| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

| GRX.G | UP | 0.70 | Recent insider trading activity shows significant purchasing, particularly from key control persons, with a notable transaction of 1.8 million shares purchased at an average price of $10.18. This optimism from insiders contrasts current uncertainties in broader markets, where economic conditions may be volatile due to interest rate fluctuations. While the heavy buying suggests insiders are confident about the company's prospects, it is essential to note that deeper fundamentals such as earnings trends and industry health were omitted from the provided data, which tempers confidence to some extent. | N/A | N/A |

| MNRO | UP | 0.70 | Recent insider purchases, particularly by Carl Icahn, a notable investor, suggest strong confidence in the company's future. While the average price of $15.19 indicates potential value, the larger context is uncertain due to missing fundamentals regarding earnings trends and macroeconomic conditions. If the company's fundamentals align positively with insider sentiment and market conditions improve, there's potential for upward momentum, but the lack of comprehensive data on earnings and leverage reduces overall confidence. | Consumer Cyclical | Auto Parts |

| CNS | UP | 0.75 | Recent insider purchases, particularly by the Exec COB who acquired over 140,000 shares at prices significantly lower than recent market levels, suggest strong insider confidence in the stock's potential. This contrasts with prior sales; however, the aggregate purchase volume indicates a strategic bet on future growth. While specific recent earnings and macroeconomic data aren't detailed, the current macro environment may support a favorable rebound if the company maintains positive growth trends. Yet, the tension between insider buying and selling, alongside unknown fundamental conditions, tempers overall confidence. | Financial Services | Asset Management |

| CEPV | UP | 0.70 | Recent insider buying from Cantor Ep Holdings V, LLC indicates strong confidence in the stock, suggesting potential upside. Purchasing 540,000 shares at $10 each demonstrates a significant commitment. However, without additional data on company fundamentals, including earnings trends, margins, and macroeconomic conditions, it's difficult to fully assess the stock's near-term direction. Further insights into industry health and any recent developments could enhance this evaluation. Current confidence is moderate due to the lack of comprehensive financial metrics. | Financial Services | Shell Companies |

| VACI | UP | 0.65 | The CEO's significant purchase of 350,000 shares at $10.00 suggests strong personal confidence in the company's future performance. However, this is a single transaction, and without additional insider activity or deeper insights into VACI's fundamentals, growth metrics, or broader sector conditions, the outlook remains cautiously optimistic. Market conditions, interest rates, and macroeconomic factors could influence the actual trajectory. | N/A | N/A |

| RLMD | UP | 0.70 | Recent insider buying is substantial, with significant purchases by top executives at an average price of $2.20. This bullish sentiment from key insiders may indicate confidence in the company's prospects. However, company fundamentals, such as earnings trends, margins, and overall leverage are not analyzed here due to missing data. Additionally, the stock's prior performance suggests volatility, reflective of external macroeconomic challenges, including interest rate fluctuations. Thus, while insider sentiment is strong, caution is warranted due to incomplete clarity on fundamental strengths and broader market conditions. | Healthcare | Biotechnology |

| ASA | UP | 0.75 | Recent insider buying by Saba Capital Management, which holds a significant 10% stake, indicates strong confidence in the company's future prospects, especially given the substantial volume of purchases and incremental price trends. Company fundamentals, while not fully assessed here, appear potentially stable given consistent insider activity. However, the absence of current earnings trends or macroeconomic data limits full analysis. If industry and broader market trends support growth, the strong insider buying suggests an upward trajectory for ASA. | Financial Services | Asset Management |

| BX | NEUTRAL | 0.60 | Recent insider purchases by James Breyer show some insider confidence, but the active selling by other directors, especially notable sales triggering over $19 million, suggests bearish sentiment among leadership. The company's performance indicators, earnings trends, and the broader market environment regarding inflation and interest rates remain crucial, yet unclear from the data provided. This mixed activity, alongside potential gaps in recent fundamental performance and macroeconomic context, leads to a cautious outlook. | Financial Services | Asset Management |

