| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

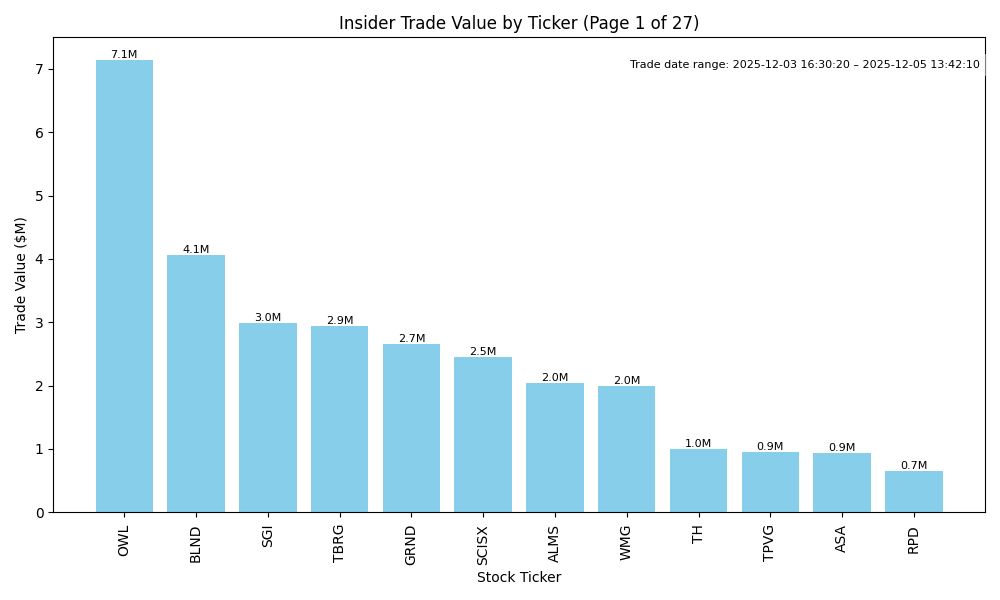

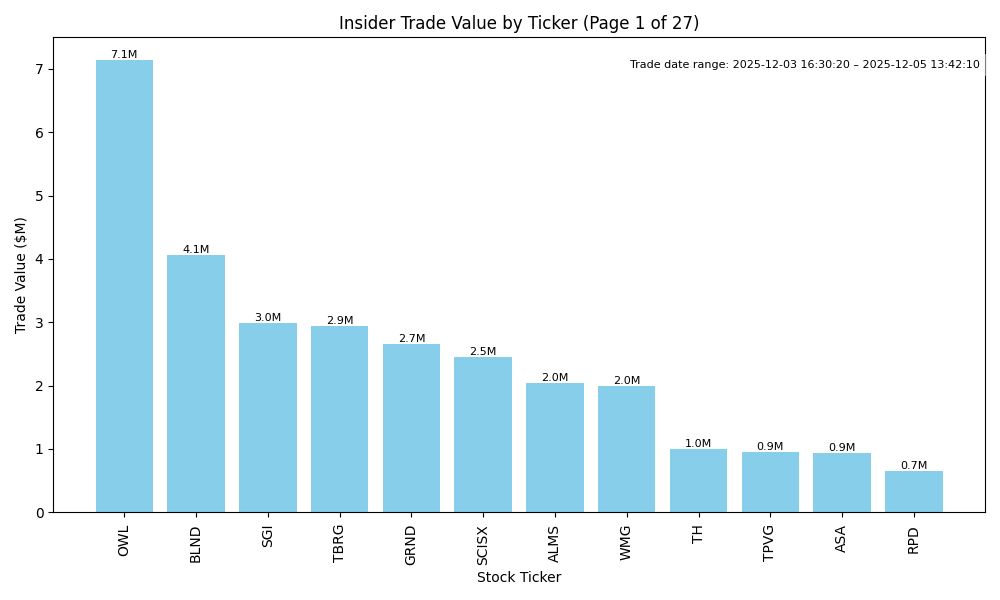

| OWL | UP | 0.80 | Recent insider purchases from multiple high-level executives, including the CFO and Co-CEOs, suggest strong confidence in the company's future prospects, especially given the significant volume and total values involved. However, the prior substantial insider selling raises questions about overall sentiment. The fundamental context is unclear without specific data on earnings trends or leverage. If the industry environment is stabilizing and macroeconomic conditions remain supportive, the aggressive insider buying could outweigh prior selling discussions, indicating a near-term upward trajectory for the stock. | Financial Services | Asset Management |

