| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

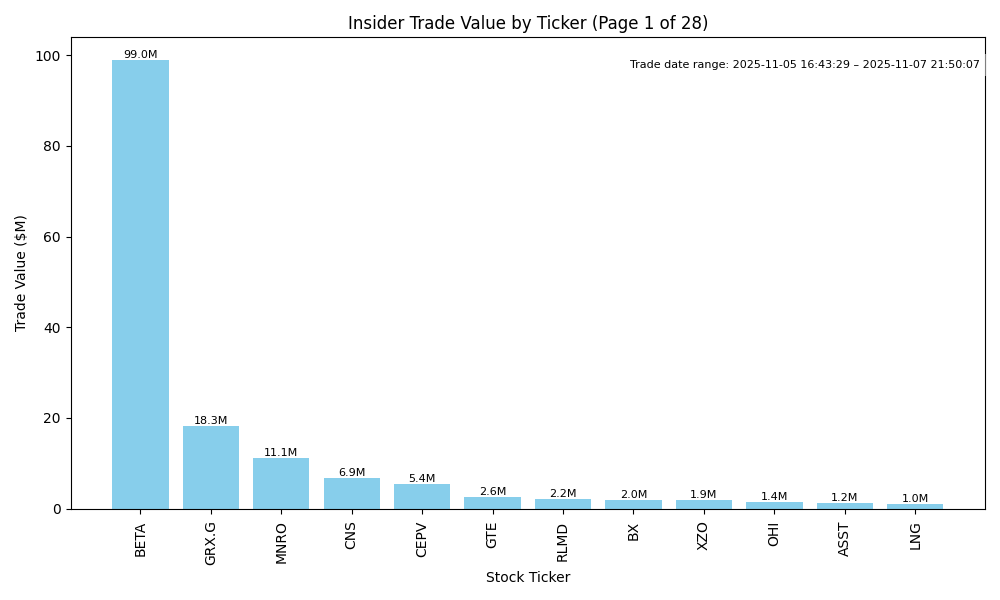

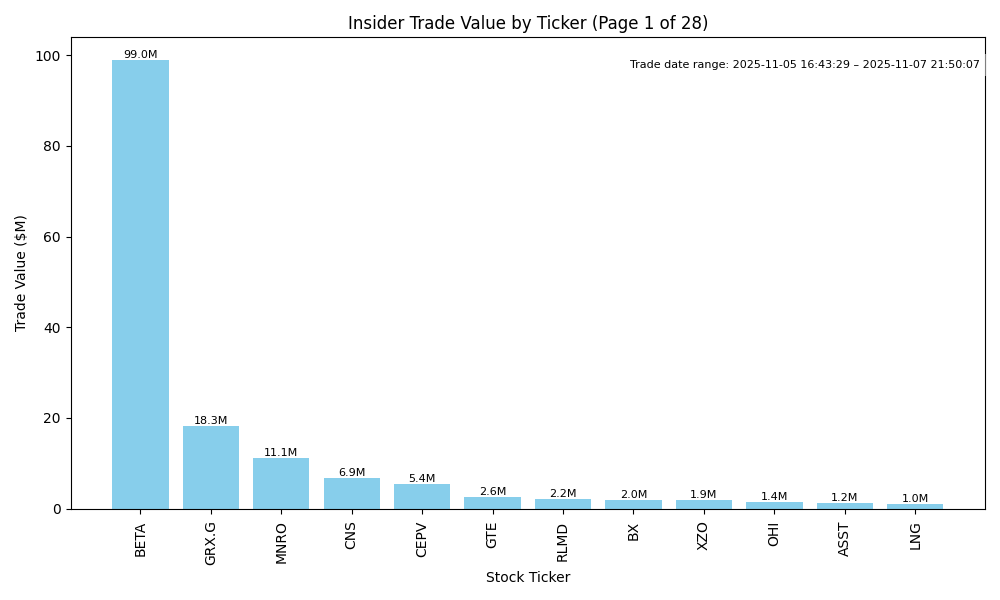

| GRX.G | UP | 0.70 | Recent insider buying activity, notably a substantial purchase by Gabelli Mario J of 1.8 million shares at $10.18, indicates strong internal confidence in the company's future. Consistent smaller purchases by Saba Capital Management reflect sustained insider optimism. However, there is a need to evaluate the company's fundamentals, industry position, and broader macroeconomic factors, which remain undisclosed here. If there are no significant underlying issues, such as poor earnings or unfavorable industry conditions, the accumulation of shares suggests a potential upward movement in stock price. As a result, confidence is moderate, acknowledging potential gaps in overall market conditions. | N/A | N/A |

