| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

| MSM | UP | 0.65 | Recent insider buying by the Director Mitchell indicates confidence in the company's future, as he purchased 181,806 shares at $84.75 after a previous notable purchase at $69.73. However, there is a notable trend of insider selling, particularly from top executives, which might suggest concerns about the stock's near-term outlook. Company fundamentals, though not explicitly provided, should also be assessed for earnings performance and revenue growth to better gauge the impact of overall market conditions. The current macroeconomic context (interest rates, inflation) adds uncertainty, but the significant insider purchases lend support to a positive near-term outlook. | Industrials | Industrial Distribution |

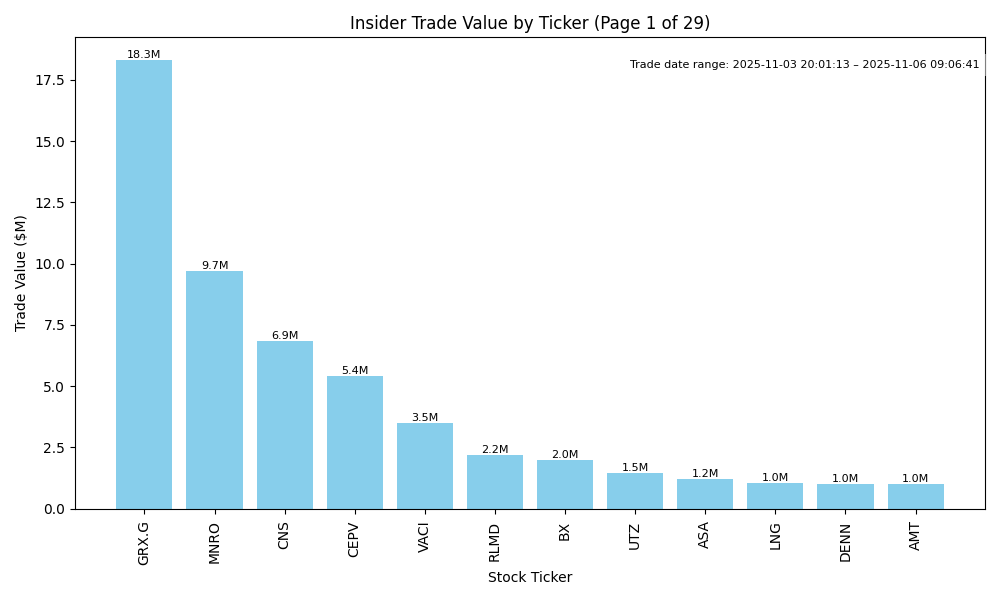

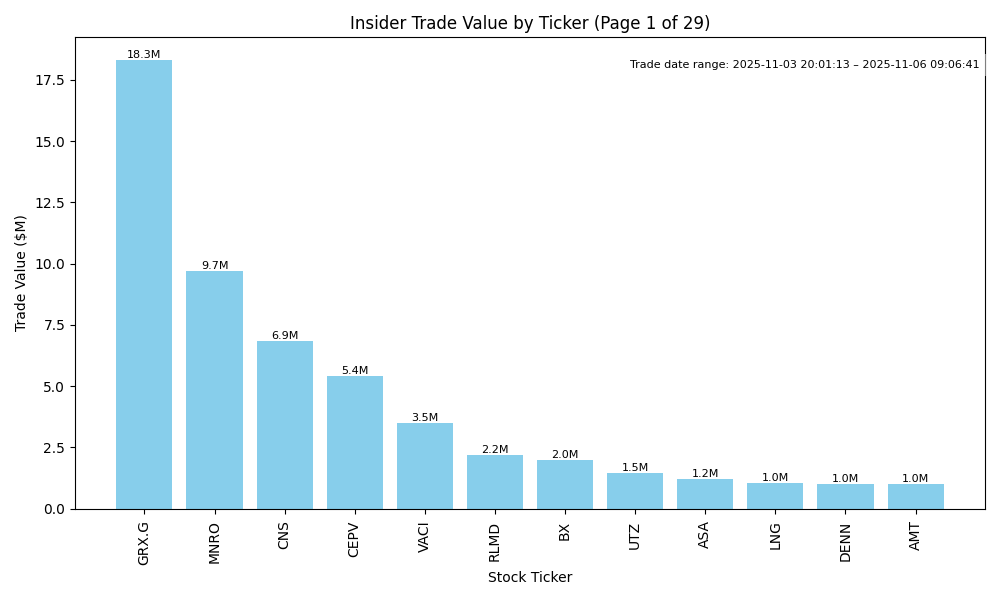

| MNRO | UP | 0.70 | The recent insider purchases by significant stakeholders, particularly Carl Icahn acquiring over 639,000 shares at a substantial price, indicate confidence in the company's future prospects. However, the CEO's smaller purchase suggests mixed sentiment. Without detailed financial metrics or recent earnings reports, the evaluation of fundamentals remains incomplete. Current macroeconomic conditions, such as interest rates and inflation, could impact performance, but the substantial insider buying trend supports a likely upward direction, albeit with moderate confidence due to missing financial data. | Consumer Cyclical | Auto Parts |

| CLVT | DOWN | 0.60 | Recent insider purchases suggest some confidence, particularly with significant buys by directors totaling several million dollars. However, there is also concern due to recent sales, especially from a president, indicating possible profit-taking. The stock price has been declining from highs and insider buying has occurred at lower levels, indicating uncertainty in sentiment. Coupled with a lack of clarity on company fundamentals and potential macroeconomic headwinds (interest rates, inflation), the overall outlook leans towards a downward direction, though with moderate confidence given insider activity. | Technology | Information Technology Services |

| LNPIX | UP | 0.75 | Insider buying by Partners Group shows strong confidence, with two substantial purchases totaling over 1.6 million shares. This reflects optimism about the company's future prospects. However, without recent earnings data or macroeconomic context, it's challenging to fully assess the stock's potential performance. If industry conditions are supportive and fundamentals remain strong, the insider sentiment could drive prices higher. Conversely, if broader conditions are unfavorable, the impact of insider buying could be muted. | N/A | N/A |

| VACI | UP | 0.70 | The recent insider purchase by CEO Hakan Wohlin of 350,000 shares at $10.00 indicates strong confidence in the company's future prospects. Insider buying typically reflects positive sentiment about the company's performance or future growth potential. However, without detailed insights into the company's financials, industry dynamics, and broader economic conditions, the analysis remains cautious. The overall market, interest rate environment, and any significant company-related developments are unknown, which lowers overall confidence. | N/A | N/A |