| BLND | UP | 0.75 | Recent insider purchases by Haveli Investments, L.P. (a significant shareholder) total more than 6 million shares, indicating strong confidence in the company's future. Despite some insider selling trends, which are typical, the volume and timing of purchases suggest a bullish outlook. However, lack of detailed information on company fundamentals such as earnings performance and macroeconomic conditions raises uncertainty. If the company's recent performance reflects improving fundamentals and the broader sector shows strength, this could lead to upward stock momentum in the near term. | Technology | Software - Application |

| SGI | DOWN | 0.60 | Recent insider trading patterns indicate significant selling activity, especially by key executives, suggesting a lack of confidence in the stock's near-term performance. Although one director made a notable purchase, the overall trend shows more shares sold than purchased, with substantial sales at lower average prices, indicating potential concern about the company's future. Without current earnings data, industry context, or macroeconomic factors provided, this analysis carries a moderate level of uncertainty. | Consumer Cyclical | Furnishings, Fixtures & Appliances |

| TBRG | DOWN | 0.60 | Recent insider trading shows significant purchases by Pinetree Capital Ltd. and other insiders, indicating positive sentiment. However, the stock's price has been fluctuating, with recent purchases occurring at much lower prices than current levels, suggesting potential overvaluation. The presence of insider selling, particularly from high-ranking officials, raises concerns about future prospects. Additionally, without detailed information on company fundamentals such as earnings trends, margins, and macroeconomic conditions like inflation or interest rates, there is uncertainty. Overall, the mixed signals from insider activity and unclear fundamentals warrant a cautious outlook. | Healthcare | Health Information Services |

| GRND | UP | 0.75 | Despite a significant historical trend of insider selling, the recent activity shows substantial purchases from Zage George Raymond III, who has acquired a significant number of shares at increasing prices. This indicates a positive outlook from insiders. On the fundamentals side, key data on earnings growth, margins, and leverage are absent, which introduces uncertainty. The broader macroeconomic environment of rising interest rates and inflation, along with potential industry challenges, may pose risks. However, the strong insider buying suggests potential confidence in upcoming performance, leading to a generally bullish yet cautious outlook. | Technology | Software - Application |

| SCISX | UP | 0.80 | Recent insider buying activity is significant, especially concentrated among major holders like Ma Eagle Holdings Fund, suggesting strong internal confidence in the company's prospects. The persistent purchases at stable price points signal belief in a favorable valuation. However, recent sales by Ma Eagle II Holdings Fund may indicate some profit-taking. Without current company fundamentals or broader macroeconomic data, this analysis faces limitation. If earnings and macroeconomic conditions align positively, this sets a bullish sentiment, supporting an upward price trajectory for SCISX. | N/A | N/A |

| ALMS | UP | 0.80 | Recent insider buying is substantial, indicating strong confidence from key stakeholders about the company's prospects. Notably, multiple directors and affiliated entities have made significant purchases at increasing prices, suggesting a bullish outlook. However, without current fundamentals—such as earnings trends or growth potential—being disclosed, the analysis is incomplete. Also, potential broader economic factors like interest rates or inflation may influence market conditions. Overall, the insider sentiment is positive, supporting an upward direction, though the lack of deeper fundamental context reduces confidence somewhat. | Healthcare | Biotechnology |

| WMG | DOWN | 0.70 | Recent insider trading shows a notable increase in selling activity by key executives, particularly the CEO, who sold significant shares at higher prices earlier this year. The recent purchases by an insider may suggest some confidence, but they are overshadowed by these larger sales. Without updated fundamental metrics or context on earnings and growth potential, the stock appears vulnerable due to the prevailing selling pressure and potential bearish sentiment amidst a challenging macroeconomic environment with rising interest rates and inflation concerns. | Communication Services | Entertainment |