| MNRO | UP | 0.75 | Recent insider purchases, particularly by significant stakeholders like Carl Icahn, suggest strong confidence in the company’s prospects. The large-volume transaction indicates a bullish outlook despite recent valuation pressure, given the average purchase price of $15.19 compared to prior transactions. However, fundamental data such as earnings trends, margins, and leverage, along with macroeconomic factors like inflation and interest rates, are not provided, introducing uncertainty in the analysis. Overall, insider buying indicates positive sentiment, but missing fundamental context warrants cautious optimism. | Consumer Cyclical | Auto Parts |

| CNS | UP | 0.70 | Recent insider purchases by a significant executive, Robert Hamilton, indicate strong confidence in the company's prospects. However, the historical trend shows notable sell-offs by other executives, potentially signaling concern about the stock's current valuation or growth trajectory. Company fundamentals and broader macroeconomic indicators are essential for a complete picture, but these patterns indicate potential near-term price appreciation amid a backdrop of mixed signals. | Financial Services | Asset Management |

| CEPV | UP | 0.75 | Recent insider buying by Cantor Ep Holdings V, LLC, who purchased 540,000 shares at $10 each, suggests strong confidence in the company's potential. However, without additional context on company fundamentals, such as earnings trends and overall market conditions, the potential for the stock's rise may be tempered. The direction appears positive, boosted by insider confidence, but potential weakness in market or sector conditions could counteract this optimism. Thus, the overall confidence leans towards a moderate positive outlook. | Financial Services | Shell Companies |

| GTE | NEUTRAL | 0.60 | Recent insider buying from Equinox Partners Investment Management, particularly a substantial purchase of 648,000 shares at $3.94, suggests positive sentiment. However, this is partially offset by frequent insider sales, including those by the CEO and other directors, indicating a lack of unified confidence. Fundamentals such as the company's earnings trends and growth potential are unclear without additional context on recent performance metrics. Additionally, general market conditions, including inflation and interest rates, may dampen enthusiasm. Thus, while there is some insider optimism, the mixed signals warrant a neutral outlook. | Energy | Oil & Gas E&P |

| RLMD | UP | 0.80 | Recent insider purchases show strong confidence from top executives, especially as the CFO, COO, and CEO collectively acquired over $2 million in shares at a notably higher price than earlier trades. The trend of increasing purchases alongside a higher average transaction value indicates optimistic sentiment about future performance. However, the absent information on the company's overall financial health, growth potential, and macroeconomic factors adds uncertainty. If the company demonstrates robust fundamentals and operates in a supportive sector, the stock is likely to trend upward. | Healthcare | Biotechnology |

| BX | DOWN | 0.70 | Recent insider activity shows a trend of significant sales, notably from directors, indicating potential lack of confidence in the stock's near-term performance. While there have been recent purchases from some insiders, they are relatively small and do not outweigh the volume of sales. Additionally, without concrete data on the company’s current fundamentals and market conditions, including earnings forecasts and broader economic indicators, the overall sentiment appears negative. The macroeconomic backdrop, including rising interest rates and inflation concerns, likely pressures performance further. | Financial Services | Asset Management |

| OHI | UP | 0.70 | Recent insider buying by key executives, including the CEO and CIO, suggests a positive outlook on the company's prospects. However, the past insider selling activity, notably by the COO and CFO, raises concerns about potential issues or differing views on future performance. Additionally, without current earnings data or macroeconomic context, such as interest rates and sector health in the healthcare REIT market, confidence is moderated. Yet insider purchases indicate potential short-term bullish sentiment. | Real Estate | REIT - Healthcare Facilities |

| LNG | DOWN | 0.60 | While there was a recent purchase of 5,000 shares by an insider at $208.22, this is overshadowed by several notable sales by other insiders, indicating potential concerns about the stock's valuation. The sales suggest that insiders may have reservations about future price appreciation. Additionally, without current data on earnings trends, company margins, and broader macroeconomic context (e.g., interest rates, inflation), the analysis remains incomplete. Overall, the mixed insider activity and missing fundamental data lead to a moderate confidence in a downward direction. | Energy | Oil & Gas Midstream |