| ASA | UP | 0.80 | Insider purchases by Saba Capital Management (10% shareholder) are substantial and recurrent, indicating strong confidence in the company's future. Recent prices trending upwards, particularly in November 2025 around $46, suggest market buy sentiment. However, the analysis lacks essential details such as earnings trends, margins, and macroeconomic influence. Without this data, while insider activity is compelling, potential underlying weaknesses could temper future stock performance, hence a high confidence but not absolute certainty. | Financial Services | Asset Management |

| BX | DOWN | 0.70 | The recent insider activity shows a concerning trend with significant sell transactions outpacing purchases, indicating a lack of confidence from key leadership. Notable sales by directors suggest they may expect short-term price declines. Although there was a recent purchase by a director, it is minor compared to the larger sell volumes. Moreover, without specific information on the company's current fundamentals or macroeconomic environment, we cannot fully gauge the long-term trajectory. Insiders' actions combined with the recent downward price trend lead to a cautious outlook. | Financial Services | Asset Management |

| UTZ | UP | 0.70 | Recent insider purchases, particularly from key executives and significant stakeholders, indicate strong confidence in UTZ's prospects, especially with notable purchases totaling over $890,000 by insiders on November 4, 2025. However, previous insider sales throughout the year raised concerns about market sentiment as prices declined from higher levels. Despite strong insider support, the lack of recent financial performance data and potential negative market conditions (high-interest rates, inflation) could weigh on stock performance. Therefore, while near-term direction looks positive due to insider buying, confidence is moderated by the broader economic context. | Consumer Defensive | Packaged Foods |

| DENN | DOWN | 0.65 | Recent insider purchases suggest some confidence from major stakeholders; however, insiders like director John C. Miller have made significant sales recently at higher prices, indicating potential concerns about valuation or future performance. The stock has seen substantial insider buying at prices ranging from $4.08 to $6.53, yet it has also undergone significant selling by insiders, signaling a possible shift in confidence. Moreover, without comprehensive visibility into current company fundamentals, such as earning trends or debt levels, along with the broader economical impact of rising interest rates and inflation, the outlook seems cautious. Overall, while insider activity is mixed, the bearish signals from recent sales position DENN's near-term direction as likely down. | Consumer Cyclical | Restaurants |