| TH | NEUTRAL | 0.60 | Insider purchases by Director Stephen Robertson indicate internal confidence; however, the sales by other insiders, particularly in recent months, raise concerns about potential stock overvaluation or differing perspectives on the company's outlook. Without strong company fundamentals or recent material positive developments in earnings, guidance, or macroeconomic conditions, the overall sentiment remains mixed. Additional context around the company's performance and industry health is necessary to form a clearer direction. | Industrials | Specialty Business Services |

| TPVG | UP | 0.80 | Recent insider purchases by the CEO and CIO suggest strong internal confidence in TPVG's prospects, especially given significant cumulative buying over short timeframes at rising prices. However, without current data on company fundamentals and broader macroeconomic conditions, the analysis is limited. If the earnings trends and growth potential are favorable alongside supportive industry conditions, the stock could trend upwards. Overall, the strong insider activity contributes to a bullish outlook. | Financial Services | Asset Management |

| ASA | UP | 0.75 | Insider buying has been robust, particularly by Saba Capital Management, indicating strong positive sentiment. The purchase activity shows a consistent trend with shares acquired at incrementally higher prices, suggesting confidence in future growth. However, without the assessment of broader company fundamentals, including earnings trends and market conditions, the conviction level is moderately high at 0.75. If positive earnings or guidance were recently announced, this would support the potential for stock appreciation further. | Financial Services | Asset Management |

| RPD | DOWN | 0.65 | Recent insider purchases by Jana Partners and key management suggest confidence in RPD's future. However, this is offset by significant prior insider sales at much higher price levels, indicating a lack of long-term confidence from insiders. Company fundamentals remain unclear without recent earnings data, and the macroeconomic environment shows potential headwinds from rising interest rates and inflation. The current bearish sentiment in the tech sector also contributes to lower confidence in a price increase in the near term. | Technology | Software - Infrastructure |