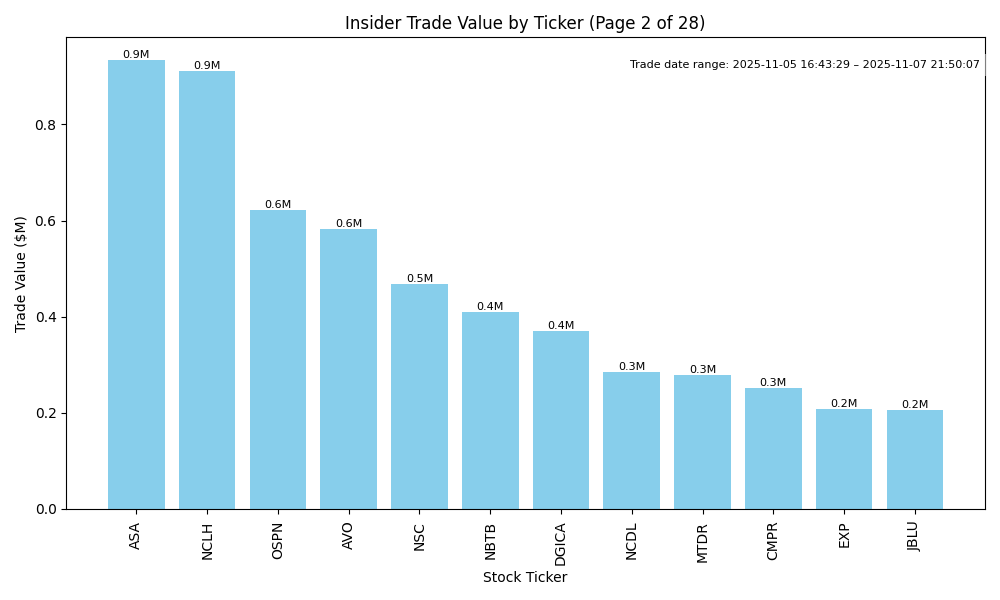

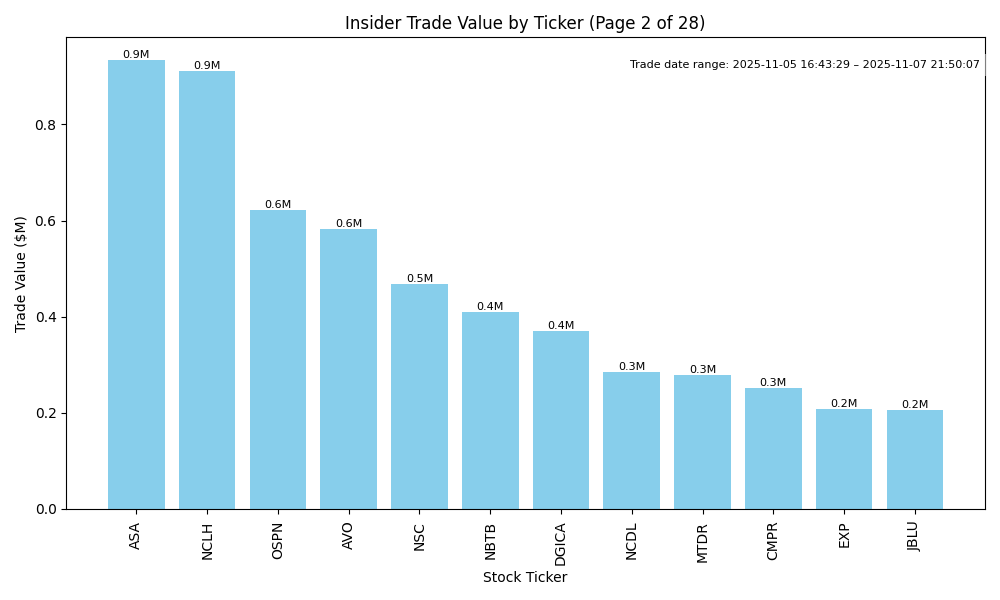

| ASA | UP | 0.75 | Saba Capital Management, a significant insider, has made substantial purchases recently, indicating confidence in the stock's prospects. The average purchase price is well above recent trading levels, suggesting a bullish outlook. However, the evaluation lacks current fundamental data regarding earnings, margins, and overall company health. Additionally, insight into industry trends and macroeconomic factors such as inflation and interest rates is absent, which could impact stock performance. Nonetheless, insider buying, especially from a major holder, typically points toward a positive near-term direction. | Financial Services | Asset Management |

| NCLH | UP | 0.70 | Recent insider buying, particularly by high-ranking executives, suggests confidence in the company's future, with substantial purchases at prices below prior trading levels. However, there is also significant selling by insiders at higher prices, which raises questions about future performance. Fundamentally, if NCLH can demonstrate growth as consumers increasingly return to leisure travel, it could support a positive outlook. Nonetheless, potential macroeconomic pressures, including rising inflation or interest rates, might constrain performance, keeping confidence moderate. | Consumer Cyclical | Travel Services |

| OSPN | UP | 0.70 | Recent insider purchases indicate strong confidence in the stock's future, especially significant buys from directors totaling over $600,000. Although there was a notable sale by McConnell, previous purchases at lower prices suggest belief in recovery potential. However, without specific data on company earnings, margins, or broader market conditions, confidence in an upward direction remains moderate. The stock could be influenced by macroeconomic factors like interest rates and inflation, which are currently uncertain. | Technology | Software - Infrastructure |

| MTDR | UP | 0.80 | Recent insider buying activity is robust, with multiple executives making significant purchases, indicating strong insider confidence. The purchases occurred at prices ranging from $37.76 to $55.40, suggesting insiders see value in the current price levels. However, it's important to consider that broader macroeconomic factors, such as potential inflation pressures and interest