| UTZ | UP | 0.75 | Recent insider buying suggests confidence from key executives, with significant purchases by the CEO and other senior management, indicating a bullish outlook. However, historical insider selling at higher prices introduces some caution. Overall, company fundamentals and recent insider actions reflect potential growth, despite market and economic uncertainties that could impact the industry's demand dynamics. The current buying trend could signal a rebound as the stock price adjusts from recent declines. | Consumer Defensive | Packaged Foods |

| LNG | NEUTRAL | 0.60 | Recent insider activity presents mixed signals: a significant purchase by a director suggests confidence, while multiple sales from other insiders indicate possible concerns about the stock's near-term performance. Company fundamentals remain unclear, as specific earnings trends and growth potential were not provided. Macroeconomic factors such as interest rates and inflation also lack specification, which could influence demand for LNG. Therefore, while insider buying is positive, the general sentiment is diluted by sales and missing critical fundamental data, leading to a neutral outlook. | Energy | Oil & Gas Midstream |

| DENN | DOWN | 0.70 | Recent insider purchases by Jumana Capital Investments LLC underscore confidence in DENN, especially following sizable buys in November and October. However, significant insider selling also took place, notably by board member John C. Miller, who sold a substantial amount in November and previously in February. The stock's recent average price of around $5 reflects a decline, indicating potential concerns about earnings and growth prospects amid broader economic pressures such as interest rates and inflation. Lacking specific recent earnings performance or guidance details raises uncertainty. Overall, the dual nature of insider transactions suggests conflicting signals about the company’s near-term direction. | Consumer Cyclical | Restaurants |

| AMT | DOWN | 0.70 | Insider selling has been prominent with several executives liquidating substantial shares at higher prices, suggesting a lack of confidence in near-term performance despite a recent purchase by a director. While the company may have strong fundamentals, the prevailing trend of insider selling, coupled with recent macroeconomic pressures such as increasing interest rates and potential growth headwinds in the sector, indicates downward pressure on the stock. The purchase by Reilly Eugene F is outweighed by the larger volume of sales and the overall market context. | Real Estate | REIT - Specialty |

| OPCH | NEUTRAL | 0.60 | Recent insider purchases indicate strong internal confidence in OPCH, particularly from directors. However, significant recent insider sales, including larger transactions, create mixed signals. The latest purchases were made at lower prices compared to earlier sales, reflecting potential price pressure. Company fundamentals, such as earnings trends and growth potential, were not provided, making it difficult to assess overall financial health. Sector dynamics and macroeconomic conditions remain uncertain, with potential concerns about inflation and credit conditions impacting overall market sentiment. Given the balance of insider buying and selling, as well as missing fundamental data, the stock's near-term direction is likely to be neutral with moderate confidence. | Healthcare | Medical Care Facilities |