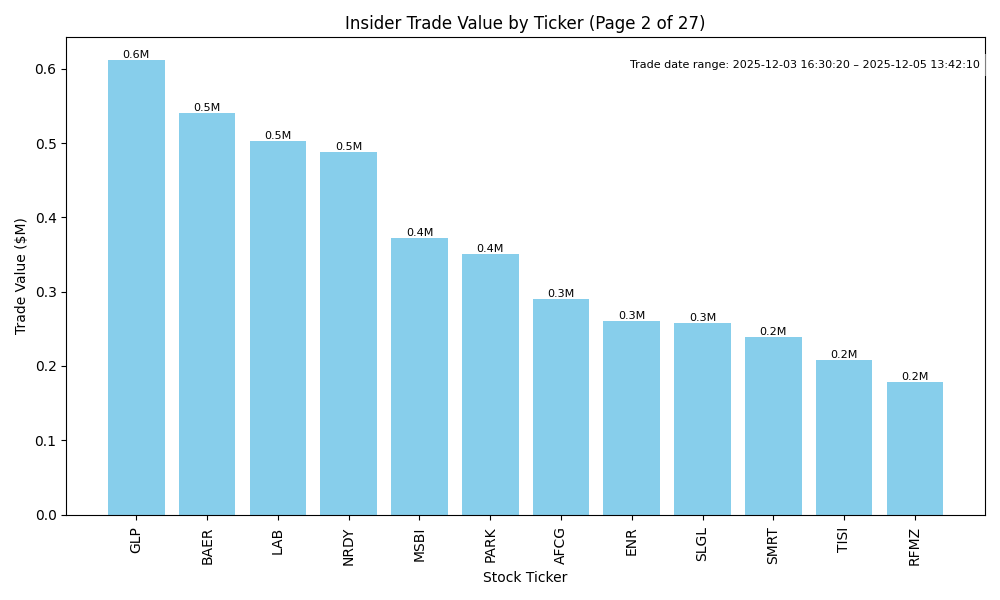

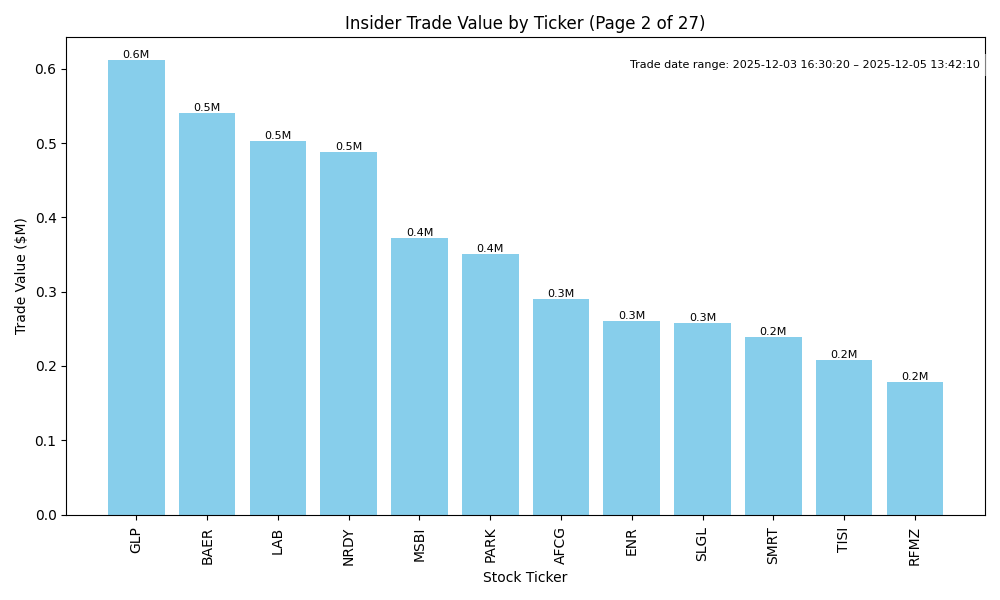

| GLP | NEUTRAL | 0.60 | Recent insider buying by Global Gp LLC indicates positive sentiment, especially as purchases have concentrated at lower prices around $42 to $44. However, there's been significant selling by COO Romaine Mark at higher prices, which raises concerns. Without current information on company fundamentals, industry dynamics, and macroeconomic context, confidence in a definitive upward or downward trend is moderate. The balance of insider sentiment and unknown external factors suggests a neutral outlook for near-term price movement. | Energy | Oil & Gas Midstream |

| BAER | UNKNOWN | 0.50 | Recent insider activity shows a mix of a significant purchase by a director (300,000 shares) at a lower price, which could indicate confidence in the company's future. However, several insider sales by key executives preceding this purchase raise concerns about potential insider sentiment regarding the company’s near-term outlook. Additionally, missing critical data on the company's earnings trends, growth potential, and broader macroeconomic context restricts the ability to form a strong evaluation. Given the conflicting signals from insider trading and the absence of vital company fundamentals, the short-term direction remains uncertain. | Industrials | Security & Protection Services |

| LAB | UP | 0.75 | Insider buying, particularly by a significant shareholder, Casdin Partners Master Fund, is substantial, suggesting confidence in the company's future. The purchase amounts indicate a strong belief in the current valuation despite past sales, which appear minor in comparison. However, without detailed recent earnings data or insights into current operational performance and macroeconomic conditions, there's some uncertainty. The recent trend of insider purchases at gradually increasing prices might indicate belief in turnaround potential, but macroeconomic pressures (like inflation and interest rates) may still pose risks. | Healthcare | Medical Devices |

| NRDY | UP | 0.75 | Insider activity has been predominantly bullish, with recent substantial purchases from CEO Charles Cohn over multiple days, indicating strong confidence in the company's future prospects. However, there are signs of cautious selling from other insiders like the CFO, suggesting that sentiment may not be universally optimistic. Given the overall positive tone of the insider trades, along with the potential need for supportive fundamentals and macroeconomic factors to sustain this momentum, the near-term direction appears favorable but carries inherent risks. Key information on company performance metrics and broader economic conditions is missing, which lowers conviction. | Technology | Software - Application |

| MSBI | NEUTRAL | 0.60 | The recent insider trading activity shows a strong pattern of purchases by company executives, which may indicate confidence in the company's prospects at lower price levels. However, the stock price has previously seen significant sales from insiders, suggesting some uncertainty. Without concrete information on the company's recent performance metrics, sector health, and broader macro factors, it is difficult to ascertain a decisive direction. The overall weak sentiment from past sales and lack of recent fundamental data creates tension, leading to a neutral outlook. | Financial Services | Banks - Regional |