rate trends, could influence stock performance. Company fundamentals, including earnings trajectory and growth potential, should remain strong, yet specific details regarding current earnings and forward guidance are missing. Given the predominant insider purchasing trend, I lean towards an upward direction for the stock, albeit with noted caution due to macroeconomic uncertainties. | Energy | Oil & Gas E&P |

| AVO | DOWN | 0.70 | The recent insider trading suggests a cautious outlook, as there has been significant selling by key insiders, including the CFO and CEO, with sales dominating over purchases. The latest purchase by Globalharvest Holdings is notable but does not compensate for the earlier heavy selling. Company fundamentals, such as earnings trends and margins, might be under pressure, and the overall market conditions could be affected by rising interest rates and inflationary pressures. These factors, combined with the substantial insider selling, create a bearish sentiment for AVO in the near term. | Consumer Defensive | Food Distribution |

| TDUP | DOWN | 0.75 | Recent insider trading shows a troubling pattern with significant sales, particularly from key executives like the CEO and CFO. These sales, often executed at higher average prices, indicate a lack of confidence in the stock's near-term performance. Although there's a recent purchase by a director, it appears to be too little in the face of substantial insider sales. The company's fundamentals are unclear, and without recent earnings performance or growth metrics, the outlook remains uncertain. Overall, the weight of insider selling suggests a bearish sentiment in the near term. | Consumer Cyclical | Internet Retail |

| NSC | UP | 0.70 | Recent insider purchases by directors indicate strong confidence in the company's prospects, especially significant transactions from key insiders like Fahmy Sameh and Anderson Richard H. However, the presence of a notable sale by former CEO Shaw Alan H. could signal profit-taking or concerns about short-term performance. Company fundamentals seem promising, although specific metrics are lacking for a thorough evaluation. The broader industry and macroeconomic conditions appear stable, supporting potential growth. Overall, the prevailing insider sentiment leans positive, despite some caution due to the mixed trading patterns. | Industrials | Railroads |

