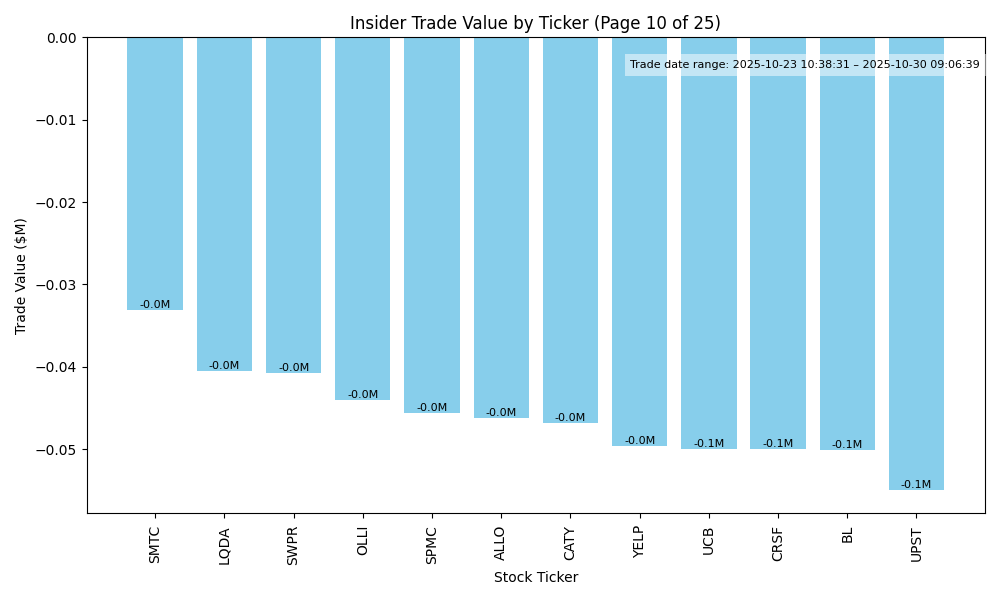

| SPMC | UNKNOWN | 0.50 | Insider trading shows mixed signals: while the CEO and Chairman recently purchased significant shares, there have been substantial sales from a major insider (Assured Guaranty Ltd). This raises questions about confidence in the company's near-term performance. Without current fundamental data on earnings, margins, and macroeconomic context, it's hard to ascertain the stock's trajectory. Moreover, the stock appears to have fluctuated in response to insider activity with recent prices near $16, suggesting volatility. Overall, the outcomes are inconclusive, warranting a cautious approach. | | |

