| Symbol |

Direction |

Confidence i

|

Rationale |

Sector |

Industry |

| MPLT | UP | 0.70 | Insider purchases by significant holders (Novo Holdings and Catalyst4, Inc.) indicate strong confidence in MPLT's future potential, as substantial shares were acquired at $17. Furthermore, the concentration of purchases suggests a positive outlook from influential stakeholders. However, without detailed insights into MPLT's earnings trends, debt levels, and broader industry dynamics, certainty is tempered. The current macroeconomic environment, characterized by interest rate fluctuations and inflation pressures, also plays a role but remains stable for growth-oriented equities. Therefore, the overall assessment leans towards a potential upward trajectory, though fundamental gaps exist. | Healthcare | Biotechnology |

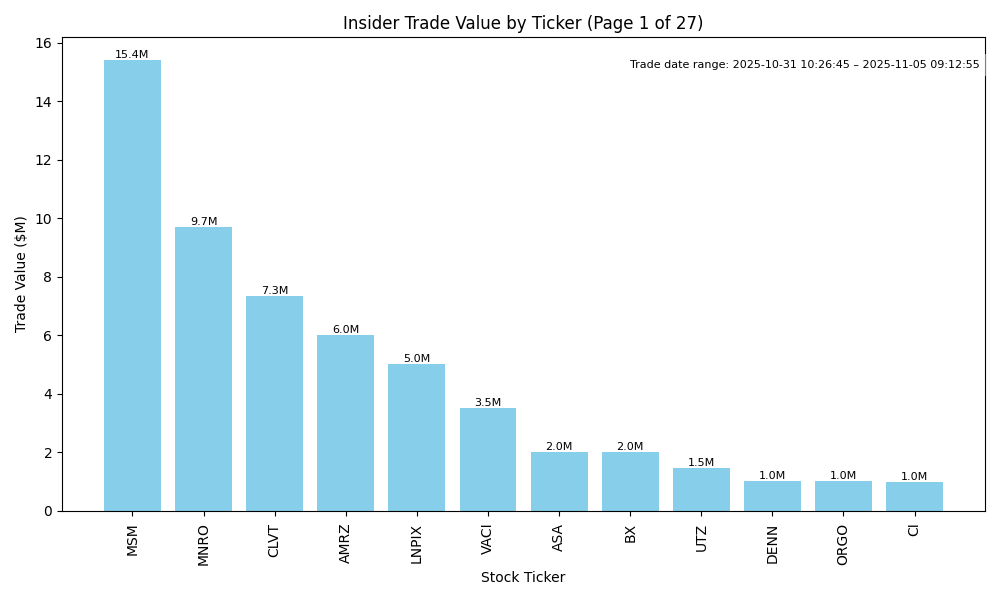

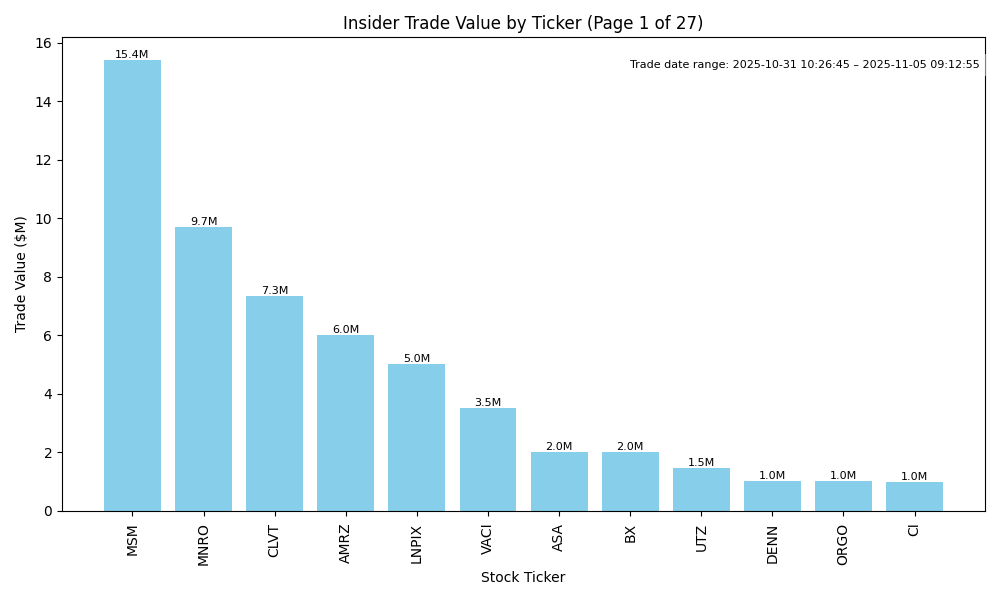

| MSM | NEUTRAL | 0.60 | Recent significant insider purchases by Jacobson Mitchell indicate strong confidence in the stock's future performance. However, there is a pattern of ongoing insider selling, particularly by top executives, which raises concerns about capitalizing on potential price declines. While insider buys suggest optimism, the overall selling by insiders, paired with general macroeconomic pressures (like rising interest rates and inflation), may limit near-term upside. Additional context on the company's earnings trends and fundamentals is necessary for a clearer direction. | Industrials | Industrial Distribution |

| NMRA | UP | 0.75 | Recent insider purchases, particularly large transactions from key insiders like Kristina Burow and Arch Venture Partners, suggest strong confidence in NMRA's future performance. The substantial volume of shares purchased at an average price of $2.61 indicates a belief in value appreciation. However, recent insider selling patterns prior to these purchases raise caution. Without comprehensive insights into the company's fundamentals, such as recent earnings performance, growth potential, and broader macroeconomic conditions, the confidence level is moderate. Overall, the positive insider sentiment and potential undervaluation justify an upward outlook, tempered by potential fundamental concerns. | Healthcare | Biotechnology |

| CLVT | UP | 0.70 | Recent insider trading shows a significant surge in purchases by directors, particularly notable is Kenneth Cornick's acquisition of 725,000 shares and Andrew Snyder's 1.46 million shares in November 2025, indicating insider optimism. However, the overall context is mixed; while insider purchases suggest positive sentiment, recent sales by insiders, such as James Samson, raise caution. The company may face challenges with market conditions; hence continued monitoring of performance metrics and macroeconomic factors is vital. Given the heavy buying versus some selling and broader stock price pullback, I lean towards a positive outlook but maintain a note of caution. | Technology | Information Technology Services |