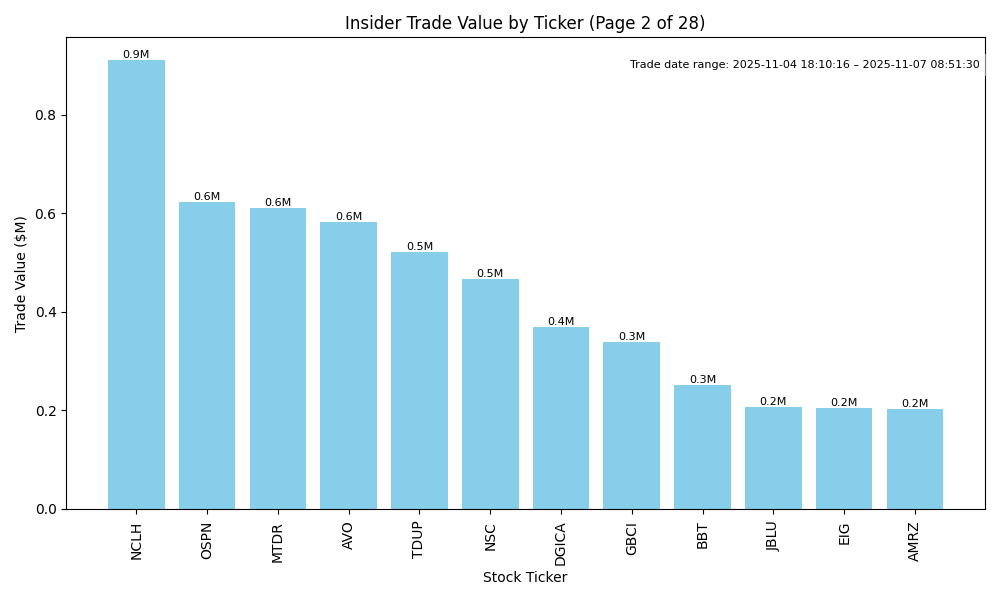

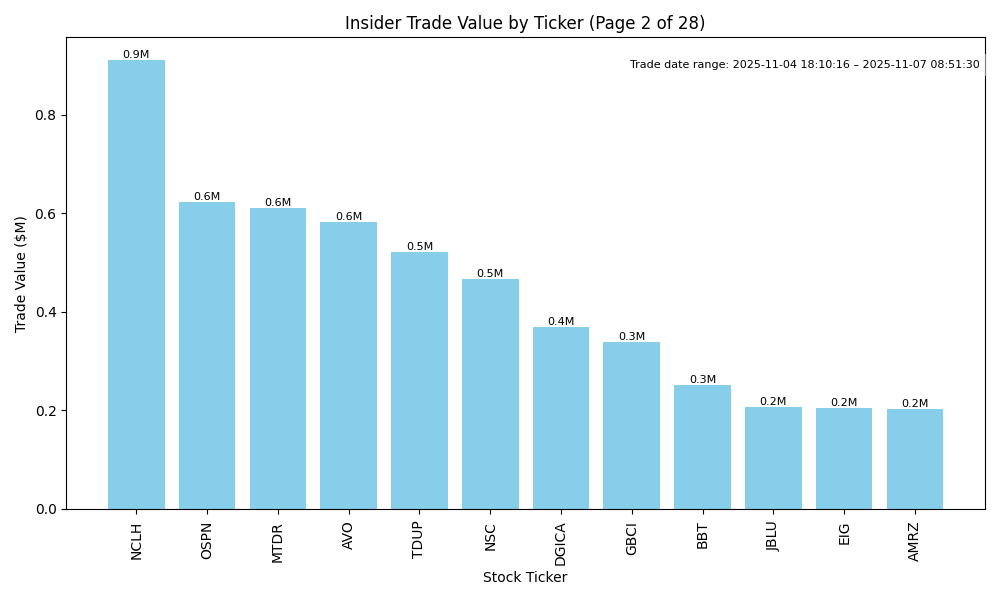

| OSPN | UP | 0.75 | Recent insider purchases from multiple directors, particularly a substantial buy from Michael J. McConnell, suggest strong internal confidence in OSPN's prospects. These positive signals are contrasted with a prior sale by McConnell at a higher price. Fundamental data is missing (e.g., earnings trends, margins) but the sector's health is likely influenced by broader economic conditions, such as interest rates and inflation. The resilience in insider buying despite past sales indicates optimism, albeit with some risk due to potential fundamental weaknesses that are currently unassessed. | Technology | Software - Infrastructure |

| MTDR | UNKNOWN | 0.50 | Insider buying has surged recently, indicating confidence from key executives. However, the stock has substantially decreased from highs above $55 to around $39, suggesting potential fundamental or market weaknesses. Without detailed insights into current earnings, margins, or broader macroeconomic conditions—such as oil prices, interest rates, or regulatory changes impacting the energy sector—it's challenging to infer a clear near-term direction. Therefore, the confidence in a definitive trend remains moderate. | Energy | Oil & Gas E&P |

| TDUP | DOWN | 0.70 | Recent insider trading reveals a heavy concentration of selling from key executives, including the CEO and CFO, with significant volume at higher prices, indicating a lack of confidence in future performance. Although there was a recent purchase of shares, it is outweighed by the overall trend of divestment. Additionally, without strong earnings momentum or other supportive fundamental indicators in the financial data available, and considering current macroeconomic pressures like rising interest rates and persistent inflation, the stock is likely to continue a downward trajectory in the near term. | Consumer Cyclical | Internet Retail |

