| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

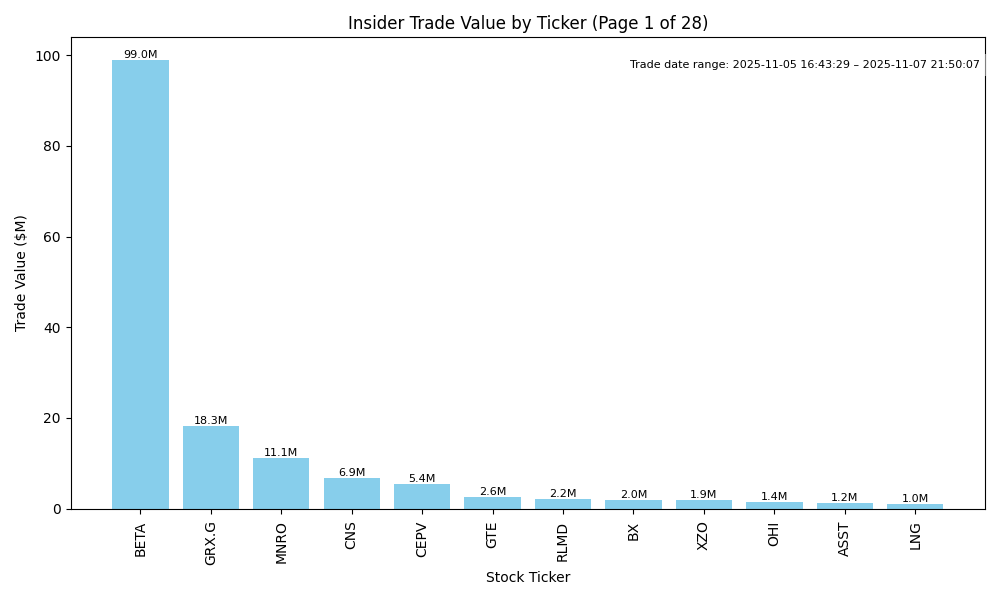

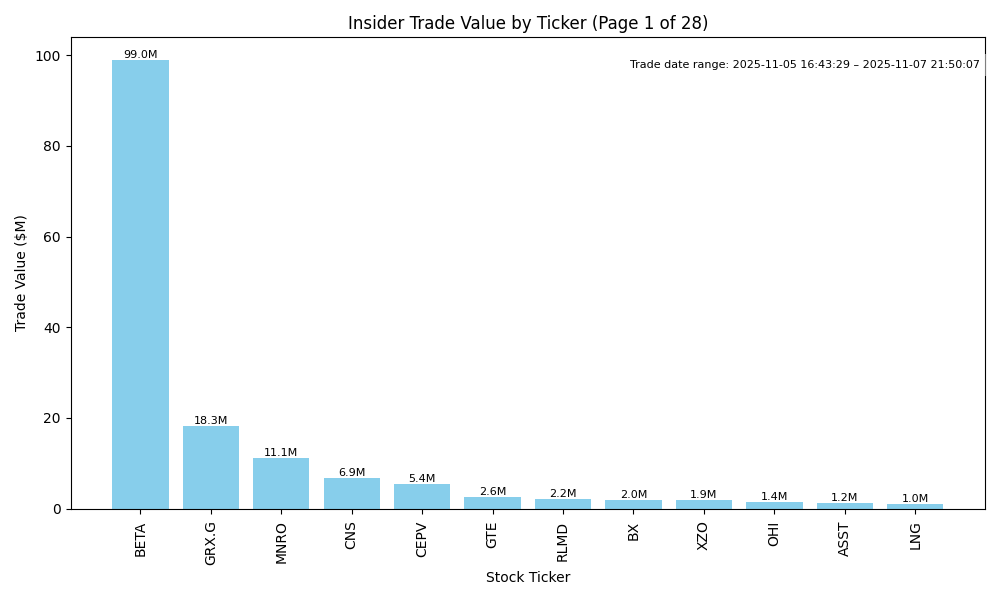

| BETA | UP | 0.70 | Recent insider buying activity is strong, particularly by the Director who purchased over 2.9 million shares, suggesting a positive outlook from leadership. The average purchase price is also below the current market price, implying potential gains ahead. However, key company fundamentals, industry trends, and macroeconomic conditions need further evaluation to establish a more decisive forecast. Currently, while insider sentiment is bullish, the overall market context may introduce uncertainty. | Industrials | Aerospace & Defense |