| AMRZ | UP | 0.80 | Recent insider purchases, particularly by top executives like the CEO and CTO, suggest strong internal confidence in the company's future. Significant purchases at varying prices indicate a bullish outlook. However, without updated company fundamentals like earnings trends and macroeconomic indicators, the analysis lacks some depth. Still, the overall pattern of insider buying, along with typical investor sentiment surrounding such activities, leans towards a positive near-term direction. | Basic Materials | Building Materials |

| LNPIX | UP | 0.70 | Recent insider purchases by Partners Group (USA) Inc. indicate strong confidence in LNPIX's near-term prospects, with over 1.6 million shares bought at prices averaging around $10.41. However, the overall market and macroeconomic conditions, such as potential inflationary pressures and interest rates, could pose challenges. Without further details on the company's fundamentals, growth potential, or industry dynamics, there's a degree of uncertainty. Nonetheless, the significant insider activity suggests a positive outlook in the near term. | N/A | N/A |

| EG | NEUTRAL | 0.60 | Recent insider purchases indicate confidence in the stock's future, especially with significant buys from directors and executives; however, the recent sales by insiders during a declining price trend raise concerns. Company fundamentals seem stable, though without specific financial metrics on earnings, margins, and leverage, a comprehensive assessment is limited. The industry outlook and broader macroeconomic factors, including interest rates and inflation, can adversely influence performance. Thus, while insider sentiment leans positive, the lack of detailed financial data and mixed signals from the macro environment suggests a cautious outlook. | Financial Services | Insurance - Reinsurance |

| CLS | DOWN | 0.70 | The recent insider activity shows a significant number of shares being sold by senior executives, indicating potential lack of confidence in the stock's near-term performance. The large sales from multiple insiders, including the CEO and COO, could signal a troubling view of the company's prospects. Although one director made a purchase, it appears to be an isolated event compared to the widespread selling. Without sufficient positive company fundamentals or macroeconomic context suggesting a recovery in the industry, the overall sentiment points to downward pressure on CLS stock. | Technology | Electronic Components |

| BAH | NEUTRAL | 0.60 | Recent insider purchases by the CEO indicate optimism, particularly in contrast to multiple significant sales by other executives. Sales have occurred at higher prices, suggesting profit-taking as the stock has declined. Additionally, strong insider buying from the CEO (24,800 shares at $84.66) could reflect confidence in the company's future prospects. However, without current insights into the company's fundamentals and any recent developments, the overall sentiment remains uncertain. Therefore, while there's some positive buying signaling, the mixed insider activity, alongside unclear fundamental prospects and broader macro pressures, yields a neutral outlook. | Industrials | Consulting Services |