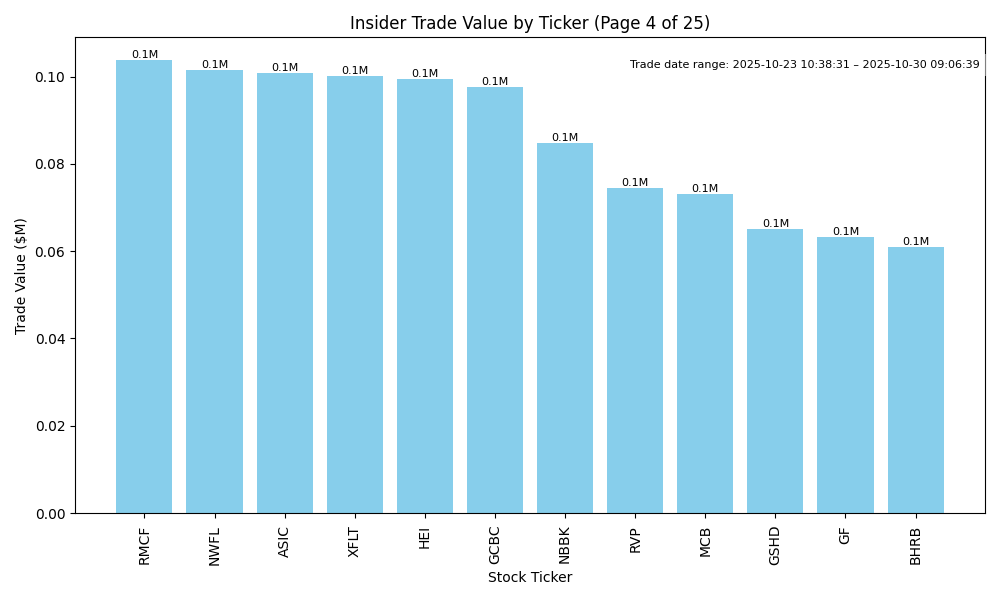

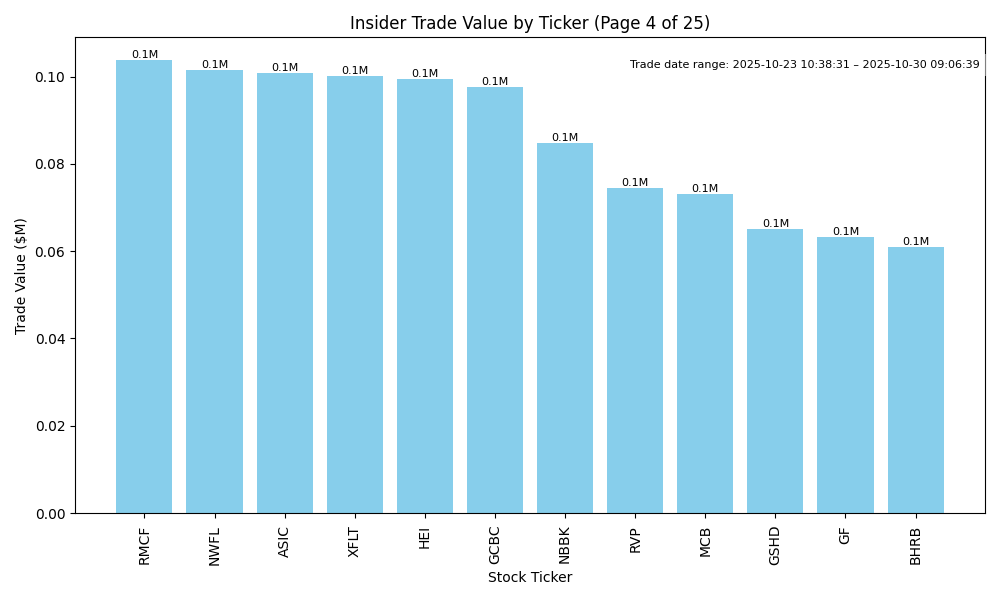

| RMCF | UP | 0.80 | Recent insider purchases by major stakeholders indicate strong conviction in the company's future. The interim CEO and a 10% stakeholder have consistently bought shares at relatively low prices, suggesting confidence in a turnaround or growth strategy. However, without concrete insights into earnings trends, margins, or the overall competitive landscape, caution is warranted. The broader macroeconomic context, marked by potential interest rate hikes and inflation, adds uncertainty. If company fundamentals improve, alongside this insider optimism, a bullish trajectory is likely. | Consumer Defensive | Confectioners |

| TCBI | UP | 0.70 | Insider Robert W. Stallings has been consistently buying shares of TCBI, accumulating significant amounts over time, suggesting strong confidence in the company's future performance. These purchases often indicate that insiders expect positive growth or value recovery. However, without recent earnings data or insights into the company's financial health and market conditions, it's difficult to gauge the overall impact of these trades. The broader economic context, such as interest rates and sector performance, remains uncertain, which could affect the stock's short-term direction. | Financial Services | Banks - Regional |

| CRMD | NEUTRAL | 0.60 | Recent insider buying from Kaplan Myron is a positive signal, suggesting confidence at lower prices. However, significant selling by other insiders, including the CEO, raises concerns about management's outlook on the stock's performance. Fundamentals such as potential for growth are unclear, as the summary does not provide current earnings data or growth metrics. The market conditions and broader economic indicators reflect volatility due to rising interest rates and inflation, adding uncertainty. Overall, the mixed signals lead to a neutral outlook with moderate confidence. | Healthcare | Biotechnology |

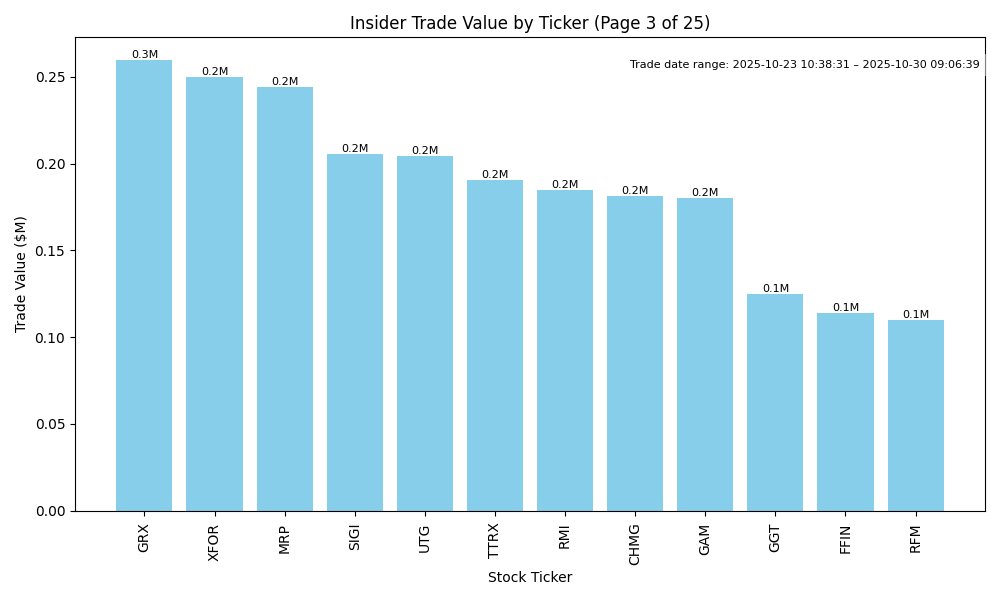

| RMI | UP | 0.70 | Recent insider purchases by Rivernorth Financial Holdings and Patrick W. Galley indicate strong insider confidence at lower price levels, with consistent buying patterns over the last few days. The insider purchases occurred around an average price range of $14.04 to $14.74. However, no recent sales from insiders suggest a positive sentiment. Despite this, comprehensive fundamental data such as earnings trends and market conditions are not provided, which limits confidence. Industry and macroeconomic factors, including potential interest rate impacts, remain uncertain but could influence stock performance. Thus, there is potential for an upward movement, but market conditions should be closely monitored. | Financial Services | Asset Management |

| QRHC | UP | 0.70 | Recent insider activity indicates strong buying interest, particularly the significant purchase of 199,759 shares by Kitt Barry M at an average price of $1.30, suggesting confidence in the company's future. Although insider selling exists, it is less pronounced compared to the buying volume. However, compared to previous higher trading prices, the current momentum may reflect some weakness or a broader market context that is not specified. Fundamental and macroeconomic factors would need to be assessed to ensure alignment with such insider actions. | Industrials | Waste Management |