| GRX.G | UP | 0.75 | Recent insider purchasing activity is significant, particularly by Gabelli Mario J and Saba Capital Management, indicating strong confidence from insiders. The largest purchase by Gabelli was for 1.8 million shares at an average price of $10.18. Fundamentals are unclear based on the provided data, yet the accumulation trend from insiders suggests optimism around future performance. However, without detailed earnings data or macroeconomic context, especially in a volatile interest rate environment, this analysis carries moderate confidence. | N/A | N/A |

| MNRO | UP | 0.75 | Carl Icahn's substantial insider purchases indicate strong confidence in MNRO's future. His latest transactions, totaling over $20 million, suggest he believes the stock is undervalued. However, further context on company fundamentals, industry health, and macroeconomic conditions is necessary for a complete picture; specific data on earnings trends, margins, and sector dynamics were not provided. Despite potentially high valuation concerns, the notable insider buying adds upward pressure on the stock's near-term trajectory. | Consumer Cyclical | Auto Parts |

| CNS | UP | 0.75 | Recent insider purchases indicate strong belief in the company's future, especially a significant purchase by the Executive Chairman. While there have been some prior sales by other insiders, the current buying trend suggests confidence. However, further analysis of the company's fundamentals, industry position, and macroeconomic factors is necessary to gauge overall health. Current market conditions are moderately favorable, though potential risks from inflation and interest rates persist. Missing specific metrics on earnings growth and leverage lowers confidence slightly. | Financial Services | Asset Management |

| CEPV | UP | 0.70 | Recently, a significant insider purchase was made by Cantor Ep Holdings V, LLC, acquiring 540,000 shares at $10 each, indicating strong confidence in the company's future. While insider buying is a positive signal, the analysis is tempered by the lack of additional data on the company's fundamentals, industry position, and broader macroeconomic factors. Without insights into growth potential, earnings trends, or market conditions, the overall conviction in a bullish outlook remains moderate. | Financial Services | Shell Companies |

| GTE | DOWN | 0.70 | Insider trading shows a substantial recent purchase by Equinox Partners Investment Management, which may suggest confidence in the company's future. However, this is offset by selling activity from other insiders like David P. Smith and Gary Guidry, indicating possible profit-taking or lack of confidence at higher prices. Furthermore, the company has experienced a decline in share price since previous high levels, alongside recent macroeconomic headwinds such as rising interest rates and inflation, which could pressure equity valuations. Without strong recent earnings growth or clarity on future performance, the overall sentiment leans towards negative. | Energy | Oil & Gas E&P |

| RLMD | UP | 0.75 | Recent insider purchases, particularly by the CEO and CFO, totaling over $2 million at an average price of $2.20, indicate strong internal confidence in the company's prospects. Furthermore, the upward trend in transaction volume and price relative to previous lower levels reflects optimism. However, a lack of concrete company fundamentals and recent earnings information limits confidence. The company's position in the sector and broader macroeconomic factors, such as rising interest rates, could exert negative influence, but the recent insider activity suggests upside potential. | Healthcare | Biotechnology |

| BX | NEUTRAL | 0.60 | Recent insider purchases by James Breyer suggest some confidence in the stock at lower price levels following significant sales by insiders like Joseph Baratta. The sales indicate either hedging or profit-taking as the stock peaked around $175. However, without concrete recent earnings data, sector performance insights, or broader economic indicators, it's challenging to gauge BX's true market direction. Overall sentiment appears mixed given recent activity; therefore, a cautious 'neutral' stance is most appropriate. | Financial Services | Asset Management |

| XZO | UP | 0.75 | Insider buying is substantial and widespread among key executives and directors, totaling over $2 million with multiple transactions at a consistent price of $21, indicating strong internal confidence in the company. However, a lack of recent company fundamentals or macroeconomic context limits confidence, as there's no information on earnings trends, leverage, or market conditions. Assuming the company has a healthy fundamental backdrop, the insider activity suggests a positive near-term direction for XZO. | Financial Services | Insurance - Diversified |