| PARK | UP | 0.75 | The recent insider buying by multiple executives, including the CEO and CFO, suggests significant confidence in the company's future performance. All transactions occurred at the same price point of $13, indicating a perceived value at this level. However, without current data on company fundamentals, industry dynamics, or macroeconomic conditions, the analysis remains incomplete. Insiders typically have better insight into the company’s future, but external factors could still impact stock performance. Therefore, while the insider buying is a bullish signal, the lack of additional context lowers confidence slightly. | Healthcare | Medical Care Facilities |

| AFCG | DOWN | 0.70 | Insider purchasing activity has been consistent, suggesting some level of confidence from executives. However, the average purchase prices have been significantly higher than recent trading levels (roughly $2.94), indicating potential distress or negative sentiment in the market. The drop in share price may reflect underlying company fundamentals or broader macroeconomic pressures, such as rising interest rates and inflation, that could impact the company's performance. Without further context on earnings trends, leverage, and industry conditions, the outlook remains cautiously negative. | Real Estate | REIT - Mortgage |

| ENR | DOWN | 0.60 | Recent insider purchases show confidence from leadership amid a decline in stock price, evident from transactions averaging around $17 compared to earlier highs above $30. However, significant insider selling earlier indicates a lack of confidence in the stock's near-term prospects at higher valuations. The industry may face challenges from macroeconomic pressures like inflation and interest rates affecting consumer spending. Overall, the mixed signals from insider activities, with recent purchases not overcoming the longer-term bearish trend, lead to a cautiously negative outlook. | Industrials | Electrical Equipment & Parts |

| SLGL | UP | 0.70 | Opaleye Management Inc.'s consistent insider purchases indicate positive sentiment, suggesting confidence in the company's future performance. The recent stock purchases at varying prices may reflect an undervaluation relative to long-term prospects. However, a detailed assessment of the company's fundamentals is lacking. Without information on earnings trends, debt levels, or overall market conditions, there is inherent uncertainty. Given the aggressive buying by insiders, the direction appears upward, but the lack of comprehensive data moderates confidence. | Healthcare | Biotechnology |

| SMRT | UP | 0.70 | Recent insider trading shows a significant concentration of purchases by the CEO and directors, indicating strong internal confidence in the company's prospects. The share price has been on a generally upward trend through these purchases, suggesting a belief in future growth. However, missing recent fundamental data regarding earnings, margins, and overall company health creates uncertainty. Additionally, industry dynamics and macroeconomic conditions need to be assessed further, but the prevailing sentiment from insider buying suggests a bullish outlook for SMRT in the near term. | Technology | Software - Application |

| TISI | DOWN | 0.65 | Although there has been significant recent insider purchasing, particularly from Corre Partners Management, LLC, which suggests positive sentiment, there are also notable insider sales, including by directors at lower prices, which could indicate mixed signals about the company's near-term prospects. The trading price has declined from much higher levels earlier this year. Additionally, without up-to-date fundamentals on earnings trends or broader market conditions, caution is warranted. If earnings are under pressure or macroeconomic conditions worsen, the stock may face downward pressure despite insider buying. | Industrials | Specialty Business Services |

| RFMZ | NEUTRAL | 0.60 | Recent insider purchases by Rivernorth Financial Holdings and O'Neill indicate confidence in the stock, especially with aggregated purchases totaling over 14,000 shares in early December. However, significant sales by Dimella and Sprauer raise caution, suggesting an unclear sentiment from management. Without information on the company's financial fundamentals or broader market context, the mixed insider signals lead to a tentative outlook. Thus, while there are positive insider moves, the potential for declines cannot be ignored. | Financial Services | Asset Management |