| NBTB | DOWN | 0.65 | Recent insider trades show a significant number of sales, particularly large transactions by multiple directors at higher prices, indicating a lack of confidence among insiders in the stock's near-term prospects. Despite some recent purchases, the volume of sales, especially preceding recent declines, raises concerns. Company fundamentals (not detailed here) and recent market sentiment suggest potential weakness. With broader macroeconomic pressures from inflation and rising interest rates weighing on the financial sector, the overall outlook may be uncertain. Thus, while insider purchases can be bullish, the prevailing trend seems negative. | Financial Services | Banks - Regional |

| DGICA | UNKNOWN | 0.50 | Recent insider trading activity shows significant purchasing by Donegal Mutual Insurance Co, indicating bullish sentiment. However, several insiders also sold shares around the same time, which introduces uncertainty. Without detailed company fundamentals, such as earnings trends or margin levels, alongside lacking industry context and macroeconomic trends, it's difficult to gauge future performance. The tension between insider purchases and sales alongside the missing fundamental data leads to a cautious outlook. | Financial Services | Insurance - Property & Casualty |

| GBCI | UP | 0.70 | Recent insider buying activity is strong, with multiple executives purchasing shares at prices lower than previous trading levels, indicating confidence in the company's prospects. However, the stock has seen prior insider sales at higher prices, suggesting some uncertainty. Without further fundamental data on earnings trends, margins, and macroeconomic conditions, the outlook is cautiously optimistic, supported primarily by the recent insider buying pattern. | Financial Services | Banks - Regional |