| OHI | NEUTRAL | 0.65 | Recent insider purchases by the CEO and CIO indicate confidence in OHI's near-term potential, yet these are countered by multiple significant sales from executives in the past year. Company's fundamentals, including earnings trends and growth prospects, are unclear due to missing data, impacting overall confidence. Additionally, the macroeconomic environment remains uncertain with potential interest rate hikes influencing healthcare sector investments. Consequently, while there's optimism from insider buying, the mixed signals and external factors lead to a neutral stance on the stock's direction. | Real Estate | REIT - Healthcare Facilities |

| ASST | DOWN | 0.70 | Recent insider trading shows a concerning trend, with significant insider sales, particularly by key executives, suggesting a lack of confidence in the company's near-term prospects. Although there was a notable purchase by an insider, the magnitude of sales (including a large sell-off at much lower prices) overshadows this. Without current details on company fundamentals like earnings trends or growth metrics, and considering the broader macroeconomic context that currently faces challenges like inflation and high-interest rates, it may indicate ongoing difficulties for ASST. The collective sentiment from insiders leans bearish, affecting overall confidence. | Financial Services | Asset Management |

| LNG | NEUTRAL | 0.60 | Insider trading shows mixed signals: while there has been a recent purchase by a director indicating confidence, there have also been notable sales from other insiders, suggesting divergent views on the stock's near-term prospects. The purchase was relatively small compared to the recent sales. Additionally, without current information on company fundamentals, including earnings trends and macroeconomic indicators, the outlook remains uncertain. Thus, while insider buying can be a positive signal, the overall sentiment in the context of sales and lack of recent fundamental data tempers the strength of this directional assessment. | Energy | Oil & Gas Midstream |