| BX | DOWN | 0.70 | Recent insider activities show a pattern of selling, particularly by directors, which may indicate a lack of confidence in near-term performance. The volume of shares sold is significant, with high average prices around $170, suggesting insiders are capitalizing on current valuations. While there was a recent purchase by a director, it is relatively small compared to the large sales. Additionally, the broader macroeconomic context, including potential rising interest rates and regulatory challenges, could negatively affect BX's performance. These selling trends, coupled with macroeconomic pressures, lead to a bearish outlook. | Financial Services | Asset Management |

| ASA | UP | 0.75 | Insider activity shows significant and consistent purchasing by Saba Capital Management, indicating strong confidence in the stock's value. These purchases are concentrated and substantial relative to the overall share count. While company fundamentals and specific macroeconomic data are not detailed in the provided information, the aggressive insider buying amidst likely positive market sentiment points to an expectation of growth. However, without insight into earnings trends or broader market conditions, the analysis remains cautious, thus the confidence level is moderately high. | Financial Services | Asset Management |

| PAYIX | UP | 0.75 | Insider buying by the CEO in significant volumes suggests strong confidence in the company's outlook. The recent purchases at prices around $25 indicate belief in the stock's undervaluation or potential growth. However, without additional context on the company's fundamentals, such as earnings growth, margins, or industry position, confidence is moderated. If the broader macroeconomic environment remains stable and supportive, the insider activity could signal positive near-term momentum, but potential volatility exists due to external economic factors. | N/A | N/A |

| CGEM | UP | 0.70 | Recent insider buying by Lynx1 Capital Management LP indicates strong confidence in CGEM's future, as they acquired shares at increasing prices. However, a number of executives have also made sales, suggesting mixed sentiment among insiders. The buying activity could reflect underlying optimism around potential growth or recovery. Without more detailed company fundamentals or context regarding recent earnings performance and macroeconomic factors, there is some uncertainty. Therefore, while there is positive momentum from insider buying, the mixed signals and lack of broader context lead to moderate confidence in a price increase. | Healthcare | Biotechnology |

| AVTR | UP | 0.75 | Recent insider buying activity, especially large purchases by Gregory L. Summe, indicates positive sentiment among insiders regarding the stock's future. However, the overall trend in the stock price has been declining from highs above $25 to lower levels around $11-12. This price drop may impact perceptions of the company's fundamentals. The market environment is uncertain with ongoing inflation pressures and interest rate risks, which could weigh on growth. Without more recent earnings data and broader industry performance metrics, confidence is moderate. The positive insider activity, particularly the concentrated buying from a key director, points to potential upside. | Healthcare | Medical Instruments & Supplies |

| ORGO | NEUTRAL | 0.50 | Insider activity shows mixed signals with recent large purchases by Glenn Nussdorf and Lori Freedman indicating confidence, yet significant sales by CEO Gary Gillheeney and others suggest skepticism or need for liquidity. The company may face challenges in fundamentals or market conditions that are not detailed here, creating tension between insider optimism and historical selling. Lacking key financial data (earnings, margins) and macro indicators (interest rates, inflation) reduces confidence in predicting the stock's movement, placing it at a neutral outlook. | Healthcare | Drug Manufacturers - Specialty & Generic |

| CI | DOWN | 0.70 | While CEO David Cordani's recent purchase of shares indicates some insider optimism, the prevailing trend shows significant insider selling, with multiple executives selling large amounts of stock at elevated prices. Fundamental challenges may also be present given this selling pattern and the stock's recent decline in price. Increased sales might suggest concerns about future performance, especially if financial metrics like earnings and margins are under pressure, though detailed data is missing for a complete assessment. The broader macroeconomic environment, including interest and inflation rates, adds to uncertainty, potentially compressing valuations. | Healthcare | Healthcare Plans |

| AJG | DOWN | 0.70 | Recent insider trading shows a significant pattern of sales, particularly by high-ranking officials like the CFO, indicating a lack of confidence in the near-term value appreciation. A large recent purchase by a VP is notable, but the scale of ongoing insider selling overshadowed that move. This selling activity, combined with the stock's declining price from peak levels above $300 indicates potential weakness. Additionally, without concrete fundamentals like current earnings data and clearer macroeconomic context, there is uncertainty about growth prospects amidst potential economic headwinds. Overall sentiment is leaning toward bearish given the balance of insider activity and pricing trends. | Financial Services | Insurance Brokers |