| ORGO | DOWN | 0.70 | Insider trading shows a mixed signal: while Nussdorf's large purchase suggests confidence, the frequency and volume of sales by other insiders, especially the CEO, raises concerns about future prospects. The sharp decline in average sale prices compared to recent purchases indicates potential overvaluation or pessimism about near-term performance. Additionally, information regarding the company’s financial health, such as earnings trends and growth potential, is missing. Without strong fundamentals or industry support, recent insider purchases may not suffice to counteract selling pressure and market uncertainties. | Healthcare | Drug Manufacturers - Specialty & Generic |

| CI | DOWN | 0.70 | Recent insider activity shows a significant trend of selling, particularly by the CEO and other executives, with notable sales at high prices and only one recent purchase by the CEO at a much lower price. This indicates a lack of confidence in the stock by insiders. Additionally, the price has significantly declined from prior levels above $300 to below $250, suggesting potential challenges in the company's fundamentals. Without specific recent earnings data or macroeconomic context impacting the healthcare sector, the outlook remains cautious, resulting in a downward direction for the stock. | Healthcare | Healthcare Plans |

| AMT | DOWN | 0.65 | Recent insider activity shows a pattern of significant sales at higher prices, suggesting a lack of confidence among executives about near-term share appreciation. Although one director made a purchase, the volume of sales, especially by high-ranking executives, indicates potential profit-taking in a declining price environment. Company fundamentals remain critical to assess, but the current context, marked by higher interest rates impacting the broader capital market dynamics, along with macroeconomic uncertainties, mitigates the potential for immediate positive price movements. Overall, the imbalance between sales and the lone purchase, and a cautious macro backdrop leads to a bearish assessment. | Real Estate | REIT - Specialty |