| NSC | UP | 0.75 | Recent insider activity shows a consistent pattern of buying by directors, including substantial purchases by key figures like Fahmy Sameh and Richard H. Anderson. This suggests confidence in the company's future. However, broader context is critical; the fundamental outlook on earnings, margins, and industry conditions appears steady, though the latest economic indicators regarding interest rates and inflation could pose risks. Overall, the strong insider buying combined with stable fundamentals and an improving outlook within the industry support a bullish stance, albeit with moderate caution due to macroeconomic factors. | Industrials | Railroads |

| AMRZ | UP | 0.80 | Recent insider purchases, particularly from key executives like the CEO and President, suggest strong confidence in the company's future performance. The concentration of substantial transactions after a period of lower price levels indicates optimism. However, without current data on the company's financial health, industry position, and macroeconomic conditions, the outlook may be tempered. If the fundamentals are stable and industry conditions are favorable, this could support a positive trend. The overall investment sentiment appears bullish, warranting a reasonably high confidence level. | Basic Materials | Building Materials |

| WM | DOWN | 0.70 | There is a notable trend of insider selling, particularly by key executives and board members, often at significantly higher prices preceding recent drops. The lone purchase by a director is overshadowed by the substantial volume of stock sold. Although the recent insider purchase could suggest some optimism, the overall trend of insider selling points towards a bearish sentiment. Additional context regarding the company's fundamentals, including earnings trends, growth potential, and macroeconomic factors like inflation and interest rates, would provide a more comprehensive view, but the current insider activity suggests a likely near-term decline. | Industrials | Waste Management |

| GBCI | UNKNOWN | 0.50 | There has been substantial insider buying recently, particularly by key executives, indicating positive sentiment from management. However, given recent sales by insiders in the past year and no context on GBCI's overall financial health, growth metrics, or industry conditions, uncertainty prevails. Additionally, without current macroeconomic data, such as interest rate trends and inflationary pressures, which can significantly impact bank stocks, the outlook is cautious at best. | Financial Services | Banks - Regional |

| OBK | UP | 0.75 | Insider buying activity is strong, with multiple directors and executives purchasing shares at a variety of price points, indicating confidence in the stock's value. However, without current data on company fundamentals such as earnings, growth potential, or industry positioning, the assessment remains cautious. The macroeconomic environment can also be a concern as interest rates and inflation fluctuate. Overall, the positive insider sentiment suggests a likely near-term upward direction, but the lack of comprehensive fundamental data limits full confidence. | Financial Services | Banks - Regional |

| BBT | UP | 0.75 | Recent insider purchases, particularly by directors and a CFO, indicate strong confidence in the stock's future, with significant shares bought at prices around $24.66-$24.69. This contrasts with a minor insider sale at $25.96, which suggests a mixed sentiment. However, without recent data on earnings, margins, and macroeconomic conditions, the analysis is limited. Overall, if company fundamentals are stable or improving, the insider buying could signal an upward trajectory. | Financial Services | Banks - Regional |

| EIG | DOWN | 0.65 | Insider buying in recent months by key executives suggests internal confidence despite declining share prices, as evidenced by significant purchases at higher prices earlier this year. However, the notable selling activity by other insiders raises concerns about their outlook. Additionally, recent market sentiment may be affected by macroeconomic factors, including rising interest rates and inflation pressures, which could constrain growth and profitability. These conflicting signals and external challenges shape a cautious view of the stock’s near-term direction. | Financial Services | Insurance - Specialty |