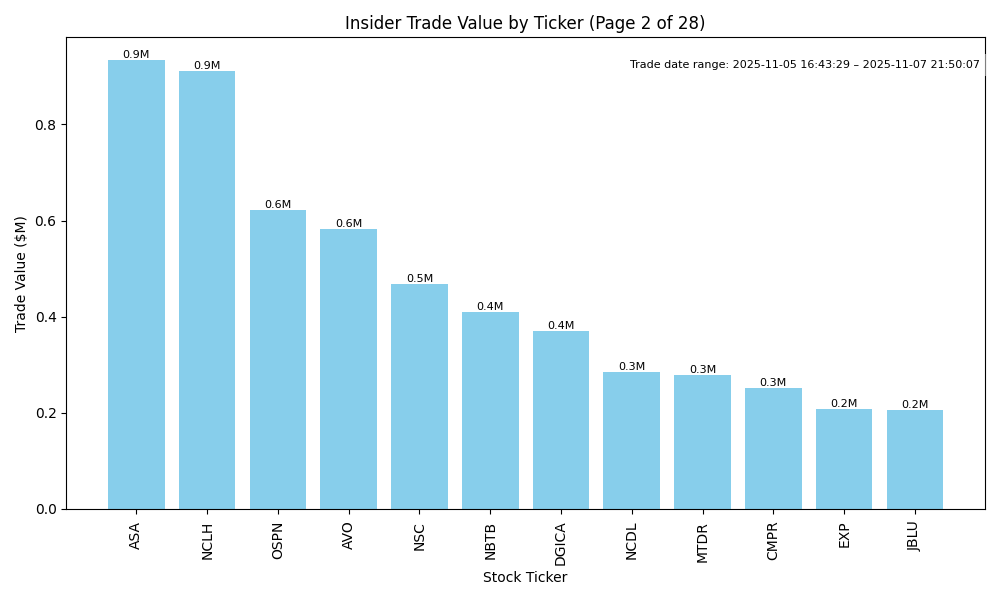

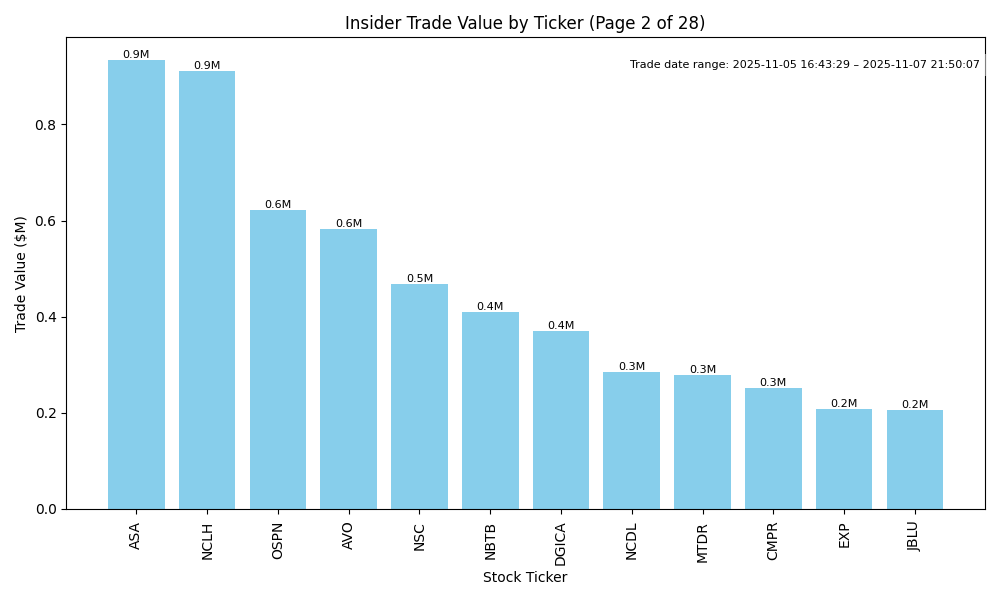

| ASA | UP | 0.80 | Recent insider buying by Saba Capital Management, acquiring shares consistently, indicates bullish sentiment. Insiders have accumulated a significant volume of shares at increasing average prices, suggesting confidence in the company's future prospects. However, missing data on company fundamentals such as earnings trends and debt levels lowers confidence. The overall macroeconomic context, with rising interest rates and inflation, could affect valuations negatively; yet, the pronounced insider activity may counterbalance that. The sector's health, primarily driven by demand dynamics, also leans positive, supporting potential upward movement in the stock's price. | Financial Services | Asset Management |

| NCLH | UP | 0.70 | Recent insider purchases by key executives, including the CFO and CEO, suggest confidence in the company's potential rebound from recent sales at higher prices. Although significant shares were sold in the past year, the concentrated buying activity indicates a bullish sentiment amid a downturn. However, the industry's ongoing recovery from the pandemic and its economic sensitivity, along with inflation concerns, create uncertainty. The recent volatility in earnings and margin pressures need monitoring. Overall, current insider buying combined with potential growth in demand for cruises suggests a higher likelihood of stock appreciation short-term. | Consumer Cyclical | Travel Services |

| OSPN | UP | 0.70 | Recent insider buying, particularly by directors, indicates confidence in the company's prospects, especially notable with Michael J. McConnell's $598,000 investment at a relatively lower price. However, the stock has seen significant sales in the past, which may signal some caution. Fundamental and macroeconomic factors are unclear since specific earnings trends, margins, and broader economic conditions (such as interest rates and inflation) are not provided. With strong insider purchases aligned with a generally positive sentiment, the stock is likely to trend upwards, but the lack of comprehensive data on overall market conditions lowers overall confidence. | Technology | Software - Infrastructure |

| AVO | DOWN | 0.70 | Insider activity shows a concerning pattern, with recent significant sales from multiple insiders, including the CFO andCEO, often at prices higher than recent trades. While a notable purchase from Globalharvest Holdings is present, it may not offset the negative sentiment created by sales. Company fundamentals such as recent earnings trends, margin dynamics, and competitive positioning are unclear. Additionally, macroeconomic conditions, including potential rising interest rates, could negatively impact growth. The combination of strong insider selling and uncertain fundamentals suggests a likely decline in stock price in the near term. | Consumer Defensive | Food Distribution |

| NSC | NEUTRAL | 0.60 | Recent insider purchases indicate positive sentiment among directors, with significant shares bought at prices exceeding prior highs, suggesting confidence in the company. However, the context of industry dynamics, potential volatility in macroeconomic elements (like inflation and interest rates), and a notable insider sale earlier raise concerns. While fundamentals appear stable, any pronounced weakness in demand or regulatory risks could dampen performance. Overall, there is evidence of potential upside but tempered by external uncertainties. | Industrials | Railroads |