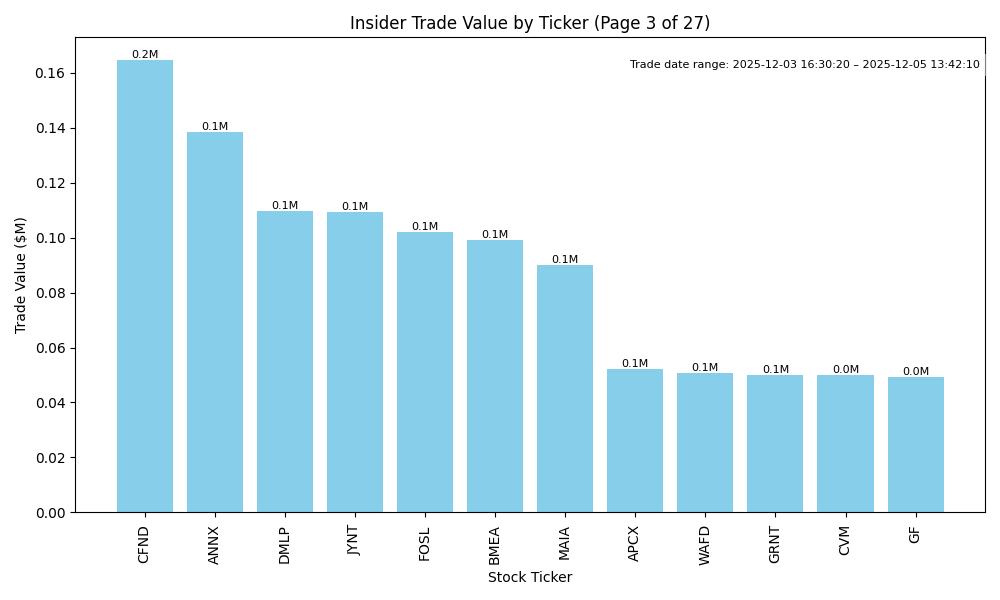

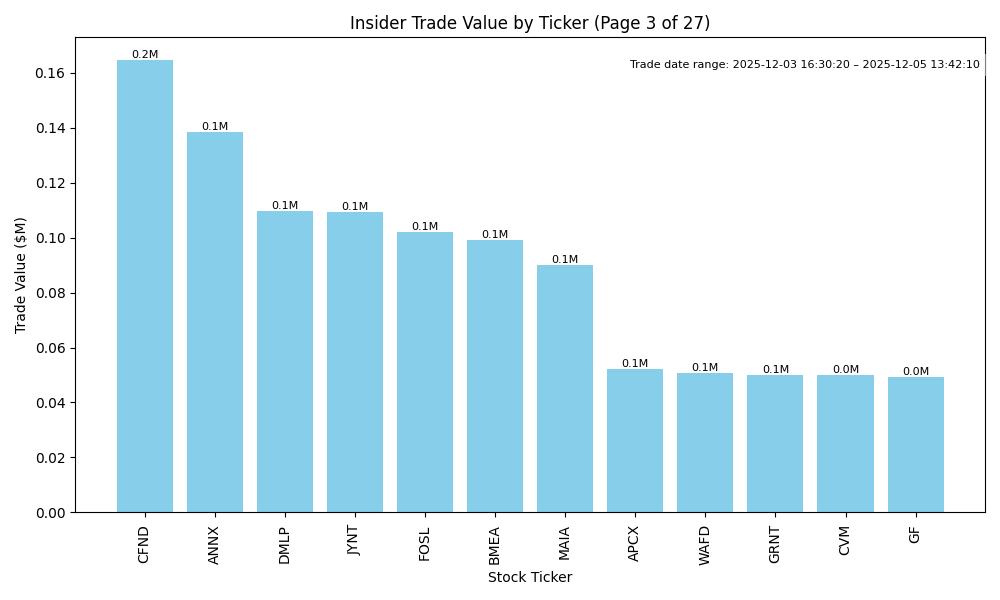

| CFND | DOWN | 0.60 | The recent insider purchases show confidence from the company's CEO and directors, indicating potential optimism about future prospects despite a declining trend in stock price from previous highs near $10 to around $5.34. Insiders have made significant purchases at lower prices, which could signal they perceive value. However, without information on current fundamental performance metrics (like earnings, revenue growth, or debt levels) or overall market conditions affecting CFND, confidence is lower. If external factors such as economic downturn or sector weaknesses are influencing performance, they could negate insider optimism. | | |