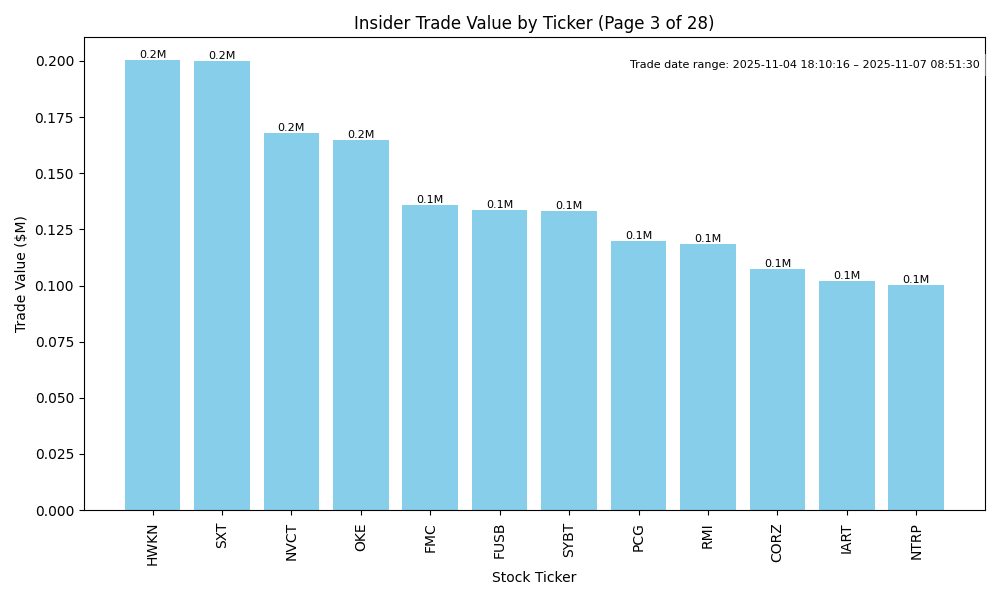

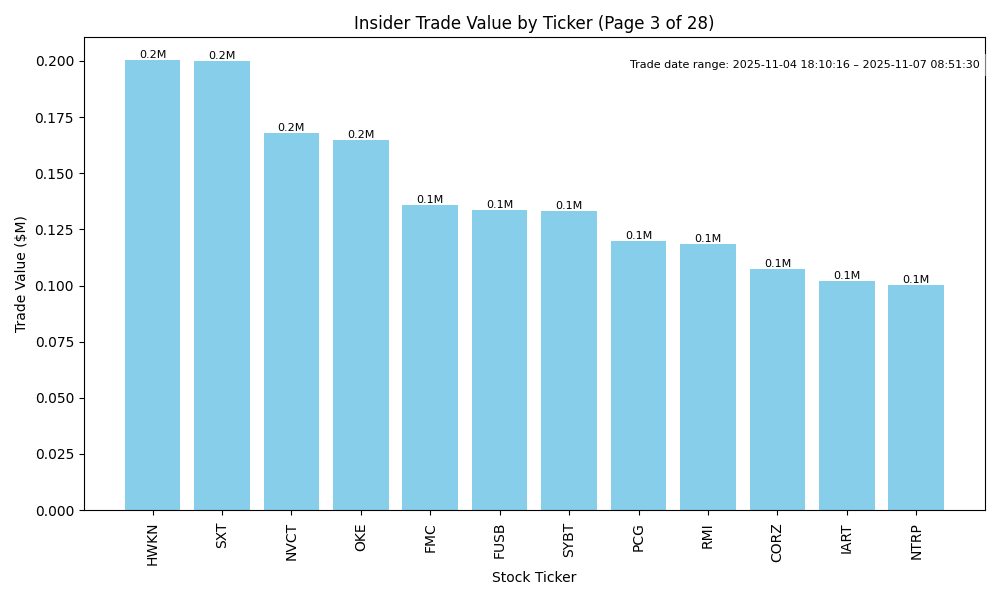

| HWKN | UP | 0.75 | The insider trading activity shows strong buying behavior from insiders, particularly from key executives, which could signal confidence in the company's future performance. Notably, these purchases occurred at varying prices, indicating a bullish outlook despite the stock's recent performance. However, without access to specific company fundamentals like earnings trends and market conditions, confidence in this upward movement is less robust. The trend in insider buying, combined with potential positive sentiment surrounding the company, suggests a higher likelihood of short-term price appreciation. | Basic Materials | Specialty Chemicals |