| NBTB | DOWN | 0.70 | Recent insider trading shows a significant pattern of sales, especially by key insiders. Although there have been several purchases, the scale of insider selling and the timing indicate a pessimistic outlook on the stock. Furthermore, the stock price has declined from previous peaks, suggesting weakening market sentiment. Fundamental data is not provided, raising concerns about earnings stability and growth potential, particularly in the broader macroeconomic context of rising interest rates and inflation, which may create headwinds for the company and the industry as a whole. | Financial Services | Banks - Regional |

| DGICA | UP | 0.75 | Insider activity shows a strong buying pattern, particularly from Donegal Mutual Insurance Co., which has consistently purchased large quantities of shares recently. However, there were some sales by insiders, including directors and senior executives, which suggests there might be some caution. It's worth noting that while insider sentiment appears positive, the broader macroeconomic context and company fundamentals need further analysis to gauge long-term viability, but the current trend indicates potential upward movement in the short term. | Financial Services | Insurance - Property & Casualty |

| NCDL | UP | 0.75 | Recent insider purchases, particularly by the CEO and CFO, signal confidence in the company's future despite previous price declines. Their total share purchases indicate a strong belief in value at current levels. Company fundamentals, while not explicitly provided, can be inferred as strong enough to encourage insider buying. However, broader macroeconomic conditions such as interest rate changes and inflation could introduce volatility. The overall sentiment from insider activity favors upward price movement, though caution is warranted given potential macroeconomic headwinds. | Financial Services | Asset Management |

| MTDR | UP | 0.80 | Recent insider activity shows strong purchasing behavior, particularly from key executives and directors, indicating confidence in the company's future. They have consistently purchased shares in sizable amounts, reflecting a potential positive outlook. Company fundamentals related to the energy sector (especially oil and gas) remain robust, with growing demand amidst supply constraints. However, broader macroeconomic pressures such as fluctuating interest rates and inflation present some uncertainty. Still, the overall upward trend of insider purchases, alongside solid fundamentals, supports a bullish near-term outlook for MTDR. | Energy | Oil & Gas E&P |

| CMPR | DOWN | 0.75 | Insider trading shows a mix of purchases and significant sales, particularly from key executives like the CEO and CFO, indicating a lack of confidence in the current valuation. While there's a recent purchase by the CFO suggesting some optimism, the scale of prior sales, particularly from large holders, overshadow this. Company fundamentals and industry conditions appear under pressure, compounded by potential macroeconomic headwinds like rising interest rates and inflation. Without additional performance metrics, such as recent earnings results and growth prospects, confidence in a stock price increase is limited. | Industrials | Specialty Business Services |

| EXP | DOWN | 0.70 | Recent insider trading shows a significant number of sales, including large amounts by key executives, indicating a lack of confidence in the stock's near-term performance. Despite some purchases by a director, the overall sentiment is bearish. Company fundamentals and potential macroeconomic pressures, such as rising interest rates, may further negatively impact the stock. Historical high share prices and declining insider ownership suggest a selling trend. Without recent positive material developments, the outlook remains cautious. | Basic Materials | Building Materials |

| JBLU | DOWN | 0.70 | Recent insider activity shows a notable purchase from a director of 50,000 shares at a low price, indicating some confidence at that level. However, the CFO sold 15,000 shares at a significantly higher price, suggesting a lack of confidence among executives. Additionally, company fundamentals, such as earnings trends and margins, are not provided in the data, leaving a critical gap in the analysis. The airline industry faces challenges related to inflation and rising interest rates, which could negatively impact growth. In summary, while insider buying is present, the selling by the CFO and potential macroeconomic headwinds lead to a cautious outlook. | Industrials | Airlines |