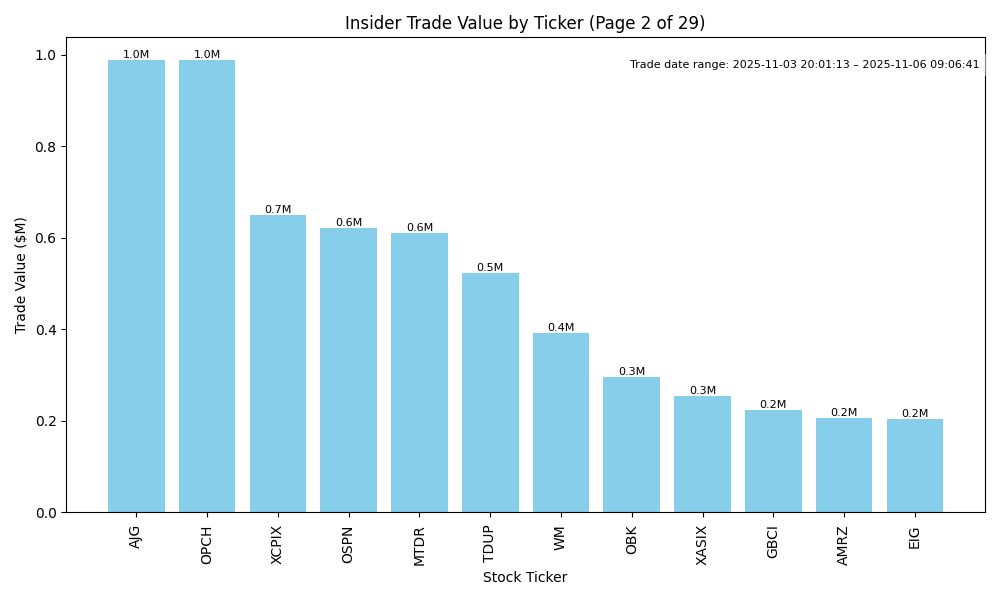

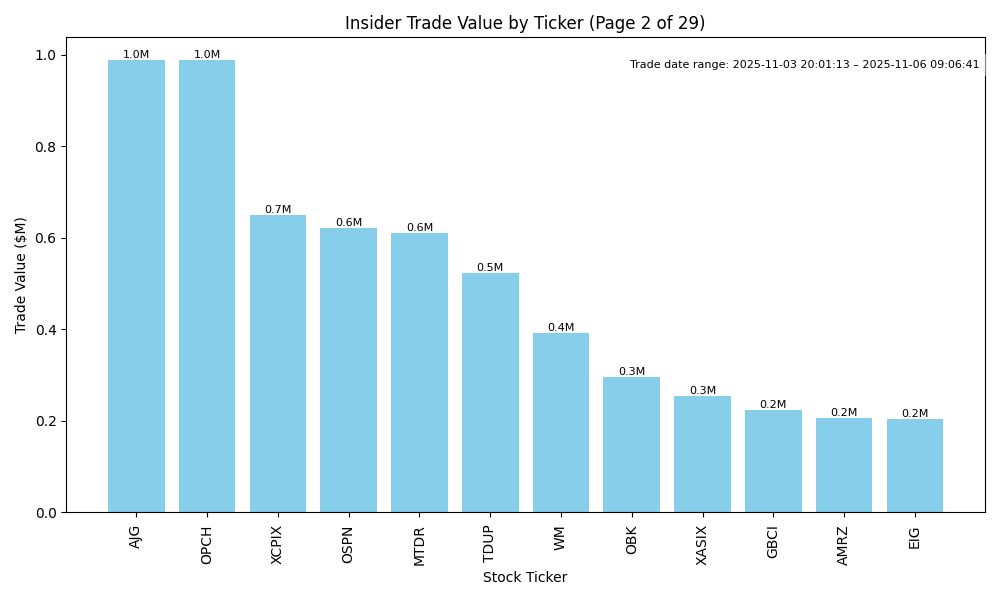

| AJG | DOWN | 0.70 | Insider selling has been significant lately, particularly by high-ranking officials like the CFO and VPs, suggesting a lack of confidence in the near-term stock value. The recent purchase by a VP of only 4,000 shares at a lower price does not outweigh the large volume of shares sold at higher prices. Given the overall trend of insider activity skewed towards sales, combined with potential macroeconomic headwinds and uncertainties in the industry, the stock is likely to face downward pressure in the near term. | Financial Services | Insurance Brokers |

| OPCH | NEUTRAL | 0.60 | Recent insider purchases indicate bullish sentiment among directors, most notably with significant buys from Kraemer Harry M Jansen Jr. However, there have also been notable insider sales at higher prices, which raises questions about the stock's near-term valuation. Company fundamentals and macroeconomic factors appear uncertain; no recent earnings reports or guidance updates were provided, which limits clarity on the company's growth potential. Consequently, while insider transactions give a positive signal, broader uncertainties suggest a neutral outlook. | Healthcare | Medical Care Facilities |

| MTDR | DOWN | 0.70 | Recent insider purchases indicate confidence, with multiple executives buying shares just above $39. However, the substantial decline in share price from recent highs above $55 suggests significant market challenges or declining fundamentals. While insiders are accumulating shares suggesting they view valuation as attractive, current market conditions, including potential pressures from macroeconomic factors such as rising interest rates and inflation, could result in continued downward pressure on the stock's price in the near term. | Energy | Oil & Gas E&P |

| FI | DOWN | 0.75 | Recent insider activity reflects a significant trend of sales, particularly by senior executives, indicating potential lack of confidence in the stock's near-term outlook. The latest purchase by a director is relatively small compared to the volume of insider sales. Furthermore, company fundamentals may be under pressure given the stark decline in share price from previous highs around $238 to recent values around $65, raising concerns about revenue growth and profit margins. Without clear earnings trends or macroeconomic support, such as favorable interest rates or stable inflation, the outlook remains bearish for FI. | Technology | Information Technology Services |

| XCPIX | UP | 0.75 | Recent insider purchases from key executives suggest bullish sentiment, with significant amounts invested at $15.50 per share. However, the analysis lacks detailed information on company fundamentals, industry trends, and macroeconomic conditions, making it difficult to ascertain the broader impact. If fundamentals align positively, the insider activity indicates potential upside, but existing gaps in financial metrics must be noted, lowering overall confidence in the outlook. | N/A | N/A |