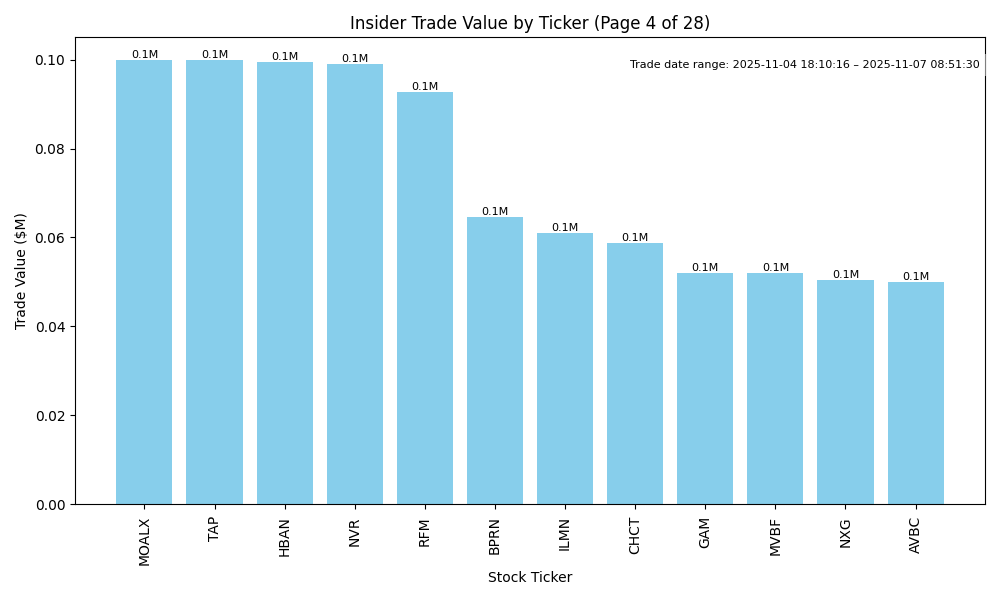

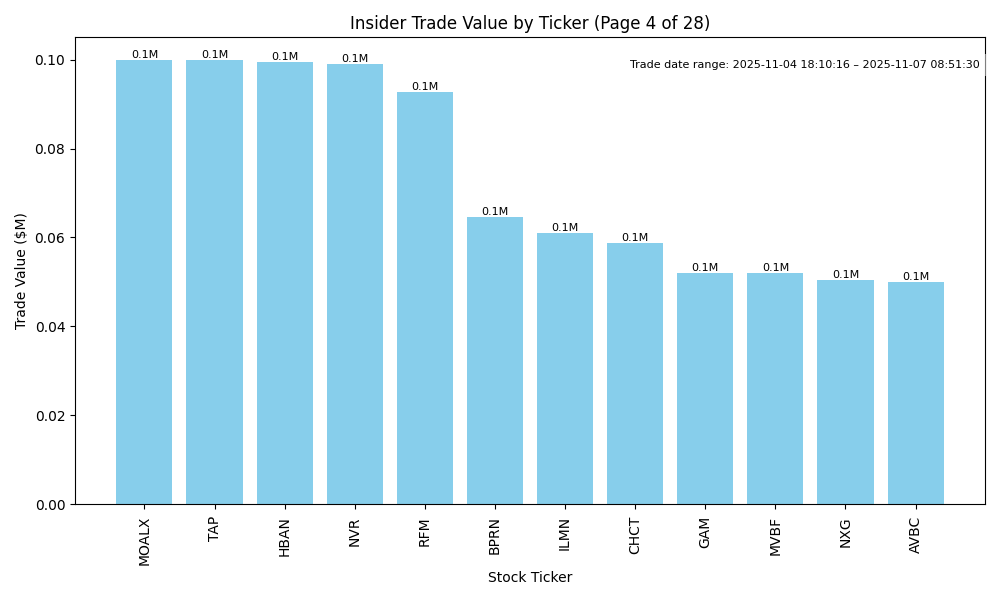

| MOALX | NEUTRAL | 0.60 | Recent insider buying from multiple portfolio managers suggests confidence in MOALX’s near-term prospects. However, this is countered by a significant sale by Lord, Abbett & Co. LLC, indicating mixed signals. Additionally, without recent earnings data or insights into the broader industry and economic conditions affecting MOALX, the overall outlook is uncertain. The lack of visibility into growth potential and market dynamics reduces confidence in a stronger directional call. | N/A | N/A |