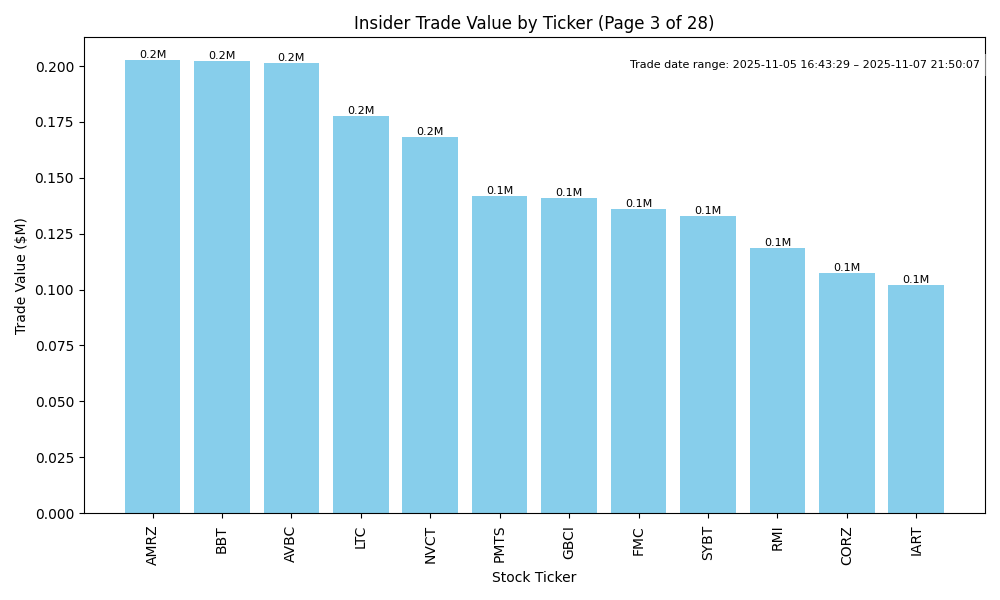

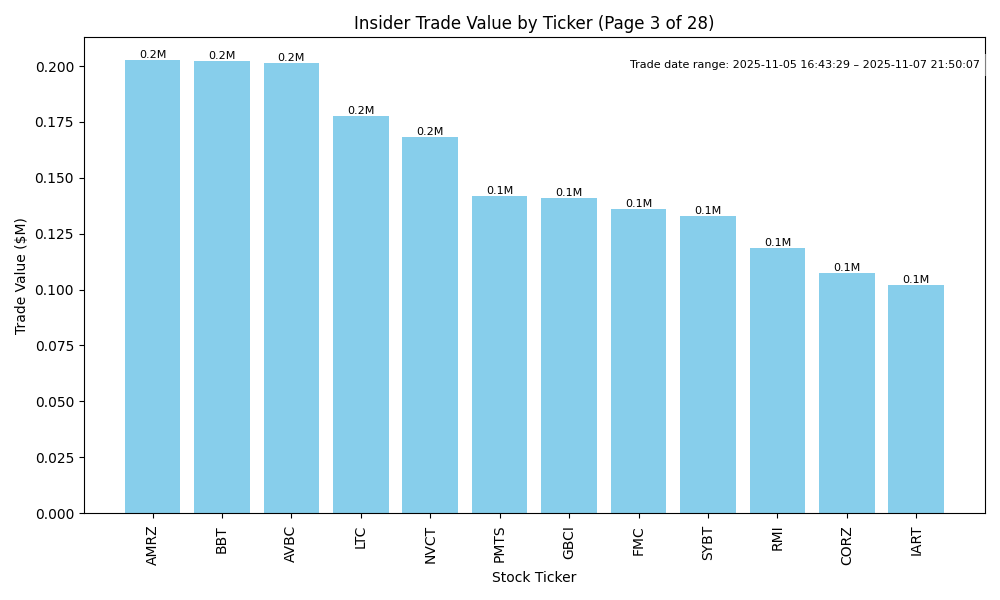

| BBT | UP | 0.75 | Recent insider purchases by multiple directors and the CFO indicate strong internal confidence in BBT's prospects despite a recent insider sale. The accumulated purchases total significant amounts, suggesting insiders expect upward movement. However, the absence of information on earnings trends, and market conditions like interest rates or inflation, introduce uncertainty. If the macroeconomic environment remains stable, particularly regarding interest rates and inflation, the outlook is positive for BBT in the near term. | Financial Services | Banks - Regional |

| JBLU | NEUTRAL | 0.60 | Recent insider purchases by directors indicate some level of confidence in the stock, particularly Peter Boneparth's significant buy. However, the CFO's recent sale amidst falling prices raises concerns about potential challenges ahead. Fundamentals are critical; without current earnings trends and broader macroeconomic data reflecting interest rates and inflation risks, the outlook remains uncertain. The airline industry is facing pressure from fluctuating demand and costs, which may weigh on growth. Therefore, the mixed signals from insider activity and lack of comprehensive market data lead to a neutral stance with moderate confidence. | Industrials | Airlines |

| EIG | DOWN | 0.65 | Recent insider activity shows a pattern of purchasing by the CFO, which indicates some confidence in the stock's future. However, alongside these purchases, multiple sales by different insiders, particularly at higher price points, suggest they may believe the stock's current value is declining. Overall, the recent purchases cannot overcome the significant sales by insiders paired with potential fundamental weaknesses or negative macro conditions. Without clear data on earnings trends and broader economic conditions affecting the stock, the outlook remains cautious. | Financial Services | Insurance - Specialty |

| AMRZ | UP | 0.80 | Recent insider buying indicates strong confidence from multiple executives, particularly the CEO purchasing significant shares. This reflects a belief in the company's future prospects. Although comprehensive company fundamentals such as earnings trends and macroeconomic conditions were not provided, the consistent insider purchasing suggests positive internal sentiment. However, without current fundamentals or broader economic context available, there is some uncertainty regarding near-term stock performance. | Basic Materials | Building Materials |

| AVBC | UP | 0.75 | Recent insider trading shows strong purchasing activity among top executives, including the Chairman and CEO, indicating confidence in the company's future. The concentration of purchases from multiple insiders, especially at prices slightly above recent levels, suggests they believe the stock is undervalued. However, without current fundamental performance metrics, growth prospects, or macroeconomic data, it's challenging to provide a higher confidence level. If industry trends appear supportive, this could further bolster the stock's near-term outlook. | Financial Services | Banks - Regional |

| HWKN | UP | 0.70 | Recent insider purchases by significant figures, particularly by the Director, show a consistent trend of confidence in HWKN's future. Transactions at increasing average prices suggest strong belief in upward potential. However, without recent earnings data or broader market context, the fundamental outlook remains uncertain. Analyzing industry trends and macroeconomic factors is critical, yet specifics are unavailable, which diminishes confidence. Thus, while insider actions are bullish, unknowns in the fundamental backdrop warrant a more cautious outlook. | Basic Materials | Specialty Chemicals |