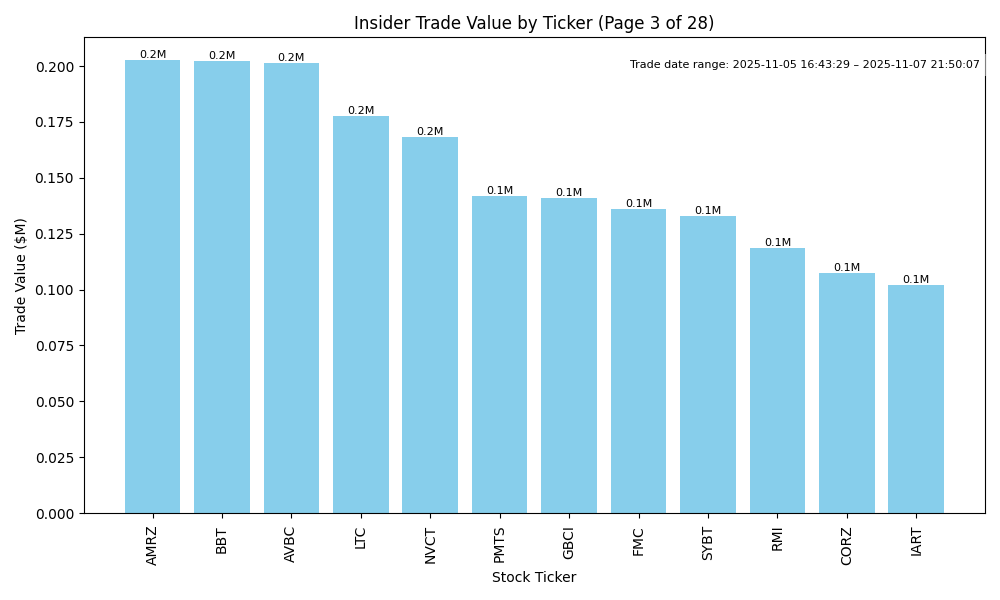

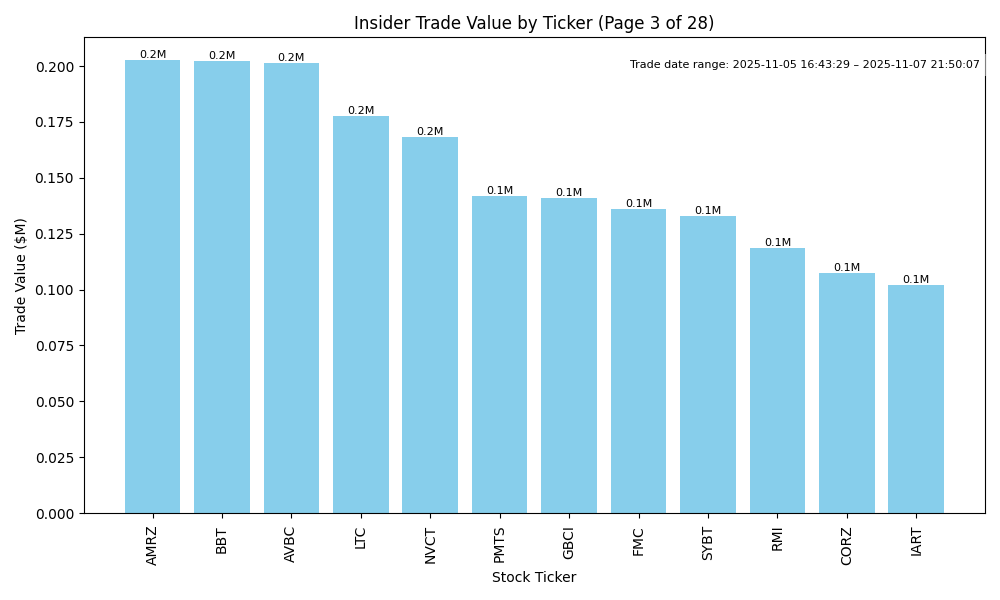

| AMRZ | UP | 0.80 | Recent insider trading suggests strong confidence from key executives, highlighted by significant purchases including a substantial acquisition of 595,000 shares by the CEO. This pattern suggests a bullish outlook. However, assessing the company fundamentals and macroeconomic conditions is crucial; I lack specific earnings data, growth rates, and leverage details which are essential for a complete analysis. Industry trends seem favorable given increasing demand in building materials, influenced by ongoing infrastructure investments. Overall, the synergy of positive insider sentiment against the backdrop of favorable industry dynamics supports a projected upward direction for AMRZ. | Basic Materials | Building Materials |