| SON | DOWN | 0.65 | Recent insider purchases by the CFO and directors suggest some confidence in the stock; however, significant insider selling at higher prices indicates potential profit-taking and may reflect concerns about future performance. The stock currently trades lower than recent purchase prices, which could indicate weakening sentiment. Company fundamentals and industry health cannot be assessed fully without current financial data, but the trend of selling suggests caution. The broader macroeconomic environment, including inflation and interest rates, may also influence performance negatively. Overall, while insider buying is a positive signal, the dominant selling and unclear fundamentals lead to a downward outlook. | Consumer Cyclical | Packaging & Containers |

| MTDR | DOWN | 0.60 | Recent insider buying suggests confidence among executives, especially with significant purchases by the CEO and key officers. However, these transactions occurred at prices notably higher than current levels (around $39-40), indicating potential concerns about valuation. Additionally, without current financial metrics or industry performance data, potential headwinds such as macroeconomic challenges (e.g., rising rates, inflation pressures) and sector-specific dynamics in the energy industry could negatively impact stock performance. While insider buying is a positive signal, underlying risks lower overall confidence. | Energy | Oil & Gas E&P |

| FI | DOWN | 0.70 | Although there was a recent purchase by an insider, the overall pattern of sales by multiple insiders, especially those in key positions, is concerning. Significant insider selling at much higher prices indicates a potential lack of confidence in the company's valuation. Additionally, if the company's fundamentals, such as earnings and growth potential, were strong, one would expect more buying activity or fewer sales. Without specific financial data available, it raises flags about the company’s performance outlook. The broader market context, particularly if affected by rising rates or inflation, could also weigh on the stock, adding to the bearish sentiment. | Technology | Information Technology Services |

| XCPIX | UP | 0.70 | Recent insider purchases by high-level executives indicate strong confidence in the company's near-term outlook, especially with significant purchases at $15.50. However, without information on company fundamentals, industry trends, and macroeconomic context, there's uncertainty. If the fundamentals are stable and align with insider expectations, this typically signals a positive price movement. Yet, any underlying weaknesses beyond the insider activity could temper the expected gains. | N/A | N/A |

| MBIN | DOWN | 0.70 | Recent insider trading trends highlight significant selling activity, particularly by the Vice Chairman of the Board, Randall D. Rogers, who has sold substantial portions of his holdings at higher prices. While there are recent purchases by the CEO and CFO, the overall sentiment appears to be bearish due to the larger volume of sales and the steep decline in stock price from recent highs. Additionally, without access to current financial metrics such as earnings trends or macroeconomic context, the outlook is uncertain, warranting a cautious stance. | Financial Services | Banks - Regional |

| UHT | UP | 0.70 | Recent insider buying activity, particularly by the CEO, suggests confidence in the stock's future. Three purchases include significant amounts (over $450k from the CEO alone), indicating strong belief in the company's prospects. However, without current data on earnings trends, margins, and macroeconomic factors impacting the industry, the assessment remains cautious. A healthy stock price reaction and retention of insider ownership could be pivotal. Current economic conditions such as inflation and interest rate trends should also be monitored as they could impact future performance. | Real Estate | REIT - Healthcare Facilities |

| WM | DOWN | 0.70 | Recent insider activity indicates significant selling pressure, with several executives liquidating substantial shares at varying price points, signaling potential concerns about future performance or overvaluation. The only recent purchase was made by a director, but it is relatively small compared to the sales volumes. Given that selling outnumbers buying, this suggests a bearish sentiment among insiders. Furthermore, if macroeconomic conditions shift adversely (e.g., rising interest rates, inflation), this could impact the company's fundamentals negatively. While industry trends may remain stable for waste management, the overall insider selling suggests caution, leading to a lower confidence in the stock's near-term prospects. | Industrials | Waste Management |

| NIC | DOWN | 0.60 | Recent insider trading shows a concerning trend, with numerous substantial sales by multiple executives, particularly the CEO and other directors, indicating potential pessimism about the stock's future. Though there were some recent purchases, the overall pattern is clearly dominated by significant selling activity at higher prices, leading to a downward pressure on the stock. Additionally, the current economic environment poses risks, such as rising interest rates and inflation, which could adversely affect the company's operational performance and stock valuation. However, without concrete details on earnings trends or macroeconomic factors specific to NIC, confidence in this assessment is moderate. | Financial Services | Banks - Regional |