| MBIN | DOWN | 0.70 | Recent insider trading shows a significant number of shares sold by high-ranking officials, notably the Vice Chairman, indicating a potential bearish outlook. This is somewhat countered by recent purchases from the CEO and CFO, which suggest some confidence in the stock's future. However, the sales occurred at much higher average prices (around $44-$45) compared to recent purchases ($31-$39). Coupled with the need for deeper analysis of the company's fundamentals, industry health, and ongoing macroeconomic pressures, the outlook skews negative. The overall confidence is moderate due to the conflicting signals from insider trades. | Financial Services | Banks - Regional |

| WM | DOWN | 0.70 | Recent insider trading shows a concerning trend, with numerous substantial sales, particularly by key executives like the CEO and CFO, indicating potential confidence issues in the stock's near-term performance. Although there is a recent purchase from a director, it is minor relative to the overall volume of shares sold. Additionally, without critical data on current earnings, growth potential, and industry health, I suggest caution. The insider sales suggest a belief that the stock might not perform well shortly, especially against a backdrop of potential macroeconomic headwinds including interest rate concerns and inflation, which may negatively impact consumer spending. | Industrials | Waste Management |

| NIC | DOWN | 0.70 | Recent insider trading indicates a significant selling trend among executives and directors, particularly robust sell-off activity since November 2024, including large sales by the CEO and other key positions. While there have been a few recent insider purchases, they are outweighed by the magnitude of the sales. Additionally, without recent performance data, earnings trends, or macroeconomic context, there are uncertainties regarding the company's fundamentals and market conditions. The prevailing selling pressure suggests bearish sentiment despite occasional buying, leading to a downward expectation for NIC stock in the near term. | Financial Services | Banks - Regional |

| VRSK | DOWN | 0.70 | Recent insider activity shows significant sales by key executives, particularly the CFO and CIO, which may indicate concerns about the company's future performance or stock valuation. While some directors recently purchased shares, suggesting a belief in value, the overall trend of substantial insider selling near high prices raises caution. Additionally, a generic decline in stock price suggests vulnerability. Without strong positive shifts in fundamentals or macroeconomic factors to counterbalance this selling pressure, my confidence in a downturn is fairly high, but not absolute due to the mixed signals from recent purchases. | Industrials | Consulting Services |

| ENPH | NEUTRAL | 0.65 | Insider purchases by the CEO suggest some confidence in the company's future, but those buys are significantly lower than prior transactions, indicating uncertainty. The spike in insider sales, particularly by directors at high prices, raises concerns about future performance. While the company operates in a competitive sector with growth potential, the broader macroeconomic headwinds, such as rising interest rates and inflation, could constrain future performance. Without current fundamental metrics (like earnings, margins, or guidance), it is difficult to assert a clear direction confidently. | Technology | Solar |

| FND | DOWN | 0.70 | Recent insider selling is concerning, especially from high-ranking executives like the CEO and President, indicating potential lack of confidence in the stock's near-term performance. Despite one recent purchase by the President, the scale of prior sales suggests a bearish sentiment among insiders. Company fundamentals—pending further details on earnings and balance sheet health—are overshadowed by the insider activity. Additionally, the broader macroeconomic context of rising interest rates and inflation could pressure discretionary spending in FND's sector, further complicating its outlook. Overall, the conflicting signals from insiders and macro conditions contribute to a bearish short-term view. | Consumer Cyclical | Home Improvement Retail |

| OBK | UP | 0.75 | Recent insider purchases at varying prices indicate strong confidence from multiple executives and directors, suggesting an optimistic outlook for OBK. With significant share purchases from key positions like CEO, COO, and CFO, this reflects a cohesive belief in the company's future. However, without specific data on company fundamentals (e.g., earnings reports, growth metrics) and broader macroeconomic conditions affecting the banking sector, this analysis carries some uncertainty. Strong insider activity leans towards a bullish perspective, supported by potential favorable conditions in the banking industry if overall economic factors align positively. | Financial Services | Banks - Regional |

| SLGN | DOWN | 0.70 | Recent insider transactions indicate a mixed picture: although the CEO bought 7,000 shares recently, there is a significant history of sales by multiple insiders, including large amounts sold by key executives. This may signal concerns about the stock's valuation or future performance. Additionally, company fundamentals likely have been under pressure given the downward trend in average trading prices from previous sales and the potential broader economic headwinds like rising interest rates and inflation. Industry and macroeconomic factors further complicate the outlook, contributing to a moderate level of confidence in a downward direction. | Consumer Cyclical | Packaging & Containers |